Telecom Billing & Revenue Management Market Size, Share & Trends Analysis Report By Component, By Deployment, By Application (Mobile Operators, Internet Service Providers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-816-9

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

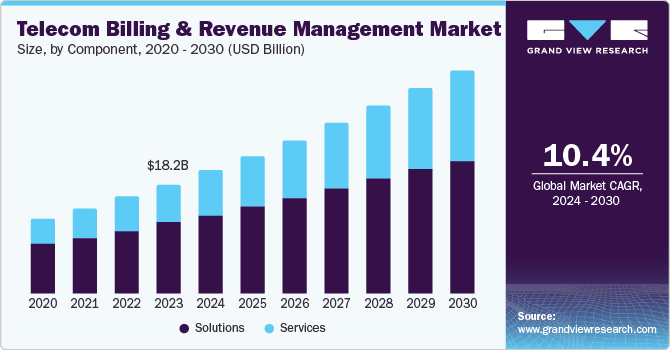

The global telecom billing & revenue management market size was valued at USD 18.22 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The growth of this market is primarily driven by factors such as the unceasing growth in cellular network subscribers and smartphone users, rising competition in the industry fuelled by numerous strategies adopted by telecom service providers, the increasing need for effective fraud management solutions, and the inclination towards adopting technology tools to ensure enhanced customer engagements and customer experiences.

With the significant increase in mobile subscribers, telecom service provider companies are seeking effective billing & revenue management solutions that can assist operations. Growing complexities of the business have developed the need for solutions associated with subscriber billing engines, customer/subscriber management, usage monitoring, and more. To ensure a smooth flow of operations, businesses in the telecom industry prefer adopting billing & revenue management solutions or services in areas such as charging or billing, payment management, fraud identification or prevention, and debtor management.

The use of billing & revenue management systems has been helping companies develop opportunities through revenue estimation, process automation, enhanced customer satisfaction and loyalty, effective catalog management, and more. For instance, in March 2024, Hrvatski Telekom, one of the prominent organizations in the telecommunication services industry, announced that the company is willing to continue its lasting partnership with Netcracker by employing Netcracker Revenue Management, which is a part of Netcracker’s digital business support system solution. Through this continued partnership, Hrvatski Telekom aims to improve its IT infrastructure and unify its fixed-line and mobile systems.

Component Insights

Based on components, the solutions segment held the largest revenue share of the global market and accounted for 64.7% in 2023. The growth of this segment is influenced by factors such as flexibility & scalability offered by solutions, seamless collaboration among teams, complete control over managing several business functions, and remote work/monitoring capabilities. Companies adopt billing & revenue management solutions for multiple functions such as billing & charging, revenue assurance, fraud management, and mediation. Automation and software assistance in such business functions help companies in various ways, including understanding customer behaviour, developing business intelligence, and ensuring strategic decision-making.

Services segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to the growing inclination towards adopting customized, tailored services suitable for an existing set of operations and the availability of on-demand professional services. Businesses in this industry provide managed and professional services associated with billing and revenue management. Managed services include multiple elements such as business advisory, engineering services, monitoring, product enhancement, migration services, and more.

Deployment Insights

The on-premise deployment segment dominated the billing & revenue management market in 2023. The growth of this segment is mainly driven by the inclination towards on-premise deployments to ensure complete control over IT infrastructure and related business processes. In addition, the growing use of data and its dependability for strategic decision-making have increased the significance of data security, storage, and protection. On-premise deployment of solutions provides businesses with desired control over relevant data sets. Availability of cost structure before implementation, customizations, and infrastructural control are expected to develop the growth of this segment during the forecast period.

The cloud deployment segment is anticipated to experience the fastest CAGR from 2024 to 2030. The growing cloud deployments of billing and revenue management solutions are driven by the advanced control offered by the deployment model, which involves remote monitoring, cost-effectiveness, scalability, real-time data processing, business intelligence, and enhanced customer experiences.

