- Home

- »

- Beauty & Personal Care

- »

-

Tampon Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Tampon Market Size, Share & Trends Report]()

Tampon Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Cotton, Blended), By Distribution (Supermarket & Hypermarket, Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-487-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tampon Market Summary

The global tampon market size was estimated at USD 6.1 billion in 2023 and is projected to reach USD 9.41 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030. The market is projected to experience robust growth, driven by several key factors that reflect evolving consumer preferences and increased awareness of menstrual health.

Key Market Trends & Insights

- By region, North America was the largest revenue generating market in 2023.

- The U.S. tampon market dominated North America with the largest revenue share in 2023.

- By material, blended accounted for a revenue of USD 2.7 billion in 2023.

- Blended is the most lucrative material segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6.1 Billion

- 2030 Projected Market Size: USD 9.41 billion

- CAGR (2024-2030): 6.7%

- North America: Largest market in 2023

One of the primary drivers of the tampon market is the increasing awareness and acceptance of menstrual hygiene products. As societal taboos surrounding menstruation diminish, more women are openly discussing their menstrual health and exploring various hygiene options. This cultural shift has led to a greater demand for tampons, often perceived as more convenient and discreet than traditional sanitary pads. Furthermore, educational initiatives promoting menstrual health have contributed significantly to the rising acceptance and use of tampons among diverse demographics.

Convenience plays a crucial role in the growing popularity of tampons. Modern lifestyles, characterized by busy schedules and active participation in various activities, have led many women to prefer tampons over other menstrual products. Tampons are compact and easy to use, making them suitable for women who engage in sports or outdoor activities where visibility and comfort are paramount. This trend is particularly evident in emerging markets such as Asia-Pacific, where increasing disposable incomes and changing cultural norms drive higher adoption rates of tampons.

Sustainability concerns are increasingly influencing consumer choices in the tampon market. As consumers become more environmentally conscious, there is a notable demand for organic and biodegradable tampons. Many manufacturers are responding by developing products that are free from synthetic materials and chemicals, aligning with broader sustainability goals. This shift addresses health concerns and appeals to eco-conscious consumers who prioritize environmentally friendly products in their purchasing decisions.

Technological innovations have also spurred growth within the tampon market. Manufacturers continually enhance product features such as absorbency, comfort, and usability through advanced materials and design improvements. These innovations cater to diverse consumer preferences, including those with specific needs or sensitivities. Additionally, companies are focusing on inclusivity by developing products that meet the requirements of various consumer groups, including those with disabilities or allergies.

The convenience of online shopping also aligns well with the busy lifestyles of modern women. As more women participate in the workforce and engage in various activities, the demand for comfortable and discreet menstrual hygiene solutions has grown. Tampons, known for their portability and ease of use, fit seamlessly into this trend. E-commerce allows for subscription services that ensure regular delivery of products without the need for reordering, catering to consumers' desire for hassle-free solutions. This subscription model enhances customer loyalty and helps brands maintain consistent sales.

Moreover, online platforms allow manufacturers to reach a wider audience beyond geographical constraints. Brands can implement targeted marketing campaigns on digital platforms to effectively reach specific consumer demographics. This capability is crucial in a market where preferences vary significantly across regions. For instance, as awareness about menstrual hygiene increases in developing countries, online retailers can introduce products tailored to local needs without the limitations of traditional retail distribution.

One of the most significant challenges for the market is the increasing availability and popularity of alternative menstrual products such as menstrual cups, pads, and period underwear. These substitutes are gaining traction due to heightened awareness regarding feminine hygiene and the availability of various product innovations. Many consumers are drawn to these alternatives because they are often perceived as more environmentally friendly or cost-effective over time. The rise of these alternatives necessitates that tampon manufacturers innovate continuously to maintain their market share and appeal to health-conscious consumers seeking sustainable options.

Environmental sustainability has become a pressing issue for consumers and industries alike. Conventional tampons are often made with synthetic materials, including plastic, contributing to plastic waste and environmental degradation. The production processes for these tampons can also involve harmful chemicals, raising concerns about their ecological impact. As consumers increasingly prioritize eco-friendly products, there is a growing demand for organic cotton tampons and biodegradable options. However, producing these alternatives can be more complex and costly, challenging manufacturers to balance sustainability with affordability.

