Telehealth Market Size, Share & Trends Analysis Report By Product (Hardware, Software, Services), By Delivery Mode, By Disease Area, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-909-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Telehealth Market Size & Trends

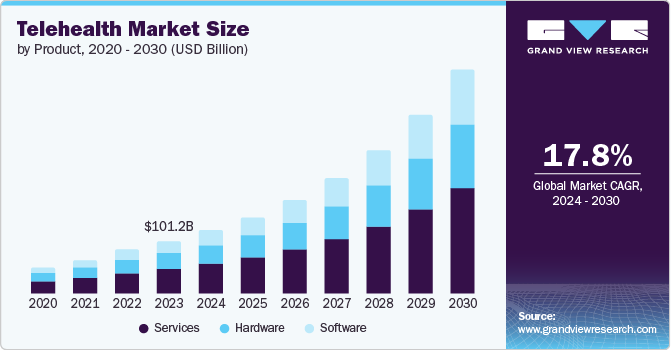

The global telehealth market size was estimated at USD 101.15 billion in 2023 and is projected to grow at a CAGR of 24.3% from 2024 to 2030. The market is primarily driven by the increasing adoption of digital health & smartphones, rising investments, improved internet connectivity, and growing technological advancements. For instance, in July 2022, the UK introduced annual digital maturity assessments across the NHS for social care and digital health. This plan raised funding of USD 2.37 billion to implement electronic patient records (EPRs) and enhance remote patient monitoring services.

Furthermore, the growing adoption and acceptance of telehealth services are expected to boost the market's growth over the forecast period. For instance, according to an article published by MJH Life Sciences and AJMC in April 2023, telehealth utilization increased in all four U.S. regions: the West (9.5%), the Midwest (9.5%), the Northeast (3.2%), and the South (6.7%) and the overall national telehealth utilization increased by 7.3%.

Moreover, smartphones have evolved from devices of communication & entertainment to devices that can monitor health and fitness. Some market players are developing Chatbot services for basic medical inquiries and one-time consultations. For instance, WeChat offers Chatbot services in China for basic medical inquiries and other mobile health solutions such as booking appointments, accessing medical records, & paying medical bills. Moreover, the market is propelled by favorable government initiatives to expand telehealth by making healthcare services more accessible and convenient for patients. The focus on cost-effective and efficient healthcare solutions further propels the adoption of telehealth services.

The rising adoption of telehealth facilities by patients, physicians, and government authorities is boosting the market. Access to healthcare through specific applications and video consultations enables communication between patients and doctors in remote locations, eliminating the need to visit hospitals or clinics. Market players such as Apple, Google, and IBM focus on improving mobile health experience by providing numerous solutions through different subscription plans and emphasizing data security. These factors are expected to drive the market over the forecast period.

Telehealth services are rapidly expanding, particularly in cardiology, behavioral health, radiology, and online consultations. This growth is fueled by a surge in startup funding and the introduction of new solutions and services, especially those designed for virtual consultations. For instance, in March 2023, Royal Philips introduced Philips Virtual Care Management. It includes flexible solutions and services that help various healthcare stakeholders effectively engage with patients, including health systems, payers, providers, and employer groups.

Furthermore, integrating artificial intelligence and machine learning algorithms enhances the personalization of healthcare services. In addition, favorable government initiatives promoting telehealth adoption drive the market. For instance, initiatives such as the National Digital Health Mission (NDHM) are anticipated to grow the adoption of the e-healthcare model in India. Similarly, the “Innovation Strategy 2019 - 2021” in UAE fuels digital transformation in the healthcare sector.

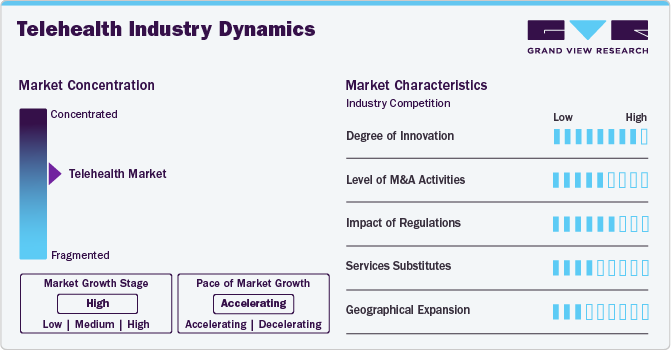

Industry Dynamics

The market is characterized by a high degree of innovation, with the introduction of new technologies and methods. Integrating artificial intelligence (AI) and machine learning (ML) into telehealth platforms is revolutionizing how healthcare is delivered. These technologies empower healthcare providers to analyze patient data remotely, enabling them to provide personalized and effective care. For instance, in June 2024, MetroHealth and MUSC Health launched Ovatient, the first virtual healthcare company. Ovatient integrates with hospital systems and patients’ medical records via Epic and MyChart, providing a personalized patient experience that empowers care teams with nearly real-time data.

