- Home

- »

- Next Generation Technologies

- »

-

Target Drone Market Size & Share, Industry Report, 2030GVR Report cover

![Target Drone Market Size, Share & Trends Report]()

Target Drone Market (2024 - 2030) Size, Share & Trends Analysis Report By Target (Aerial, Ground, Marine), By Application (Training, Target & Decoy, Reconnaissance), By Operation Mode, By End Use, By Payload, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-391-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Target Drone Market Size & Trends

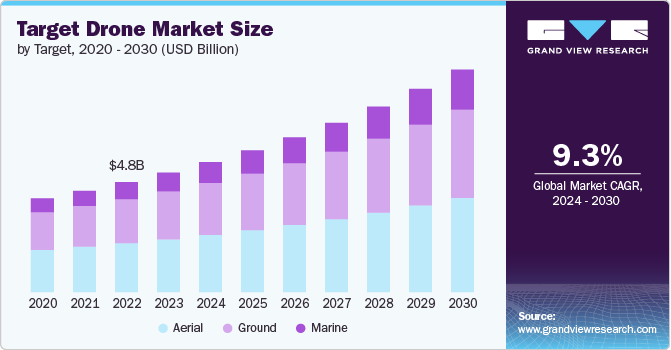

The global target drone market size was estimated at USD 5.18 billion in 2023 and is expected to expand at a CAGR of 9.3% from 2024 to 2030. The increasing military and defense expenditures worldwide is boosting the demand for target drones. Governments and defense organizations are investing heavily in advanced technologies to enhance their military capabilities. As geopolitical tensions and defense budgets continue to rise, the demand for sophisticated target drones is expected to grow, providing military forces with realistic training scenarios and high-performance targets.

There is a growing interest in law enforcement agencies, search and rescue teams, and industries such as security and surveillance are beginning to adopt these drones for various applications, including training law enforcement and emergency response teams. The versatility of target drones allows them to be utilized in different environments, further driving their adoption across sectors for training and simulation purposes. For instance, drones can be used for disaster response training, airport security drills, and emergency response scenarios. This diversification of applications is expanding the target drone market beyond traditional defense sectors, creating new opportunities for growth.

Moreover, the need for realistic training and simulation is a key factor driving the market growth. Modern warfare and defense strategies require high levels of precision and adaptability, necessitating advanced training tools. Target drones provide realistic targets that can mimic various threats and environmental conditions, allowing trainees to practice and refine their skills in a controlled setting. As military forces and defense organizations emphasize the importance of effective training programs, the demand for advanced target drones that can replicate diverse combat scenarios is expected to increase.

Governments are prioritizing military modernization and enhancing their training capabilities to address evolving security threats. As a result, there is a growing demand for target drones for use in live-fire training exercises, weapons testing, and the evaluation of missile systems, which is expected to further fuel the market growth in coming years.

Technological advancements such as enhanced automation, improved flight stability, and advanced targeting systems have made target drones more efficient and effective for military training and testing. Additionally, the integration of AI and machine learning algorithms enables these drones to simulate realistic enemy scenarios, further boosting their demand. The ongoing research and development in drone technology is expected to continue to drive the market growth in the coming years.

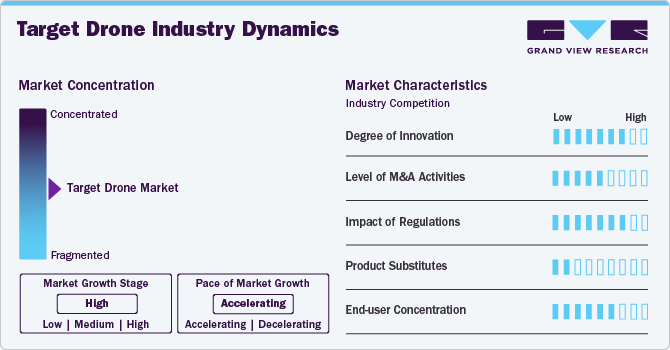

Market Concentration & Characteristics

The market is characterized by high degree of innovation, driven by continuous advancements in drone technology and artificial intelligence. Companies in this sector are heavily investing in research and development to enhance the capabilities of target drones, including improved flight stability, advanced targeting systems, and sophisticated AI-driven features. This constant innovation is crucial for maintaining a competitive edge, as military and defense organizations demand increasingly realistic and efficient training tools.

The level of mergers & acquisition activities in the market is expected to be moderate, as established defense contractors and technology firms seek to expand their capabilities and market share. These strategic moves allow companies to integrate new technologies, diversify their product offerings, and access new customer bases.