Health concerns associated with tampon use, particularly the risk of Toxic Shock Syndrome (TSS), pose another challenge for the market. TSS is a rare but severe condition linked to tampon use, leading to increased scrutiny from regulatory bodies and consumer hesitance. Manufacturers must invest in research and development to ensure their products are safe while complying with stringent market regulations. This need for rigorous testing and adherence to safety guidelines can increase production costs and complicate product launches in various regions.

The stigma surrounding menstruation remains a significant barrier in many cultures, affecting women's willingness to discuss or purchase tampons openly. In some societies, menstruation is still viewed as a taboo subject, which can lead to misinformation and discomfort regarding menstrual hygiene products. This stigma can limit market penetration and hinder awareness campaigns aimed at educating women about the benefits of using tampons. Overcoming these cultural barriers requires comprehensive education initiatives that normalize conversations about menstruation and promote understanding of menstrual health as an essential aspect of overall well-being.

Material Insights

A blend of rayon and cotton was the most extensively used material for tampons and accounted for a market of USD 2.79 billion in 2023. Blended tampons, which typically combine cotton and rayon, offer a unique balance of absorbency and comfort. Rayon, a synthetic fiber known for its high absorbency, works effectively alongside the natural softness of cotton. This combination results in a product that absorbs menstrual fluid efficiently and feels gentle against the skin, appealing to consumers seeking both performance and comfort during their menstrual cycles.

One of the primary drivers for the popularity of blended tampons is their affordability compared to organic or fully cotton alternatives. Blended tampons tend to be less expensive due to the incorporation of rayon, which can reduce production costs. This affordability makes them an attractive option for budget-conscious consumers, particularly in regions with high price sensitivity. As a result, blended tampons are expected to dominate the market, projected to surpass USD 820 million by 2032, reflecting their growing acceptance among women who prioritize quality and cost-effectiveness in menstrual products.

In addition to cost considerations, the increasing awareness of personal hygiene and menstrual health has significantly contributed to the demand for blended tampons. As more women become educated about their menstrual health needs, there is a corresponding rise in the demand for effective and reliable menstrual products. Blended tampons provide a solution that meets these needs by offering enhanced absorbency and reduced leakage risk. This effectiveness particularly appeals to active women who participate in sports or outdoor activities, as blended tampons allow for greater mobility without compromising protection.

Moreover, the sustainability trend influences consumer choices in the tampon market. While blended tampons incorporate synthetic materials, many manufacturers focus on producing eco-friendly versions that utilize responsibly sourced cotton and rayon. This shift addresses environmental concerns associated with traditional tampons while providing benefits for blended materials. As consumers increasingly seek products that align with their values regarding health and sustainability, blended tampons that emphasize eco-friendly practices are likely to gain traction.

Technological advancements in tampon design enhance blended options' appeal. Innovations such as improved absorbent technologies and user-friendly applicators make these products more accessible and comfortable for consumers. As manufacturers continue to invest in research and development, blended tampons are expected to evolve further, incorporating features that cater to diverse consumer needs while maintaining their core benefits of comfort and absorbency. This ongoing innovation will likely solidify the position of blended tampons in the market as a preferred choice among women seeking effective menstrual management solutions.

Cotton tampons are expected to grow at a CAGR of 6.5% from 2024 to 2030. One of the primary drivers is the rising demand for organic cotton tampons, which are perceived as safer and healthier alternatives to traditional tampons made from synthetic materials. Organic cotton is cultivated without harmful pesticides or fertilizers, making these products appealing to health-conscious consumers who prioritize natural ingredients in their personal care items. The emphasis on organic materials aligns with broader trends towards sustainability and environmental responsibility, as more women seek products that minimize their ecological footprint.

