- Home

- »

- Medical Devices

- »

-

Syringes Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Syringes Market Size, Share & Trends Report]()

Syringes Market (2025 - 2033) Size, Share & Trends Analysis Report By Usage (Disposable, Reusable), By Design (Conventional, Safety), By Application (Vaccines and Immunizations), By Material, By End Use, By Region And Segment Forecasts, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-077-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Syringes Market Summary

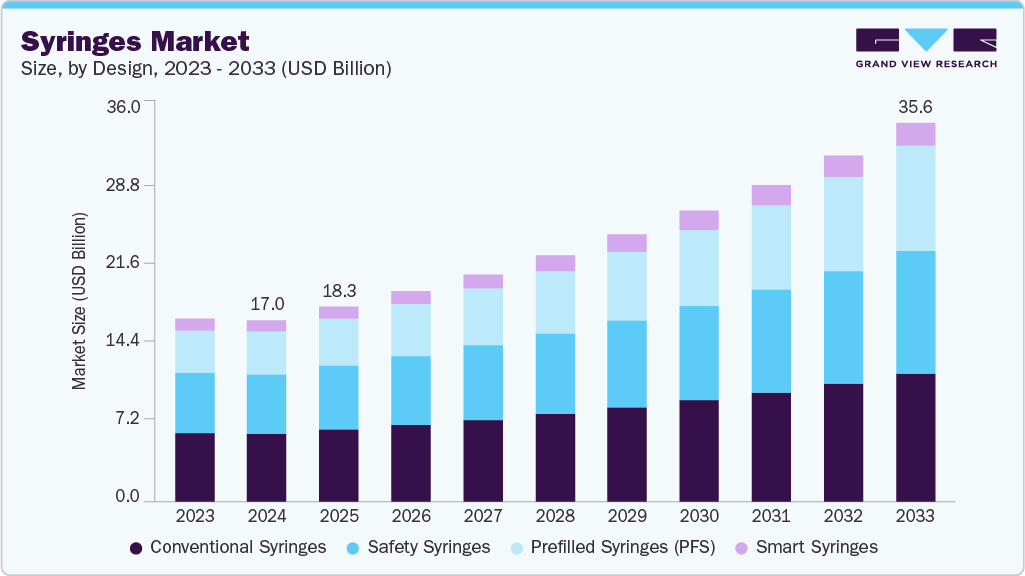

The global syringes market size was estimated at USD 17.03 billion in 2024 and is projected to reach USD 35.61 billion by 2033, growing at a CAGR of 8.66% from 2025 to 2033. The demand for syringes is rising owing to the increasing burden of chronic disorders, the rising number of surgical procedures, and the growing hospitalizations.

