- Home

- »

- Biotechnology

- »

-

Targeted Protein Degradation Market, Industry Report, 2033GVR Report cover

![Targeted Protein Degradation Market Size, Share & Trends Report]()

Targeted Protein Degradation Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (PROTAC, Molecular Glues, LYTACs), By Application (Drug Discovery, Therapy Development), By End Use (Hospitals & Clinical Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-351-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Targeted Protein Degradation Market Summary

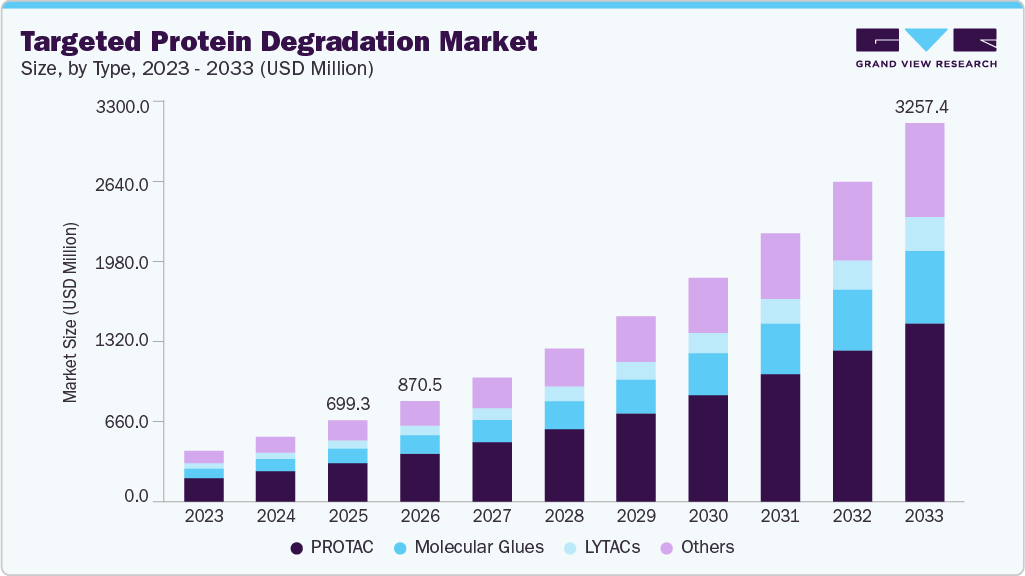

The global targeted protein degradation market size was estimated at USD 699.3 million in 2025 and is projected to reach USD 3,257.4 million by 2033, growing at a CAGR of 20.75% from 2026 to 2033. The constantly growing frequency of chronic disease conditions such as cancer and neurodegenerative diseases, along with changing lifestyles and increasing healthcare spending, is accelerating the market growth.

Key Market Trends & Insights

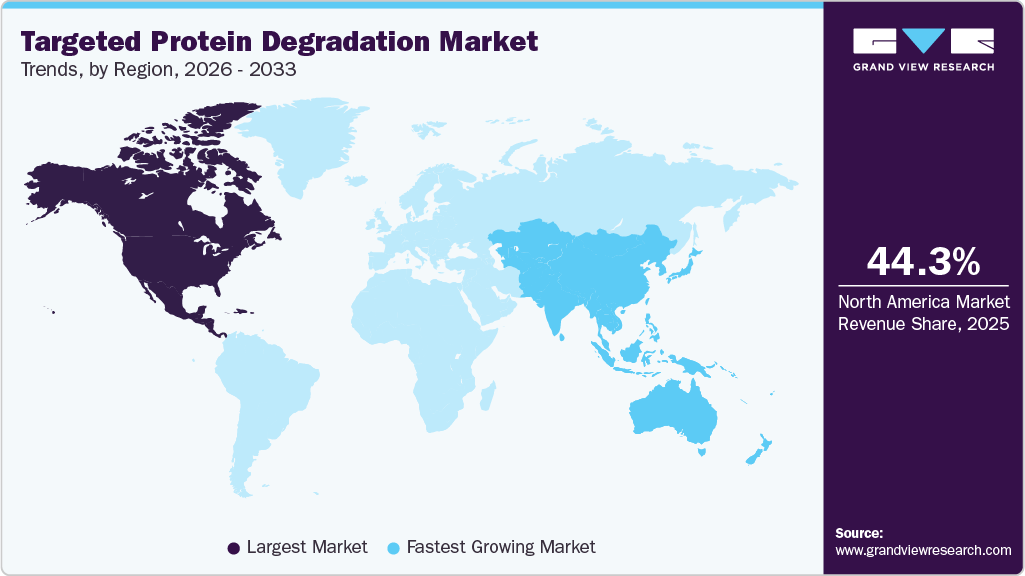

- The North America targeted protein degradation market held the largest share of 44.34% of the global market in 2025.