The convenience and comfort offered by cotton tampons also play a crucial role in their market appeal. Unlike traditional sanitary pads, tampons provide a discreet option for menstrual management that allows women to engage in various activities, including sports and swimming, without concern for leakage or visibility. The compact design of tampons makes them easy to carry and use, catering to the busy lifestyles of modern women. This practicality appeals to working women and active individuals who prioritize convenience in their personal care routines.

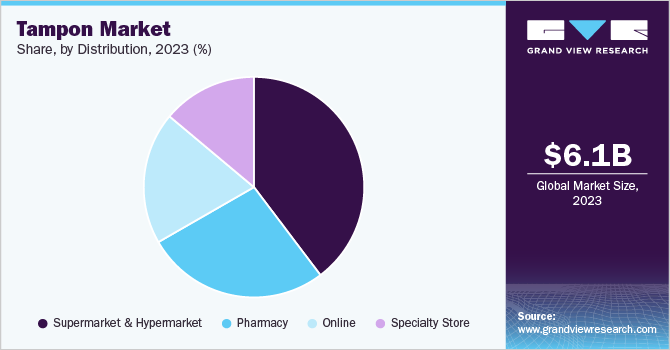

Distribution Insights

Supermarkets and hypermarkets held the largest revenue share of over 40% in 2024 due to their extensive product offerings and competitive pricing, these retail formats are increasingly becoming preferred shopping destinations for women seeking tampons. The availability of various brands, sizes, and types of tampons in one location allows consumers to make informed choices based on their individual needs and preferences. This convenience particularly appeals to middle-income populations, who benefit from the discounts and promotions often available in these larger retail environments.

Furthermore, supermarkets and hypermarkets enhance consumer trust through their established reputations and the ability to offer holistic product information. Shoppers can easily compare different products, read labels, and access promotional materials that educate them about the benefits of specific tampon types, such as organic or blended options. This accessibility encourages trial and fosters brand loyalty as consumers become more familiar with the available products. As a result, the tampon market is projected to see substantial gains from this distribution channel, with an expected market share increase as more women prioritize convenience and variety in their shopping experiences.

The global growth of supermarket and hypermarket chains also contributes to expanding the tampon market. As these retailers continue to open new locations, they bring menstrual hygiene products closer to consumers in both urban and rural areas. This increased accessibility helps to normalize conversations around menstruation and enhances awareness about menstrual health, encouraging more women to purchase tampons regularly. Additionally, government initiatives to improve menstrual hygiene access further bolster this trend by ensuring these products are available in mainstream retail outlets.

Moreover, the strategic placement of tampons within supermarkets and hypermarkets-often located near other personal care items-can influence purchasing behavior by encouraging impulse buys. Promotional displays, discounts, and bundled offers can attract attention and incentivize consumers to try new brands or types of tampons they may not have considered otherwise. This marketing approach drives sales and helps introduce innovative products to a broader audience.

The online distribution channel is expected to grow at a CAGR of 8.4% from 2024 to 2030. The rise of e-commerce platforms has made it easier for consumers to access various tampon brands and types, often at competitive prices. This convenience is particularly appealing for personal care products like tampons, which some consumers prefer to purchase discreetly. Online shopping allows customers to browse extensive selections without the discomfort that may accompany in-store purchases, especially in cultures where menstruation is still stigmatized.

The growth of online distribution channels is also fueled by the rapid increase in internet penetration and smartphone usage globally. As consumers become comfortable with online shopping, they are more likely to explore and purchase menstrual hygiene products through digital platforms. Many online retailers offer subscription services that provide regular deliveries of tampons, ensuring that consumers never run out of essential products while promoting brand loyalty. This model enhances convenience and allows for personalized shopping experiences tailored to individual preferences and needs.

In addition, online channels enable brands to implement targeted marketing strategies that reach specific demographics more effectively than traditional retail methods. Through social media advertising, email marketing, and influencer partnerships, companies can engage with potential customers directly, raising awareness about their products and driving sales. This targeted approach is particularly effective in promoting new product launches or eco-friendly options, such as organic cotton tampons, which are gaining popularity among health-conscious consumers.

