- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Technical Ceramics Market Size And Share Report, 2030GVR Report cover

![Technical Ceramics Market Size, Share & Trends Report]()

Technical Ceramics Market Size, Share & Trends Analysis Report By Raw Material, By Product (Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-158-0

- Number of Report Pages: 142

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Technical Ceramics Market Size & Trends

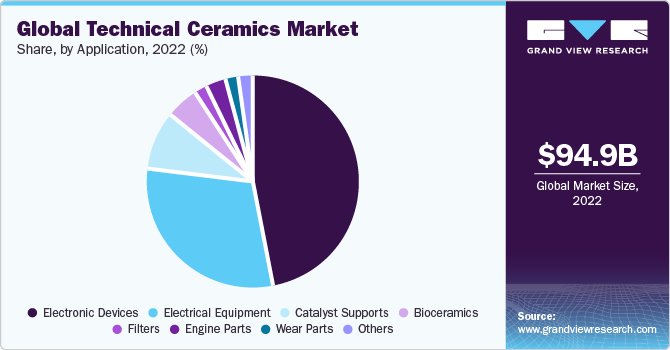

The global technical ceramics market size was valued at USD 94.87 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Various properties of technical ceramics, such as low thermal expansion, robustness, and high-temperature stability, have increased their popularity in different end-use industries, including electrical & electronics, power, and automotive, which in turn is expected to have a positive impact on the market over the forecast period. Technical ceramics are expected to replace traditional materials extensively over the forecast period due to their superior functional characteristics. These materials exhibit greater corrosion resistance unlike other products such as aluminum and steel, and hence are being widely employed in the medical and automotive sectors. The growth of the automotive and medical industries in emerging economies of Asia Pacific is expected to fuel product demand over the projected period.

The sector is governed by strict regulations regarding its use in the medical, automotive, machinery, and electronic & electrical industries. Additionally, various agencies, including the U.S. Clean Water Act, monitor mining operations under CWA Sections 404 and 402, due to their harmful environmental effects. The Land Protection Branch has implemented the Surface Mining Act in Georgia, where the world’s largest Kaolin deposits are located. As per the act, only a certain amount of mining activities can be conducted annually. Environmental sustainability is the key aim of product manufacturers.

Securing an inexpensive fuel supply in a volatile natural gas market is an important criterion for a company’s sustainability and competitiveness in the industry. Because of the unpredictable nature of natural gas prices, smaller companies mainly focus on looking into alternative fuel options or alternative technologies to manufacture these products.

Raw Material Insights

The alumina ceramics segment accounted for the largest revenue share of 36.0% in 2022. Increasing use of alumina in end-use sectors such as machinery, automotive, and electrical & electronics on account of superior weathering and corrosion resistance properties is expected to fuel industry growth over the forecast period.

The titanate ceramics segment is expected to expand at the fastest CAGR of 7.2% during the forecast period. Titanates are well known for the production of high-quality materials, including potassium titanate and sodium titanate, which are used as friction modifiers in brake pads and linings. The U.S., due to its high consumption capacity, leads the titanates market.

Product Insights

The monolithic ceramics segment accounted for the dominant revenue share of 84.0% in 2022. Major types include zirconium, silicon nitride, zirconium carbide, aluminum nitride, zirconium oxide, aluminum oxide, and silicon carbide. These materials offer very specific properties favorable to industrial use, such as durability, reliability, wear, and high-temperature resistance. They are used in a variety of applications such as electronics and electrical, power automotive, aerospace, defense, medical, and transportation. In the power generation industry, monolithic products are mainly used in the manufacturing of turbine blades and engine components for machinery units.

The ceramic matrix composites (CMCs) segment is expected to expand at the fastest CAGR of 8.0% during the forecast period. They are primarily employed in the automotive and machinery industries and space-related uses, such as heat-resistant tiles. These products are also used in the manufacturing of transportation equipment for space shuttles as a result of their hardness properties and longer life span. Furthermore, they are widely employed in the production of sports equipment such as golf clubs.

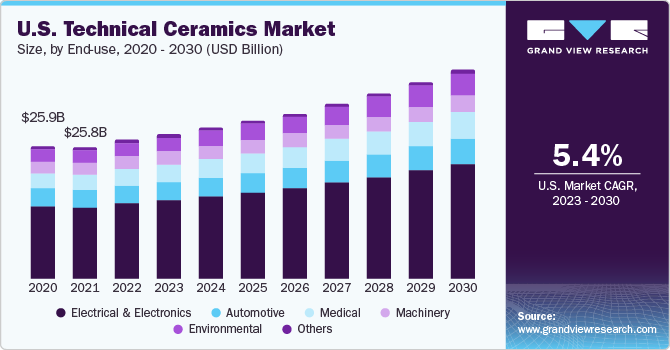

End-use Insights

Electrical & electronics emerged as the largest end-use segment in 2022, accounting for a revenue share of 54.8% of the global market. The industry uses very large amounts of ceramics for the production of numerous devices and related products. Technical ceramics are used in the industry, mainly because of their electrical conductivity and mechanical properties. They are widely used in circuit breakers and λ sensors.

The medical segment is expected to register a growth rate of 6.7% over the forecast period. Technical ceramics are effectively employed in orthopedics to increase the quality of life with implant components for artificial hip joints and knee replacements. These are also employed in medical devices and equipment such as lithotripters, ultrasonic cleaners, and dental products.

These products can withstand mechanical stresses and high temperatures in applications such as energy generation in turbines and power plant engines. In addition, technical ceramics are used in systems for solar thermal energy conversion and in photovoltaic, water, and wind power plants. The product ensures efficient use of energy supply and distribution resources from both renewable and conventional sources.

