System Infrastructure Software Market Size, Share & Trends Analysis Report By Type (Storage, Network & System Management, Security), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-980-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

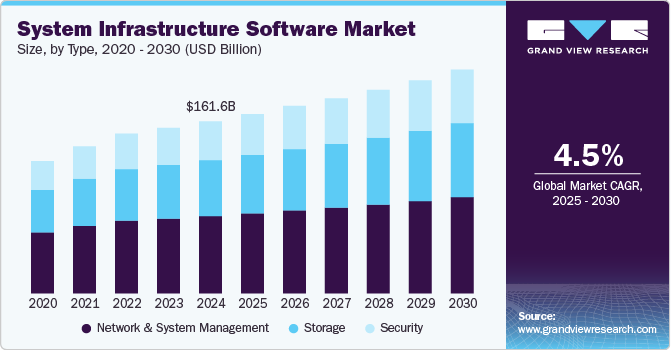

The global system infrastructure software market size was estimated at USD 161.55 billion in 2024 and is anticipated to grow at a CAGR of 4.5% from 2025 to 2030. The system infrastructure software industry growth is propelled by the increasing digitization of enterprises across industries. Organizations are prioritizing the integration of advanced digital tools to streamline operations, boost productivity, and deliver enhanced customer experiences. Organizations are seeking robust software solutions to protect their networks, data, and systems from cyber threats. Additionally, the rapid advancement of technologies such as artificial intelligence (AI) and machine learning is creating demand for innovative infrastructure software capable of managing and processing large volumes of data.

Shifting consumer preference toward cloud-based technologies & solutions and rising need for efficient digital framework to handle higher data complexities is creating positive traction for the system infrastructure market. Remarkable cloud integrations across various industries, such as manufacturing, BFSI, IT & telecom, and healthcare is anticipated to create robust market opportunities in the forecast timeline. Several organizations are shifting their business operations to cloud platforms for remote work management and optimized internal dataflow through cloud integrations. System infrastructure software assists in managing cloud services across all business operations and ensures security compliance to protect data privacy, improving industry statistics.

The escalating landscape of cybersecurity threats has significantly amplified the demand for robust system infrastructure software, as organizations prioritize safeguarding their data and maintaining operational integrity. With the proliferation of digital technologies and increased reliance on interconnected systems, the attack surface for cybercriminals has expanded dramatically. Threats such as ransomware, phishing attacks, and advanced persistent threats (APTs) target vulnerabilities in critical infrastructure, potentially leading to data breaches, financial losses, and reputational damage.

System infrastructure software plays a pivotal role in fortifying defenses by providing advanced tools for monitoring, detection, and response. These solutions enable real-time threat analysis, automated incident management, and secure data encryption, reducing the risk of unauthorized access or data compromise. As businesses embrace cloud computing, hybrid IT environments, and remote work models, the complexity of managing cybersecurity increases, necessitating scalable and adaptable infrastructure software. The integration of artificial intelligence (AI) and machine learning (ML) enhances the effectiveness of these solutions, enabling predictive analytics and proactive threat mitigation.

Despite its growth, the high costs associated with implementing and maintaining advanced infrastructure software solutions may deter smaller enterprises. Complexity in deploying these systems, coupled with a shortage of skilled IT professionals, poses another barrier. Additionally, concerns around data privacy and compliance with evolving regulations may slow adoption rates in certain regions or industries. Addressing these challenges will be critical for sustained growth in the market.

Type Insights

The network & system management software accounted for a market share of over 44% in 2024. The adoption of hybrid and multi-cloud environments has significantly increased the complexity of IT infrastructure management. Organizations now operate across diverse platforms, requiring advanced tools to ensure seamless connectivity and maintain system performance. Network and system management software address this complexity by providing centralized monitoring, optimization, and security capabilities. These solutions enable IT teams to track resource utilization, identify performance bottlenecks, and manage configurations across varied systems efficiently. Additionally, they reduce downtime through proactive issue detection and resolution, ensuring business continuity. By optimizing resource allocation and integrating seamlessly with existing infrastructure, these tools play a critical role in helping organizations adapt to the demands of modern, interconnected IT ecosystems while maintaining operational efficiency and security.

The security segment is anticipated to grow at a significant CAGR of 5.5% owing to rising security concerns with the rise in internet penetration and migration to digital infrastructure. The companies preferring cloud platforms are primarily focusing on strengthening the software security to deal with evolving digital threats, such as Distributed Denial of Service attacks (DDoS), Trojans, ransomware viruses, and phishing. Security infrastructure software provides various benefits to businesses, such as reducing payment fraud, preventing unauthorized access, capability to the central system to defend against digital threats, and mitigating financial risks, augmenting segment growth. These features and capabilities will further boost the demand for the segment during the forecast period.

