Telecom Service Assurance Market Size, Share & Trends Analysis Report By Component, By Operator, By Deployment, By Enterprise Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-359-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Telecom Service Assurance Market Trends

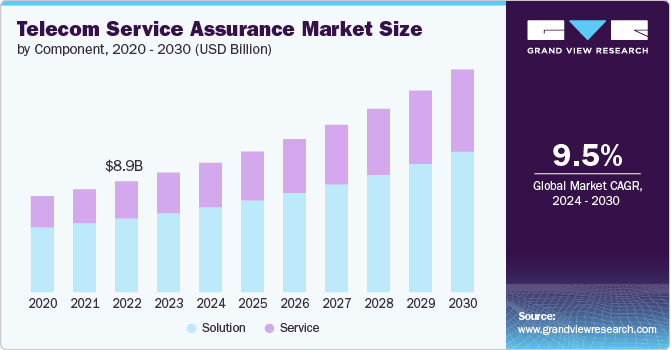

The global telecom service assurance market size was estimated at USD 9.67 billion in 2023 and is expected to expand at a CAGR of 9.5% from 2024 to 2030.The increasing number of mobile phone users worldwide is creating a demand for improved network performance and service quality. This, in turn, is driving the growth of the telecom service assurance market. The deployment of 5G technology is another major driver. 5G networks are more complex than previous generations and require more sophisticated service assurance solutions to deliver a wider range of services with enhanced mobile broadband, ultra-reliable low latency communication, and massive machine-type communication.

The growing complexity of telecom networks is pushing the need for automation in service assurance. Automation helps operators improve efficiency, reduce costs, and improve service quality. Service assurance solutions with automation capabilities can automatically detect and troubleshoot problems without manual intervention. Data analytics is also playing an increasingly important role. Service assurance solutions are collecting more and more data about network performance and user experience. This data can be used to identify trends, predict problems, and improve service quality.

Telecom operators are increasingly prioritizing a customer-centric approach to differentiate themselves in a competitive market. Service assurance solutions are crucial in this effort, enabling operators to monitor, manage, and enhance service quality. These solutions provide real-time monitoring of network performance and service quality, offering immediate insights into the health of the network and allowing for quick detection and resolution of service issues. With end-to-end visibility across the entire network infrastructure, operators can understand the impact of different network segments on overall customer experience and pinpoint specific issues affecting service quality.

An open architecture in service assurance is becoming increasingly important as it facilitates seamless integration with other tools and platforms. This open system approach fosters collaboration and interoperability, allowing different systems to work together harmoniously. By adopting open architectures, operators can more easily adapt to changing industry standards and incorporate new technologies into their existing infrastructure. This flexibility is crucial for future-proofing investments in a rapidly evolving technological landscape. Ultimately, open architectures enable operators to stay agile and responsive to market demands, ensuring they remain competitive.

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing service assurance processes by driving predictive analytics and enabling proactive issue resolution. These technologies empower operators to anticipate and address network anomalies before they impact the user experience, ensuring seamless and reliable service delivery. AI and ML can optimize network performance by analyzing vast amounts of data and identifying patterns that human operators might miss. This leads to more efficient resource allocation and enhanced service quality. By leveraging AI and ML, operators can respond swiftly to emerging issues, maintaining high standards of customer satisfaction and network reliability.

Component Insights

Based on component, the solution segment led the market and accounted for 66.2% of the global revenue in 2023. The solution segment includes probe system, network management, workforce management, fault management, quality monitoring, and others. Solutions offer end-to-end visibility, advanced analytics, and automation, enabling operators to proactively manage and optimize their networks. The increasing complexity of telecom networks, driven by the adoption of new technologies such as 5G, necessitates robust solutions that can seamlessly integrate with existing systems. In addition, the demand for enhanced customer experience and the need to maintain competitive advantage further drive the adoption of sophisticated service assurance solutions.

The service segment is expected to register significant growth from 2024 to 2030. The service segment includes professional services and managed services. One major trend is the increasing reliance on specialized expertise to handle complex network environments and ensure optimal performance. In addition, the shift towards managed services is fueled by the need for cost efficiency and the desire to focus on core business operations while outsourcing network management. The rapid deployment of 5G and IoT technologies also propels the demand for professional and managed services to maintain and enhance network reliability and customer satisfaction.