Key Market Trends & Insights

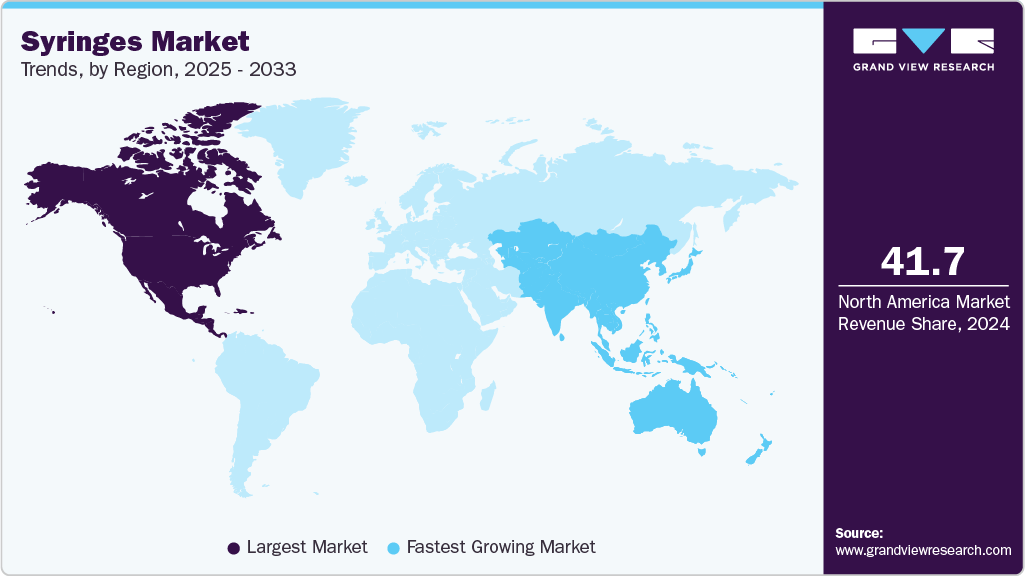

- North America dominated the syringes market with the largest revenue share of 41.73% in 2024.

- By design, the conventional syringes segment led the market with the largest revenue share of 37.14% in 2024.

- Based on usage, the disposable syringes segment is anticipated to grow fastest over the forecast period.

- Based on end use, the direct tenders segment led the market with the largest revenue share of 44.23% in 2024.

- By application, the vaccines and immunizations segment led the market, with a revenue share of 39.40% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.03 Billion

- 2033 Projected Market Size: USD 35.61 Billion

- CAGR (2025-2033): 8.66%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the advancements in syringes are anticipated to propel the market growth. The increasing prevalence of chronic diseases and the resulting hospitalizations are major market drivers. According to the data published by the WHO in December 2024, chronic diseases claimed the lives of at least 43 million people globally in 2021. In addition, a study published by the Mayo Clinic in February 2024 projects that the global economic burden of chronic diseases will reach an estimated USD 47 trillion by 2030. This growing burden underscores the rising demand for medical supplies, including syringes, as healthcare systems work to manage and treat these long-term conditions.

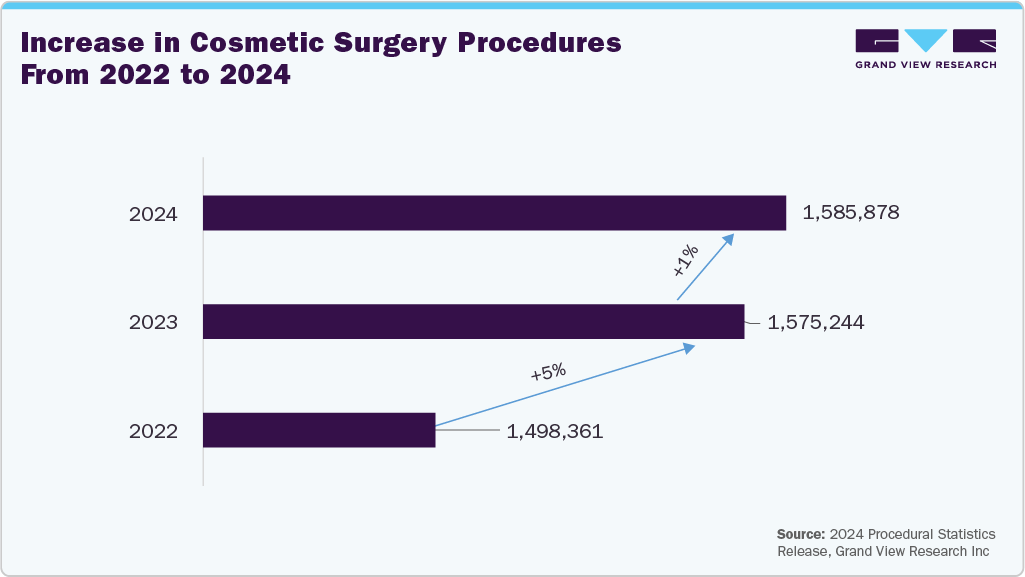

Furthermore, the rising number of hospitalizations and an increasing volume of surgical procedures drive the demand for syringes in the coming years. As surgical interventions, including cosmetic, cardiac, and orthopedic surgeries, become more prevalent across various countries and regions, the need for syringes grows. These surgeries often require the use of syringes for anesthesia and medication delivery, contributing to the overall surge in demand. Moreover, advancements in surgical techniques and a growing patient population further support this rising need for syringes in healthcare settings.