Several market players, such as Cerner Corporation (Oracle), GE Healthcare, Siemens Healthineers, and Medtronic, are engaged in acquisition and merger activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in January 2024, 98point6 Technologies announced the acquisition of Bright.md. to accelerate the launch of 98point6’s asynchronous care module. This development enables healthcare organizations to license an integrated, purpose-built clinician solution supporting multiple care delivery models.

Regulations, particularly the Health Insurance Portability and Accountability Act (HIPAA) of 1996 and its amendments under the Health Information Technology for Economic and Clinical Health (HITECH) Act, positively impact market growth. These regulations play a crucial role in ensuring digital health information's secure handling and privacy, shaping the operational framework and compliance standards for telehealth services, especially in the U.S.

The market offers various similar services at prices ranging from low to high, depending on the service being used. Although patients can visit hospitals and clinics for diagnosis and treatment, service providers have found ways to commercialize their products and thrive in this highly competitive market.

Market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in January 2022, MDLive launched a patient health monitoring program aimed at providing better insights for improving outcomes.

Product Insights

By product, services segment held the largest market share of 47.1% in 2023. The rising need for telehealth applications in chronic disease management and real-time monitoring, technological advancements in digital infrastructure, growing internet and smartphone penetration, and development in hardware and software components are driving segment growth. For instance, in April 2023, Providence partnered with Cadence and launched a remote patient monitoring and responsive virtual care program for chronic care across Providence’s clinics. Furthermore, the constantly evolving digital space is expected to support the growing need for these services.

The software segment is anticipated to witness the fastest growth over the forecast period. Favorable government initiatives and a rise in demand for technologically advanced Healthcare IT solutions are expected to boost the segment's growth. For instance, in July 2022, in India, the National Health Authority (NHA) expanded the digital health facilities under its Ayushman Bharat Digital Mission (ABDM) scheme with integrations of 52 digital health applications.

Delivery Mode Insights

By delivery mode, the web-based segment held the largest market share of 45.5% in 2023. Factors such as the growth of virtual care and web-based applications, along with the increased use of web-based delivery models that offer patients immediate access to healthcare services, fuel the market growth. Web-based solutions are provided to users through web servers by deploying internet protocol. These solutions encompass four key components: an internet connection, a data administrator, a web server, and a software coding system. The use of the internet and web-based services enables access to the most distant locations with just a single computer or monitoring device.

The cloud-based delivery mode segment is expected to witness the fastest growth during the forecast period owing to the rising adoption of cloud-based applications by healthcare providers and patients and the introduction of technologically advanced solutions. For instance, in March 2023, Fujitsu introduced a cloud-based platform that allows users to securely collect and leverage health-related data to promote digital transformation in the medical field.

Disease Area Insights

By disease area, the radiology segment held the largest market share of 12.6% in 2023. Factors such as the implementation of Picture Archiving and Communication System (PACS), the integration of AI into teleradiology, and increasing R&D activities pertaining to eHealth boost segment growth. For instance, in November 2023, Koninklijke Philips N.V. introduced its next-generation ultrasound systems, AI-enabled cloud solutions that improve radiology efficiency and clinical output.

The psychiatry segment is anticipated to grow at the fastest CAGR over the forecast period, owing to an increase in the patient pool of stress, anxiety, and mental illnesses. Moreover, the growing adoption of telepsychiatry services by people to treat mental health is expected to boost the market growth over the forecast period. Telepsychiatry services help provide affordable, convenient, and readily accessible mental health services. The American Psychiatric Association helped psychiatrists adopt telepsychiatry services for better patient satisfaction and care.

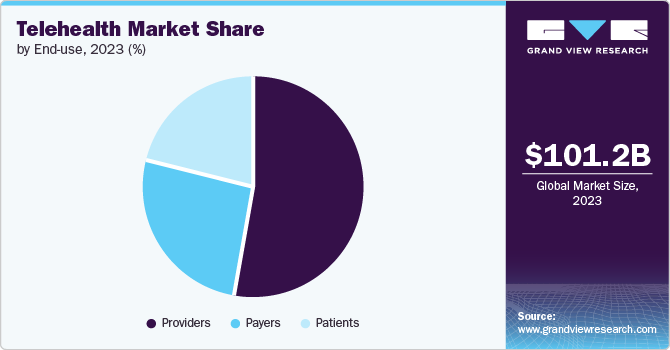

End-use Insights

By end use, the provider segment dominated the market with a revenue share of 52.8% in 2023 due to the increasing adoption of teleconsultation, telemedicine, and telehealth among healthcare professionals to reduce the burden on healthcare facilities. Moreover, the rise in the number of partnerships and collaborations among various public & private healthcare organizations to drive the adoption and accessibility of telehealth services is further fueling segment growth. For instance, in April 2021, DOC2US, the telemedicine provider in Malaysia, collaborated with GDEX Bhd to provide easy medication delivery services by secure and real-time tracking of medication.

