- Home

- »

- Biotechnology

- »

-

T-cell Therapy Market Size & Share Analysis Report, 2030GVR Report cover

![T-cell Therapy Market Size, Share & Trends Report]()

T-cell Therapy Market (2023 - 2030) Size, Share & Trends Analysis Report By Modality, By Therapy (CAR T-cell, Tumor-Infiltrating Lymphocytes), By Indication (Hematologic Malignancies (Lymphoma)), And Segment Forecasts

- Report ID: GVR-3-68038-685-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

T-cell Therapy Market Summary

The global T-cell therapy market size was estimated at USD 2.83 billion in 2022 and is projected to reach USD 32.75 billion by 2030, growing at a CAGR of 35.33% from 2023 to 2030. With the approval of Tecartus, Yescarta, and Kymriah, various entities have shifted their business model from the development of small molecule and protein-based treatments to adoptive therapies.

Key Market Trends & Insights

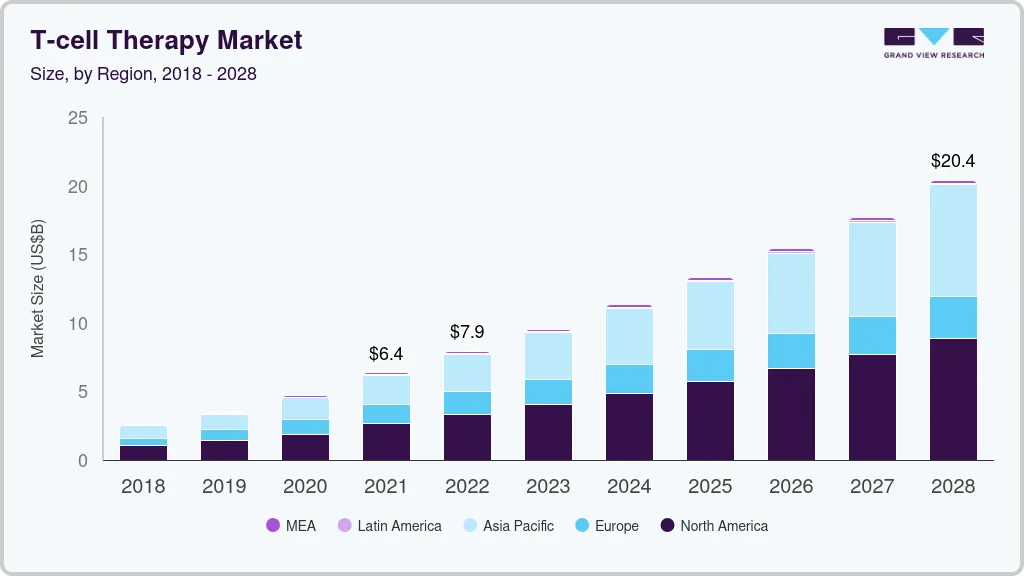

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, China holds the most registered clinical trials for CAR-T therapies, making it an attractive market for these therapies.

- In terms of modality, the research-based segment dominated the market owing to the high number of T-cell therapy products in the clinical development phase.

- Commercialized is the most lucrative modality segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 2.83 Billion

- 2030 Projected Market Size: USD 32.75 Billion

- CAGR (2023-2030): 35.33%

- North America: Largest market in 2022

This factor has increased strategic investments by private as well as public agencies in the arena, resulting in a boost to the market. The rising product approval, along with increasing manufacturing capacities, is expected to increase the market competition in T-cell therapy entities in the forecast years. For instance, in February 2022, the U.S. FDA approved Yescarta as the first chimeric antigen receptor (CAR) T-cell therapy for the initial management of relapsed or refractory large B-cell lymphoma (LBCL). Yescarta is the first CAR T-cell therapy to obtain a Category 1 recommendation in the NCCN Treatment Guideline. Similarly, in February 2022, the FDA authorized ciltacabtagene autoleucel (Carvykti) for people with multiple myeloma that is refractory, or not responding to treatment, or that has returned after treatment (relapsed).