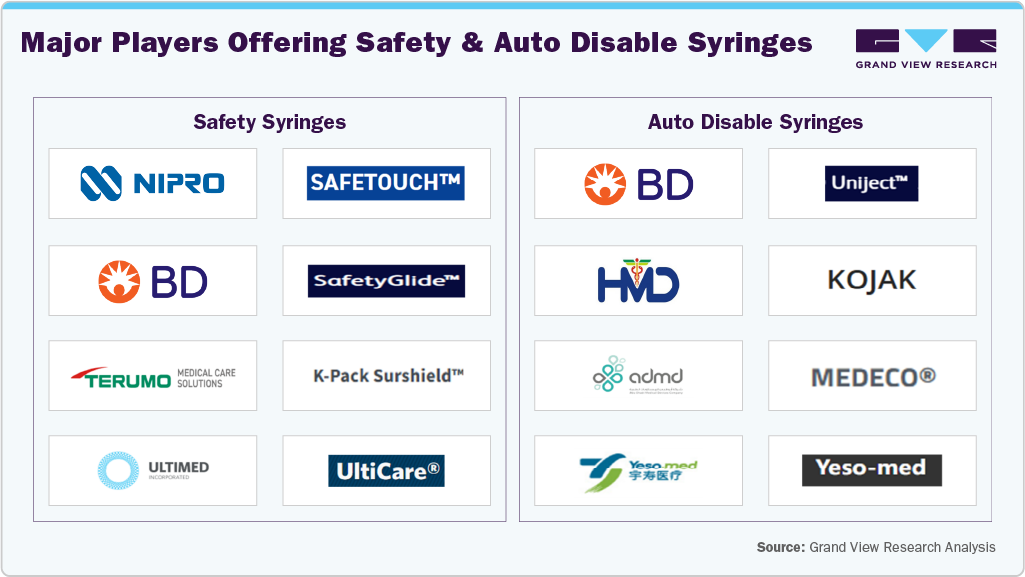

The growing emphasis on safety and auto-disable syringes is expected to propel market growth in the coming years. Companies are increasingly innovating their product offerings with these advanced solutions. For example, in March 2024, Hindusta Syringes and Medical Devices introduced the Dispojekt single-use syringes with safety needles. These syringes aim to reduce the risk of accidental needle-stick injuries (NSIs) among healthcare workers, lower infection control costs, and minimize expenses related to disposal and training, ultimately delivering long-term financial benefits to the healthcare sector.

Moreover, the growing demand for vaccinations and immunizations is driving the need for syringes, with new market entrants focusing on manufacturing auto-disable syringes to meet this demand. For example, according to data published by VaccinesWork in February 2024, Revital Healthcare has become the first African manufacturer of WHO-prequalified, single-use, safe syringes. These African-made auto-disable (AD) syringes enhance immunization efforts across the continent. In Kenya, the immunization system strongly advocates for AD syringes, which are developed to prevent reuse by locking automatically post single injection, making them the gold standard for vaccination safety.

“Average syringe transport times are expected to decrease by up to 80-90% on the continent”. Said Roneek R. Vora, director, Revital Healthcare (EPZ) Limited

"We broke barriers by exporting these syringes to more than 35 countries, including India - despite India being a syringe production powerhouse -and four European countries, and to other African countries." Says Vora, who is also a founding member of the Kenyan Ministry of Health's End Malaria Council & Fund.

Such increasing manufacturing and export of auto-disabled syringes for vaccinations and immunizations is anticipated to propel market growth in the coming years.

