Tangential Flow Filtration Market Size, Share & Trends Analysis Report By Product, By Technology (Ultrafiltration, Microfiltration), By Application (Protein Purification), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-997-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Tangential Flow Filtration Market Trends

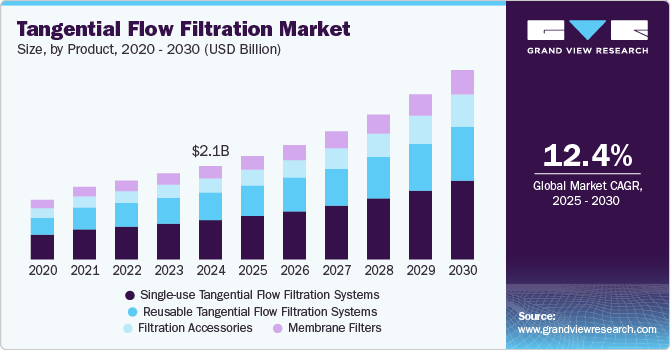

The global tangential flow filtration market size was valued at USD 2.05 billion in 2024 and is expected to grow at a CAGR of 12.4% from 2025 to 2030. This growth is attributed to the advancements in biotechnology and biopharmaceuticals as the demand for effective therapies and vaccines rises. In addition, the increased prevalence of chronic diseases and the growing focus on precision medicine fuel market growth. Moreover, the rapid adoption of single-use technologies enhances operational efficiency, while substantial investments in research and development by pharmaceutical companies support innovation in filtration technologies.

Tangential flow filtration (TFF), or crossflow filtration, is a critical technology widely used in biopharmaceuticals. It is particularly effective for protein purification, virus filtration, and various downstream processing tasks. The growing difficulty of bioprocessing workflows and the need for effective filtration methods have led to an increased adoption of TFF systems. This technique excels at handling large feed volumes while safeguarding the accurate separation of target molecules from mixtures, making it essential for biopharmaceutical filtration.

Significant investments by pharmaceutical companies are accelerating the development and implementation of TFF technologies. In addition, firms are increasingly directing resources toward bioprocessing and biomanufacturing to improve production efficiencies and meet the rising demand for biopharmaceuticals. This funding surge fosters the creation of more advanced TFF systems, which are vital for scaling up biologics production, subsequently impacting overall market growth.

Moreover, single-use TFF systems have gained traction as they remove the extensive cleaning and validation procedures required by traditional reusable systems. This not only saves time but also reduces operational costs related to bioprocessing. As a result, these systems are rapidly being integrated into both small-scale and large-scale biopharmaceutical production processes, further propelling market expansion.

Product Insights

Single-use tangential flow filtration (TFF) systems led the market and accounted for the largest revenue share of 42.0% in 2024 attributed to the increasing adoption of single-use technologies across pharmaceutical companies, contract organizations, and research institutions. Their advantages, such as smaller footprints, reduced processing times, and the elimination of cross-contamination, contribute significantly to market demand. In addition, ongoing investments in research and development and launching innovative products further propel growth. Furthermore, the surge in biopharmaceutical production, particularly for vaccines and therapeutics during the COVID-19 pandemic, has created new opportunities, making single-use TFF systems essential for efficient bioprocessing.

Filtration accessories are expected to grow at a CAGR of 14.9% over the forecast period, owing to their complementary role in enhancing filtration processes. The rising demand for biopharmaceuticals necessitates efficient and reliable filtration solutions, driving the need for high-quality accessories that support TFF systems. In addition, these accessories improve operational efficiency by facilitating easier integration and ensuring optimal performance during filtration processes. Furthermore, as pharmaceutical companies continue to invest in advanced filtration technologies, the market for filtration accessories is expected to expand significantly, supporting overall growth in the tangential flow filtration market.

Technology Insights

Ultrafiltration technology dominated the market and accounted for the largest revenue share, 55.8%, in 2024, owing to the rising demand for ultrapure water in the food and beverage, pharmaceuticals, and wastewater treatment sectors. In addition, stringent regulatory requirements regarding water quality and environmental sustainability compel industries to implement advanced filtration technologies. Furthermore, the versatility of ultrafiltration in removing macromolecules and particulate matter further enhances its appeal across various applications, including biopharmaceuticals and dairy processing, contributing to a robust market expansion.

Microfiltration technology is expected to grow at a CAGR of 12.4% over the forecast period, owing to its effectiveness in separating suspended solids and microorganisms. In addition, the increasing focus on maintaining high-quality standards in biopharmaceutical manufacturing drives the demand for microfiltration systems. Furthermore, the technology's ability to operate at lower pressures while providing optimized flux makes it cost-effective for various applications. Moreover, as industries prioritize efficient separation processes and compliance with stringent health regulations, the adoption of microfiltration technology is expected to rise, supporting overall market growth in tangential flow filtration.

