Telecom Analytics Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Model, By Organization Size, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-481-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Telecom Analytics Market Size & Trends

The global telecom analytics market size was valued at USD 7.07 billion in 2024 and is projected to grow at a CAGR of 14.9% from 2025 to 2030. The significant increase in data traffic due to the proliferation of smartphones and IoT devices drives the demand for advanced analytics solutions. Telecom companies face revenue generation and customer engagement challenges, necessitating the adoption of analytics to gain insights into customer behavior and preferences. Furthermore, the need for enhanced risk management and fraud detection solutions has become critical as telecom networks experience rising cyber threats.

Moreover, integrating Artificial Intelligence (AI) and Machine Learning (ML) technologies enhances real-time data analysis capabilities, allowing telecom operators to optimize network performance and improve service delivery. In addition, regulatory pressures for compliance and security measures are likely to increase demand for robust analytics solutions that can monitor and manage network integrity effectively. For instance, in 2024, the Telecom Regulatory Authority of India (TRAI) introduced new quality of service regulations to enhance the standards for telecommunications and broadband services. As competition intensifies within the telecommunications sector, companies increasingly leverage analytics to reduce churn rates and personalize customer interactions, further propelling market expansion.

Furthermore, the increasing focus on improving customer experience is set to play a crucial role in shaping the future of telecom analytics. Companies are anticipated to leverage data-driven insights to customize their services and proactively address customer needs, fostering loyalty and satisfaction. In addition, the transition toward cloud-based analytics solutions facilitates scalability and flexibility, allowing telecom operators to adapt swiftly to evolving market dynamics.

Component Insights

The solutions segment dominated the market with a share of 70.9% in 2024, reflecting the increasing reliance of telecom operators on advanced analytical tools to enhance operational efficiency and customer engagement. These solutions encompass a wide range of functionalities, including network performance monitoring, customer experience analytics, and revenue assurance. By leveraging these tools, telecom companies can gain critical insights into their operations, identify bottlenecks, and optimize resource allocation. The growing complexity of telecom networks, driven by the rise of 5G technology and the Internet of Things (IoT), necessitates sophisticated analytics capabilities to manage vast amounts of data effectively.

The services segment is projected to grow at a significant CAGR during the forecast period. As telecom companies increasingly adopt analytics solutions, there is a rising demand for professional services that facilitate implementation, integration, and ongoing support. These services include consulting, training, and managed services that help organizations maximize their analytics investments. The complexity of integrating new technologies into existing systems requires specialized expertise, which many telecom operators lack internally. By partnering with service providers, companies can ensure a smoother transition and better utilization of analytical tools.

Deployment Model Insights

The cloud segment dominated the market with the largest revenue share in 2024. The advantages of cloud-based solutions, such as scalability, flexibility, and cost-effectiveness, make them particularly appealing to telecom operators looking to manage large datasets efficiently. In addition, cloud solutions facilitate real-time data processing and collaboration across different departments and locations, which is vital for timely decision-making in a fast-paced industry. For instance, AT&T harnesses cloud computing to enhance its network functions, reducing hardware expenses and improving operational efficiency. Using Microsoft’s hybrid cloud technology, AT&T supports its mobile core network with over 60 cloud-native network functions (CNFs) and virtual network functions (VNFs) sourced from various vendors. As organizations seek to leverage real-time analytics to improve service delivery and customer satisfaction, cloud deployment models are becoming increasingly integral to their strategies.

The on-premise segment is projected to grow at a significant CAGR during the forecast period due to concerns about data security and control over sensitive information. For many telecom operators, especially those handling critical infrastructure or sensitive customer data, having an on-premise solution allows for greater oversight and compliance with regulatory requirements. This preference drives investment in on-premise analytics systems tailored to specific organizational needs and integrated seamlessly with existing IT frameworks. Moreover, companies increasingly prioritize security measures that on-premise solutions can provide as cyber threats evolve. For instance, Orange Cyberdefense employs a team of 3,000 experts dedicated to ensuring online safety for users, enabling them to identify potential risks proactively and effectively protect clients against evolving cyber threats.

