- Home

- »

- Plastics, Polymers & Resins

- »

-

Tackifier Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Tackifier Market Size, Share & Trends Report]()

Tackifier Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Synthetic, Natural), By Form (Solid, Liquid, Resin Dispersion), By Application (Packaging, Bookbinding, Non-woven), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-392-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tackifier Market Size & Trends

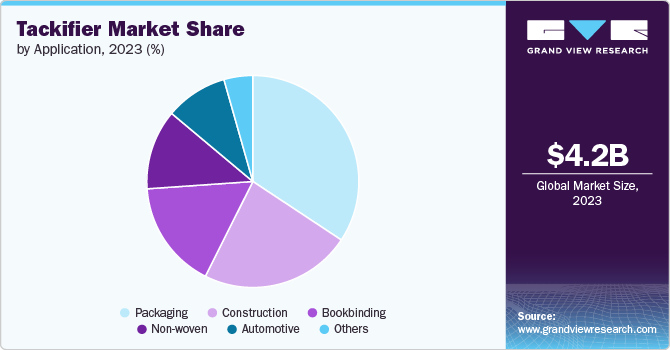

The global tackifier market size was valued at USD 4.15 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing demand for adhesives and sealants in industries such as packaging, construction, and pharmaceuticals is favorably boosting the global market. Tackifiers are chemical composites used in the production of adhesives, and they are the most significant component of hot-melt adhesives that require sensitive adhesives. They find applications in various sectors, including assembling adhesives, bookbinding adhesives, tapes and labels, leather, construction adhesives, footwear, and rubber goods.

The packaging, construction, and pharmaceutical industries are witnessing a surge in demand for tackifiers as adhesives and sealants. In the packaging industry, tackifier adhesives are widely used in door sealants, seat upholstery attachments, and packaging tray seals. The construction industry also relies on tackifiers for various applications, such as bonding materials and sealing joints. Additionally, the pharmaceutical industry utilizes tackifiers in the production of drug delivery systems and medical devices. The growth of these industries is driving the demand for tackifiers, contributing to the overall growth of the market.

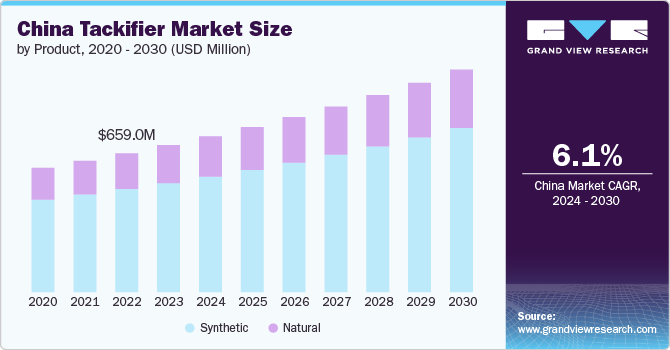

China plays a significant role in the global tackifier industry, both as a consumer and a producer. The demand for tackifiers in China is driven by various factors, including the growth of industries such as packaging, construction, automotive, and electronics. In the packaging industry, China's booming e-commerce sector has led to increased demand for packaging materials and adhesives, thereby driving the demand for tackifiers. Additionally, the construction industry in China is experiencing rapid growth, leading to increased demand for adhesives and sealants for various applications. The automotive and electronics industries also contribute to the demand for tackifiers, as they require adhesive solutions for bonding and assembly processes.

The packaging industry, in particular, is witnessing a surge in demand for tackifiers due to the rise of e-commerce and the need for efficient and secure packaging solutions. The construction industry is also driving the demand for tackifiers, as adhesives and sealants are essential for various applications, including bonding and sealing. Moreover, the automotive industry's focus on lightweight and fuel-efficient vehicles has led to the development of advanced adhesive solutions that require tackifiers. Additionally, the healthcare industry's need for reliable and safe products has increased the demand for tackifiers in the production of medical devices and drug delivery systems.

Drivers, Opportunities & Restraints

The growing demand for adhesives and sealants across various industries such as packaging, construction, automotive, and healthcare is a major driver for the tackifier industry. The increasing use of lightweight materials in automotive manufacturing requires specialized adhesives and tackifiers for effective bonding, creating opportunities for the tackifier industry. Additionally, the rise in consumer awareness about healthy diets and natural ingredients has led to an increased demand for food stabilizers, including tackifiers, presenting growth opportunities for the industry.

