- Home

- »

- Pharmaceuticals

- »

-

T-cell Lymphoma Market Size, Share & Growth Report, 2030GVR Report cover

![T-cell Lymphoma Market Size, Share & Trends Report]()

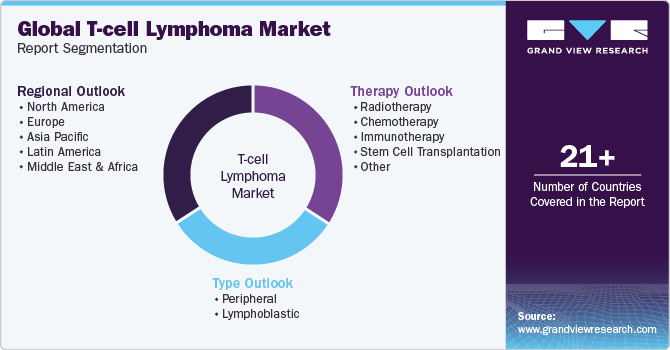

T-cell Lymphoma Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Peripheral, Lymphoblastic), By Therapy (Radiotherapy, Immunotherapy, Stem Cell Transplantation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-318-4

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

T-cell Lymphoma Market Size & Trends

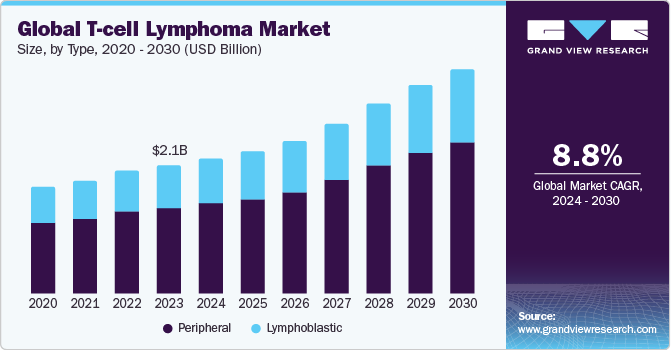

The global T-cell Lymphoma market size was estimated at USD 2.12 billion in 2023 and is expected to grow at a CAGR of 8.83% from 2024 to 2030. The T-cell Lymphoma (TCL) market is experiencing a period of substantial growth, driven by advancements in treatment options, and strategic initiatives by pharmaceutical companies. One of the primary factors for this growth is the introduction of new key pipeline agents and the expansion of existing therapies to new indications. These developments provide more options for patients and reduce the reliance on traditional chemotherapy regimens, which have been the mainstay of TCL treatment.

In 2023, there were approximately 12,600 new cases of Peripheral T-cell Lymphoma (PTCL) in the U.S. This number is expected to increase by 2030, reflecting a rising incidence of the disease. Additionally, the total incident cases of selected indications for CAR-T therapies in Non-Hodgkin Lymphoma (NHL) in the 7MM (the United States, France, Germany, Italy, Spain, UK, and Japan) comprised approximately 155,300 in 2023. The emerging pipeline of CAR-T therapies includes drugs at various stages of development-late-stage, mid-stage, and early-stage-targeting different lines of therapies and indications, mainly B-cell Lymphoma such as DLBCL, FL, MCL, MZL, and CLL/SLL, with one being developed for PTCL.

Currently, newly diagnosed PTCL patients are typically treated with anthracycline-based chemotherapy regimens. The standard initial treatment involves combination chemotherapy regimens such as CHOP (cyclophosphamide, doxorubicin, vincristine, and prednisone) or CHOEP (cyclophosphamide, doxorubicin, vincristine, etoposide, and prednisone). However, new treatment paradigms are emerging. For instance, CHP-BV (cyclophosphamide, doxorubicin, prednisone, and brentuximab vedotin) is a new regimen for ALCL, representing a shift towards more targeted therapies.