Additionally, the worldwide COVID-19 pandemic has stimulated investment in studies that aim to understand how T-cell therapies could be used to treat viral infections. For instance, in November 2022, Tevogen Bio stated that it plans to investigate the potential therapeutic applications of TVGN-489, an experimental COVID-19 T cell treatment, in Long COVID. The cytotoxic CD8+ T lymphocytes (CTLs) TVGN-489 are highly purified and intended to identify and eliminate SARS-CoV-2 infected cells.

Furthermore, due to its higher success rate, T-cell-based techniques are currently frequently used in the field of cancer immunotherapy. Since March 2021, more than 500 clinical trials investigating CAR-T cells for cancer treatment are being carried out globally. Thereof, most are being carried out in East Asia, next the U.S., and finally Europe. This data shows the increasing importance of CAR therapies in cancer treatment. Moreover, most of the key players are investing in CD19 CART-T therapies to increase their market position in the coming years.

On the other hand, a key factor in the success of CAR-T therapies is the growing gene therapy arena. The gene therapy market is likely to continue to grow as a result of rising investment. For instance, in January 2022, Ori Biotech raised more than USD 100 million in a Series B funding to introduce a novel C&G therapy developing platform. This funding allowed for a rapid transition from precommercialization to market-launch gene therapies for several chronic indications.

Modality Insights

The research-based market for T-cell therapies dominated the modality segment owing to the high number of T-cell therapy products in the clinical development phase. Several research institutions, including Mayo Clinic, are actively involved in operating CAR-T therapy programs, promoting the strategy as a better way to control cancer.

The shift in focus on advancing the development of CAR-T therapies to broaden the scope of therapeutic application is the result of several operating companies working with research groups around the world. For instance, in November 2022, the Peter MacCallum Cancer Centre (Peter Mac) entered into a joint development programme agreement (CDPA) with Cartherics Pty Ltd (Cartherics) to develop Cartherics' patented autologous CAR-T cell therapy (CTH-001) for the treatment of cutaneous T-cell lymphoma. Setting up CTH-001's clinical-scale manufacturing and carrying out a phase-I clinical trial are the core elements of the collaborative research.

On the other hand, commercialized products segment is expected to show a significant market share owing to increasing product approval from the regulatory bodies to propel the commercial use of T-cell therapies in hospital and clinical settings. For instance, in August 2022, the FDA approved Bristol Myers Squibb's Breyanzi CAR T Cell Therapy for relapsed or refractory large B-cell lymphoma.

Therapy Type Insights

The CAR-T therapies held the highest share of 95.66% in 2022, owing to the exponential growth in the number of CAR-T therapy clinical studies and the rising engagement of major players in this market. Clinical studies for CAR-T therapy products are being conducted by a significant number of new players and academic institutions for both the same and different indications, strengthening the segment's dominance.

The use of CAR-T therapies in the treatment of different cancers has increased as a result of improvements in their manufacturing. Emergence of new strategies like second- and next-generation CAR-T immunotherapy can overcome challenges like resistance and adverse effects, increasing the generation of organic revenue.

On the other hand, T-cell receptor-based therapies is expected to show significant growth at a CAGR of over 30% by 2030 owing to their potential for the treatment of solid malignancies. For the treatment of melanoma, this area is receiving a lot of attention. In partnership with GlaxoSmithKline, Adaptimmune is one of the company that specializes in TCR therapy for melanoma.

Indication Insights

Hematological malignancies hold a major revenue share of over 50% in 2022. Since receiving initial FDA approval in 2017, CAR-T cell therapy has demonstrated promising efficacy against a number of hematological malignancies and even offer patients with severe diseases, such as B cell acute lymphoblastic leukemia or lymphoma, a curative treatment option. B cell maturation antigen for multiple myeloma and CD19 for a variety of lymphoid malignancies, including B-ALL and diffuse large B-cell lymphoma, are the two main targets for CAR-T cell treatment that are currently licensed (DLBCL). However, with several key players entering the market and high fixed costs of producing autologous cells, the segment is anticipated to experience intense market competition in the coming years.