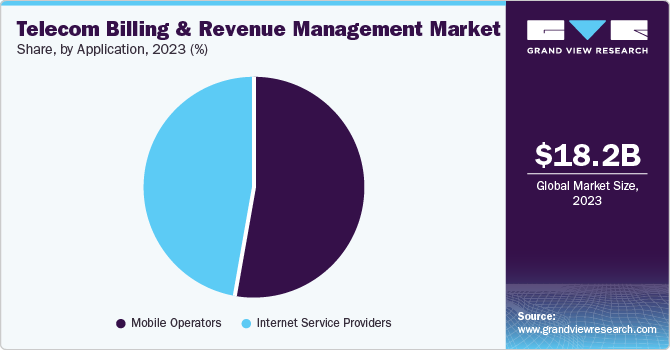

Application Insights

Based on application, mobile operators segment held the largest revenue share of the global market. The growing cloud deployments of billing and revenue management solutions are driven by the advanced control offered by the deployment model, which involves remote monitoring, cost-effectiveness, scalability, real-time data processing, business intelligence, and enhanced customer experiences. Complexities in advanced telecom services have encouraged companies to adopt billing & revenue management services associated with billing, charging, payment management, customer assistance, and more. Unceasing growth in smartphone users has influenced this segment in recent years. According to the International Telecommunication Union (ITU), in 2023, 73 % of individuals aged ten and older owned mobile phones.

The internet service providers segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to numerous factors, such as the growing demand for automated billing solutions, invoice generation, payment tracking, customer accounts management, maintaining payment histories, interaction and keeping logs, and handling subscriptions. Internet services providers also prefer the adoption of billing & revenue management solutions to ensure a reduction in operational costs and improve scalability. Continuous growth in smartphone users, growing adoption of advanced technologies such as Internet of Things, Artificial intelligence, machine learning etc., and growing demand for high-speed internet connections is projected to drive growth for this segment in approaching years.

Regional Insights

North America dominated the global telecom & revenue management market and accounted for the largest revenue share of 35.0% in 2023. This is attributed to factors such as the growing use of mobile phones in the region, increasing dependence on internet-driven technology solutions, a large number of existing customers, and rising complexities of the telecommunication industry. The emergence and implementation of technologies such as 5G and others have driven demand for effective billing & revenue management solutions in North America. In March 2024, the total number of 5G connections in North America was marked at 220 million.

U.S. Telecom Billing & Revenue Management Market Trends

The U.S. telecom billing & management market held the largest regional industry revenue share, accounting for 73.5% in 2023. This market is mainly influenced by the increasing demand for flawless telecom services by the growing number of mobile phone users, early adoption trends in technology, and rising adoption of advanced technologies such as AI and others in the telecom industry. Nearly 99% of American adults between the ages 18 and 29 own a cell phone. Rising dependence on internet-driven technology tools adopted by businesses for performance enhancements and improved productivity has generated an upsurge in demand for high-performance telecom networks and devices enabled with high-speed internet availability. These aspects are expected to result in growth for the U.S. telecom billing & revenue management market during the forecast period.

Europe Telecom Billing & Revenue Management Market Trends

Europe telecom billing & revenue management market is projected to experience a noteworthy growth during forecast period. This is primarily attributed to the increase driven by the fragmented nature of the market. For instance, in 2023, Europe was home to 45 large groups functioning in the mobile operating industry with 500,000 customers. To compare the scenario in other regional industries, the U.S. had eight, China & Japan had four, and South Korea had three of such groups.

Germany telecom billing & revenue management market held significant revenue share of the regional industry. The growth of this market is mainly influenced by the high penetration of smartphone technology coupled with growing demand for mobile and high-performance broadband connections. This market is also driven by the inclination of telecom services providers towards adopting billing & revenue management solutions backed by technology to address issues such as revenue leakage and billing errors.

