- Home

- »

- Healthcare IT

- »

-

Telesurgery Market Size, Share And Growth Report, 2030GVR Report cover

![Telesurgery Market Size, Share & Trends Report]()

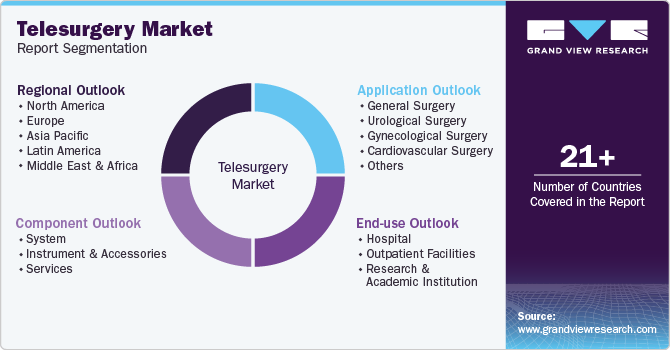

Telesurgery Market Size, Share & Trends Analysis Report By Component (System, Instrument & Accessories), By Application (General Surgery, Urological Surgery), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-422-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Telesurgery Market Size & Trends

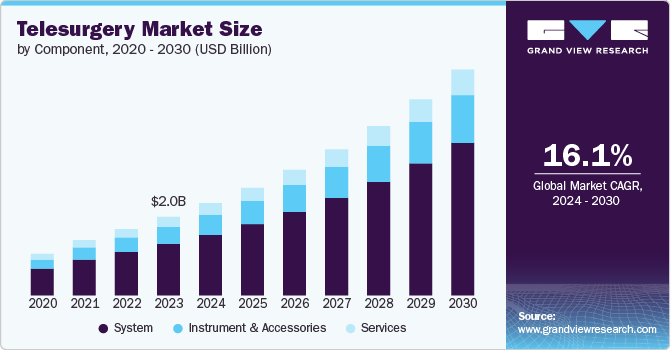

The global telesurgery market size was estimated at USD 2.05 billion in 2023 and is projected to grow at a CAGR of 16.1% from 2024 to 2030. The significant advancements in telecommunications and robotic surgery are driving the adoption of telesurgery. Furthermore, the increasing collaboration between companies to established telesurgery center is fostering market growth. For instance, in December 2023, Iran and Indonesia agreed to open a robotic telesurgery center as a joint venture. The new center will be located at a hospital in Makassar, a port city in Indonesia. The collaboration involves Iran’s Sina Robotics Company, vice presidency for science, and Tehran University of Medical Sciences, as well as Indonesia’s Hasanuddin University, Indofarma Company, and Ministry of Health.

The increasing number of clinical trials for telesurgery is anticipated to boost market growth. For instance, in October 2023, clinician-scientists from Singapore and Japan are working together on an innovative telesurgery trial that covers over 5,000 km. Within a sterile operating room located in Nagoya, Japan, robotic arms are being utilized to carry out a complex laparoscopic surgical procedure. Furthermore, AI plays a crucial role in advancing telesurgery by improving decision-making, predicting surgical outcomes, and optimizing procedural efficiency. Moreover, machine learning algorithms can analyze large volumes of data to offer insights and recommendations, aiding surgeons in making better-informed decisions. Additionally, AI-powered robotic systems also facilitate precise and consistent movements, decreasing human error and enhancing patient outcomes. This technology assists the surgeon in planning and executing complex procedures with greater accuracy, thereby supplementing market growth.

The emergence of 5G technology is transforming the field of telesurgery by offering ultra-low latency and high-speed connectivity necessary for real-time surgical procedures. According to an article released in 2024 by Telefonaktiebolaget LM Ericsson, trials for telesurgery worldwide have confirmed that in an optimal internet environment, the achieved latency is approximately 5 times the theoretically lowest possible delay. In a fully managed system consisting of managed fiber and 5G, this figure is reduced to only 2 times, resulting in significantly better performance. Thus, the reliable and instant communication enabled by 5G networks assures that surgeons can conduct complex operations remotely with precision, reducing the risk of delays or disconnections. This advancement allows for high-definition video streaming and real-time data transmission, which are crucial for the complex nature of surgical procedures.