Application Insights

The data center infrastructure segment accounted for the largest market share in 2024 due to the rising demand for cloud computing has significantly impacted data center infrastructure, driving investments to support public, private, and hybrid cloud models. As businesses increasingly adopt cloud services for scalability and flexibility, managing the complexity of these systems has become essential. Advanced data center infrastructure software plays a crucial role by providing tools for efficient resource allocation, workload optimization, and real-time monitoring. These solutions enable organizations to ensure seamless integration across cloud platforms, maintain system performance, and reduce operational costs. Moreover, as the volume of cloud-based data grows, robust software becomes indispensable for ensuring data security, compliance, and scalability. This trend underscores the critical role of infrastructure software in enabling efficient and reliable cloud operations.

The cloud integration segment is expected to grow at a significant CAGR during the forecast period. Digital transformation is driving enterprises to modernize their operations and enhance customer experiences, with cloud integration software playing a critical role in this shift. By bridging legacy systems and modern cloud applications, these tools enable seamless data exchange, ensuring continuity in workflows and processes. This integration eliminates silos, enhances operational efficiency, and supports real-time decision-making, which is essential for staying competitive in a rapidly evolving market. Furthermore, cloud integration maximizes return on investment (ROI) by leveraging existing infrastructure while enabling scalable, flexible solutions that align with modern business needs, empowering organizations to achieve their digital transformation goals effectively.

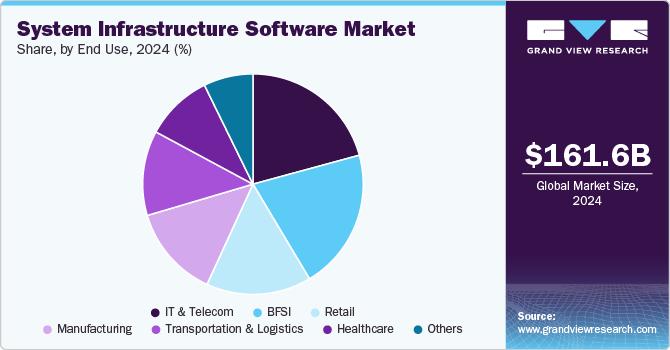

End Use Insights

The IT & Telecom segment accounted for the largest market share of over 20% in 2024. The segment growth can be attributed to the rising demand for 5G connectivity, edge computing & IoT services, and growing internet users is propelling the sale of system infrastructure software. Telecommunications companies are upgrading their network infrastructure to improve connectivity & coverage and attract potential business clients, supporting the industry trend. Further, IT companies are incorporating system infrastructure software in their business model for automating their primary tasks, workforce management, and efficient virtual & physical resource utilization. Moreover, by increasing infrastructure automation, organizations can optimize costs and be more efficient and flexible. These will further boost the demand for system infrastructure software in the IT & telecom sector during the forecast period.

The BFSI segment is expected to grow at the fastest CAGR during the forecast period. The BFSI sector is rapidly embracing digital transformation to enhance customer experiences, streamline operations, and offer real-time services. Advanced technologies such as cloud computing, AI, and big data analytics are driving this shift. System infrastructure software is pivotal in enabling this transformation by providing secure, scalable, and efficient IT frameworks. These solutions facilitate seamless integration of digital platforms, ensure reliable service delivery, and enhance data management. Additionally, they support automation and real-time processing, which are essential for modern banking and financial operations. By leveraging robust infrastructure software, BFSI organizations can remain competitive and adapt to evolving customer and market demands.

Regional Insights

North America system infrastructure software industry held the major share of over 35% in 2024. In North America, the system infrastructure software industry growth can be attributed to the proliferation of data centers encouraging market players to establish their independent data infrastructure systems for data processing and storing and emerging startups in the region are creating robust market opportunities in the U.S. and Canada. Further, shifting government focus on digitizing their business operations to improve the transparency of the processes is creating a positive market outlook for system infrastructure software in the region.

U.S. System Infrastructure Software Trends

The system infrastructure software industry in the U.S. is expected to grow significantly from 2025 to 2030. The growing cybersecurity threats have prompted U.S. businesses to invest heavily in advanced infrastructure software. These solutions safeguard sensitive data, ensure regulatory compliance with frameworks like GDPR and CCPA, and protect critical operations. Robust security measures help mitigate risks, maintain trust, and support seamless business continuity in a digital-first environment.

Europe System Infrastructure Software Trends

The system infrastructure software market in Europe is growing significantly at a CAGR of over 4.1% from 2025 to 2030. European governments and industries are accelerating digital transformation through initiatives like the EU Digital Strategy. These programs promote the adoption of advanced technologies to enhance efficiency and competitiveness. System infrastructure software is integral to this shift, enabling seamless integration of digital tools, improved data management, and scalable IT systems. This widespread push for digitalization is driving significant demand for robust and efficient infrastructure solutions across various sectors in the region.

The U.K. system infrastructure software industry is expected to grow rapidly in the coming years. The U.K. government’s focus on modernizing public services, such as through the Government Digital Service (GDS) and Digital Transformation Strategy, is driving demand for advanced system infrastructure software to support secure, scalable, and efficient IT operations.

The system infrastructure software market in Germany held a substantial market share in 2024. German businesses are increasingly adopting cloud computing and hybrid IT environments. System infrastructure software facilitates seamless cloud integration, resource management, and enhanced data security, catering to the needs of these complex ecosystems.