Asia Pacific Telecom Billing & Revenue Management Market Trends

Asia Pacific telecom billing & revenue management market is anticipated to experience the fastest CAGR of 12.2% from 2024 to 2030. This is attributed to unprecedented growth in smartphone users and demand for internet connections in the region. Government initiatives such as "Digital India" by India or "Plan for the Overall Layout of Building a Digital China" by China play a vital role in the growing demand for mobile connections and broadband services. In 2023, 66 % of the total population from Asia Pacific used the internet in line with the global average.

India telecom billing & revenue management market is expected to grow significantly during the forecast period. The rising adoption of smartphone technology, increasing acceptance of advanced technologies in multiple industries such as banking, financial services, and insurance and enhanced availability & accessibility of high-speed internet are driving the growth of this market. To address the rising complexity of telecom business operations and competition driven by an increasing number of internet users, multiple companies are adopting billing & revenue management solutions in this market.

Key Telecom Billing & Revenue Management Company Insights

Some of the key companies operating in the telecom billing & revenue management market include Amdocs, Netcracker, Comviva, Huawei Technologies Co., Ltd, Formula Telecom Solutions Ltd, and others. Growing competition has encouraged the major market participants in this industry to adopt strategies such as collaborations & partnerships with other organizations, increased emphasis on technology adoption, improved customer assistance, and innovation.

-

Netcracker, one of the prominent companies in the technology and innovation industry, offers Next-Generation Revenue Management, a modernization platform for businesses. This platform ensures seamless entry and operations in a digital economy equipped with cloud-native architecture. This platform comprises multiple elements such as service data collection, payment management, financial data export, and more.

-

Huawei Technologies Co., Ltd, a major industry participant in information and communications technology (ICT) infrastructure and smart devices, provides revenue management offerings such as charging for Communications Service Provider (CSP), convergent billing for mobile, convergent billing for Fixed Mobile Convergence (FMC), and others.

Key Telecom Billing & Revenue Management Companies:

The following are the leading companies in the telecom billing & revenue management market. These companies collectively hold the largest market share and dictate industry trends.

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

Recent Developments

-

In May 2024, Ooredoo, a key multinational telecommunications company from Qatar, and Netcracker, a major market participant in telecom billing & revenue management, extended the existing partnership. The Middle Eastern operator utilizes managed services support and a digital BSS product suite.

-

In April 2024, Optiva Inc., one of the major companies in cloud-native billing and revenue management solutions, and GDi Group, a digital technology and software organization, announced a strategic partnership to deliver pre-integrated and tested BSS and OSS software to communication service providers (CSPs).

Telecom Billing & Revenue Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.51 billion |

|

Revenue forecast in 2030 |

USD 37.04 billion |

|

Growth Rate |

CAGR of 10.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, application, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Amdocs; Cerillion Technologies Ltd; Comarch SA; CSG Systems, Inc.; Formula Telecom Solutions Ltd; Huawei Technologies Co., Ltd; Intracom Telecom; Comviva; Netcracker; Optiva, Inc.; Oracle; SAP SE; STL Tech; SUBEX; Telefonaktiebolaget LM Ericsson |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

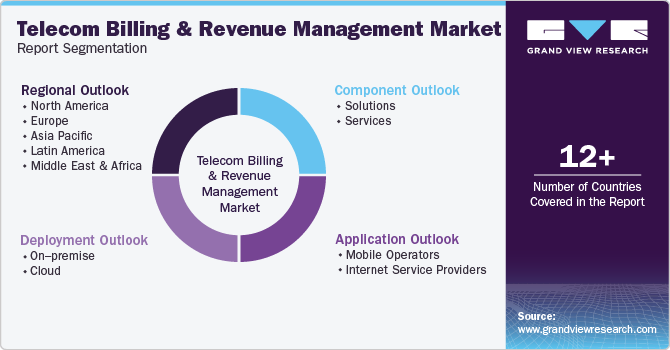

Global Telecom Billing & Revenue Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the telecom billing & revenue management market report based on component, deployment, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Operators

-

Internet Service Providers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."