The impact of regulations on the market is expected to be moderate to high. Governments and international bodies impose strict regulations to ensure the safe and secure use of drones, particularly in military and defense applications. Compliance with these regulations is essential for market players, influencing product development, manufacturing processes, and operational protocols. Regulations can also impact market entry barriers, with stringent requirements potentially limiting the number of new entrants.

The competition from product substitutes in the market is expected to be low. While target drones are increasingly preferred for military training and testing, there are substitutes that could impact their market. Traditional manned aircraft, simulators, and other unmanned systems can serve as alternatives for specific training and testing needs. However, target drones offer unique advantages such as cost-effectiveness, reusability, and the ability to simulate a wide range of scenarios, making them a preferred choice in many cases.

The end user concentration in the market is moderate. The market for target drones is primarily concentrated among defense and military organizations, which constitute the largest segment of end users. These organizations require sophisticated training tools to prepare for modern warfare, driving the demand for advanced target drones. Additionally, aerospace companies, defense contractors, and research institutions also utilize target drones for various testing and development purposes.

Target Insights

The aerial segment accounted for the largest market share of over 44% in 2023. This can be attributed to the broad application of target drones across military, defense, and commercial sectors. Aerial target drones are extensively used for a range of purposes including training, target simulation, and surveillance, owing to their versatility and effectiveness in replicating airborne threats. Their widespread use in various scenarios and their proven track record in delivering realistic training experiences is contributing to the segmental growth.

The marine segment is expected to witness the fastest CAGR of over 11% from 2024 to 2030, owing to the growing recognition of the strategic importance of maritime operations and the increasing deployment of drones in naval applications. Marine target drones offer critical capabilities for training naval forces, simulating maritime threats, and conducting oceanographic research. The expansion of maritime surveillance and the need for advanced training tools in naval environments drive the demand for marine drones, supported by technological advancements that enhance their performance in challenging aquatic conditions.

Application Insights

The training segment held the largest share in 2023, owing to the increased number of military training programs globally, driven by rising geopolitical tensions and higher defense budgets. Modern target drones, equipped with advanced technologies, provide realistic combat scenarios essential for enhancing military personnel skills. This comprehensive and effective training methodology has led to significant investments in target drones for training purposes, which is further expected to fuel the segmental growth in coming years.

The target and decoy segment is anticipated to record the fastest growth from 2024 to 2030, owing to the evolving nature of modern warfare, which increasingly relies on electronic warfare and advanced combat strategies. Target and decoy drones are crucial for simulating real targets and misleading enemy defenses, supported by continuous advancements in decoy technologies. Additionally, their cost-effectiveness and crucial role in testing and evaluating new weapons and defense systems further drive their demand, positioning this segment for rapid growth in the coming years.

End Use Insights

The military & government segment registered the largest revenue share in 2023. This growth can be attributed to its extensive and critical use in defense and training applications. Military and government organizations are major consumers of target drones, utilizing them for realistic combat simulations, testing weapon systems, and enhancing tactical training. The high demand for reliable and sophisticated target drones in these sectors, coupled with substantial defense budgets.

The commercial segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth can be attributed to the expanding applications of target drones beyond traditional defense use. These drones are used for applications such as precision agriculture, monitoring and surveillance, and promotional events, driven by advancements in technology and decreasing costs. The versatility and growing acceptance of drones in various commercial sectors contribute to the segment's rapid growth projection.

Operation Mode Insights

The piloted segment in the market registered the largest share in 2023, owing to its established use in various defense and training applications where human control is crucial for precise operations and real-time decision-making. Piloted target drones offer flexibility and adaptability, allowing operators to manually adjust the drone's flight path and behavior to create realistic training scenarios. This operational control and the proven reliability of piloted systems is expected to fuel the segmental growth in coming years.

The autonomous segment is anticipated to record the fastest growth from 2024 to 2030. The advancements in technology increasingly enable drones to operate without direct human intervention, which is driving the segmental growth. Additionally, the growing integration of artificial intelligence and machine learning in autonomous systems enhances their capability to mimic diverse targets and scenarios, driving their rapid adoption in both military and commercial applications.

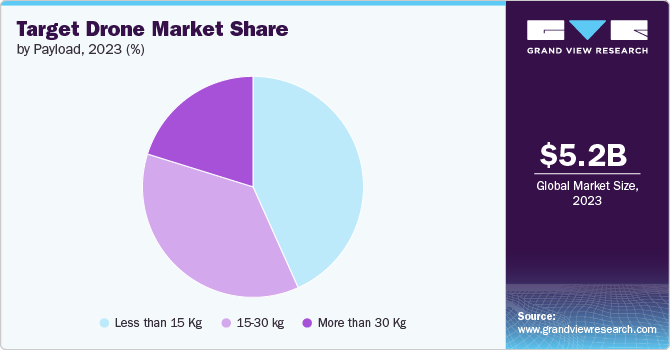

Payload Insights

The less than 15 kg segment in the market registered the largest share in 2023, owing to its widespread adoption across various applications, including military training, research, and recreational use. These drones are generally more affordable and versatile, making them suitable for a broad range of training exercises and test scenarios. Their compact size and lower operational costs have led to their extensive use, contributing to their segmental growth.