The introduction of new therapies such as HIYASTA for ATLL and PTCL, DARVIAS, and REMITORO for relapsed or refractory (R/R) ATLL and R/R PTCL in Japan provides additional treatment options and drives space growth. These new drugs offer hope for improved outcomes for patients who have limited treatment options. The field of CAR-T and NK (natural killer) cell treatments is also making inroads into TCL. Although these therapies are still in the preclinical phase, larger clinical studies are recruiting or underway. These innovative treatments hold promise for more effective and personalized approaches to TCL.

In addition to CAR-T and NK cell therapies, new biologics are being developed to target specific proteins and signals involved in TCL. These include drugs targeting programmed cell death protein 1/programmed cell death ligand 1 (PD-1/PD-L1), NK-cell engagers targeting CD30/16a, the inhibition of 'Do Not Eat Me' signals by the anti-CD47 monoclonal antibody, and antibodies like mogamulizumab targeting CCR4. These advancements offer new opportunities to create highly disease-specific treatment platforms, potentially leading to better patient outcomes.

Several industry-changing events are anticipated between 2020 and 2030, particularly in Japan and the U.S. These events are expected to boost the total space size of TCL by 2030. Pharmaceutical companies are employing strategies such as introducing same-in-class drugs into new spaces where the mechanism of action (MOA) was previously unavailable, testing novel or existing MOAs in a TCL subtype-specific fashion, and focusing on new or under-researched targets.

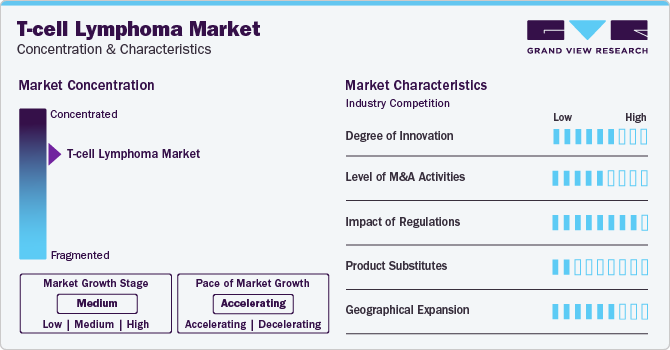

Market Concentration & Characteristics

The market is characterized by a high degree of innovation. This is evident from the introduction of 14 new pipeline agents and the expansion of labels for existing therapies. These developments represent significant advancements over traditional chemotherapy regimens, offering more targeted and effective treatment options for patients. The ongoing research into CAR-T and NK cell therapies, as well as new biologics targeting specific proteins and signals, further underscores the innovative nature of the TCL industry.

Merger and acquisition (M&A) activity in the TCL space is moderately high. Pharmaceutical companies are actively seeking to strengthen their portfolios and expand their presence through strategic acquisitions. These activities help companies acquire new technologies, therapies, and expertise, allowing them to offer a broader range of treatment options and stay competitive. Recent M&A activity has focused on acquiring companies with promising pipeline agents and innovative treatment platforms.

Regulations have a significant impact. Stringent regulatory requirements ensure that new therapies are safe and effective, but they also pose challenges for companies seeking to bring new treatments to space. The approval process can be lengthy and costly, affecting the pace at which new therapies become available. However, regulatory support for innovative treatments, such as fast-track designations and priority reviews, can help expedite the development and approval of promising new therapies.

TCL market does not have any potential substitutes. However, generic chemotherapy regimens and biosimilars options impede space growth, these are generally less expensive, they often come with lower efficacy and more side effects compared to the newer, targeted therapies. The availability of substitutes can impact the space dynamics by providing alternative treatment options, particularly in regions with limited access to newer therapies or where cost is a significant consideration.

Geographical expansion is a key focus for many pharmaceutical companies in the space. Companies are looking to enter new markets, particularly in regions with a high incidence of TCL and unmet medical needs. Expanding into markets such as Japan and the U.S., where significant changing events are anticipated between 2020 and 2030, is a strategic priority. This expansion is expected to drive market growth by increasing the availability of advanced therapies and improving patient outcomes across different regions.