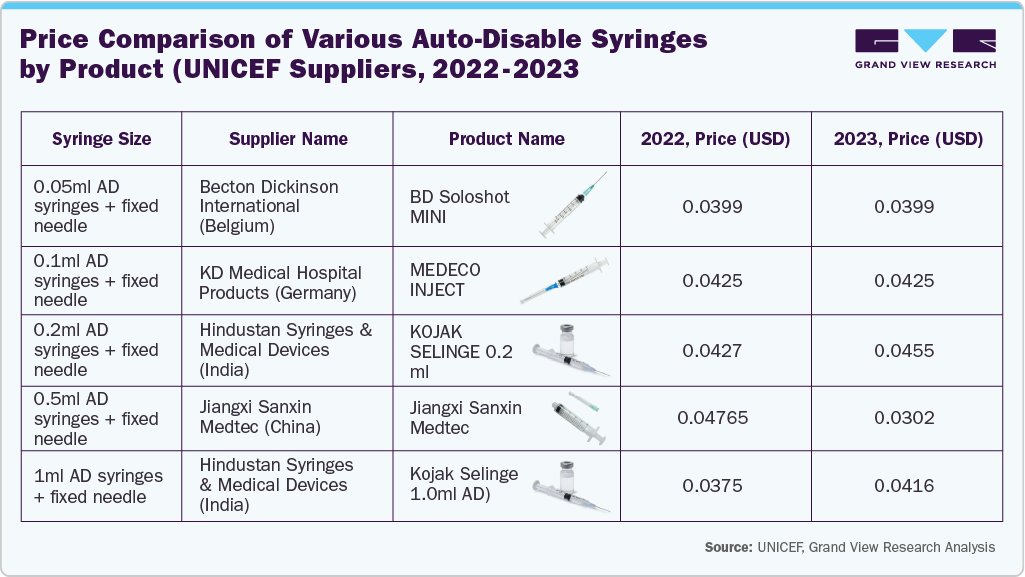

In addition, the availability of syringes in various sizes supports market growth. The pictorial representation below highlights the prices of some auto-disabled syringes along with their size and brand name for 2022 and 2023.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Eric Borin, president of Medication Delivery Solutions at BD.

“Domestic manufacturing is crucial for ensuring a resilient supply of essential healthcare devices. By expanding our production capacity, we are not only meeting the critical needs of patients and providers, but we are also reinforcing our commitment to the nation’s health care infrastructure,”

- Cost Efficiency & Competitive Advantage

- Increased Local Demand

- Enhancing local manufacturing capabilities

Minister of Health, Dr. Sabin Nsanzimana

“This marks a major step forward for local manufacturing in Africa. This new syringe manufacturing facility will improve access to essential medical supplies, improve healthcare access, and create jobs, especially for women.”

- Opportunity for revenue generation in Africa

- Manufacturing and Production Expansion

Dr. Beth Stein, M.D., Director of Neuromuscular Diseases, St. Joseph’s Health, Clifton, NJ.

“I am excited to offer my patients living with gMG and CIDP the option of the new prefilled syringe for VYVGART Hytrulo. This new self-injection option will lead to more convenient and flexible patient administration, empowering them to decide when and where to receive treatment. A ready-to-use option enhances patient independence and reduces the time required for treatment, making disease management and control more seamless.”