The COVID-19 pandemic further accelerated the shift towards online shopping as many consumers turned to e-commerce due to lockdowns and social distancing measures. This trend has led to a significant increase in online sales of tampons and other feminine hygiene products as physical stores face disruptions. The convenience of home delivery and the ability to compare prices and product reviews have made online shopping a preferred option for many women, solidifying its role in the tampon market's growth trajectory.

Regional Insights

The North America tampon market dominated the global market with revenue of USD 1.98 billion in 2023. Regional sales are expected to grow at a CAGR of 5.8% from 2024 to 2030. The growth of the tampon market in North America, particularly in the U.S., can be attributed to several key factors that reflect changing consumer preferences and increased awareness of menstrual health. One of the primary drivers is the rising awareness and education surrounding menstrual hygiene. As societal taboos diminish, more women are engaging in conversations about their menstrual health, leading to a greater acceptance and usage of tampons. Reports indicate that approximately 70% of women in the U.S. use tampons, highlighting their popularity as a preferred menstrual product among females aged 12 to 50 years.

U.S. Tampon Market Trends

The U.S. tampon market is expected to reach USD 2.2 billion by 2030. A significant factor contributing to the growth of the U.S. tampon market is the increasing demand for organic and eco-friendly products. Consumers are becoming more health-conscious and environmentally aware, driving interest in tampons made from organic cotton and free from harmful chemicals. This trend aligns with broader movements towards sustainability and personal health, prompting manufacturers to innovate and offer products that meet these evolving consumer expectations. The U.S. market is witnessing a notable rise in organic tampon sales, with projections indicating substantial growth in this segment over the coming years.

Tampon accessibility through various distribution channels also plays a crucial role in market expansion. Supermarkets, hypermarkets, and online platforms provide convenient access to a wide range of tampon brands and types, making it easier for consumers to purchase these products. The COVID-19 pandemic accelerated the shift towards online shopping, with many consumers opting for discreet home delivery options. This change has allowed brands to reach a broader audience while catering to the preferences of women who value convenience and privacy when purchasing menstrual products.

In addition, established industry players such as Johnson & Johnson and Kimberly-Clark significantly support market growth through their extensive marketing efforts and product innovations. These companies invest heavily in advertising campaigns that promote awareness about the benefits of using tampons over traditional sanitary pads, further driving consumer adoption. Their commitment to research and development ensures that new and improved products are continuously introduced, enhancing consumer trust and loyalty.

Lastly, government initiatives aimed at improving menstrual hygiene awareness contribute to North America's tampon market growth. Campaigns that educate women about menstrual health and promote access to hygienic products are essential for increasing tampon usage rates. These initiatives help normalize discussions around menstruation and encourage women to choose tampons as a reliable option for menstrual management. Overall, these factors collectively drive the robust growth of the tampon market in North America, positioning it as a leader in global sales within this sector.

Asia Pacific Tampon Market Trends

The Asia Pacific tampon market is expected to be the fastest growing and will grow at a CAGR of 7.7% from 2024 to 2030. This rapid expansion is largely attributed to the increasing acceptance of modern menstrual products, including tampons, as societal taboos surrounding menstruation continue to diminish.

One of the primary drivers for the growth of the tampon market in Asia is the heightened awareness and education regarding menstrual health. Various non-governmental organizations (NGOs) and government initiatives are actively promoting menstrual hygiene awareness, which has led to a greater understanding of the benefits of using tampons over traditional sanitary pads. In countries like India, where cultural stigmas have historically hindered discussions about menstruation, these educational efforts are crucial in encouraging women to adopt tampons as a viable option for menstrual management.

In addition, the rising disposable income among women in Asia is contributing to the increased demand for tampons. As more women enter the workforce and gain financial independence, they are more likely to invest in personal care products that offer convenience and comfort. The busy lifestyles of modern women necessitate effective solutions for menstrual management, making tampons an attractive option due to their portability and ease of use. This trend is particularly evident in urban areas where women are increasingly seeking products that align with their active lifestyles.