- The targeted protein degradation industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the PROTAC segment held the largest market share in 2025.

- Based on application, the therapy development segment held the largest market share in 2025.

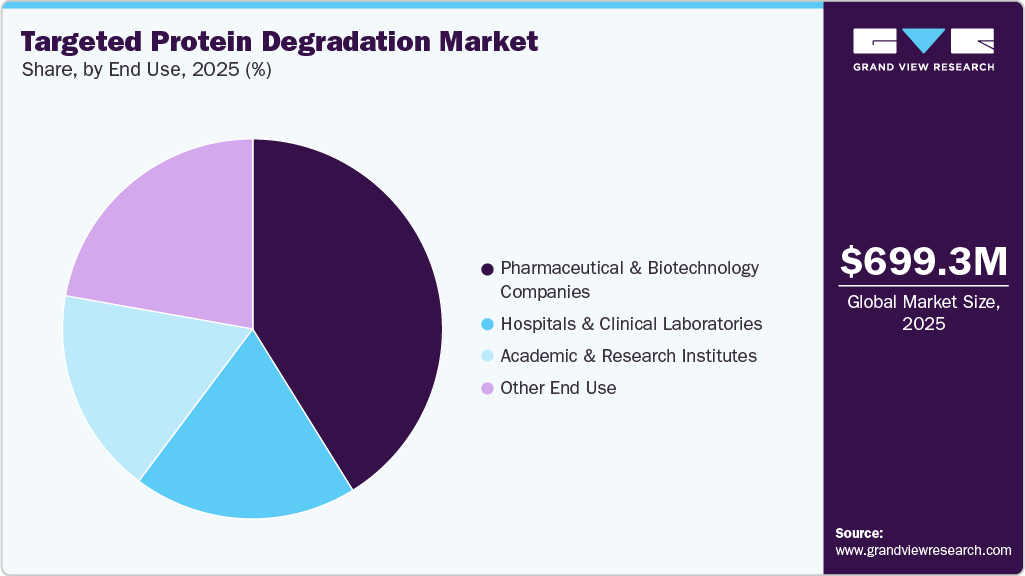

- Based on end use, the pharmaceutical & biotechnology companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 699.3 Million

- 2033 Projected Market Size: USD 3,257.4 Million

- CAGR (2026-2033): 20.75%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The high prevalence of these diseases creates a strong demand for novel treatment options, driving market growth. The expanding number of research and development activities in this field provides significant market growth opportunities. For instance, in December 2023, the Austrian Science Fund (FWF) approved the Special Research Program (SFB) in Targeted Protein Degradation for a second funding period of another four years. The SFB in targeted protein degradation is a research initiative focusing on understanding and developing methods to target specific proteins for cell degradation. This program aims to advance the field of targeted protein degradation, which has gained significant attention in recent years due to its potential applications in drug discovery and therapeutic interventions.

The supportive regulatory environment, particularly the streamlined approval processes by agencies such as the FDA and EMA, has played a crucial role in accelerating the adoption of TPD-based therapies. Rapid advancements in the underlying technologies drive the targeted protein degradation industry. The development of innovative approaches, such as proteolysis-targeting chimeras (PROTACs), molecular glues, and lysosome-targeting chimeras (LYTACs), has expanded TPD's capabilities to eliminate disease-causing proteins selectively. These technological breakthroughs have opened up new avenues for targeting previously undruggable proteins, driving the growth of the targeted protein degradation industry.

The increasing recognition of the therapeutic potential of targeted protein degradation in addressing previously undruggable targets is a key driver for the targeted protein degradation industry. Traditional approaches often struggle with proteins that are difficult to modulate, but technologies such as PROTACs (proteolysis-targeting chimeras) provide a favorable solution by promoting the degradation of disease-causing proteins. This method has shown considerable promise in treating conditions such as cancer and neurodegenerative disorders, sparking a surge in research and investment in this area. The National Institute of Health highlights PROTACs as a leading drug development technology in recent years. The increasing success in preclinical and early-phase clinical trials drives pharmaceutical and biotech companies to integrate targeted protein degradation into their pipelines, recognizing its potential to transform therapeutic strategies.