Furthermore, surging number of surgeries in remote locations and smaller cities are driving market growth. In June 2024, a team of doctors from the Rajiv Gandhi Cancer Institute and Research Centre (RGCIRC) in Rohini utilized the first indigenous surgical robot, Mantra, to conduct the inaugural telesurgery. The surgeon controlled the robotic instruments through a console remotely from Gurgaon, and the surgical procedure, which lasted one hour and 45 minutes, was successfully completed. Moreover, the benefits associated with telesurgery, such as improving surgical accuracy, eliminating potential shortage of surgeons, and minimizing the risk of infection, are contributing to market growth.

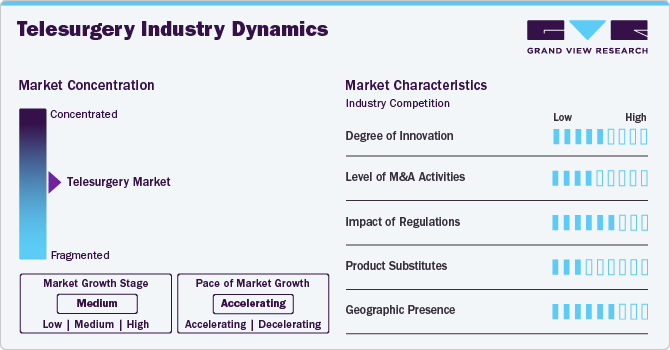

Market Concentration & Characteristics

The telesurgery market shows a high degree of innovation. This innovation is driven by advancements in robotics, telecommunication technologies, and artificial intelligence. These technologies enable surgeons to conduct complex procedures with precision and control, even from remote locations. The incorporation of real-time imaging, haptic feedback, and improved visualization systems further enhances the accuracy and safety of surgical interventions. Moreover, advancements in data security and connectivity play a vital role in addressing concerns related to patient data privacy and ensuring stable communication during procedures.

The telesurgery market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for robots. Furthermore, increasing collaborations among market players will boost market growth. In July 2022, Soliton Systems in Japan, a global IT security and live streaming technology developer, completed a trial in remote surgery with KDDI and Riverfield, showcasing wireless tele-surgery.

Regulations play a critical role in shaping the development and adoption of the telesurgery market. The regulation of the telesurgery market involves various national and international bodies. In the U.S., the Food and Drug Administration (FDA) is responsible for regulating medical devices, including robotic surgery systems used in telesurgery. The Federal Communications Commission (FCC) oversees communication technologies crucial for data and video transmission in telesurgery. Regulatory bodies set standards for the safety, efficacy, and quality of telesurgery systems, ensuring that the technology meets rigorous criteria before it is used in clinical settings.

In the field of telesurgery, potential alternatives mainly consist of traditional surgical methods and minimally invasive surgeries performed on-site without robotic assistance. For example, laparoscopic surgery offers minimally invasive options with shorter recovery times and reduced risks compared to open surgery. However, these methods may not offer the precision, advanced visualization, and access to hard-to-reach areas that telesurgery systems provide. Another alternative is the use of augmented reality (AR) and virtual reality (VR) technologies in traditional surgeries, which improve visualization and planning without the need for robotic systems.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. In June 2022, an Indonesian Robotic Surgery Center was established by the Health Ministry at Hasan Sadikin Hospital (RSHS) in Bandung and Dr. Sardjito Public Hospital in Yogyakarta to support the advancement of remote surgical services.