- Convenience-driven growth

- Potential regulatory approvals and manufacturing investments

- Increased patient flexibility

Source: Grand View Research Analysis

Market Concentration & Characteristics

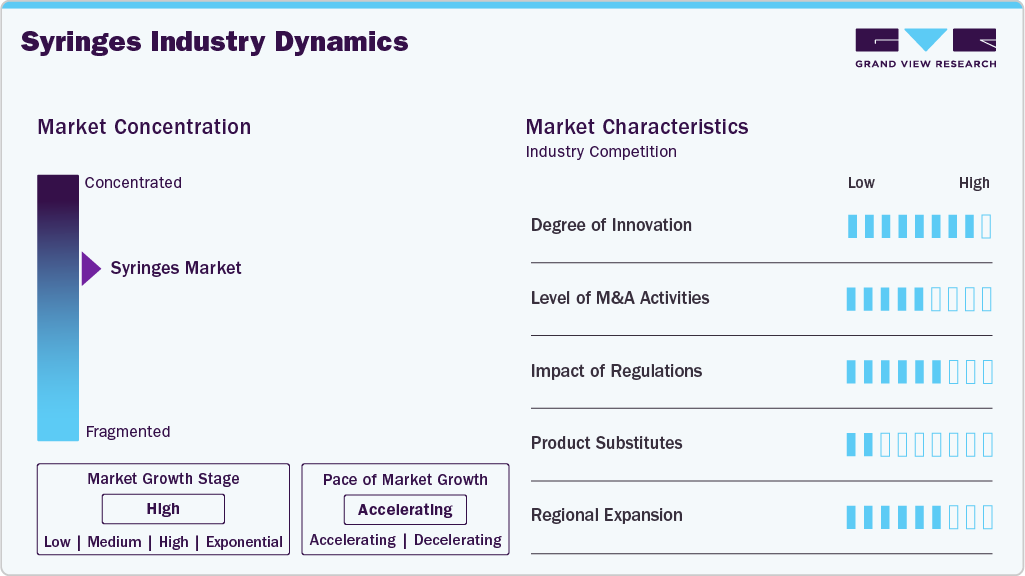

The market growth stage is high, and the pace of growth is accelerating. The syringes industry is characterized by high growth due to the growing demand for different types of syringes, growing launches of novel products, and increasing manufacturing capacities.

Companies are developing innovative solutions such as smart syringes to gain a competitive advantage. For instance, in June 2025, Schreiner MediPharm launched the Smart Syringe Box-a technology-driven solution designed to track syringe usage in clinical trials. Equipped with integrated electronics, the Smart Syringe Box enables accurate digital trial data reporting, enhancing monitoring precision. In addition, the system can be outfitted with a temperature monitoring function, supporting the safety and effectiveness of trials involving temperature-sensitive biopharmaceuticals.

Regulatory authorities such as the U.S. Food and Drug Administration (FDA), Health Canada, and the Central Drugs Standard Control Organization (CDSCO), among others, are responsible for overseeing the regulation, marketing authorization, and clinical evaluation of syringes. These agencies ensure syringes' safety, efficacy, and quality through stringent oversight. For example, in June 2024, the U.S. FDA issued an update regarding its ongoing evaluation of quality and performance concerns associated with plastic syringes manufactured in China. It also outlined additional recommendations and actions being taken to address these issues.

Mergers and acquisitions play a strategic role in the syringes industry, driving expansion and innovation. Some companies have recently employed this strategy, which is mentioned in the table below:

Company Name

Acquisition Details

Acquisition Date

PCI Pharma Services

The company acquired Ajinomoto Althea, strengtheningU.S. drug product manufacturing capabilities for aseptic filling of prefilled syringes and cartridges.

May 2025

Sharps Technology Inc.

The company acquired Safegard Medical’s syringe manufacturing facility in Hungary, enhancing its production capacity for patented, single-use smart safety syringes.

July 2022

Source: Grand View Research Analysis

These initiatives reflect ongoing consolidation and investment in advanced syringe technologies and manufacturing infrastructure. Syringe manufacturers are increasingly pursuing regional expansion by ramping up local production to strengthen market access. In January 2025, BD committed over USD 10 million to expand syringe, needle, and IV catheter manufacturing in Nebraska and Connecticut, enhancing safety‑engineered syringe capacity by over 40% and conventional syringe output by more than 50%. Also, in December 2024, Gerresheimer AG significantly invested at its Skopje, North Macedonia facility-adding a 7,600 m² production hall dedicated to glass syringes, doubling staff to roughly 500, and consolidating plastic and glass syringe production on-site. These expansions will drive regional growth.

