Telecom API Market Size, Share & Trends Analysis Report By Type (Messaging API, IVR API, Payment API, Location API), By End-user (Enterprise Developers, Partner Developers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-230-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global telecom API market was valued at USD 185.11 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 21.3% from 2023 to 2030. A telecom application programming interface (API) is used to manage web-based services such as cloud-based, banking, and identity management telecom software by arranging programming instructions and standard protocols. The market provides cost-effective solutions by enhancing the system performance of existing web-based applications. These device and communication protocols facilitate agility in mobile application development as it enables the developers to focus on developing primary functions without the need to develop them from scratch.

Growing penetration of the Internet of Things (IoT), wearable, and device integration in the telecom sector is anticipated to positively impact the market over the forecast period. Telecom APIs allow end-to-end IoT solutions as they act as a singular point of interaction between several nodes within a network and hence reducing the multiple third-party service providers for system integration. With growing IoT penetration, the market for telecom API is anticipated to grow at a phenomenal rate. For instance, according to The State of Mobile 2021 report, a research study published by the GSMA, the total number of global IoT connections is expected to reach USD 25.2 billion by 2025 supporting the telecom API market growth over the forecast period.

Telecom API has prominent applications in all areas involving mobile applications and services such as location tracking apps, messaging apps, online mobile payments, and voice & video calls, among others. With the raising number of mobile service subscribers, the demand for mobile-based technologies has increased significantly in past years further increasing the demand for telecom APIs due to the scalability it offers. For instance, the data published by Global Systems for Mobile Communications Association (GSMA), by the end of 2021, 5.2 billion people subscribed to mobile services and is projected to reach 5.7 billion people by 2025. This may bring new opportunities for the telecom API in mobile-based applications.

The recent increasing number of start-ups launched in the field of telecom API in emerging markets such as the Asia Pacific and Africa are expected to open new opportunities areas for the telecom API service providers during the forecast year. Industry giants such as Google, Vodafone, and communications service providers (CSPs) and technology suppliers Group have developed partnerships with start-ups from these emerging markets to create a nurturing ecosystem for the growth of telecom startups by offering their APIs for application developments thus, propelling the market growth.

Despite the phenomenal benefits offered by telecom API, data security concerns amongst the end-users are hindering the market growth. For instance, based on a recently published report on data security, it is observed that for enterprise and commercial web applications, API attacks will become the most-frequent attack resulting in data breaches. wherein malicious parties will get access to end-user data such as the name, contact details, and IMEI number of the device on which the application is operating.

The increasing adoption of machine-to-machine (M2M) devices is also estimated to propel the telecom API market from 2023 to 2030. APIs are critical for M2M communication as they identify the message format that can be used for device control. Moreover, increasing the adoption of mobile commerce is expected to increase the demand for telecom APIs in applications such as payment API and location API. Various mobile payment gateways such as Stripe, Zooz, PayPal, and Amazon Pay, among others allow the user to purchase products through cards using the payment API for processing the transactions.

In 2020, due to the COVID-19 crisis, many leading CSPs and technology provider companies operating in the telecom API market had to change their strategies owing to the increasing demand for connectivity. Large organizations adopted new growth strategies to expand in new markets and change business models in the functions such as security, sales, and support. The market witnessed unprecedented growth in smartphone data usage, thus, impacting the telecom API market positively.

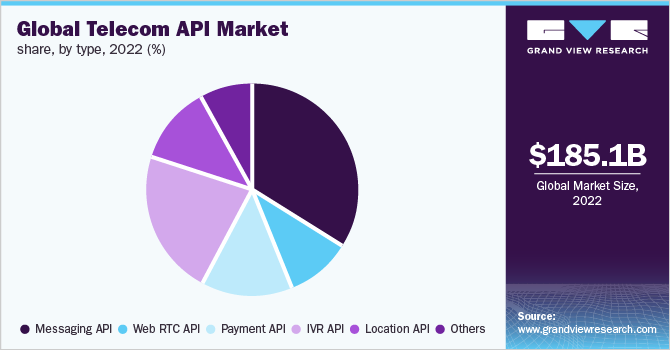

Type Insights

Based on type, the telecom API market report is categorized into messaging API, webRTC API, payment API, IVR API, location API, and others. In 2022, the messaging API sub-segment held the largest market share contributing more than 35% to the total market, and is projected to expand at a CAGR of over 21.4% from 2023 to 2030. The high growth of messaging APIs is owing to the growing demand for SMS and RCS services that have the application of messaging APIs. The penetration of the SMS market is growing as an increasing number of companies are utilizing SMS services for personalized marketing efforts and enhancing customer engagement and experience. Thus, propelling the demand for messaging APIs.

Moreover, the IVR API sub-segment of the telecom API market is expected to witness significant growth over the forecast period. This growth in the market can be attributed to the increasing number of BPO service providers, specifically in developing markets such as South Africa, China, and India. Furthermore, the location API sub-segment held a considerable revenue share exceeding 13% in 2022 owing to increasing demand for location-based web-application services.

End-user Insights

Based on end-user, the telecom API market is categorized into internal telecom developers, enterprise developers, partner developers, and long tail developers. The enterprise developer sub-segment holds the largest market share of over 35% owing to the high penetration and adoption rate of large-scale enterprises. In large-scale organizations, A2P messages are majorly used in the announcement of offers, promotional activities, and changes in company policies, among others. The broadcast the above messages, organizations mostly use bulk messaging tools & software that drive the market growth for telecom APIs.

The partner developer sub-segment of the telecom API market is projected to expand at a CAGR of over 20% in the forecast period. Partner APIs help in creating a single-point data-sharing platform between CSPs and other developers to develop services such as payment services, and streaming services, among others. Developers can develop these services and get support from telecom organizations to manage service infrastructure. Furthermore, the customer base for partner developers is expanding rapidly as compared to enterprise developers resulting in their growth over the forecast period.