Component Insights

In 2023, the system segment dominated the telesurgery market and accounted for the largest revenue share of 65.5%. The growing adoption of telemedicine and remote healthcare services is propelling the telesurgery market. Additionally, increasing funding for the development of advanced telesurgery robots are supplementing market growth. In September 2023, Virtual Incision, the startup preparing to launch a small surgical robot into space, announced that it has secured an additional USD 30 million in funding, building upon its previous USD 46 million series C financing. This round of funding will sustain the company’s activities until at least 2025 as it gets ready to bring to market the compact robotic system intended for abdominal surgery.

The instrument & accessories segment in the telesurgery market is expected to witness the fastest growth over the forecast period. Continuous innovation in surgical instruments and accessories, which are essential for the effective use of robotic platforms, are fueling market growth. These innovations include advanced surgical tools, improved imaging systems, and specialized accessories that enhance the precision and versatility of robotic-assisted surgeries. The increasing complexity of surgical procedures and the demand for minimally invasive techniques are driving the need for highly specialized instruments and accessories capable of performing difficult tasks with high accuracy. Moreover, the rising number of robotic surgeries globally is boosting the demand for surgical instruments and accessories. For instance,surgeons worldwide have received training on da Vinci systems, totaling more than 60,000 in number. Additionally, they have successfully performed over 10 million surgical procedures using da Vinci systems.

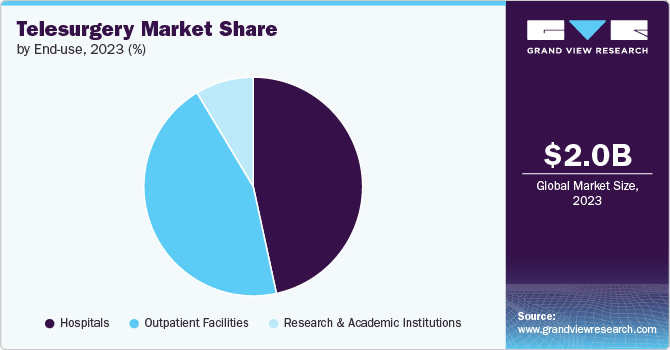

End Use Insights

The hospitals segment held the largest revenue share of 46.6% in 2023. The increasing adoption of advanced robotic systems and telecommunication technologies in the hospitals is supplementing segmental growth. For instance, in June 2019, Tian Wei, the president of Beijing Jishuitan Hospital, conducted the first remote surgery at the hospital's Robot Teleoperation Center utilizing orthopedic surgery robots. This surgery utilized Huawei's communication technology and China Telecom's 5G to establish a connection between Beijing Jishuitan Hospital, Jiaxing No. 2 Hospital of Zhejiang, and Yantaishan Hospital of Shandong. Moreover, increasing patient population across the globe is anticipated to boost market growth.

Outpatient facilities segment in telesurgery market is anticipated to register a significant growth over the forecast period. The demand for outpatient procedures is rising as patients and healthcare systems prioritize cost-effective and less invasive treatment options. According to ClinicView data from Definitive Healthcare, the number of procedures performed in outpatient clinics increased consistently from over 272 million in 2016 to over 414 million in 2021. This reflects a compound annual growth rate of 8.80% over the five-year period. Furthermore, as patients become more comfortable with telemedicine solutions, the acceptance of telesurgery is anticipated to grow.

Application Insights

The general surgery segment held the largest revenue share of 38.1% in 2023. The growing number of general surgeries across the globe is accelerating market growth. According to a report published by the American College of Surgeons, there are four million abdominal operations performed in the U.S. each year. Some of these operations may require hernia repair, with more than 400,000 ventral hernia repair procedures being performed annually. Additionally, the ongoing advancements in telecommunications and networking technologies are supplementing market growth. Moreover, the growing need for minimally invasive treatments and a requirement for remote medical services are fostering market growth. A study conducted in 2020 at 73 hospitals in the U.S. revealed a rise in the utilization of surgical robots, increasing from 1.8% in 2012 to slightly over 15% in 2018.