Usage Insights

The disposable syringes segment held the largest market share in 2024. It is also anticipated to grow fastest over the forecast period. Disposable syringes offer significant advantages over reusable ones, primarily by preventing the spread of infections and enhancing patient safety. Reusing syringes poses a risk of contracting blood-borne pathogens such as Hepatitis B, Hepatitis C, and HIV. Moreover, the growing demand for disposable syringes for vaccinations and immunizations is expected to drive the growth of this segment. Hindustan Syringes & Medical Devices Ltd (HMD) has supplied approximately 650 million AD and disposable syringes to UNICEF as of May 2023.

The reusable syringes segment is projected to grow moderately over the forecast period. This moderate growth is driven by superior cost-effectiveness over time, especially in high-volume chronic care and laboratory settings, combined with a lower environmental footprint than disposable alternatives. Furthermore, consistent demand from hospitals, research institutions, and clinics supports steady adoption of reusable syringes.

Design Insights

The conventional syringes segment held the largest market share of 37.14% in 2024. This dominance is driven by their widespread use in hospitals, clinics, and laboratories for drug delivery, vaccinations, and sample collection. Their affordability makes them the preferred option in low- and middle-income countries (LMICs) and public health programs requiring large-scale distribution. Furthermore, major players' increased production capacity is expected to fuel segment growth. For instance, in January 2025, BD announced that new production lines at its Connecticut and Nebraska facilities would boost its conventional syringe output by over 50%.

The prefilled syringes (PFS) segment is projected to experience the fastest growth during the forecast period, driven by increasing regulatory approvals and expanding manufacturing capabilities. Recent developments highlight this trend, including the FDA approval in February 2025 of Argenx’s VYVGART Hytrulo prefilled syringe for self-injection in chronic inflammatory demyelinating polyneuropathy and generalized myasthenia gravis. Moreover, in April 2024, Laboratorios Farmacéuticos Rovi’s subsidiary, ROVI Pharma Industrial Services, signed an agreement to manufacture prefilled syringes for a global pharmaceutical company. These advancements underscore growing demand and investment in the PFS space, contributing significantly to the segment’s anticipated rapid expansion.

Application Insights

The vaccines and immunizations segment dominated the market in 2024, capturing the largest share of 39.40%. This dominance is primarily driven by intensified global vaccination campaigns, increased government initiatives, and the rising prevalence of infectious diseases. The surge in disease outbreaks such as the COVID-19 pandemic and other infectious disorders continues to bolster demand for vaccination. For example:

-

As of early 2025, human cases of West Nile virus (WNV) have been reported in Greece, Romania, and Italy, with Italy confirming 10 cases.

-

In the U.S., 1,466 WNV cases were reported in 2024, over 1,000 of which affected the nervous system.

Ongoing clinical trials for WNV vaccine candidates further support segment growth by addressing the increasing infectious disease burden. The diabetes segment is expected to record the fastest market growth over the forecast period, fueled by the rising global prevalence of diabetes and increasing demand for insulin syringes. According to the International Diabetes Federation (IDF) Diabetes Atlas 2025, 11.1% of adults, or 1 in 9 individuals (aged 20-79), are living with diabetes, with more than 40% undiagnosed. This figure is projected to rise to 1 in 8 adults-approximately 853 million-by 2050, marking a 46% increase. Moreover, product innovations and new launches, such as Terumo India’s introduction of insulin syringes in November 2023, are further propelling segment growth.

End Use Insights

The direct tenders segment dominated the market in 2024, accounting for the largest share of 44.23%. This dominance is primarily driven by large-scale procurement from government bodies, hospitals, and global health organizations aiming to support immunization programs, chronic disease management, and public health initiatives. These buyers prioritize safety-engineered and prefilled syringes that reduce contamination and dosing errors, aligning with regulatory standards. In addition, technological advancements and bulk purchasing cost-efficiencies make tender-based sourcing attractive for institutions, positioning this segment as a key contributor to overall market growth, especially in emerging and low-income regions.