Operator Insights

The fixed operator segment accounted for the largest market revenue share in 2023. The growth in the segment is influenced by the rising demand for high-speed broadband services and the ongoing transition to fiber-optic networks. As customers increasingly rely on stable and fast internet connections for work, entertainment, and smart home applications, fixed operators must ensure consistent service quality. The integration of advanced analytics and monitoring tools helps fixed operators manage network performance and swiftly address potential issues. Furthermore, the competition to provide superior customer experience drives fixed operators to continually enhance their service assurance capabilities.

The mobile operator segment is expected to grow significantly from 2024 to 2030. The mobile operator segment in the telecom service assurance market is driven by the rapid proliferation of 5G networks, which require sophisticated assurance solutions to manage increased data traffic and ensure low latency. The growing demand for mobile data services and the expansion of IoT devices further stress the need for advanced service assurance to maintain high-quality user experiences. In addition, mobile operators are increasingly adopting AI and ML technologies to predict and resolve network issues proactively. Enhanced customer expectations for seamless and uninterrupted mobile services also push operators to invest heavily in robust service assurance solutions.

Deployment Insights

The on-premise segment accounted for the largest market revenue share in 2023. The on-premise segment remains vital due to the need for robust security and control over sensitive network data. Many telecom operators prefer on-premise solutions to comply with stringent regulatory requirements and maintain data sovereignty. The trend towards customized and highly specialized service assurance systems also supports the demand for on-premise deployments. Furthermore, operators with substantial existing infrastructure investments continue to rely on on-premise solutions to ensure seamless integration and performance management within their networks.

The cloud segment is expected to grow significantly from 2024 to 2030. Telecom operators are increasingly adopting cloud-based assurance solutions to quickly adapt to changing network demands and integrate new technologies such as 5G and Internet of Things (IoT). The cost-efficiency and reduced need for extensive on-site infrastructure further propel the shift toward cloud deployments. In addition, the ability to leverage advanced analytics and AI capabilities in the cloud enhances proactive monitoring and optimization of network performance.

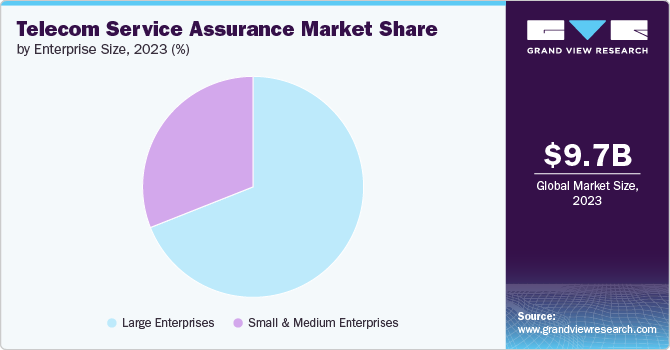

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. The growth of the segment is driven by the need for comprehensive and scalable solutions to manage complex and expansive network infrastructures. Large enterprises are increasingly adopting advanced analytics, AI, and machine learning technologies to ensure high performance and reliability across their networks. The demand for enhanced customer experience and stringent compliance requirements further propel investment in sophisticated service assurance solutions. In addition, large enterprises prioritize robust security measures and customized solutions, which are more readily available in this segment.

The small & medium enterprises segment is expected to grow significantly from 2024 to 2030. The small and medium enterprises (SMEs) segment in the telecom service assurance market is influenced by the growing availability of cost-effective and scalable service assurance solutions. SMEs are increasingly adopting cloud-based service assurance to benefit from lower upfront costs and the flexibility to scale as their business grows. The trend towards digital transformation and the need to ensure reliable connectivity and service quality for their customers drive SMEs to invest in service assurance. In addition, the rising competition in the SME market encourages these enterprises to prioritize customer satisfaction through efficient network performance management.

Regional Insights

Asia Pacific telecom service assurance market dominated the global market and accounted for 33.30% in 2023. The telecom service assurance market is fueled by rapid urbanization, technological advancements, and the growing adoption of 5G and IoT technologies in the Asia Pacific region. The region's diverse and expanding telecom infrastructure requires scalable and flexible assurance solutions to handle the increasing network complexity. Telecom operators in Asia Pacific prioritize cost-effective solutions and cloud-based deployments to support their large and varied customer bases. Additionally, the focus on improving customer experience and competitive differentiation drives the adoption of advanced service assurance technologies.

