- Home

- »

- Consumer F&B

- »

-

Taurine Supplements Market Size And Share Report, 2030GVR Report cover

![Taurine Supplements Market Size, Share & Trends Report]()

Taurine Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Men, Women, Infants), By Application, By Form (Liquid, Powder, Capsules/Tablets), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-429-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Taurine Supplements Market Size & Trends

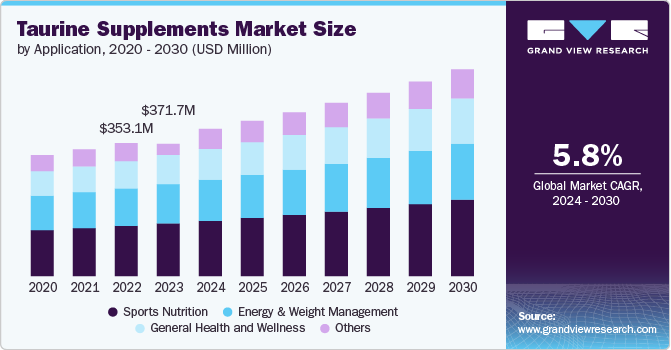

The global taurine supplements market size was estimated at USD 371.7 million in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The increasing demand for taurine supplements among consumers can be attributed to a variety of factors and emerging trends. As more people adopt active lifestyles and focus on fitness, there is a heightened interest in supplements that enhance physical performance and recovery. Taurine, known for its role in muscle function and reducing fatigue, has gained popularity, particularly among athletes and fitness enthusiasts. Additionally, the general rise in health awareness has led to greater interest in supplements like taurine, which is recognized for its antioxidant properties and overall health benefits.

The popularity of energy drinks has also significantly boosted the demand for taurine. Taurine is a common ingredient in these beverages, which are consumed widely for their perceived benefits in enhancing mental and physical performance. As energy drinks continue to be a staple in many people's diets, the demand for taurine supplements has risen accordingly.

Another contributing factor is the aging global population. With a growing focus on longevity and maintaining health in older age, supplements that support cardiovascular health, cognitive function, and overall vitality are in demand. Taurine’s potential benefits in these areas have made it an attractive option for older adults seeking to improve their quality of life.

Awareness of taurine’s benefits has also increased due to scientific research and media coverage. Studies suggesting that taurine can improve heart health, reduce the risk of diabetes, and support the nervous system have fueled consumer interest. Furthermore, individuals following vegetarian or vegan diets, who may not obtain sufficient taurine from their food, are turning to supplements to meet their nutritional needs.

End Use Insights

Taurine supplements for women accounted for a share of 45.0% in 2023. Taurine is thought to have a role in regulating mood and reducing symptoms of stress and anxiety. Women experiencing hormonal fluctuations or those seeking support for emotional well-being may use taurine supplements to help stabilize mood and manage stress more effectively.

Taurine supplements for infants are expected to grow at the highest CAGR of 6.3% from 2024 to 2030. Taurine is an essential amino acid naturally found in breast milk and is important for infant development, including brain and eye health. As more parents and caregivers recognize its importance, there is a growing demand for infant formulas and supplements that include taurine to ensure adequate nutritional support.

Application Insights

Taurine supplements for sports nutrition accounted for a revenue share of 37.7% in 2023. Taurine is believed to improve exercise performance by increasing endurance and reducing muscle fatigue. Athletes and fitness enthusiasts are turning to taurine supplements to boost their stamina and help them push through intense training sessions more effectively.

Taurine supplements for general health & wellness are expected to grow at a CAGR of 6.7% from 2024 to 2030. Taurine is associated with benefits for heart health, including lowering blood pressure, reducing cholesterol levels, and supporting overall cardiovascular function. As people become more proactive about maintaining heart health, taurine supplements are increasingly popular for their potential to support a healthy cardiovascular system.

Distribution Channel Insights

The offline segment accounted for a revenue share of 76.5% in 2023. In-store shopping provides the opportunity for personal interaction with knowledgeable staff who can offer recommendations and answer questions about different taurine supplements. This personalized service can enhance the shopping experience and help consumers make informed choices.

The online segment is expected to grow at a CAGR of 6.6% from 2024 to 2030. Online platforms offer a broader selection of taurine supplements compared to brick-and-mortar stores. Consumers can easily browse and compare different brands, formulations, and types of supplements to find what best suits their needs.