Solid tumors is expected to exhibit a significant market growth at a CAGR of over 25% during the forecast period. A new chimeric antigen receptor (CAR) T-cell product demonstrated promising early results in solid tumor patients both as a monotherapy and in conjunction with an mRNA vaccination. It also had an acceptable safety profile. However, due to difficulties with growth, persistence, and trafficking as well as interactions with the aggressive tumor microenvironment, the therapy has limited applications for patients with solid tumors (TME).

Regional Insights

North America held around 63.88% revenue share of the T-Cell therapy market in 2022. The U.S.'s dominance in the global market has largely been attributed to the region's strong research, commercial base, and large number of clinical studies being done for T-cell therapies nationwide.

Additionally, the growing number of regulatory approvals in the United States and Canada as well as the changing reimbursement landscape in the region have accelerated the uptake of these therapies, creating significant market growth.

Asia Pacific region is expected to witness a rapid CAGR of over 30% during the forecast period. China holds the most registered clinical trials for CAR-T therapies, making it an attractive market for these therapies in recent years. The nation has had substantial growth as a consequence of concentrated efforts on government investment and reforms, and as a result, it has the fastest CAGR in the Asia-Pacific.

Key Companies & Market Share Insights

The rising number of entities involved in CAR-T therapies development is expected to increase the competitive rivalry in the market. As of now Novartis AG and Kite Pharma have dominated the T-cell therapy market with innovation and novel product launches. Furthermore, other key companies are undertaking several strategic initiatives to strengthen their market presence. For instance, in December 2021, Lonza collaborated with Agilent Technologies, Inc. to integrate the latter’s analytical technologies with Cocoon Platform. The integration of Agilent’s analytical specialties into Cocoon Platform’s manufacturing workflow was expected to transform the manufacturing and delivery of cell therapies. The collaboration is aimed to enhance cell therapy manufacturing workflows and is expected to support the company’s growth. Some of the prominent players in the global T-cell therapy market include:

-

Novartis AG

-

Merck KGaA

-

Gilead Sciences Inc.

-

TCR2 Therapeutics Inc

-

Bluebird Bio Inc.

-

Sorrento Therapeutics

-

Fate Therapeutics

-

Pfizer Inc.

-

Amgen

-

Celgene Corporation

T-cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.94 billion

Revenue forecast in 2030

USD 32.75 billion

Growth rate

CAGR of 35.33% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, indication, and region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; UK; Germany; Japan; China

Key companies profiled

Novartis AG; Merck KGaA; Gilead Sciences Inc.; TCR2 Therapeutics Inc.; Bluebird Bio Inc.; Sorrento Therapeutics; Fate Therapeutics; Pfizer Inc.; Amgen; Celgene Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global T-cell Therapy Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global T-cell therapy market report on the basis of therapy type, indication, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CAR T-cell Therapy

-

T Cell Receptor (TCR)-based

-

Tumor Infiltrating Lymphocytes (TIL)-based

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Hematologic Malignancies

-

Lymphoma

-

Leukemia

-

Myeloma

-

-

Solid Tumors

-

Melanoma

-

Brain & Central Nervous System

-

Liver Cancer

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global T-cell therapy market size was estimated at USD 2.83 billion in 2022 and is expected to reach USD 3.94 billion in 2023.

b. The global T-cell therapy market is expected to grow at a compound annual growth rate of 35.33% from 2023 to 2030 to reach USD 32.75 billion by 2030.

b. CAR T-cell therapy dominated the T-cell therapy market with a share of 95.66% in 2022. This is attributable to the recent approval of Kymriah & Yescarta that has accelerated R&D investments in this segment.

b. Some key companies operating in the T-cell therapy market are Novartis AG; Gilead Sciences; bluebird bio, Inc.; Celgene Corporation, bluebird bio; TCR2 Therapeutics Inc.; Sorrento Therapeutics; and Fate Therapeutics.

b. Key factors that are driving the T-cell therapy market growth include improving the financing landscape for advanced therapies including cell & gene therapies coupled with technological advancements in the manufacturing process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.