Application Insights

The electronic devices segment held the largest revenue share of 46.8% in 2022. Technical ceramics offer superior thermal and chemical properties, which have led to their extensive use in numerous applications in the electronics industry such as core materials, circuit carriers, and ceramic substrates. Electrical equipment was the second-largest application segment, accounting for 30.2% of the revenue share in 2022. Extensive improvements in the shipment qualities of raw materials such as titanate, cordierite, and zirconate ceramics is expected to boost product demand in this area.

On the other hand, the bioceramics segment is expected to expand at the fastest CAGR of 8.4% over the forecast period. These products are widely employed in the manufacturing of dental as well as medical implants. In addition, bioceramics are employed in the replacement of hard tissue such as teeth and bones. They are also used in the production of kidney dialysis machines, pacemakers, and respirators. A large healthcare base in Europe is expected to fuel product demand over the forecast period.

Regional Insights

Asia Pacific dominated the technical ceramics market and accounted for the largest revenue share of 41.3% in 2022, due to the rising consumer spending on electronics in the region, primarily in the economies of India and China. Factors such as competitive manufacturing costs, high economic growth, and rapid development of end-use industries will continue to drive product demand over the projection period.

On the other hand, North America is expected to expand at a growth rate of 5.4% over the forecast period. The region is primarily characterized by new product developments and growing consumer preference for these products. Within North America, the U.S. is the predominant market and is witnessing growth in terms of ceramic applications in architectural projects and fine arts. In addition, the U.S. is expected to witness market expansion in terms of product use in the environmental and medical sectors.

Key Companies & Market Share Insights

The industry is fragmented and competitive due to the presence of several key players. These companies have strong geographical presence with numerous production facilities worldwide. However, the presence of numerous small regional vendors with significant market shares is expected to pose a threat to these international companies over the assessment period.

Various product types, including zirconia, titania, aluminum nitride, and silicon carbide-based materials, have their own characteristics and are employed as an economic and high-performance substitute for traditional materials such as metals, glass, and plastics. Key players in the market are expected to increase their R&D expenditure to comply with the rising demand from new applications. Most companies have been trying to improve product quality at a reduced cost, which is expected to propel product demand over the forecast period. Some of the key companies operating in the global technical ceramics market include:

-

CeramTec GmbH

-

Elan Technology

-

Oerlikon Surface Solutions AG

-

Ortech Incorporated

-

Morgan Technical Raw Materials PLC

-

CoorsTek

-

Kyocera Industrial Ceramics Corporation

-

3M

-

DuPont

-

Murata Manufacturing Co. Ltd.

-

General Electric

-

Honeywell

-

Momentive Performance Materials Inc.

-

Pall Corporation

-

Saint-Gobain

Recent Developments

-

In July 2022, Bosch Advanced Ceramics (grow platform GmbH) in collaboration with Karlsruhe Institute of Technology (KIT) and BASF SE developed the world’s first microreactor made of technical ceramic materials using the 3D printing technique

-

In October 2022, Artemis Capital Partners announced that it had acquired McDanel Advanced Ceramic Technologies, a specialist in advanced technical ceramics

-

In February 2021, STC Raw Material Solutions announced the acquisition of IJ Research, Inc., a specialist in sapphire-to-metal assemblies based in California. The acquisition is expected to help the company expand its services portfolio, including consulting on the selection of materials

-

In May 2021, 3DCeram, a French firm dealing in 3D ceramic materials & processes, collaborated with the Indian firm Shree Rapid Technologies, to increase its foothold in India by pooling the expertise of both companies in 3D printed ceramics

Technical Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 99.14 billion

Revenue forecast in 2030

USD 145.14 billion

Growth Rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Brazil; Mexico; Saudi Arabia

Key companies profiled

CeramTec GmbH; Elan Technology; Oerlikon Surface Solutions AG; Ortech Incorporated; Morgan Technical Raw Materials PLC; CoorsTek; Kyocera Industrial Ceramics Corporation; 3M; DuPont; Murata Manufacturing Co. Ltd.; General Electric; Honeywell; Momentive Performance Materials Inc.; Pall Corporation; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Technical Ceramics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global technical ceramics market report based on raw material, product, application, end-use, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alumina Ceramics

-

Titanate Ceramics

-

Zirconate Ceramics

-

Ferrite Ceramics

-

Aluminium Nitride

-

Silicon Carbide

-

Silicon Nitride

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monolithic ceramics

-

Ceramic coatings

-

Ceramic matrix composites

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrical equipment

-

Catalyst supports

-

Electronic devices

-

Wear parts

-

Engine parts

-

Filters

-

Bioceramics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Automotive

-

Machinery

-

Environmental

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global technical ceramics market size was estimated at USD 94.87 billion in 2022 and is expected to reach USD 99.14 billion in 2023.

b. The global technical ceramics market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 145.14 billion by 2030.

b. By raw material, alumina ceramics dominated the technical ceramics market with a share of over 36.0% in 2022. This is attributable to the increasing use of alumina in end-use sectors such as machinery, automotive, and electrical & electronics on account of superior weathering and corrosion resistance properties.

b. Some key players operating in the technical ceramics market include Kyocera Corporation, CeramTec GmbH, Morgan Advanced Materials, McDanel Advanced Ceramic Technologies, and Saint-Gobain Ceramic Materials, among others.

b. Key factors that are driving the market growth include rising demand for electronic devices among consumers in Asia Pacific particularly in China and India.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."