The 15-30 kg segment is anticipated to record the fastest growth from 2024 to 2030, due to increasing demand for drones that offer a balance between payload capacity and maneuverability. This weight class provides enhanced capabilities such as carrying more sophisticated sensors and payloads, making them ideal for advanced training, target simulation, and military applications that require more realistic and challenging scenarios. Additionally, improvements in technology and a growing focus on more versatile and durable drones are fueling the rapid expansion of this segment.

Regional Insights

North America accounted for the highest revenue share of over 34% in 2023. The market is driven by the extensive use of drones for military training and testing purposes. The U.S. Department of Defense’s significant investments in drone technology, coupled with the presence of major drone manufacturers, is boosting the market growth. Additionally, technological advancements and increasing use of target drones in homeland security applications is expected to further propel the market growth.

U.S. Target Drone Market Trends

The target drone market in the U.S. is projected to grow at a CAGR of over 8% from 2024 to 2030. There is a growing emphasis on developing drones that can simulate various threats, including sophisticated electronic warfare and radar evasion techniques, to provide more comprehensive training for military personnel. Additionally, the U.S. is investing in autonomous and swarm drone technologies to simulate complex aerial combat scenarios, which is expected to drive the market growth in coming years.

Europe Target Drone Market Trends

The target drone market in Europe is anticipated to grow at a CAGR of over 8% from 2024 to 2030. This growth is driven by the increased defense spending and collaborative defense initiatives among European Union countries. The focus on enhancing military training and readiness, along with the presence of established drone manufacturers in countries is fueling the market growth. Furthermore, the adoption of target drones for both military and civilian applications, such as research and development, supports the market in this region.

The UK target drone market is anticipated to grow at a CAGR from 2024 to 2030. The UK market growth is driven by the military's emphasis on realistic training scenarios, technological advancements in drone capabilities, and increased defense budgets. The integration of AI and machine learning into target drones, participation in collaborative defense programs such as NATO, and a focus on developing drones to test counter-unmanned aerial vehicles are the key trends in the region.

The target drone market in Germany is expected to grow at a CAGR from 2024 to 2030. The use of autonomous systems and AI in drones, the expansion of target drone applications to civilian security, and the development of eco-friendly drones to address environmental concerns are the key trends influencing the market growth in the country.

The France target drone market is projected to grow at a CAGR from 2024 to 2030. France's target drone market is driven by the modernization of the armed forces, strategic defense investments outlined in the military planning law and the rising threat perceptions.

Asia Pacific Target Drone Market Trends

The target drone market in Asia Pacific is expected to grow at the fastest CAGR of over 10% from 2024 to 2030, owing to rising defense budgets and increasing geopolitical tensions. Countries in this region are investing heavily in drone technology for military training and surveillance. The adoption of advanced drone systems by various defense forces and the expansion of local drone manufacturing capabilities are key drivers in this region.

The China target drone market is projected to grow at a CAGR from 2024 to 2030. China’s strategic emphasis on enhancing its defense readiness amid regional security concerns, technological advancements that improve the performance and versatility of target drones, and government policies that support the development of indigenous defense technologies are the key factors driving the market in China.

The target drone market in Japan is expected to grow at a CAGR from 2024 to 2030. Japan’s strategic need to modernize its defense systems in response to regional security dynamics, advancements in drone technology that offer improved precision and simulation capabilities, and government initiatives aimed at strengthening defense infrastructure is contributing to the market’s growth in Japan.

The India target drone market is expected to grow at a CAGR from 2024 to 2030. India’s rising defense budget, regional security challenges, and ongoing modernization programs that prioritize the integration of cutting-edge technologies in defense are the key trends driving the market growth.

Middle East and Africa Target Drone Market Trends

The target drone market in the Middle East and Africa is expected to grow at a CAGR of over 10% from 2024 to 2030. The increasing advancements in military technology, modernization efforts, and the need to address regional conflicts and security concerns are driving the market growth in the region. Many countries are investing heavily in advanced military technology, including target drones, to enhance training and simulation capabilities. This demand is driven by geopolitical instability, technological advancements in drone capabilities, and government initiatives aimed at improving defense readiness.

The Saudi Arabia target drone market is anticipated to grow at a CAGR from 2024 to 2030. The country’s investments in modernizing its defense capabilities and enhancing military training programs are expanding the market expansion in the country. The emphasis on sophisticated training solutions, including advanced target drones, is driven by strategic defense objectives and regional security concerns.

