Taste Modulators Market Size, Share & Trends Analysis Report By Product (Sweet Modulators, Salt Modulators, Fat Modulators), By End-use (Food, Beverage, Pharmaceuticals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-350-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Taste Modulators Market Size & Trends

“2030 Taste Modulators Market value to reach USD 2,363.5 million”

The global taste modulators market size was estimated at USD 1,452.7 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The market growth is attributed to the rising demand for convenient and processed food. Additives play a significant role in improving flavor, texture, and preservation, contributing to the expansion of the food industry. Their ability to provide a longer shelf life and enhance taste is the reason the food industry depends on them.

Consumers worldwide are increasingly interested in products that promote health. As a result, the product market has become essential in the functional food and beverage industry. Products labeled "ready to drink" and options with reduced sugar or sodium have increased the demand for products, especially for sweetness and saltiness. These products are now commonly used in fortified beverages to appeal to health-conscious consumers without compromising taste and texture.

Drivers, Opportunities & Restraints

The trend of increased consumer demand for reduced-calorie products that retain the sweet taste of sugar has significantly driven the market. This rise in demand stems from a growing awareness among consumers about the health risks associated with high sugar and calorie intake, such as obesity, diabetes, and heart disease. However, even as consumers seek healthier options, they are unwilling to compromise on taste, a pivotal component of food enjoyment and satisfaction.

The stringent regulations and international standards concerning sweet and salt-reducing ingredients can be seen as a significant market restraint for the market. Such regulatory measures often require extensive documentation, compliance, and safety assessments, which can be time-consuming and costly for companies operating in this space. Additionally, adhering to these standards can limit the innovation and development of new products, as companies might be cautious of the regulatory hurdles and the potential for non-compliance. This could result in slower product development and innovation pace within the market.

The research into positive allosteric modulators could revolutionize this market by offering more precise and effective ways to alter taste perceptions. For example, they could enable the creation of substances that can make bitter or unpalatable healthy foods taste better without adding unhealthy ingredients. This, in turn, could help tackle obesity and other diet-related health issues by making healthier diets more appealing to the general public.

Product Insights

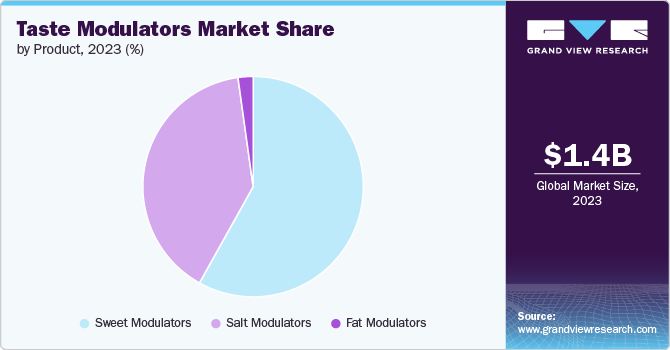

“Sweet Modulators emerged as the fastest growing end use with a CAGR of 8.2%”

Sweet modulators segment dominated the market and accounted for a revenue share of 58.1% in 2023. Sweet modulators are compounds designed to enhance or mimic the taste of sugar, enabling the reduction or elimination of added sugars in food and drinks. They help control calorie intake and manage dietary health concerns, such as diabetes, without sacrificing sweetness. These modulators work by interacting with taste receptors on the tongue, either by amplifying the sensation of sweetness or by directly stimulating the sweet taste receptors, thereby requiring smaller quantities of sugar or artificial sweeteners to achieve the desired taste. As a result, they play a crucial role in developing healthier, low-calorie, and sugar-free food products.

Salt modulators, in the culinary context, refer to ingredients or techniques used to enhance or balance the saltiness in dishes without necessarily adding more salt. These can include acids like vinegar or lemon juice, sweet elements like sugar or honey, and umami-rich components such as mushrooms or soy sauce. By adjusting the levels of these modulators, chefs can achieve a desired flavor profile, highlighting specific tastes or offsetting excessive saltiness, thus ensuring the dish's overall palatability and complexity.

End-use Insights

“Food emerged as the fastest growing end use with a CAGR of 6.0%”

Food dominated the market with a market and accounted for a revenue share of 58.9% in 2023. In the food industry, innovative ingredients enhance, block, or modify the taste profile of foods and beverages. These product market compounds help reduce sugar, salt, or fat content without compromising on taste. They are instrumental in creating healthier options for consumers, making products more palatable without the additional calories. Taste modulators interact with taste receptors, either amplifying the desired flavors or suppressing the unfavorable ones, thus playing a crucial role in product development and reformulation within the industry.

In the beverage industry, the product market plays a crucial role in enhancing the flavor profile of drinks without significantly altering their nutritional value. These unique ingredients or additives are designed to mask or modify undesirable tastes, such as bitterness or excessive sweetness, making the final product more palatable. They are essential in products aimed at health-conscious consumers, allowing manufacturers to reduce sugar content without compromising taste. Additionally, the product can help create more complex and unique flavor experiences, catering to evolving consumer preferences for innovative and healthier beverage options.