The payers segment is anticipated to witness the fastest growth during the forecast period. This segment comprises health plan sponsors (employers and unions), insurance companies, and third-party payers. Payers are increasingly adopting telehealth solutions to ensure their members receive the right care at the right time in the right place while saving the employer and the member money owing to major cost-saving options provided by telehealth services, including reduced cost per consultation in comparison to traditional in-person appointments and number of diagnostic tests required during telehealth consultations with in-person visits.

Regional Insights

North America telehealth market dominated the overall market with a revenue share of 46.3% in 2023. Key factors driving the growth of telehealth services in the region include the higher healthcare IT expenditure, rapid adoption of smartphones, a significant shortage of primary caregivers, advancements in coverage networks, a growing geriatric population, a surge in chronic disease prevalence, increasing healthcare costs, and a rising need for enhanced prevention and management of chronic conditions. For instance, according to What'sthebigdata, 276.14 million individuals in the U.S. have a smartphone in 2023.

U.S. Telehealth Market Trends

The telehealth market in the U.S. dominated the North American region owing to innovative software development, advanced healthcare management, and the presence of several market players operating across segments, such as mobile and network operations. Increasing awareness regarding the availability of digital health solutions, such as mHealth and telehealth, is driving their adoption rate. For instance, according to data published by Harvard Health Letter, almost 50 million people in the U.S. use remote patient monitoring devices.

Europe Telehealth Market Trends

Europe telehealth market is witnessed considerable growth in 2023. The market is fueled by the launch of the Telehealth Quality of Care Tool by the World Health Organization (WHO) in March 2024. It is a significant step towards the development of telehealth in Europe. By promoting trust, harmonizing regulations, and encouraging evidence-based practice, the tool is expected to help create a more robust and sustainable telehealth ecosystem, driving the growth of the market and improving access to quality healthcare for all.

The telehealth market in UK is anticipated to register the significant growth rate during the forecast period. The widespread adoption of technology and high-speed internet in the UK has made telehealth more accessible and convenient for patients. This has led to an increase in the number of patients using telehealth services, thereby driving the growth of the telehealth market.

Germany telehealth market dominated the Europe overall market. The German Digital Healthcare Act (DVG), which came into effect in December 2019, is expected to have a positive impact on the telehealth market. This act aims to improve patient care and access to healthcare services by expanding the use of digital health applications and telemedicine, thereby driving the market growth in the country.

Asia Pacific Telehealth Market Trends

The telehealth market of Asia Pacific is anticipated to witness the fastest growth over the forecast period. Factors such as the growing investments and geriatric population in countries such as Japan and India, along with technological advancements in digital health and research initiatives undertaken by the key players in the region, are anticipated to contribute to the market growth. For instance, in 2023, the Australian Government invested around USD 107.2 million in digital health programs and innovations to update their healthcare system.

China telehealth market dominated the Asia Pacific region. The Chinese government actively supports telehealth integration into the healthcare system through policies and initiatives that drive market growth in the country. Furthermore, addressing the growing prevalence of chronic diseases due to lifestyle changes and urbanization, telehealth plays a vital role in offering convenient and accessible healthcare solutions across China.

The telehealth market in Japan is anticipated to register a considerable growth rate during the forecast period, owing to the introduction of new digital health technologies and the rising popularity of at-home care & regular monitoring services. The Robot for Interactive Body Assistance (RIBA) in critical care, an IT-enabled robot for geriatric patients, is an important example of Japan embracing telehealth solutions for patient monitoring. The introduction of technologically advanced mobile and wearable devices is boosting the demand for telehealth services in the country.

Latin America Telehealth Market Trends

Latin America telehealth market is anticipated to witness significant growth. The high prevalence of chronic diseases, such as cardiovascular disease, arthritis, and cancer, necessitates ongoing medical supervision, and rising investments are fueling the demand for telehealth in Latin America. For instance, Argentina's government invested USD 63.89 million in 2020 over the next three years to develop a Federal Digital Health Program.

The telehealth market in Brazil is anticipated to witness a significant growth during the forecast period. The Brazilian Telehealth Act, which came into force in February 2021, is a significant driver of growth for the market in the country. This legislation provides a legal framework for the use of telehealth services, including remote consultations, diagnosis, and treatment. It also establishes guidelines for data privacy and security, ensuring patient confidentiality.