Asia Pacific System Infrastructure Software Trends

The system infrastructure software industry in the Asia Pacific is growing significantly at a CAGR of over 6.1% from 2025 to 2030. The rapid growth of e-commerce and digital payment systems in APAC demands robust infrastructure software to ensure reliable, secure, and efficient transaction management. Simultaneously, significant investments in smart city projects and IoT applications by APAC governments are driving the need for advanced software to process large data volumes and enable seamless integration between devices. These trends underscore the critical role of infrastructure software in supporting digital innovation across the region.

The China system infrastructure software industry held a substantial market share in 2024. The explosion of e-commerce and fintech in China is fueling demand for robust system infrastructure software. These solutions ensure secure, scalable, and high-performance transaction management and data handling for millions of users.

The system infrastructure software industry in Japan held a substantial market share in 2024. Japan is increasingly adopting cloud computing and hybrid IT solutions for flexibility, scalability, and cost efficiency. System infrastructure software is crucial for managing complex cloud environments, ensuring smooth integration, and optimizing resources.

India’s system infrastructure software industry is growing rapidly owing India’s push to develop smart cities and IoT applications drives the need for advanced system infrastructure software. These solutions are essential for managing connected devices, processing vast amounts of data, and ensuring seamless integration in urban environments.

Key System Infrastructure Software Company Insights

Key players operating in the system infrastructure software industry include Amazon Web Services, Inc.; BMC Software, Inc.; Broadcom Inc. (CA Technologies); Red Hat, Inc.; Hewlett Packard Enterprise (HPE); Nutanix; SolarWinds; Cisco Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise; IBM Corporation; Microsoft Corporation; Oracle Corporation; and TIBCO Software Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2024, Cisco Systems, Inc. introduced new AI solutions to facilitate enterprise adoption of AI technologies. These include AI server families optimized for GPU-intensive workloads and AI PODs designed to simplify infrastructure Type. Managed by Cisco Intersight, these solutions offer centralized control and automation, enabling organizations to scale AI capabilities efficiently.

-

In April 2024, BMC Software, Inc. announced it had completed the acquisition of Netreo, a provider of IT network and application observability solutions. This strategic move aims to enhance BMC's Helix Observability and AIOps platforms by integrating Netreo's capabilities, thereby offering comprehensive application and network management solutions.

Key System Infrastructure Software Companies:

The following are the leading companies in the system infrastructure software market. These companies collectively hold the largest market share and dictate industry trends:

- Amazon Web Services, Inc.

- BMC Software, Inc.

- Broadcom Inc. (CA Technologies)

- Red Hat, Inc.

- Hewlett Packard Enterprise (HPE)

- Nutanix

- SolarWinds

- Cisco Systems, Inc.

- Dell Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- TIBCO Software Inc.

System Infrastructure Software Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 168.34 billion |

|

Revenue forecast in 2030 |

USD 209.98 billion |

|

Growth rate |

CAGR of 4.5% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Amazon Web Services, Inc.; BMC Software, Inc.; Broadcom Inc. (CA Technologies); Red Hat, Inc.; Hewlett Packard Enterprise (HPE); Nutanix, SolarWinds; Cisco Systems, Inc.; Dell Inc.; IBM Corporation; Microsoft Corporation; Oracle Corporation; TIBCO Software Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global System Infrastructure Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the system infrastructure software market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Storage

-

Network & System Management

-

Security

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building Management

-

Integrated Communication

-

Data Center Infrastructure

-

Cloud Integrations

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail

-

Healthcare

-

Manufacturing

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global system infrastructure software market size was estimated at USD 161.55 billion in 2024 and is expected to reach USD 168.34 billion in 2025.

b. The global system infrastructure software market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 209.98 billion by 2030.

b. The network & system management software segment in the system infrastructure software market captured the largest revenue share of over 44% in 2024. The adoption of hybrid and multi-cloud environments has significantly increased the complexity of IT infrastructure management. Organizations now operate across diverse platforms, requiring advanced tools to ensure seamless connectivity and maintain system performance. Network and system management software address this complexity by providing centralized monitoring, optimization, and security capabilities.

b. Key players operating in the system infrastructure software industry include Amazon Web Services, Inc., BMC Software, Inc., Broadcom Inc. (CA Technologies), Red Hat, Inc., Hewlett Packard Enterprise (HPE), Nutanix, SolarWinds, Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise, IBM Corporation, Microsoft Corporation, Oracle Corporation, TIBCO Software Inc.

b. The system infrastructure software market is propelled by the increasing digitization of enterprises across industries. Organizations are prioritizing the integration of advanced digital tools to streamline operations, boost productivity, and deliver enhanced customer experiences. Organizations are seeking robust software solutions to protect their networks, data, and systems from cyber threats. Additionally, the rapid advancement of technologies such as artificial intelligence (AI) and machine learning is creating demand for innovative infrastructure software capable of managing and processing large volumes of data

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."