Urological surgery segment in telesurgery market is anticipated to register the fastest growth over the forecast period. Increasing adoption of robots in urological surgeries are fueling segmental growth. For instance, according to the report published in ScienceDirect in 2021 titled "Statistical analysis of da Vinci procedure volumes of 2021 in the Chinese Mainland," robotic surgeries are predominantly carried out in the urology department, which is the largest specialty, accounting for over 40,000 procedures (45.5%). Moreover, the increasing incidence of chronic diseases, such as cancer, is contributing to the expansion of the market. As per the WHO report, bladder cancer ranks as the ninth most prevalent type of cancer globally. In 2022, over 600,000 individuals received a diagnosis of bladder cancer worldwide, and more than 220,000 people lost their lives to this disease. The rise in bladder cancer cases will lead to a greater demand for surgeries, thus driving market growth.

Regional Insights

North America dominated the telesurgery market in 2023 and accounted for the largest revenue share of 51.56% owing to the advanced healthcare infrastructure, high healthcare expenditure, and the rapid adoption of innovative technologies. Moreover, the presence of key market players, such as Intuitive Surgical, accelerates the development and deployment of telesurgery systems in the region. Additionally, government initiatives and funding for telemedicine and telesurgery projects are supplementing market growth.

U.S. Telesurgery Market Trends

The telesurgery market in the U.S. held the largest share of 95.5% in 2023. Growing number of robotic assisted surgeries are driving the market growth. For instance, according to a WebMD article, approximately 644,000 robotic surgeries were conducted in the U.S. in 2021. This figure is projected to reach nearly 1 million by 2028. Additionally, an increasing prevalence of chronic diseases necessitating surgical interventions, coupled with a shortage of specialized surgeons are fueling market growth.

Canada telesurgery market is anticipated to register the fastest growth during the forecast period. The increasing prevalence of chronic diseases and the aging population create a growing demand for minimally invasive surgical procedures, thereby supplementing market growth. For instance, as per Statistics Canada, on July 1, 2022, nearly 18.8% of the population, or 7,329,910 people, were aged 65 or older.

Europe Telesurgery Market Trends

Telesurgery market in Europe is anticipated to register the fastest growth during the forecast period owing to a well-established healthcare system and significant investments in research and development. Furthermore, increasing acceptance of robotic surgeries is fostering regional growth. For instance, the U.S., Europe, and Japan conduct approximately 90% of all robotic surgeries.

Germany telesurgery market is anticipated to register a considerable growth rate during the forecast period. The government is actively supporting digital health programs by creating policies and providing funding to incorporate telehealth solutions into the healthcare system. Moreover, the growing spending on healthcare is driving market growth. According to the World Bank Group data, in 2022, healthcare expenditure in Germany accounted for 12.65% of the GDP.

Telesurgery market in UK is anticipated to register a considerable growth rate during the forecast period. The increasing application of robotic surgeries is escalating market growth. According to the article published by John Wiley & Sons, Inc., robotic procedures in England are predominantly urological (84.2%), followed by gynecological (9.9%), colorectal (4.2%), and general surgery (1.7%).

Asia Pacific Telesurgery Market Trends

Telesurgery market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period owing to the expanding healthcare infrastructure and increasing healthcare expenditure in countries like China, India, and Japan. The region's large and aging population, along with the rising incidence of chronic diseases are boosting market growth.

China telesurgery market held the largest share in 2023. Increasing adoption of robotic surgeries are driving the demand of telesurgery. In June 2024, a Chinese surgeon successfully conducted a remote robotic prostate removal surgery on a patient in Beijing from a location in Rome. This telesurgery involved the use of a surgical console connected over 8,000km (about 5,000 miles) to a set of robotic arms, facilitated by a 5G network and fiber-optic connections.