North America Telecom Services Assurance Market Trends

The North America telecom service assurance market is anticipated to register significant growth from 2024 to 2030. The telecom service assurance market is driven by the rapid deployment of 5G networks and the high demand for advanced mobile services. The region's emphasis on cutting-edge technology and innovation pushes telecom operators to adopt sophisticated service assurance solutions to maintain network reliability and performance. Additionally, the increasing number of IoT devices and smart city initiatives requires robust network management. Regulatory compliance and the need for enhanced cybersecurity measures also contribute to the growing investment in service assurance..

The U.S. telecom service assurance market is anticipated to register significant growth from 2024 to 2030. The increasing consumer demand for high-speed internet and reliable mobile services pushes operators to invest in robust assurance solutions. Furthermore, the competitive telecom market in the U.S. compels operators to focus on customer satisfaction and network performance.

Europe Telecom Services Assurance Market Trends

The European telecom service assurance market is poised for significant growth from 2024 to 2030. European telecom operators focus on enhancing customer experience and operational efficiency, leading to increased telecom service assurance. In addition, the region's diverse and competitive telecom landscape necessitates continuous network optimization and performance management.

Key Telecom Service Assurance Company Insights

Key players operating in the telecom service assurance market include NEC Corporation, Telefonaktiebolaget LM Ericsson, Nokia, Amdocs, NETSCOUT, Broadcom, Huawei Technologies Co., Ltd., Comarch SA, Spirent Communications., and TEOCO. These players established themselves as frontrunners by offering comprehensive service assurance portfolios that cater to the evolving needs of telecom operators. These companies leverage advanced technologies, including AI and machine learning, to provide real-time monitoring, predictive analytics, and proactive issue resolution, ensuring optimal network performance and enhanced customer experience.

Leading companies in the market are undertaking strategic actions to improve their customer experiences. For instance, in February 2024, ServiceNow and NVIDIA expanded their partnership by introducing telco-specific generative AI solutions aimed at improving service experiences in the telecommunications industry. The first solution, Now Assist for Telecommunications Service Management (TSM), is built on the Now Platform and leverages NVIDIA AI to enhance agent productivity, speed up resolution times, and improve customer experiences. This collaboration addresses telcos' priorities of reducing costs and uncovering new business opportunities through AI and automation.

Key Telecom Service Assurance Companies:

The following are the leading companies in the telecom service assurance market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- Telefonaktiebolaget LM Ericsson

- Nokia

- Amdocs

- NETSCOUT

- Broadcom

- Huawei Technologies Co., Ltd.

- Comarch SA

- Spirent Communications

- TEOCO

Telecom Service Assurance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.47 billion |

|

Revenue forecast in 2030 |

USD 18.00 billion |

|

Growth rate |

CAGR of 9.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, operator, deployment, enterprise size, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

NEC Corporation; Telefonaktiebolaget LM Ericsson; Nokia; Amdocs; NETSCOUT; Broadcom; Huawei Technologies Co., Ltd.; Comarch SA; Spirent Communications.; TEOCO |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Telecom Service Assurance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the telecom service assurance market based on component, operator, deployment, and enterprise size.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Probe System

-

Network Management

-

Workforce Management

-

Fault Management

-

Quality Monitoring

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Operator Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Operator

-

Fixed Operator

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global telecom service assurance market size was estimated at USD 9.67 billion in 2023 and is expected to reach USD 10.47 billion in 2024.

b. The global telecom service assurance market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 18.00 billion by 2030.

b. Asia Pacific dominated the telecom service assurance market with a share of 33.30% in 2023. Asia Pacific dominated the largest market share in 2023 owing to rapid urbanization, technological advancements, and the growing adoption of 5G and IoT technologies.

b. Some key players operating in the telecom service assurance include NEC Corporation, Telefonaktiebolaget LM Ericsson, Nokia, Amdocs, NETSCOUT, Broadcom, Huawei Technologies Co., Ltd., Comarch SA, Spirent Communications., TEOCO

b. Key factors that are driving the market growth include the increasing number of mobile phone users and the deployment of 5G networks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."