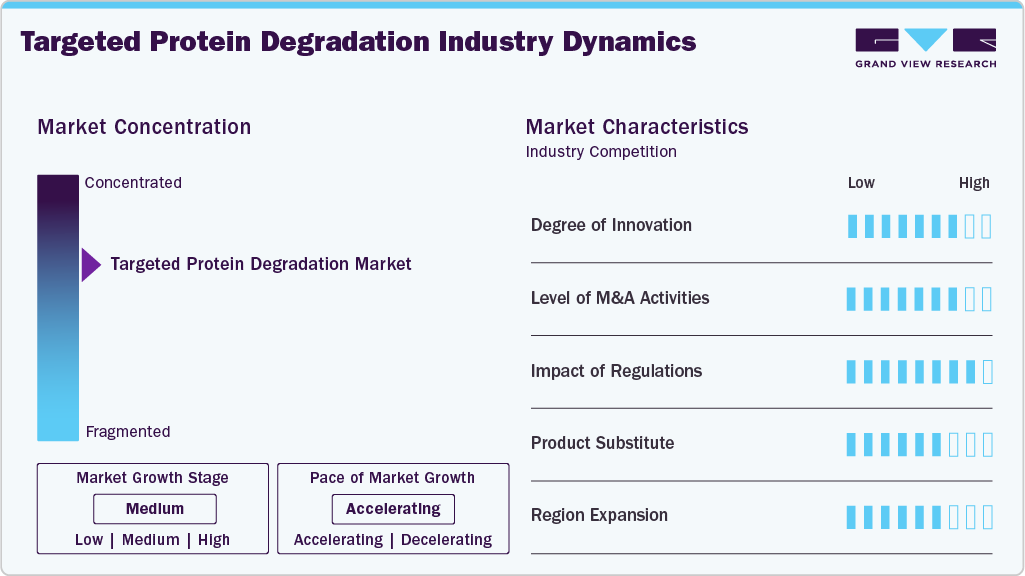

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by technological advancements, diversification of technologies, increased focus on orally bioavailable compounds, robust research and development activities, and supportive regulatory environments. In March 2024, researchers at the University of Toronto and Sinai Health created an innovative platform to identify 'effector' proteins. These proteins can regulate the stability of other proteins and offer new opportunities for developing targeted therapies for diseases by utilizing protein interactions within cells.

Major pharmaceutical companies are collaborating and partnering with TPD-focused biotechnology firms to co-develop and commercialize novel degrader-based treatments. For instance, in May 2022, Evotec, a drug discovery alliance and development partnership company, extended and expanded its strategic partnership with Bristol Myers Squibb (BMS) in protein degradation. This collaboration aims to leverage Evotec’s expertise in drug discovery and BMS’s capabilities to develop novel therapies to advance the discovery of new medicines using protein degradation technologies.

The regulatory environment plays a significant role in shaping the TPD industry. Regulatory bodies such as the U.S. FDA and the European Medicines Agency (EMA) have a crucial role in approving TPD-based therapies for clinical use. The streamlining of approval processes by these agencies can accelerate the commercialization of novel TPD-based treatments, driving targeted protein degradation industry growth.

There are several key product substitutes in the market, including traditional small molecule inhibitors, Biologics and antibody-based therapies and gene therapy and RNA interference. These substitutes offer different mechanisms and applications compared to TPD, which leverages the body's natural protein degradation pathways to selectively eliminate disease-causing proteins.

The industry is witnessing significant regional expansion, driven by an increasing strong emphasis on research and development, coupled with a growing pool of skilled scientists and researchers, which has fueled the advancement of TPD technologies.

Type Insights

The PROTAC segment dominated the market with the largest revenue share of 47.56% in 2025. PROTACs employ an innovative approach by using E3 ligases to tag proteins for degradation. These bifunctional molecules bind to target proteins and an E3 ubiquitin ligase, leading to ubiquitination and the proteasomal degradation of the target. This novel method efficiently degrades problematic proteins, showing promise in drug development. For instance, according to the NIH, the PROTAC molecules ARV-110 for prostate cancer and ARV-471 for breast cancer have shown encouraging results in clinical trials, fueling significant investor interest and accelerating the advancement of PROTAC-based therapies.