Regional Insights

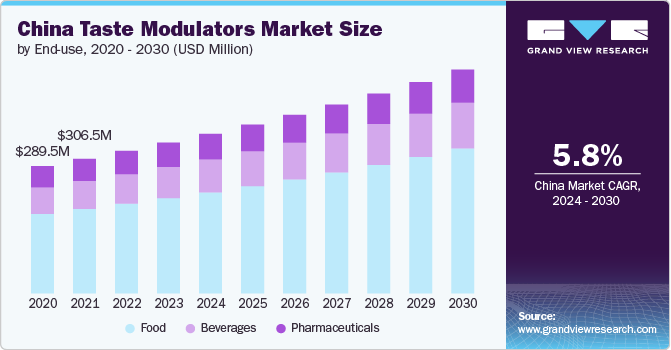

“China is expected to dominate the Asia-Pacific market with a market share of 33.5% in 2030”

Asia Pacific dominated the market and accounted for a 70.5% share in 2023. This growth is attributed to increasing demand and consumption of processed and convenience food in the region. For instance, in February 2023, according to UNICEF, Asia Pacific, known for its vibrant and diverse food cultures, changed quickly. Traditional healthy, fresh foods are being replaced by a growing consumption of highly processed junk food and drinks full of salt, sugar, and unhealthy fats.

China Taste Modulators Market Trends

China dominated the market and accounted for a market share of 33.5% in 2023. This growth is attributed to increasing demand for pre-packaged food in the region. This is demonstrated by the increasing sales of processed and pre-packaged food in the region. This has led to rise in demand for product market in the region.

North America Taste Modulators Market Trends

The market in North America is expected to be driven by increasing consumption of processed and convenience food. This rise in consumption of processed food has led to a rise in demand for the product market which plays an essential role as taste modulators.

Europe Taste Modulators Market Trends

Europe plays a significant role in the taste modulators market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the demand for processed food and quick food services in the region, leading to rise in demand for taste modulators.

Key Taste Modulators Company Insights

Some of the key players operating in the global taste modulators market include

-

Döhler GmbH is a global marketer, producer, and provider of technology-driven ingredient systems, integrated solutions, and natural ingredients for the global beverage, food, and nutrition industry. The company operates in over 160 countries, with over 45 production sites and 75 offices worldwide.

-

DSM is a global, science-based company specializing in Health, Nutrition, and Sustainable Living. The company's food and Beverage division offers science-based ingredients, expertise, and solutions that improve taste and texture while boosting nutrition profiles.

Evonik Industries and LG Chem are some of the emerging market participants in the global taste modulators market.

-

Cargill Incorporated is a global manufacturer of agriculture, food, industrial, and financial products and services. The company serves food and beverage manufacturers, food service companies, and retailers with a wide range of food ingredients for food and non-food applications. Additionally, the company processes poultry, beef, egg products, and value-added meats for food service companies, food makers, and retailers. Cargill's salt is utilized in agriculture, food production, deicing, and water softening. The company operates in 70 countries.

-

Tate & Lyle PLC provides food and beverage solutions and ingredients. The company's product portfolio includes sweeteners, texturants, and fiber enrichments. They also offer crystalline sucralose, fructose, sweeteners, corn syrup, starches, glucose, dextrose, and animal feeds. Tate & Lyle's products are used in beverages, bakery & snacks, dairy products, sauces and dressings, soups, personal care, confectionery, animal feed, pharmaceuticals, and other industries. They are present across the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Key Taste Modulators Companies:

The following are the leading companies in the taste modulators market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Döhler GmbH

- IFF

- Givaudan

- Kerry Group PLC

- Ingredion

- Symrise

- Tate & Lyle

- Corbion

- Takasago International Corporation

- Cargill Incorporated

Recent Developments

-

In April 2023, Döhler GmbH has announced a collaboration with Ixora Scientific. The partnership aims to enhance natural taste modulation and expand Döhler's expertise in natural ingredients and integrated solutions. This collaboration will be supported by establishing a state-of-the-art hub in North Brunswick to drive rapid flavor innovation and better serve customers' needs in the US.

-

In November 2021, Kerry Group PLC introduced Tastesense, the first organically certified sweet modulator. This product launch is aimed at satisfying the increasing need for organic-based sweet modulators that comply with U.S. standards in the beverage industry. These products cater to various preferences, including low- to no-sugar beverages, flavored sparkling water, energy and functional drinks, and high- and low-ABV alcoholic beverages.

Taste Modulators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,557.3 million |

|

Revenue forecast in 2030 |

USD 2,363.5 million |

|

Growth rate |

CAGR of 7.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

DSM; Döhler GmbH; IFF; Givaudan; Kerry Group PLC; Ingredion; Symrise; Tate & Lyle; Corbion; Takasago International Corporation; Cargill Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Taste Modulators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global taste modulators market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sweet Modulators

-

Salt Modulators

-

Fat Modulators

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceuticals

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global taste modulators market size was estimated at USD 1,452.7 million in 2023 and is expected to reach USD 1,557.3 million in 2024.

b. The global taste modulators market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 2,363.5 million by 2030.

b. Asia Pacific dominated the market and accounted for a 70.5% share in 2023. This growth is attributed to increasing demand and consumption of processed and convenience food in the region.

b. Some key players operating in the taste modulators market include DSM; Döhler GmbH; IFF; Givaudan; Kerry Group PLC; Ingredion; Symrise; Tate & Lyle; Corbion; Takasago International Corporation; and Cargill Incorporated.

b. Key factors that are driving the market growth include an increase in Consumers worldwide who are increasingly interested in products that promote health. As a result, the product market has become essential in the functional food and beverage industry. Products labeled "ready to drink" and options with reduced sugar or sodium have increased the demand for products, especially for sweetness and saltiness

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."