Key Target Drone Company Insights

Some of the key players operating in the target drone market include Northrop Grumman Corporation and The Boeing Company.

-

Northrop Grumman Corporation is a global aerospace and defense technology company. It provides innovative systems, products and solutions in autonomous systems, cyber, C4ISR, space, strike, and logistics and modernization to government and commercial customers worldwide. The company's five operating sectors are Aeronautics Systems, Defense Systems, Mission Systems, Space Systems, and Technology Services.

-

The Boeing Company is a leading global aerospace company that develops, manufactures, and services commercial airplanes, defense, space, and security systems. In the target drone market, Boeing offers a range of unmanned aerial vehicles (UAVs) and target drones designed to meet the needs of military and defense customers. These systems are used for training, testing, and evaluation purposes to enhance the effectiveness and safety of military operations.

Airbus SE and Griffon Aerospace are some of the emerging market participants.

-

Airbus SE focuses on developing innovative and high-performance unmanned aerial systems (UAS) that serve as target drones for military training and testing purposes. Airbus’s commitment to research and development ensures that its target drones meet the evolving needs of modern defense forces, providing reliable and realistic training solutions.

-

Griffon Aerospace is an American company specializing in the design and manufacture of unmanned aerial vehicles (UAVs) and target drones. The company’s products are designed to simulate a wide range of aerial threats, providing realistic training scenarios for military personnel. Griffon Aerospace's target drones are valued for their cost-effectiveness, durability, and versatility, making them a preferred choice for various defense training and testing applications.

Key Target Drone Companies:

The following are the leading companies in the target drone market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- The Boeing Company

- Airbus SE

- BAE Systems plc

- Kratos Defense & Security Solutions, Inc.

- QinetiQ Group plc

- Griffon Aerospace

- Leonardo S.p.A.

- Safran Electronics & Defense

Recent Developments

-

In June 2024, Safran Electronics & Defense launched its Skyjacker counter-drone system, designed to counter the growing threat of drones in battlespace and at sensitive installations. Skyjacker uses a unique spoofing capability to alter the trajectory of drones by simulating GNSS signals, ensuring guidance towards its target.

-

In July 2023, Kratos Defense & Security Solutions, Inc. secured a USD 95-million contract to supply unmanned target systems to the US Army. The target drones must be fixed-wing, subscale, and jet-propelled. Kratos produces the BQM-167A and BQM-177A target drones, which provide realistic training for air-to-air engagements.

-

In March 2023, QinetiQ Group plc signed a contract to provide uncrewed aerial target services to the Japan Ground Self-Defense Force (JGSDF) for anti-aircraft firing training. This marks the first time QinetiQ has sold aerial targets to Japan, following over 20 years of successful maritime target services to the Japan Maritime Self-Defense Force (JMSDF) and Japan Air Self-Defense Force (JASDF).

Target Drone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.64 billion

Revenue forecast in 2030

USD 9.64 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Target, application, operation mode, end use, payload, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Lockheed Martin Corporation; Northrop Grumman Corporation; The Boeing Company; Airbus SE; BAE Systems plc; Kratos Defense & Security Solutions, Inc.; QinetiQ Group plc; Griffon Aerospace; Leonardo S.p.A.; Safran Electronics & Defense

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Target Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global target drone market report based on target, application, operation mode, end use, payload, and region:

-

Target Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerial

-

Ground

-

Marine

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Training

-

Target and Decoy

-

Reconnaissance

-

Others

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Piloted

-

Autonomous

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Government

-

Commercial

-

-

Payload Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 15 Kg

-

15-30 kg

-

More than 30 Kg

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global target drone market size was estimated at USD 5.18 billion in 2023 and is expected to reach USD 5.64 billion in 2024.

b. The global target drone market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 9.64 billion by 2030.

b. The target drone market in North America accounted for a significant revenue share of over 34% in 2023. The market is driven by the extensive use of drones for military training and testing purposes. The U.S. Department of Defense’s significant investments in drone technology, coupled with the presence of major drone manufacturers, is boosting the market growth.

b. Some key players operating in the target drone market include Lockheed Martin Corporation, Northrop Grumman Corporation, The Boeing Company, Airbus SE, BAE Systems plc, Kratos Defense & Security Solutions, Inc., QinetiQ Group plc, Griffon Aerospace, Leonardo S.p.A., Safran Electronics & Defense

b. Key factors that are driving target drone market growth include the increasing military and defense expenditures worldwide, growing interest in law enforcement agencies, search and rescue teams, and industries such as security and surveillance, and the need for realistic training and simulation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.