Telesurgery market in India is anticipated to register a considerable growth during the forecast period. Increasing trials of telesurgeries in India is fostering market growth. In India, two doctors published the outcomes of five telesurgery procedures that took place in September 2019 using Corindus Vascular Robotics Inc.’s CorPath platform. Effective surgeries indicate progress in treating heart attacks and strokes through remote, robot-assisted operations.

Latin America Telesurgery Market Trends

Telesurgery market in Latin America is anticipated to register significant growth during the forecast period. Increasing adoption of telemedicine will escalate market growth. Moreover, growing usage of robotics system in the surgeries are boosting market growth. As reported by Global Health Intelligence, in 2021, 130 medical institutions in Latin America incorporated 150 robotic systems.

Brazil telesurgery market is anticipated to register a considerable growth during the forecast period. Increasing usage of robots is fostering market growth. For instance, according to the article released by the Royal College of Surgeons of England in 2024, there are 106 robotic system installations in Brazil, and 118,000 robotic procedures have been carried out.

MEA Telesurgery Market Trends

MEA telesurgery market is anticipated to register lucrative growth during the forecast period. Evolving healthcare landscape and growing demand for advanced medical technologies will escalate market growth. Moreover, increasing disease burden is expected to boost market growth.

Key Telesurgery Company Insights

Key participants in the telesurgery market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Telesurgery Companies:

The following are the leading companies in the telesurgery market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical

- Sina Robotics & Medical Innovators Co, Ltd

- Asensus Surgical US, Inc.

- SS Innovations International Inc.

- RIVERFIELD Inc.

- Siemens Healthcare

- MicroPort

Recent Developments

-

In June 2024, SS Innovations introduced SSI Mantra 3, the latest and most advanced version of the Mantra surgical robot system.SSI Mantra 3 features five robotic arms and a 3D HD headset that delivers clear optics and vision to ensure effective precision and control.

-

In June 2024, Sovato reported successful remote robotic-assisted operations conducted over 500 miles using the Sovato system. The Sovato platform supports the entire remote surgical process, providing assistance to surgeons, care teams, and patients throughout the surgical journey.

-

In May 2023, Monogram Orthopaedics, a developer of surgical robotics, partnered with Real-Time Innovations (RTI) to integrate RTI's Connext Anywhere platform for telesurgery communications. Using Data Distribution Service (DDS), the software will facilitate data flow over unreliable networks. Monogram can utilize the software's Cloud Discovery Service to link proprietary applications across various networks.

-

In January 2022, SS Innovations introduced the SSI MANTRA (Multi-Arm Novel Tele Robotic Assistance) surgical robotic system suitable for various major surgical specialties such as urology, gynaecology, general surgery, cardiac, thoracic, and head & neck surgery.

Telesurgery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.41 billion

Revenue forecast in 2030

USD 5.91 billion

Growth rate

CAGR of 16.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Intuitive Surgical; Sina Robotics & Medical Innovators Co., Ltd; Asensus Surgical US, Inc.; SS Innovations International Inc.; RIVERFIELD Inc.; Siemens Healthcare; MicroPort

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telesurgery Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global telesurgery market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

System

-

Instrument & Accessories

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Urological Surgery

-

Gynecological Surgery

-

Cardiovascular Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Outpatient Facilities

-

Research & Academic Institution

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. In 2023, the system segment dominated the telesurgery market and accounted for the largest revenue share of 65.5%. The growing adoption of telemedicine and remote healthcare services is propelling the telesurgery market.

b. Some key players operating in the market include Intuitive Surgical, Sina Robotics & Medical Innovators Co.,Ltd, Asensus Surgical US, Inc., SS Innovations International Inc., RIVERFIELD Inc., Siemens Healthcare, MicroPort

b. The significant advancements in telecommunications and robotic surgery are driving the adoption of telesurgery.

b. The global telesurgery market size was estimated at USD 2.05 billion in 2023 and is expected to reach USD 2.41 billion in 2024.

b. The global telesurgery market is expected to grow at a compound annual growth rate of 161% from 2024 to 2030 to reach USD 5.91 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."