In terms of opportunities, the innovation in technology and emerging applications using customized stabilizer blends and systems present significant growth opportunities for the tackifier industry. The market also has opportunities for expansion in emerging markets, particularly in the Asia-Pacific region, where industries like packaging, construction, and automotive are experiencing rapid growth.

However, there are also restraints that can impact the tackifier market. Adherence to international quality standards and regulations for food additives, including stabilizers and tackifiers, can act as a restraint for market growth. Additionally, the fluctuation of raw material prices can pose a challenge for the tackifier market, as it can impact production costs and profitability.

Product Insights

Synthetic products dominated the market and accounted for a revenue share of 72.9% in 2023. The dominance of synthetic products in the market is supported by various industries and sectors. For instance, in the food preservatives industry, synthetic additives are commonly used alongside the growing traction of clean-label alternatives. Similarly, in the fragrance market, synthetic fragrances have a dominant market share due to their low cost and longer lifespan compared to natural fragrances.

The use of natural ingredients, such as salt, sugar, and natural aromatics, is prevalent in the food preservatives and fragrance industries. Additionally, customer preferences for more authentic and natural appearances and textures drive the demand for human hair extensions over synthetic options.

Form Insights

Solid segment dominated the market and accounted for a revenue share of 54.4% in 2023. The solid form segment has dominated the tackifier market. Solid tackifiers are widely used in various industries, including adhesives, sealants, packaging, construction, automotive, and healthcare. The demand for solid tackifiers is driven by their ease of handling, stability, and versatility in different applications. Solid tackifiers provide excellent adhesion, cohesion, and tackiness, making them suitable for a wide range of formulations and end products.

Resin dispersion form is another important segment in the tackifier market. Resin dispersions are water-based or solvent-based systems that contain tackifying resins dispersed in a liquid medium. These dispersions offer advantages such as ease of handling, improved compatibility with other ingredients, and enhanced stability. Resin dispersions are commonly used in applications where water or solvent-based formulations are preferred, such as in paints, coatings, and adhesives.

Liquid form tackifiers also play a significant role in the market. Liquid tackifiers are typically low-viscosity materials that can be easily mixed with other ingredients. They offer advantages such as easy application, good wetting properties, and compatibility with various substrates. Liquid tackifiers are commonly used in applications where a liquid or sprayable adhesive is required, such as in packaging, labeling, and assembly processes.

The dominance of solid form tackifiers in the market is attributed to their versatility, stability, and ease of handling. However, resin dispersions and liquid tackifiers also have their respective advantages and find applications in specific industries and formulations. The choice of tackifier form depends on the specific requirements of the application and the desired performance characteristics.

Application Insights

“Construction emerged as the fastest growing mode of application with a CAGR of 5.3%”

Packaging dominated the market and accounted for a revenue share of 34.3% in 2023. The demand for tackifiers in the construction industry is closely linked to the overall growth of the construction sector. As urbanization and infrastructure development continue to expand globally, the demand for construction materials and adhesives, including tackifiers, is expected to rise. The construction industry's demand for tackifiers is projected to grow steadily in the coming years. Non-woven materials are commonly used in filtration and separation applications, such as air and liquid filtration, geotextiles, and industrial filtration. Tackifiers are utilized in the production of non-woven materials for these applications to enhance their filtration efficiency, particle retention, and resistance to clogging.

Tackifiers are used in the formulation of adhesives for bookbinding. They improve the adhesive properties of bookbinding adhesives, ensuring strong and durable bonds between book components such as pages, covers, and spines. Tackifiers enhance the tackiness and bonding strength of adhesives, providing reliable adhesion in bookbinding applications.

Tackifiers are used in the production of non-woven materials to enhance their performance characteristics. Tackifiers improve the bonding strength and cohesion of non-woven fibers, ensuring the integrity and durability of the final product. They contribute to the overall strength, tear resistance, and dimensional stability of non-woven materials.

Regional Insights

The demand for tackifiers in North America is driven by a high concentration of end-user industries in the U.S. and Canada. Furthermore, the readily available raw materials are expected to significantly contribute to the market's growth. Additionally, positive construction forecasts are poised to propel the expansion of the tackifier market across the region.