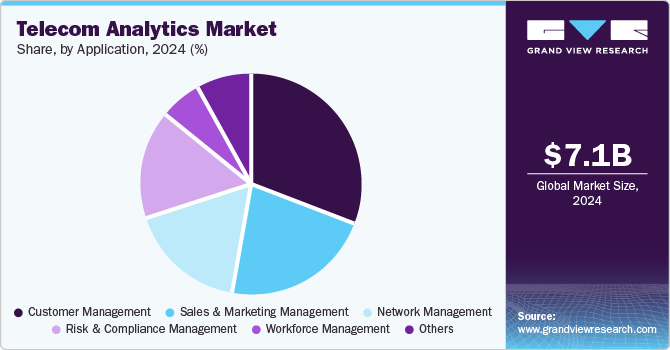

Application Insights

The customer management segment dominated the market with the largest revenue share in 2024 due to its critical role in enhancing customer satisfaction and loyalty. Telecom operators utilize advanced analytics tools to better understand customer preferences, predict churn rates accurately, and develop personalized offerings that meet evolving needs. Companies can create comprehensive profiles that inform targeted marketing strategies by analyzing customer interactions across various touchpoints such as call centers, mobile apps, and social media. This focus on customer-centric approaches improves retention rates and fosters long-term relationships between operators and customers.

The risk and compliance management segment is expected to grow at the highest CAGR over the forecast period due to rising concerns about cybersecurity threats and regulatory compliance requirements. Telecom operators face significant risks related to data breaches and fraud that can undermine customer trust and lead to substantial financial losses. Consequently, there is an urgent need for robust analytics solutions that can monitor risks proactively and ensure compliance with industry regulations such as GDPR or CCPA. By investing in advanced risk management tools that leverage predictive analytics capabilities, companies can identify vulnerabilities before they escalate into serious issues. This focus safeguards operations and enhances trust among customers and stakeholders within the telecom analytics industry.

Organization Size Insights

The large enterprises segment dominated the market with the largest revenue share in 2024, primarily due to their substantial resources and capacity to invest in advanced analytics solutions. Large telecom operators leverage these tools to optimize operations and drive innovation across their service offerings. With extensive customer bases and complex network infrastructures, these enterprises utilize advanced predictive analytics to anticipate market trends and customer needs effectively. Furthermore, their ability to harness vast amounts of data positions them favorably within the competitive landscape of the telecom analytics industry.

The small and mid-sized enterprises segment is expected to grow at a significant CAGR over the forecast period. As these organizations increasingly recognize the value of data-driven decision-making, they are more likely to adopt tailored analytics solutions that fit their unique requirements. The expansion of affordable and scalable analytics options enables SMEs to compete effectively with larger players in the market without requiring extensive capital investment upfront. In addition, many SMEs leverage cloud-based solutions that offer flexibility while minimizing operational costs. This democratization of access to advanced analytics tools empowers SMEs to enhance their service offerings and improve customer engagement strategies significantly within the evolving framework of the telecom analytics industry.

Regional Insights

North America telecom analytics market dominated the global market with a revenue share of 39.2% in 2024. This dominance can be attributed to the region's advanced telecommunications infrastructure and high investment in technology. Major telecom operators in the U.S. and Canada are increasingly adopting analytics solutions to enhance operational efficiency and improve customer experiences. The competitive landscape in North America drives telecom companies to leverage data analytics for better decision-making, enabling them to respond swiftly to market changes and consumer demands.

U.S. Telecom Analytics Market Trends

The U.S. telecom analytics market dominated the regional market in 2024. The presence of major telecommunications companies and a strong focus on innovation contribute significantly to this leadership. U.S. firms invest heavily in advanced analytics capabilities, including artificial intelligence and machine learning, to enhance their service offerings and operational efficiencies. Furthermore, the increasing demand for real-time data analysis to optimize network performance and customer satisfaction underscores telecom analytics' role in shaping U.S. telecom operators' strategies.