The molecular glues segment is projected to grow at a significant rate over the forecast period. Molecular glues are a class of TPD agents that induce protein degradation by binding to both the target protein and an E3 ligase, simplifying the degradation process compared to PROTACs. These agents offer benefits such as a lower molecular weight and improved cell permeability. Advances in understanding their design have led to more potent degraders, such as thalidomide analogs targeting previously "undruggable" proteins. As knowledge and applications of molecular glue platforms grow, they will significantly impact drug development and market growth.

Application Insights

The therapy development segment held the largest share in 2025 and is anticipated to grow rapidly over the forecast period. The segment encompasses cancer, neurology, infectious diseases, cardiovascular diseases, and other conditions. This sector's growth is fueled by an intensifying emphasis on developing new treatments, supported by robust research and development activities, increased funding, and collaborations among pharmaceutical and biotech companies. For Instance, in November 2022, the Tang Research Group, under Professor Weiping Tang at the University of Wisconsin-Madison, made significant strides in targeted protein degradation, including a novel method to degrade proteins on and outside liver cells previously deemed untargetable.

The drug discovery segment is expected to grow significantly during the forecast period. The growing acceptance of advanced TPD technologies, such as epichaperome inhibitors, hydrophobic tags, and lysosome targeting chimeras, has fueled the adoption of these approaches in drug discovery. Drug discovery in targeted protein degradation involves identifying small molecules that can selectively degrade disease-causing proteins by harnessing the ubiquitin-proteasome system. The potential of targeted protein degradation to offer more precise and effective treatment options for various diseases fuels the growth of the drug discovery segment within the targeted protein degradation market.

End Use Insights

Pharmaceutical & biotechnology companies held the largest share of 41.16% in 2025. These companies are integrating targeted protein degradation (TPD) strategies into their R&D to meet diverse therapeutic needs. Key players such as AbbVie, Novartis, and Pfizer are forming partnerships with TPD-specialized biotech companies to advance degrader-based treatments. These collaborations leverage the expertise and resources of pharmaceutical giants and innovative biotechnology firms to accelerate the advancement of TPD-based drug candidates.

Hospitals & clinical laboratories are anticipated to witness significant growth over the forecast period. This is attributed to the increasing adoption of TPD technologies for diagnostic and therapeutic applications in clinical settings. Hospitals and clinical laboratories are at the forefront of implementing TPD-based assays and tests for disease diagnosis, patient stratification, and treatment monitoring. These technologies are essential for disease diagnosis, patient stratification, and treatment monitoring, especially with the development of companion diagnostics. The demand is driven by the need for more accurate, personalized treatments and the ability of TPD to target hard-to-drug proteins. As TPD advances and our understanding of diseases improves, its adoption in clinical settings continues to grow, keeping these institutions at the forefront of the TPD market.

Regional Insights

The North America targeted protein degradation industry dominated the global market and accounted for a 44.34% share in 2025, owing to the strong emphasis on innovation and technological advancements driven by a supportive regulatory environment. In the U.S., the Food and Drug Administration (FDA) has played a pivotal role in streamlining the approval process for TPD-based treatments, fostering the growth of this market. Economically, the region's robust healthcare infrastructure, access to advanced diagnostic tools, and the presence of leading pharmaceutical and biotechnology companies have enabled the early identification of disease-causing proteins and the development of innovative TPD-based therapies.

U.S. Targeted Protein Degradation Market Trends

The targeted protein degradation industry in the U.S. is experiencing significant trends shaping its growth and development. The increasing cancer prevalence in the U.S. is boosting the targeted protein degradation (TPD) market as innovative treatments become crucial for managing various cancers-lung, breast, prostate, and colorectal, among others. With their ability to target previously undruggable proteins involved in cancer progression, TPD has emerged as a promising solution to address this unmet need. The National Cancer Institute forecasts about 2 million new cancer cases and over 600,000 deaths in 2024, highlighting the urgent need for effective solutions against common cancers, including melanoma, bladder, and liver cancer, to name a few.

Europe Targeted Protein Degradation Market Trends

The targeted protein degradation industry in Europe is anticipated to grow rapidly, driven by collaborative research and efforts to broaden TPD's therapeutic applications. Thanks to partnerships between academia and biotech, the UK and Germany are leading in TPD advancements. For instance, in March 2023, FIMECS, a biotechnology firm, is advancing drugs via its RaPPIDSTM technology. FIMECS will showcase its research at the 3rd Annual Targeted Protein Degradation Europe Summit in London, underlining the market's dynamic progress and FIMECS's pivotal role in TPD innovation.