Middle East & Africa Telehealth Market Trends

Middle East and Africa telehealth market is anticipated to witness lucrative growth during the forecast period. Improving internet connectivity and increasing smartphone penetration are supporting the digitalization of healthcare. According to GSMA, The Mobile Economy estimates for the Middle East and North Africa regions, the number of mobile internet users exceeded 300 million. Smartphone penetration is anticipated to reach 50.0% of the total population by the end of 2022. Thus, such factors boost market growth.

The telehealth market in Saudi Arabia is anticipated to witness significant growth during the forecast period. Rising smartphone penetration, adoption of teleconsultation services with physicians, and the growing number of users of digital applications such as Seha, Tawakkalna, and Tabaud, which provide telehealth services in the country, boost the market growth.

Key Telehealth Company Insights

The key players in the market have been involved in mergers and acquisitions to increase their share and provide innovative solutions for users, which is anticipated to boost the market's growth during the forecast period. Furthermore, several initiatives are being undertaken by the key players globally, which have significantly contributed to the market's growth.

Key Telehealth Companies:

The following are the leading companies in the telehealth market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V

- GE Healthcare

- Cerner Corporation (Oracle)

- Siemens Healthineers

- Medtronic

- Teladoc Health Inc

- American Well

- MD Live

- Doctor On Demand

- Global Med

Recent Developments

-

In October 2023, Glenn Gaunt MD, announced its official launch, introducing an alternative to traditional healthcare. The platform offers accessible and convenient healthcare services, enabling patients to receive medical attention from the comfort of their homes.

-

In September 2023, Apollo Telehealth introduced Tele-Emergency ICU services across nine NTPC plants, enhancing critical care capabilities. This initiative aims to provide remote medical supervision and support for emergency situations, leveraging advanced telehealth technologies.

-

In August 2023, Spark Biomedical launched telehealth services for Sparrow Ascent with the aim to improve patient access to opioid withdrawal treatment. Sparrow Ascent is a medication-assisted treatment (MAT) program that provides comprehensive care for individuals struggling with opioid use disorder. The program utilizes a combination of medication, counseling, and support services to help patients achieve long-term recovery.

-

In February 2022, Teladoc Health, Inc. launched Chronic Care Complete, a comprehensive solution dedicated to managing chronic conditions. This innovative offering is designed with the primary goal of enhancing healthcare outcomes for individuals grappling with persistent health challenges.

-

In February 2022, GlobalMed launched the Portable Audiology Backpack to enable telehealth audiology examinations from a distance, extending the reach of patient care.

-

In August 2021, Philips announced the launch of Philips Acute Care Telehealth which will provide flexible and configurable solution to help the healthcare systems provide virtual care.

Telehealth Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 123.26 billion |

|

Revenue forecast in 2030 |

USD 455.27 billion |

|

Growth rate |

CAGR of 24.3% from 2023 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, delivery mode, disease area, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Koninklijke Philips N.V; GE Healthcare; Cerner Corporation (Oracle); Siemens Healthineers; Medtronic; Teladoc Health Inc.; American Well; MD Live; Doctor On Demand; and Global Med |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Telehealth Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global telehealth market report based on product, delivery, end-use, disease area, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Monitors

-

Medical Peripheral Devices

-

Blood Pressure Meters

-

Blood Glucose Meters

-

Weighing Scales

-

Pulse Oximeters

-

Peak Flow Meters

-

ECG Monitors

-

Others

-

-

-

Software

-

Standalone Software

-

Integrated Software

-

-

Services

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store and Forward

-

Others

-

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Web-based

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Patients

-

-

Disease Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Psychiatry

-

Substance Use

-

Radiology

-

Endocrinology

-

Dermatology

-

Gastroenterology

-

Neurological Medicine

-

ENT

-

Cardiology

-

Oncology

-

Dental

-

Gynecology

-

General Medicine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global telehealth market size was estimated at USD 101.1 billion in 2023 and is expected to reach USD 123.26 billion in 2024.

b. The global telehealth market is expected to grow at a compound annual growth rate of 24.3% from 2024 to 2030 to reach USD 455.27 billion by 2030.

b. The services segment held the largest share of 47.2% in 2023. The segment is anticipated to grow at a lucrative rate owing to the prevailing trend of outsourcing these services.

b. Some key players operating in the global telehealth market include Teladoc Health, American Well, GE Healthcare, Cerner Corporation, Medtronic, Siemens Healthineers, Koninklijke Philips N.V, Doctor on Demand, and GlobalMed.

b. Key factors that are driving the telehealth market growth include increasing access to basic healthcare along with improved healthcare quality and patient safety by early detection and diagnosis.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."