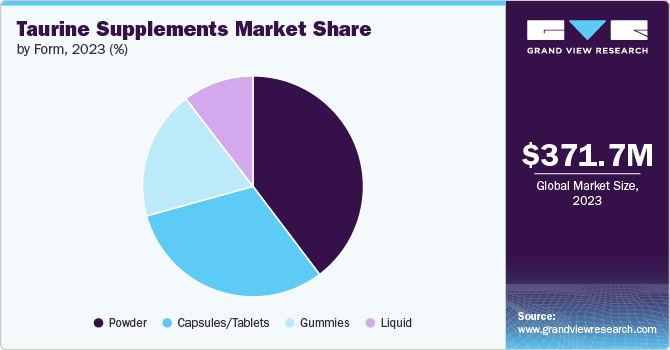

Form Insights

Powdered taurine supplements accounted for a share of 39.7% in 2023. Powdered taurine supplements offer flexibility in dosing and easy integration into various beverages or foods. This makes it convenient for users to customize their intake according to personal preferences and needs, whether by mixing it into water, smoothies, or protein shakes.

Gummies are expected to grow at a CAGR of 6.6% from 2024 to 2030. Gummies offer a flavorful and enjoyable way to consume taurine, making them more appealing than traditional pills or powders. The taste and chewable texture can make taking supplements a more pleasant experience.

Regional Insights

North America taurine supplements market accounted for a revenue share of over 30% in 2023 of the global market. North America has a strong fitness culture, with many individuals engaging in regular exercise and competitive sports. Taurine is valued for its potential benefits in improving athletic performance, reducing muscle fatigue, and supporting recovery, driving demand in the sports nutrition sector.

U.S. Taurine Supplements Market Trends

The taurine supplements market in the U.S. is facing intense competition due to innovation in taurine supplement varieties. There is rising awareness and focus on health and wellness in the U.S. Consumers are increasingly seeking supplements that support overall well-being, enhance physical performance, and manage stress, making taurine supplements more popular as part of a proactive approach to health.

Europe Taurine Supplements Market Trends

The taurine supplements market in Europe is expected to grow at a CAGR of 5.9% during the forecast period. Taurine is a common ingredient in energy drinks and functional foods, which are popular across Europe. As consumers seek out products that offer additional health benefits or enhanced performance, taurine supplements are seeing increased demand as part of a broader trend toward functional nutrition.

Asia Pacific Taurine Supplements Market Trends

The taurine supplements market in Asia Pacific is expected to grow at a CAGR of 5.5% from 2024 to 2030. Fitness and sports nutrition are gaining popularity in many Asia-Pacific countries, with an increasing number of people engaging in regular exercise and competitive sports. Taurine’s potential benefits in enhancing physical performance, reducing muscle fatigue, and supporting recovery are driving its demand among athletes and fitness enthusiasts.

Key Taurine Supplements Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Taurine Supplements Companies:

The following are the leading companies in the taurine supplements market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- Dr. Oscar

- Pure Encapsulations

- Life Extension

- Herbsmith

- Nutrition Strength

- Source Naturals Inc.

- ThorneVet

- AniForte

- VETRISCIENCE

Taurine Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 390.9 million

Revenue forecast in 2030

USD 548.6 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, application, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and UAE

Key companies profiled

NOW Foods, Dr. Oscar, Pure Encapsulations, Life Extension, Herbsmith, Nutrition Strength, Source Naturals Inc., ThorneVet, AniForte, VETRISCIENCE

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Taurine Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global taurine supplements market report based on end use, application, form, distribution channel, and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Infants

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Health and Wellness

-

Energy & Weight Management

-

Sports Nutrition

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Gummies

-

Capsules/Tablets

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Specialty stores

-

Pharmacies

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global taurine supplements market size was estimated at USD 371.7 million in 2023 and is expected to reach USD 390.9 million in 2024.

b. The global taurine supplements market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 548.6 million by 2030.

b. Taurine supplements for women accounted for a share of 45.0% in 2023. Hormonal Balance and Mood Support: Taurine is thought to have a role in regulating mood and reducing symptoms of stress and anxiety. Women experiencing hormonal fluctuations or those seeking support for emotional well-being may use taurine supplements to help stabilize mood and manage stress more effectively.

b. Some key players operating in taurine supplements market include NOW Foods, Dr. Oscar, Pure Encapsulations, Life Extension, Herbsmith, and others.

b. Key factors that are driving the market growth include rising energy drinks among younger demographics and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.