The UK targeted protein degradation industry is influenced by the robust healthcare system and its focus on personalized medicine. This has created a favorable environment for the adoption of TPD technologies. The growing awareness among healthcare professionals and patients about the potential of TPD to address unmet medical needs has driven the demand for these innovative therapies, further fueling the market's expansion.

The targeted protein degradation industry in Germany is observed to be a lucrative market in the region owing to strong funding and academic-industry collaborations. Institutions, including Ludwig Maximilian University of Munich, lead in TPD research, fostering developments in drug discovery. Notably, the German-Israeli Project Cooperation funded a key project in January 2024 with 1.655 million Euros, focusing on defeating degradation-resistant cancers. This initiative underscores the active efforts and international partnership to advance cancer therapy through innovative research in Germany's robust TPD landscape.

Asia Pacific Targeted Protein Degradation Market Trends

The targeted protein degradation industry in the Asia Pacific is growing due to the region's strong emphasis on research and development, coupled with a growing pool of skilled scientists and researchers, which has fueled the advancement of TPD technologies. Furthermore, the region's large patient population and the increasing prevalence of chronic diseases have created a significant demand for innovative therapeutic approaches, such as TPD.

The China targeted protein degradation industry is driven by strong government support for R&D, increased funding for TPD projects, and a growing demand for innovative therapies to address the country's unmet medical needs. In May 2023, Cullgen, Inc., a biotech firm based in San Diego, CA, and Shanghai, China, advancing small molecule treatments through its unique uSMITE technology for targeted protein degradation, secured $40 million in investment.

The targeted protein degradation industry in Japan is influenced by the well-established pharmaceutical industry. The thriving venture capital ecosystem has provided the necessary resources and investment opportunities for TPD-focused companies to grow. The Japanese population's growing awareness and acceptance of personalized medicine have contributed to the demand for innovative TPD-based therapies, further driving the market's expansion.

Middle East & Africa Targeted Protein Degradation Market Trends

The targeted protein degradation industry in the Middle East and Africa is anticipated to expand, fueled by increasing healthcare spending due to the rise of chronic diseases and the demand for novel treatments. This growth is creating new opportunities for TPD technologies, with pharmaceutical and biotech companies aiming to meet the unaddressed medical needs. A surge in awareness about the benefits of protein degradation is boosting the demand for TPD therapies, paving the way for their broader adoption in treating complex diseases across the region.

The Saudi Arabia targeted protein degradation industry is likely influenced by various factors, including the adoption of advanced technology, increasing demand for immunoassays to diagnose infections, growing awareness about the benefits of protein degradation, and the need for innovative drug discovery strategies.

The targeted protein degradation industry in the UAE is expected to witness growth due to the supportive regulatory environment and focus on advancing personalized medicine. The country's robust financial infrastructure and growing life sciences sector have provided TPD-focused companies with the necessary resources and funding opportunities to establish their presence in the region.