The tampon market in China is growing significantly due to rapid urbanization and the shift towards Western consumer habits. As urban populations grow and lifestyles evolve, there is a noticeable shift in preferences towards modern hygiene products. The availability of tampons in supermarkets, pharmacies, and online platforms has made them more accessible to consumers, further driving adoption rates. The rise of e-commerce has been particularly impactful, allowing brands to reach a wider audience while providing discreet purchasing options that appeal to many women.

Key Tampon Company Insights

The market landscape is characterized by a mix of established multinational corporations and emerging brands, each vying for market share in a competitive environment. Key players include industry giants such as Procter & Gamble (with brands like Tampax and Always), Kimberly-Clark (U by Kotex), and Johnson & Johnson. These companies dominate the market due to their extensive distribution networks, strong brand recognition, and significant marketing and product innovation investment. For instance, Procter & Gamble has been at the forefront of introducing new features, such as organic materials and enhanced absorbency technologies, catering to the growing demand for sustainable and effective menstrual products.

In addition to these major players, the market is witnessing the rise of niche brands focusing on organic and eco-friendly products. Companies like Cora and The Honest Company are gaining traction among younger consumers who prioritize health-conscious and environmentally sustainable options. This trend reflects a broader shift in consumer preferences towards products perceived as safer and less harmful to the environment. As a result, many established brands are expanding their product lines to include organic tampons, thereby increasing competition in this segment.

Key Tampon Companies:

The following are the leading companies in the tampon market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Kimberly-Clark

- Johnson & Johnson

- Unicharm

- Edgewell Personal Care Company

- Playtex

- Natracare

- Lil-lets

- Corman S.p.A.

- First Quality Enterprises Inc.

- Svenska Cellulosa Aktiebolaget (SCA)

- MOXIE

- Rossmann

- Bodywise Ltd.

- Cora

Tampon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.39 billion

Revenue forecast in 2030

USD 9.41 billion

Growth rate

CAGR 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Turkey; Iran

Key companies profiled

Procter & Gamble; Kimberly-Clark; Johnson & Johnson; Unicharm; Edgewell Personal Care Company; Playtex; Natracare; Lil-lets; Corman S.p.A.; First Quality Enterprises Inc.; Svenska Cellulosa Aktiebolaget (SCA); MOXIE; Rossmann; Bodywise Ltd.; Cora

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

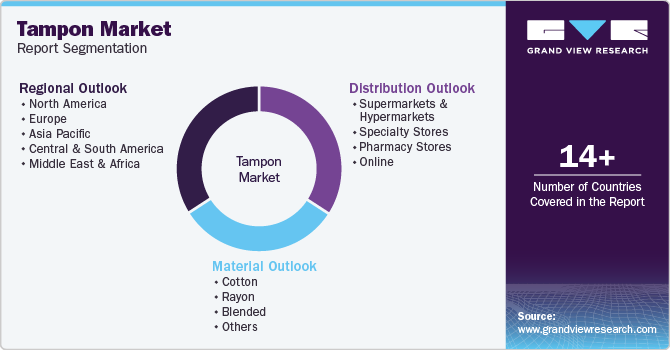

Global Tampon Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tampon market report based on the material, distribution, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Rayon

-

Blended

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacy Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Russia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tampon market size was estimated at USD 6.1 billion in 2023 and is expected to reach USD 6.39 billion in 2024.

b. The global tampo market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030, reaching USD 9.41 billion by 2030.

b. Cotton tampons dominated the global tampon market with a share of 45% in 2023. One of the primary drivers is the rising demand for organic cotton tampons, which are perceived as safer and healthier alternatives to traditional tampons made from synthetic materials.

b. Some key players operating in the tampon market include Procter & Gamble; Kimberly-Clark; Johnson & Johnson; UnicharmEdgewell Personal Care Company; Playtex; Natracare; Lil-lets; Corman S.p.A.; First Quality Enterprises Inc.; Svenska Cellulosa Aktiebolaget (SCA); MOXIE; Rossmann; Bodywise Ltd.; Cora.

b. The tampon market is projected to experience robust growth, driven by several key factors that reflect evolving consumer preferences and increased awareness of menstrual health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.