Type Insights

The peripheral type segment dominated the market with the largest revenue share of over 66% in 2023. PTCL includes various subtypes, such as Angioimmunoblastic T-cell Lymphoma (AITL) and Anaplastic Large Cell Lymphoma (ALCL). These subtypes are commonly treated with anthracycline-based chemotherapy regimens like CHOP and CHOEP. However, recent advancements have introduced new therapies such as CHP-BV for ALCL and other targeted treatments. The increasing incidence of PTCL, with approximately 12,600 new cases in the U.S. in 2023, and the introduction of innovative treatment options are key factors driving the growth of this segment. Additionally, the launch of new therapies in regions like Japan provides further momentum, making PTCL the largest and most dynamic segment in the TCL market.

The Lymphoblastic T-cell Lymphoma (LBL) segment is experiencing moderate growth. LBL is a more aggressive form of lymphoma that often affects younger patients and requires intensive treatment regimens. Traditional chemotherapy remains a primary treatment option; however, there is ongoing research and development aimed at finding more effective therapies with fewer side effects. While the growth in this segment is not as rapid as in the PTCL segment, advancements in targeted therapies and the introduction of new treatment protocols are contributing to steady growth. The focus on improving patient outcomes and the development of new drugs are expected to drive continued interest and investment in the LBL segment, supporting its moderate growth trajectory.

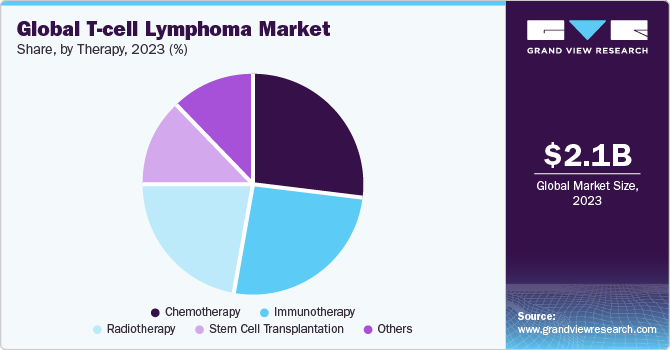

Therapy Insights

The chemotherapy segment dominated the market with the largest revenue share in 2023. For many years, chemotherapy has been the cornerstone of TCL treatment, with regimens such as CHOP (cyclophosphamide, doxorubicin, vincristine, and prednisone) and CHOEP (cyclophosphamide, doxorubicin, vincristine, etoposide, and prednisone) being commonly used. These regimens are widely recognized for their effectiveness in managing disease and are typically the first line of treatment for newly diagnosed patients. Despite the emergence of new therapies, chemotherapy continues to be the primary choice due to its established protocols and widespread availability. The enduring reliance on these treatments sustains the prominence of the chemotherapy segment.

The Immunotherapy segment is expected to grow at the fastest growth rate over the forecast period. This rapid growth is driven by significant advancements and the introduction of novel therapies that harness the body's immune system to target cancer cells more precisely. For instance, CAR-T cell therapy, which involves modifying a patient's T cells to attack cancer cells, has shown promising results in clinical trials and is expanding its indications. Additionally, new biologics targeting specific proteins and pathways involved in TCL, such as the anti-CD47 monoclonal antibody and mogamulizumab, are being developed and introduced to the space. In December 2023, the launch of HIYASTA in Japan marked a significant step forward in immunotherapy options for patients with TCL. The continued innovation and increasing approval of these targeted treatments are expected to drive substantial growth in the immunotherapy segment, making it the fastest-growing area in the TCL.

Regional Insights

North America T-cell lymphoma market held the largest share of 37.67% in 2023, driven by advanced healthcare infrastructure, high healthcare expenditure, and significant ongoing research and development. In the United States, which accounted for the high number of incident cases of CTCL in the 7MM in 2023, males had a higher incidence of CTCL. The sapce is characterized by the availability of advanced treatments like VALCHLOR, POTELIGEO, and ADCETRIS. The prevalence of TCL in the U.S. is projected to increase by 2030, further solidifying North America's dominance in the TCL market.