Asia Pacific Telecom Analytics Market Trends

The Asia Pacific telecom analytics market is expected to grow at the highest CAGR from 2025 to 2030, driven by rapid digital transformation and increasing investments in IoT technologies. Countries in this region are experiencing significant growth in mobile subscriptions and data consumption, creating a pressing need for advanced analytics solutions. Telecom operators are focusing on harnessing data insights to improve service delivery and customer engagement. The expansion of 5G networks further enhances the demand for sophisticated analytics tools to manage increased data traffic effectively.

China telecom analytics market dominated the Asia Pacific region in 2024 due to its vast telecommunications landscape and significant investments in technology infrastructure. Chinese telecom companies are leveraging analytics to enhance operational efficiency, reduce costs, and improve customer satisfaction amidst fierce competition. The government's push for digital economy initiatives also fosters an environment conducive to innovation in telecom analytics.

Europe Telecom Analytics Market Trends

Europe telecom analytics market is expected to grow at a significant CAGR from 2025 to 2030, supported by increasing adoption of cloud-based solutions and data-driven decision-making among telecom operators. European companies recognize the importance of analytics in managing procurement processes and enhancing customer interactions. The regulatory environment also encourages investments in compliance related analytics solutions as operators seek to adhere to stringent data protection laws. As European telecom firms continue to embrace advanced analytical techniques, they contribute positively to the overall growth trajectory of the telecom analytics industry.

Key Telecom Analytics Company Insights

The telecom analytics market features several key players that shape its landscape. Adobe offers tools for unifying customer measurement and enhancing user experiences, while Alteryx specializes in data blending and advanced analytics for actionable insights. Cisco Systems integrates analytics into its networking solutions to improve network performance and security, while SAP SE provides ERP solutions with analytics functionalities that optimize operations and enhance service delivery for telecom operators. These companies play a significant role in shaping the telecom analytics industry.

-

Cisco Systems, Inc. specializes in networking hardware, software, and telecommunications equipment. In the telecom analytics market, Cisco offers advanced AI-enabled analytics solutions that provide high visibility and rapid remediation across network platforms. Its products enable telecom operators to monitor and analyze network performance, troubleshoot issues, and ensure service quality by leveraging real-time data insights. Cisco's analytics capabilities enhance operational efficiency and support proactive decision-making.

-

SAP SE is known for its comprehensive solutions that help organizations manage their business processes. In the telecom analytics market, SAP provides integrated software applications that facilitate data-driven decision-making across various functions such as customer management, financial reporting, and supply chain operations. Its analytics tools empower telecom operators to optimize performance, improve customer engagement, and drive digital transformation by harnessing data across the organization.

Key Telecom Analytics Companies:

The following are the leading companies in the telecom analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Alteryx

- Cisco Systems, Inc.

- SAP SE

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM

- Microsoft

- MicroStrategy Incorporated

- Oracle

Recent Development

-

In November 2024, Dell Technologies announced the expansion of its Dell AI for Telecom program in collaboration with Intel, aimed at enhancing solutions for CSPs. This initiative focuses on integrating AI into network operations and enterprise-edge applications, enabling CSPs to improve reliability, efficiency, and cost-effectiveness. The new offerings facilitate the seamless incorporation of AI into existing networks, allowing CSPs to monetize their infrastructure investments while developing innovative services tailored for enterprise clients.

-

In January 2024, Databricks introduced the Data Intelligence Platform for Communications, a comprehensive data and AI platform for telecommunications carriers and network service providers. This platform provides CSPs with a unified foundation for managing their AI and data, enabling them to comprehensively understand their networks, operations, and customer interactions while ensuring confidential intellectual property protection and data privacy.

Telecom Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.10 billion |

|

Revenue forecast in 2030 |

USD 16.21 billion |

|

Growth Rate |

CAGR of 14.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment model, organization size, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

Adobe Inc.; Alteryx; Cisco Systems, Inc.; SAP SE; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM; Microsoft; MicroStrategy Incorporated; Oracle |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Telecom Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telecom analytics market report based on component, deployment model, organization size, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Network Analytics

-

Customer Analytics

-

Subscriber Analytics

-

Location Analytics

-

Price Analytics

-

Service Analytics

-

Others

-

-

Services

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Mid-Sized Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Customer Management

-

Sales and Marketing Management

-

Network Management

-

Risk and Compliance Management

-

Workforce Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."