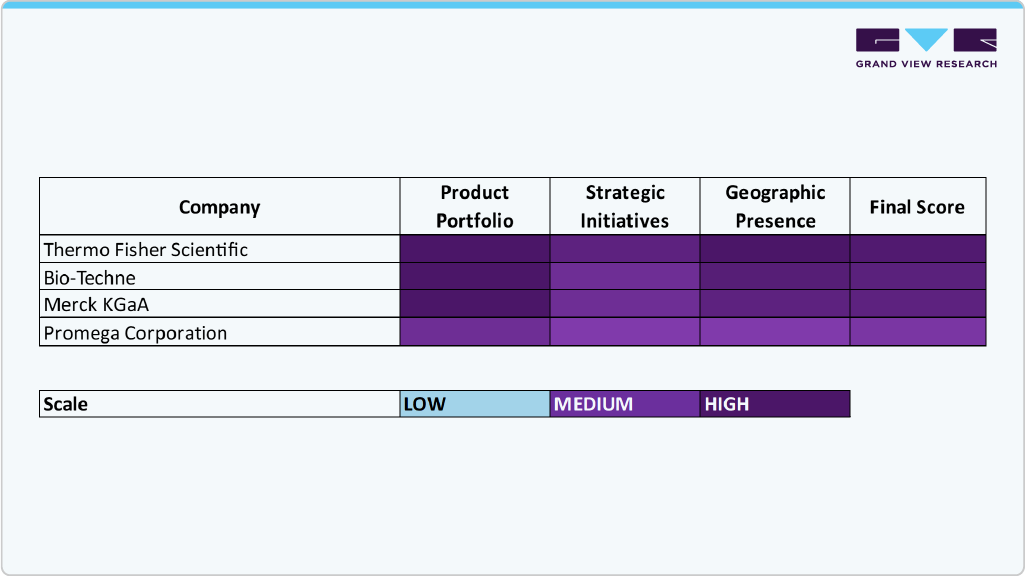

Key Targeted Protein Degradation Company Insights

The targeted protein degradation (TPD) market is characterized by a dynamic competitive landscape, where specialized biotechnology innovators and large pharmaceutical companies co-drive growth and differentiation. Thermo Fisher Scientific leverages its broad portfolio of instruments, reagents, and proteomics solutions to support TPD research workflows, including mass spectrometry, protein assays, and degradation analysis tools; its global scale and extensive customer base make it one of the most prominent suppliers in the TPD ecosystem, even though it doesn’t commercialize degrader drugs directly.

Bio-Techne holds a strong niche as a specialized reagent and protein biology supplier, with focused offerings in high-quality antibodies, kits, and assay platforms that are frequently used in protein degradation experiments and related research. Merck KGaA, with its Sigma-Aldrich portfolio and deep biochemical reagent catalog, competes closely in providing reagents, kits, and analytical tools essential for degrader discovery and validation, often differentiated by breadth of biochemical chemistries and integrated workflows.

Key players operating in the market are playing a crucial role by providing the necessary tools, technologies, and services to support the research, development, and commercialization of TPD-based therapies across various disease areas.

Key Targeted Protein Degradation Companies:

The following are the leading companies in the targeted protein degradation market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Bio-Techne

- BOC Sciences

- BPS Bioscience, Inc.

- BroadPharm

- LifeSensors Inc.

- MedChemExpress.

- Merck KGaA

- Promega Corporation

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In April 2024, Novartis acquired a Phase 3-ready protein degrader for prostate cancer from Vividion Therapeutics. The protein degrader in question is VVD-101, which is designed to target the androgen receptor, a key driver of prostate cancer. Novartis aims to advance this compound into clinical trials as part of its efforts to develop innovative treatments for prostate cancer.

-

In March 2024, C4 Therapeutics, a biopharmaceutical company focused on developing small molecule drugs for targeted protein degradation, announced a strategic discovery research collaboration with Merck KGaA, Darmstadt, Germany. The partnership aims to target critical oncogenic proteins using C4T’s Degronimid platform technology.

-

In May 2023, The Max Planck Institute of Biochemistry (MPIB) researchers have made a groundbreaking discovery in cellular biology. They have identified a mechanism that facilitates the recycling of protein modules, enabling the targeted degradation of unwanted proteins within cells. This mechanism plays a crucial role in maintaining the integrity of the cellular supply chain and ensuring proper protein turnover.

Targeted Protein Degradation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 870.5 million

Revenue Forecast in 2033

USD 3,257.4 million

Growth rate

CAGR of 20.75% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bayer AG; Bio-Techne; BOC Sciences; BPS Bioscience, Inc.; BroadPharm; LifeSensors Inc.; MedChemExpress.; Merck KGaA; Promega Corporation; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Targeted Protein Degradation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global targeted protein degradation market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

PROTAC

-

Molecular Glues

-

LYTACs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery

-

Therapy Development

-

Cancer

-

Neurology

-

Infectious Diseases

-

Cardiovascular Diseases

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Hospitals & Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global targeted protein degradation market size was estimated at USD 699.3 million in 2025 and is expected to reach USD 870.5 million in 2026.

b. The global targeted protein degradation market is expected to witness a compound annual growth rate of 20.75% from 2026 to 2033 to reach USD 3,257.4 million by 2033.

b. The therapy development segment held the largest share in 2025 and is anticipated to grow rapidly over the forecast period. This sector's growth is fueled by an intensifying emphasis on creating new treatments, supported by robust research and development activities, increased funding, and collaborations among pharmaceutical and biotech companies.

b. The key players operating in the targeted protein degradation market include Bayer AG; Bio-Techne; BOC Sciences; BPS Bioscience, Inc.; BroadPharm; LifeSensors Inc.; MedChemExpress.; Merck KGaA; Promega Corporation; Thermo Fisher Scientific, Inc.

b. Some of the factors driving the targeted protein degradation market include the constantly growing frequency of chronic disease conditions such as cancer and neurodegenerative diseases, along with changing lifestyles and increasing healthcare spending.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.