U.S. T-cell Lymphoma Market Trends

The T-cell lymphoma market in the U.S. is majorly driven by a high incidence of the disease. The incidence of CTCL was high among the 7MM in 2023, with males representing a larger proportion of the patient population. Advanced diagnostic and treatment facilities contribute to the significant industry size. Emerging therapies like SGX301 and I/ONTAK are expected to enhance the treatment landscape from 2024 to 2030, addressing unmet needs and offering new standard care options for patients.

Europe T-cell Lymphoma Market Trends

The T-cell lymphoma market in Europe is growing due to substantial contributions from countries like the UK, France, and Germany. The region benefits from well-established healthcare systems and access to cutting-edge treatments. However, the market size varies across countries, with Germany holding the largest share among the EU4 and the UK in 2023.

The UK T-cell lymphoma market is growing steadily, driven by increased awareness and early diagnosis of the disease. The UK accounted for ~1,407 cases of Stage IA CTCL in 2023, reflecting a strong healthcare system capable of managing early-stage diseases effectively. Emerging therapies and clinical trials are expected to further bolster market growth.

The T-cell lymphoma market in France contributes significantly to the European TCL market. With a focus on innovative treatments and comprehensive healthcare coverage, France is well-positioned to adopt new therapies as they become available. The country continues to invest in research to address the unmet needs in TCL treatment.

Germany T-cell lymphoma market is expected to grow over the forecast period. Germany had the largest market size among the EU4 and the UK in 2023. The country’s robust healthcare infrastructure and focus on research and development enable it to be a leader in the adoption of new treatments. Germany's growth is expected to continue with the introduction of emerging therapies.

Asia Pacific T-cell Lymphoma Market Trends

The T-cell lymphoma market in Asia Pacific is experiencing rapid growth driven by increasing incidence rates and improving healthcare infrastructure. Countries like India, China, and Japan are significant contributors to this growth.

India T-cell lymphoma market is growing due to increasing awareness and improving healthcare access. While traditional chemotherapy remains prevalent, there is a growing interest in innovative treatments as the healthcare system evolves.

The T-cell lymphoma market in China is witnessing a rise in TCL cases, with significant investments in healthcare infrastructure and research. The country is focusing on adopting advanced therapies and improving diagnostic capabilities to manage the increasing patient load effectively.

Japan T-cell lymphoma market has a well-established market with advanced treatment options available. The introduction of new therapies like HIYASTA in December 2023 marks a significant development, enhancing the treatment landscape for TCL patients and driving space growth.

Latin America T-cell Lymphoma Market Trends

The T-cell lymphoma market in Latin America is growing, with Brazil being a key player. The region is gradually adopting advanced therapies, although access to cutting-edge treatments varies.

Brazil T-cell lymphoma market is a significant market in the Latin America region, with an increasing incidence of TCL and improving healthcare infrastructure. The country is focusing on enhancing access to advanced treatments and diagnostics to better manage the disease.

Middle East & Africa T-cell Lymphoma Market Trends

The T-cell lymphoma market in the Middle East & Africa is an emerging market for TCL, with countries like Saudi Arabia investing in healthcare improvements. The region faces challenges related to access to advanced treatments, but ongoing healthcare reforms are promising.

Saudi Arabia T-cell lymphoma market is actively investing in its healthcare system to improve access to advanced TCL treatments. The country's efforts to enhance healthcare infrastructure and adopt new therapies are expected to drive market growth in the region.