Furthermore, there has been a significant surge in residential construction, resulting in the creation of numerous housing units. This surge is expected to drive the demand for tackifiers, thereby fueling the growth of the tackifier market in the U.S.

Asia Pacific Tackifier Market Trends

“China is expected to dominate the Asia Pacific market with a market share of 43.0% in 2030”

Asia Pacific dominated the market and accounted for a 39.01% share in 2023. China's robust economic growth and its position as the "factory of the world" have contributed to its dominance in various industries, including manufacturing and exports. The country's manufacturing capabilities and infrastructure have allowed it to become a major player in the production and supply of tackifiers.

The increasing demand for hot-melt adhesives in industries such as packaging, construction, and pharmaceuticals is creating opportunities for the tackifier market in the Asia Pacific region. Tackifiers are essential components in the formulation of hot-melt adhesives, which are widely used in various applications.

Europe Tackifier Market Trends

The trend toward sustainable products is also observed in the Europe tackifier market. There is an increasing demand for bio-based tackifiers driven by environmental concerns and regulations. Manufacturers are exploring eco-friendly alternatives to traditional tackifiers.

Key Tackifier Company Insights

Some of the key players operating in the global tackifier market include:

-

Henkel AG & Co. KGaA is a German multinational chemical and consumer goods company headquartered in Düsseldorf, Germany. With a history spanning over 145 years, Henkel is known for its innovative and sustainable brands and technologies. The company operates in two globally operating business units: Consumer Brands and Adhesive Technologies. In the Consumer Brands unit, Henkel offers a wide range of products, including hair care products, laundry detergents, fabric softeners, and cosmetics and toiletries. Some of the well-known brands under this unit include Persil, Schwarzkopf, Dial, Purex, got2b, and Palette.

-

Eastman Chemical Company is a global specialty materials company headquartered in Kingsport, Tennessee, United States. The company was established in 1920 as a subsidiary of Eastman Kodak to produce chemicals. Over the years, Eastman Chemical Company has grown into a leading global player in the specialty chemicals industry. The company operates in various segments, including Additives & Functional Products, Advanced Materials, Chemical Intermediates, and Fibers. Eastman offers a wide range of products, including specialty chemicals, adhesives, coatings, plastics, fibers, and performance materials. These products find applications in industries such as automotive, construction, packaging, electronics, healthcare, and textiles.

Key Tackifier Companies:

The following are the leading companies in the tackifier market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. Kga

- ZEON CORPORATION

- Eastman Chemical Company

- Arkema

- Kolon Industries, Inc.

- H.B. Fuller Company

- Exxon Mobil Corporation

- BASF SE

- SI Group, Inc.

- KRATON CORPORATION

Recent Developments

-

In 2024, TotalEnergies' subsidiary, Cray Valley, has concluded the divestment of three product lines, namely Wingtack, PolyBD, and Dymalink, to Pacific Avenue Capital Partners. The transaction includes the transfer of ownership of four production facilities located in the U.S., the Cray Valley Italy affiliate, and the corresponding customer portfolio.

-

In September 2022, Eastman Chemical Company completed the sale of its adhesive’s resins business.

Tackifier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.35 billion

Revenue forecast in 2030

USD 5.80 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Henkel AG & Co. Kga; ZEON CORPORATION; Eastman Chemical Company; Arkema, Kolon Industries, Inc.; H.B. Fuller Company; Exxon Mobil Corporation; BASF SE; SI Group, Inc.; KRATON CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tackifier Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tackifier market report based on product, form, application and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Solid

-

Liquid

-

Resin Dispersion

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Packaging

-

Bookbinding

-

Non-woven

-

Construction

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tackifier market size was valued at USD 4.15 billion in 2023 and is expected to reach USD 4.35 billion in 2024

b. The global tackifier market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 5.80 billion by 2030

b. Asia Pacific dominated the market and accounted for a 39.01% share in 2023. China's robust economic growth and its position as the "factory of the world" have contributed to its dominance in various industries, including manufacturing and exports.

b. Some key players operating in the tackifier market include Henkel AG & Co. Kga, ZEON CORPORATION, Eastman Chemical Company, Arkema, Kolon Industries, Inc., H.B. Fuller Company, Exxon Mobil Corporation, BASF SE, SI Group, Inc., KRATON CORPORATION

b. The increasing demand for adhesives and sealants in industries such as packaging, construction, and pharmaceuticals is favorably boosting the global tackifier market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.