Regional Insights

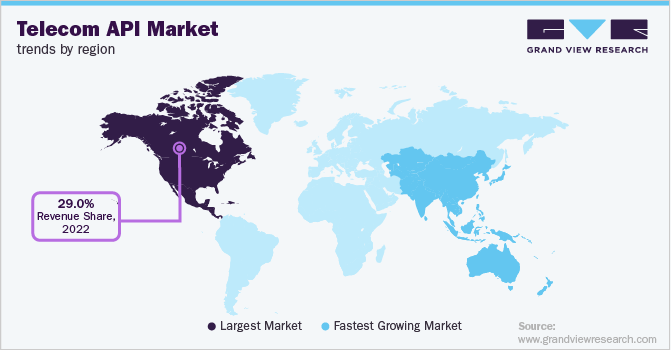

The Telecom API market in North America witnessed the largest market share in 2022 and accounted for over 29% in the forecast period. This growth can be attributed to the significant presence of various large market players such as Broadcom, AT&T Intellectual Property, Google, and Oracle Corporation, among others in this region. Moreover, the adoption of technologies such as 4G and improvement in 5G technology is a major factor contributing to the high telecom API market growth in this region. With the integration of 4G or 5G technology and APIs, communication services such as voice & video calls, and video & speech integration services are delivered competently, and the productivity of businesses is improved to a greater extent.

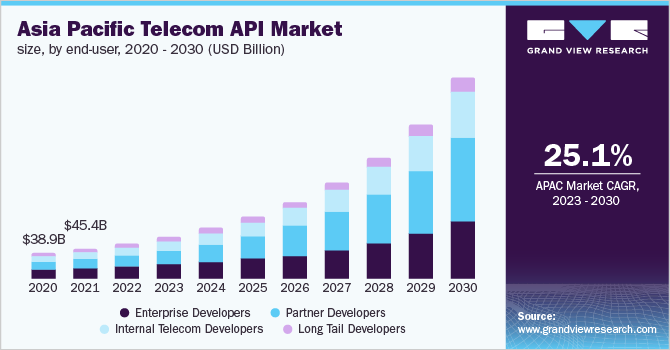

The telecom API market in Asia Pacific is projected to be one of the most attractive regions owing to the increasing number of mobile subscribers in the region and the increasing adoption of 5G technologies in the near future. Asia Pacific is expanding at the fastest CAGR of over 25.1% from 2023 to 2030. According to the report published by GSMA, in 2021, there were more than 1.2 billion mobile internet users in the Asia Pacific. This number is projected to reach 1.5 billion by 2025.

Key Companies & Market Share Insights

The telecom API market is fragmented and characterized by high competition among the key players operating in a particular region. Each region or country is dominated by a few prominent players that mostly includes the CSPs of that particular region. These market players are focusing on adopting new organic & inorganic growth strategies such as mergers & acquisitions, partnerships, and joint ventures or collaborations in order to enhance their market presence.

In order to increase their market share and to gain a competitive edge over competitors in the market, telecom API provider companies are launching new products and complimentary services. For instance, in 2021, Reliance Jio, a CSP from India, accomplished Open API Platinum conformance certification, showcasing an increasing trend toward using Open APIs to help create open ecosystems for startups operating in the telecom sector. The key players participating in the market include CSPs, third-party solution developers, and system integrators, among others. Some of the prominent players in the global telecom API market are:

-

AT&T Intellectual Property,

-

Google

-

Verizon

-

Telefonica S.A.

-

TWILIO INC.

Telecom API Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 214.64 billion |

|

Revenue forecast in 2030 |

USD 827.45 billion |

|

Growth rate |

CAGR of 21.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Actual estimates/Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico |

|

Key Companies Profiled |

AT&T Intellectual Property; Telefonica S.A.; Google; Verizon; TWILIO INC. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Telecom API Market Segmentation

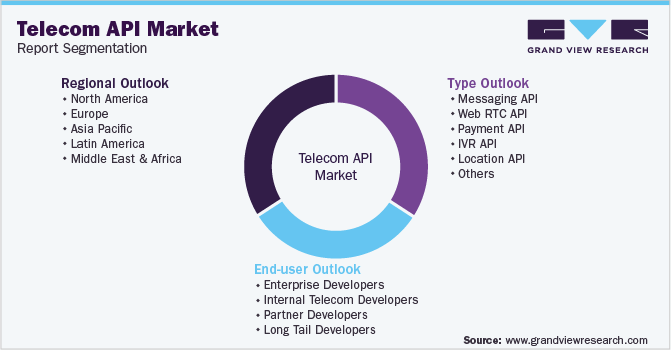

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global telecom API market report based on type, end-user, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Messaging API

-

Web RTC API

-

Payment API

-

IVR API

-

Location API

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise Developers

-

Internal Telecom Developers

-

Partner Developers

-

Long Tail Developers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global telecom API market size was estimated at USD 185.11 billion in 2022 and is expected to reach USD 214.64 billion in 2023.

b. The global telecom API market is expected to grow at a compound annual growth rate of 21.3% from 2023 to 2030 to reach USD 827.45 billion by 2030.

b. Messaging API segment dominated the telecom API market with a share of 38.84% in 2022. This is attributable to the increasing adoption of SMS and RCS services that use messaging APIs.

b. Some key players operating in the telecom API market include AT&T, Inc., Telefonica S.A., Google LLC, Verizon Communication, Inc., and Twilio Inc.

b. Key factors that are driving the telecom API market growth include an increasing number of mobile service subscribers, growing adoption of the Internet of Things (IoT), and increasing number of mobile internet users.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."