Applications Insights

Raw material filtration led the market and accounted for the largest revenue share in 2024, owing to the increasing demand for high-quality raw materials across various industries, particularly in pharmaceuticals and food and beverage. This necessitates effective filtration solutions to ensure purity and safety. In addition, stringent regulatory requirements regarding product quality further drive the adoption of advanced filtration technologies. Furthermore, the rising focus on sustainability and environmental concerns also encourages industries to implement efficient filtration processes that minimize waste and enhance resource recovery, thereby boosting the raw material filtration segment.

Antibody purification applications are expected to grow at the fastest CAGR of 15.2% from 2025 to 2030 attributed to the expanding biopharmaceutical sector, driven by the rising prevalence of chronic diseases and the need for innovative therapies. In addition, tangential flow filtration offers advantages such as high throughput and scalability, making it ideal for large-scale antibody production. Furthermore, advancements in technology and increased investment in research and development by pharmaceutical companies enhance the efficiency and effectiveness of antibody purification processes.

End-use Insights

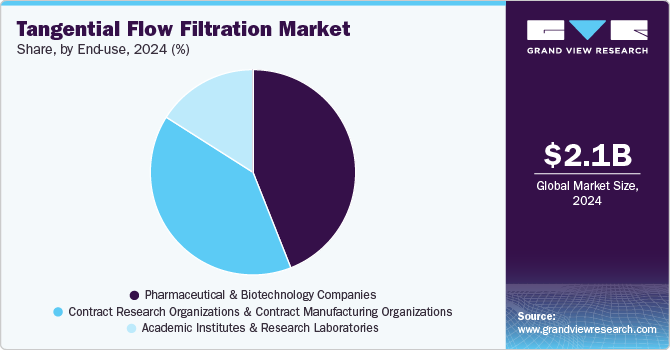

Pharmaceutical and biotechnology companies dominated the market and accounted for the largest revenue share of 44.0% in 2024 attributed primarily to the increasing demand for biopharmaceuticals. As the prevalence of chronic diseases rises, these companies are investing heavily in advanced filtration technologies to ensure the purity and efficacy of their products. In addition, the advantages of tangential flow filtration, such as high throughput and scalability, make it essential for large-scale production processes. Furthermore, ongoing innovations and the need for efficient downstream processing methods further contribute to the robust growth of this segment.

Academic institutes and research laboratories are expected to grow at the fastest CAGR over the forecast period, owing to the need for advanced research capabilities. These institutions increasingly focus on bioprocessing and molecular biology, requiring efficient filtration methods to purify proteins and other biomolecules. In addition, the rising emphasis on innovative therapies and vaccine development, particularly highlighted during the COVID-19 pandemic, has led to increased funding and research initiatives. Moreover, the flexibility and ease of use offered by tangential flow filtration systems support diverse applications in research, driving their adoption in academic settings.

Regional Insights

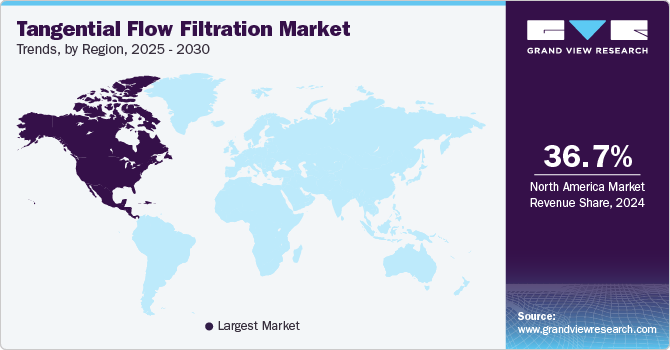

The North America tangential flow filtration market dominated the global market and accounted for the largest revenue share of 36.7% in 2024, driven by a robust healthcare infrastructure and a strong presence of biopharmaceutical companies. In addition, the region's significant investment in research and development fosters innovation in filtration technologies. Furthermore, the increasing prevalence of chronic diseases and genetic disorders necessitates advanced filtration solutions for drug development. Moreover, the rise in personalized medicine and gene therapies further accelerates the adoption of tangential flow filtration systems, positioning North America as a leader in this market.

U.S. Tangential Flow Filtration Market Trends

The U.S. tangential flow filtration market dominated the North American market and accounted for the largest revenue share in 2024, owing to substantial investments in biopharmaceutical research and development. In addition, the country is home to numerous leading pharmaceutical companies prioritizing advanced filtration technologies for efficient bioprocessing. Furthermore, the demand for biologics and biosimilars is rising, driven by an aging population and increased healthcare needs. Moreover, favorable government policies and initiatives supporting biotechnology innovation enhance the market landscape, making the U.S. a pivotal player in the global tangential flow filtration sector.

Asia Pacific Tangential Flow Filtration Market Trends

The Asia Pacific tangential flow filtration market is expected to grow at a CAGR of 14.3% over the forecast period, fueled by increasing investments in healthcare and biotechnology. In addition, supportive government frameworks and the growing incidence of chronic diseases further contribute to market expansion. Furthermore, the emergence of contract manufacturing organizations (CMOs) enhances production abilities, making Asia Pacific a key region for tangential flow filtration technologies.