Key T-Cell Lymphoma Company Insights

Key companies in the space include established players such as Takeda Pharmaceuticals, Bristol-Myers Squibb, and Novartis, alongside emerging companies like Citius Pharmaceuticals, Innate Pharma, and Soligenix. Takeda's ADCETRIS (brentuximab vedotin) and Bristol-Myers Squibb's POTELIGEO (mogamulizumab) are prominent therapies, providing significant treatment options for patients. Novartis is actively involved in developing CAR-T cell therapies, reflecting its strong commitment to innovation. Among emerging players, Citius Pharmaceuticals is developing I/ONTAK (E7777), expected to make a positive impact on the treatment landscape from 2024 onwards. Soligenix's SGX301 and Innate Pharma's Lacutamab are other notable emerging therapies poised to enhance patient care. These companies are driving space growth through strategic initiatives and innovative treatments, addressing the unmet needs in TCL management.

Key T-Cell Lymphoma Companies:

The following are the leading companies in the T-cell lymphoma market. These companies collectively hold the largest market share and dictate industry trends.

- Acrotech Biopharma

- Affimed GmbH

- Bristol Myers Squibb

- Chipscreen Biosciences

- Citius Pharma

- Daiichi Sankyo Company, Limited

- Eisai Co., Ltd.

- Genor Biopharma Co. Ltd

- Innate Pharma

- Dizal Pharma

Recent Developments

-

In March 2024, Breyanzi for CLL/SLL received FDA approval, other key players are likely to strategize. Initiatives may include exploring similar approvals for T-cell Lymphoma indications, investing in CAR T-cell therapies, and enhancing clinical trials for broader applications. These actions could shape competitive dynamics and treatment options in the space.

-

In June 2024, Takeda Pharmaceuticals announced the expansion of its ADCETRIS (brentuximab vedotin) into frontline treatment for advanced Hodgkin lymphoma. This expansion follows the positive results from the Phase 3 ECHELON-1 clinical trial, which showed significant improvement in patient outcomes.

-

In January 2021, Novartis entered into a strategic collaboration with BeiGene to co-develop and commercialize Tislelizumab, a PD-1 inhibitor, for treating various cancers, including T-cell lymphomas. This collaboration aims to leverage both companies' expertise to accelerate the development and availability of innovative therapies.

T-cell Lymphoma Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.23 billion

Revenue forecast in 2030

USD 3.70 billion

Growth rate

CAGR of 8.83% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, therapy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Acrotech Biopharma; Affimed GmbH; Bristol Myers Squibb; Chipscreen Biosciences; Citius Pharma; Daiichi Sankyo Company; Limited; Eisai Co., Ltd.; Genor Biopharma Co. Ltd; Innate Pharma; Dizal Pharma.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global T-cell Lymphoma Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global T-cell Lymphoma market report based on type, therapy, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral

-

Cutaneous T-cell Lymphoma

-

Anaplastic Large Cell Lymphoma

-

Angio-immuno-blastic T-cell Lymphoma

-

Other

-

-

Lymphoblastic

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiotherapy

-

Chemotherapy

-

Immunotherapy

-

Stem Cell Transplantation

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global T-cell Lymphoma market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.23 billion in 2024.

b. The global T-cell Lymphoma market is expected to grow at a compound annual growth rate of 8.83% from 2024 to 2030 to reach USD 3.70 billion by 2030.

b. The Chemotherapy segment held the largest revenue share of 26.69% in 2023. For many years, chemotherapy has been the cornerstone of TCL treatment, with regimens such as CHOP (cyclophosphamide, doxorubicin, vincristine, and prednisone) and CHOEP (cyclophosphamide, doxorubicin, vincristine, etoposide, and prednisone) being commonly used. These regimens are widely recognized for their effectiveness in managing disease and are typically the first line of treatment for newly diagnosed patients

b. Key companies in the T-Cell Lymphoma (TCL) market include Acrotech Biopharma, Affimed GmbH, Bristol Myers Squibb, Chipscreen Biosciences, Citius Pharma, Daiichi Sankyo Company, Limited, Eisai Co., Ltd., Genor Biopharma Co. Ltd, Innate Pharma, and Dizal Pharma.

b. Key factors that are driving the market growth include the introduction of new key pipeline agents and the expansion of existing therapies to new indications. These developments provide more options for patients and reduce the reliance on traditional chemotherapy regimens, which have been the mainstay of TCL treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.