The tangential flow filtration market in China is expected to grow significantly over the forecast period, owing to its strong bioprocessing industry. The country is experiencing rapid investments in life sciences and biopharmaceuticals, which are essential for meeting domestic and global healthcare demands. The government's focus on improving healthcare infrastructure and encouraging innovation supports adopting advanced filtration technologies. Moreover, China's large consumer base presents significant opportunities for growth, making it an attractive market for tangential flow filtration systems.

Europe Tangential Flow Filtration Market Trends

Europe tangential flow filtration market is expected to experience substantial growth, driven by stringent regulatory standards that require high-quality biopharmaceutical products. The region's well-established pharmaceutical industry invests heavily in advanced filtration technologies to comply with these regulations. Moreover, the increasing focus on biologics and personalized medicine fuels the demand for effective separation procedures. Collaborative research initiatives between academic institutions and industry players also contribute to technological advancements, positioning Europe as a significant contributor to the global tangential flow filtration market.

The growth of the tangential flow filtration market in the UK is expected to be fueled by its strong pharmaceutical sector and emphasis on innovation. The country's commitment to research and development fosters advancements in bioprocessing technologies, including tangential flow filtration systems. In addition, increasing investments from domestic and international companies enhance production capabilities, particularly in biologics manufacturing. Furthermore, the UK's regulatory framework supports high-quality standards in drug development, driving the demand for effective filtration solutions within its biopharmaceutical landscape.

Key Tangential Flow Filtration Company Insights

Some of the key players in the market include Danaher Corporation, Sartorius AG, Parker-Hannifin Corporation, and others. Key companies in the tangential flow filtration systems market adopt various strategies to maintain a competitive edge, including new product launches and strategic collaborations to enhance technological capabilities and market reach. In addition, companies also focus on mergers and acquisitions, allowing firms to consolidate resources and expertise. Furthermore, investments in research and development ensure continuous improvement of filtration technologies, enabling companies to meet evolving industry demands effectively and efficiently.

-

Danaher Corporation manufactures various products, including membrane filters and filtration systems designed for biopharmaceutical applications. Danaher's extensive portfolio supports various segments, such as life sciences, diagnostics, and environmental monitoring. Through strategic acquisitions and partnerships, the company continuously enhances its capabilities, focusing on innovation to meet the growing demands of the biotechnology and pharmaceutical industries.

-

Merck KGaA manufactures diverse products, including membrane filters and filtration systems that facilitate the purification of biologics and other critical compounds. The company operates across multiple segments, including life sciences, healthcare, and performance materials. Its strong geographic presence and commitment to research and development enable the company to address evolving market needs effectively, solidifying its position in the TFF industry.

Key Tangential Flow Filtration Companies:

The following are the leading companies in the tangential flow filtration market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Sartorius AG

- Parker-Hannifin Corporation

- Alfa Laval AG

- Merck KGaA

- Repligen Corporation

- FUJIFILM Wako Pure Chemical Corporation

- ABEC, Inc.

- Sterlitech Corporation

- Synder Filtration, Inc.

- Meissner Filtration Products, Inc.

Recent Development

-

In January 2024, FUJIFILM Wako Pure Chemical Corporation introduced the MassivEV Purification Buffer Set and MassivEV EV Purification Column PS, designed for high-purity extracellular vesicle purification to support exosome research. These products utilize the PS Affinity method, enabling efficient single-step purification with higher purity than conventional methods, which often rely on filtration-based tangential flow filtration. The new offerings cater to the growing demand for mass purification in pharmaceuticals and diagnostics, and they are now available in the U.S. market.

Tangential Flow Filtration Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.26 billion |

|

Revenue forecast in 2030 |

USD 4.13 billion |

|

Growth rate |

CAGR of 12.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; South Korea; Australia; Brazil; Argentina; Kuwait; Saudi Arabia; South Africa; UAE. |

|

Key companies profiled |

Danaher Corporation; Sartorius AG; Parker-Hannifin Corporation; Alfa Laval AG; Merck KGaA; Repligen Corporation; FUJIFILM Wako Pure Chemical Corporation; ABEC, Inc.; Sterlitech Corporation; Synder Filtration, Inc.; Meissner Filtration Products, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tangential Flow Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global tangential flow filtration market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-use Tangential Flow Filtration Systems

-

Reusable Tangential Flow Filtration Systems

-

Membrane Filters

-

Polyethersulfone (PES)

-

Polyvinylidene Difluoride (PVDF)

-

Polytetrafluoroethylene (PTFE)

-

Mixed Cellulose Ester & Cellulose Acetate

-

Polycarbonate Tracked Etched (PCTE)

-

Regenerated Cellulose

-

Others

-

-

Filtration Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrafiltration

-

Microfiltration

-

Nanofiltration

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Purification

-

Vaccine And Viral Vectors

-

Antibody Purification

-

Raw Material Filtration

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic Institutes & Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."