The online pharmacies segment is expected to witness the fastest market growth from 2025 to 2033. The rising consumer preference for e‑commerce and at‑home healthcare solutions drives this growth. Online pharmacies offer convenience, competitive pricing, wide product ranges, and doorstep delivery-especially appealing for individuals managing chronic conditions or those using prefilled or disposable syringes for self‑administration.

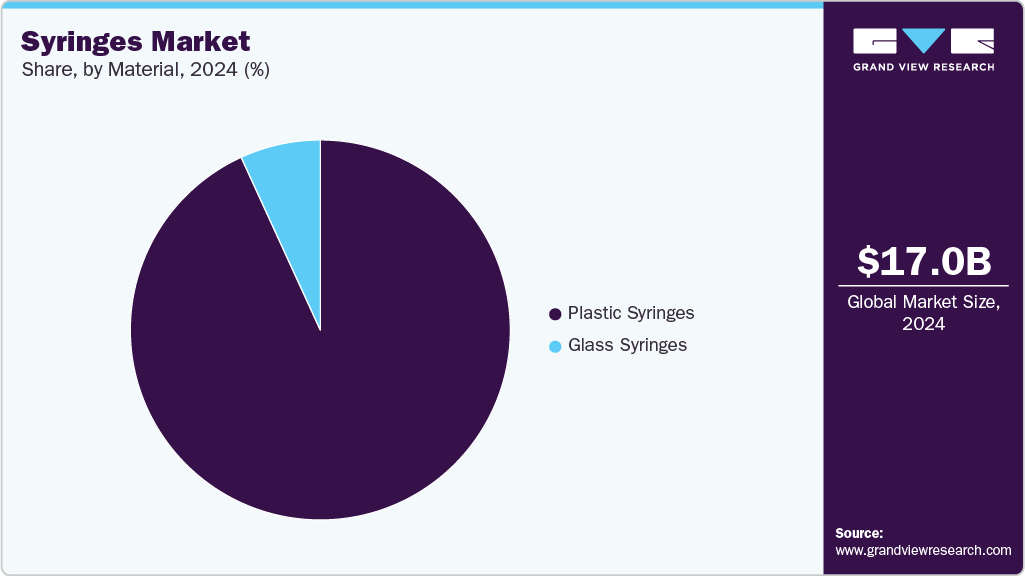

Material Insights

The plastic segment held the largest market share in 2024. It is also anticipated to grow fastest over the forecast period, driven by its cost-effectiveness, ease of mass production, and widespread use in disposable applications. Favorable government policies further support this dominance. For instance, in June 2025, the Indian government exempted a medical-grade plastic, high-density polyethylene (HDPE)-a critical material for disposable syringes -from mandatory BIS certification, ensuring smoother supply and reduced manufacturing hurdles. Furthermore, rising demand for single-use syringes due to infection control, expanding vaccination programs, and increased adoption in emerging economies continues to boost the plastic segment's growth.

The glass segment is projected to experience significant market growth between 2025 and 2033. This growth is driven by the superior gas and moisture barrier properties of glass prefilled syringes compared to polymer alternatives. Glass syringes offer a highly stable, long-term storage solution for sensitive drugs, ensuring safety and convenience for patients and healthcare providers. Moreover, prefilled glass syringes simplify the administration process by requiring fewer manual steps than traditional packaging, significantly reducing the risk of medical errors and infections, further boosting their adoption in clinical settings.

Regional Insights

In 2024, North America accounted for the largest revenue share in the syringes market at 41.73%. This dominance is attributed to the presence of major industry players, increasing regulatory approvals from agencies like Health Canada and the U.S. FDA, and supportive government initiatives. For example, in 2024, over 7 million syringes were distributed across 11 countries in the Americas through a collaborative effort between the Pan American Health Organization (PAHO) and Canada, highlighting the region’s strong role in advancing syringe availability and public health programs.

U.S. Syringes Market Trends

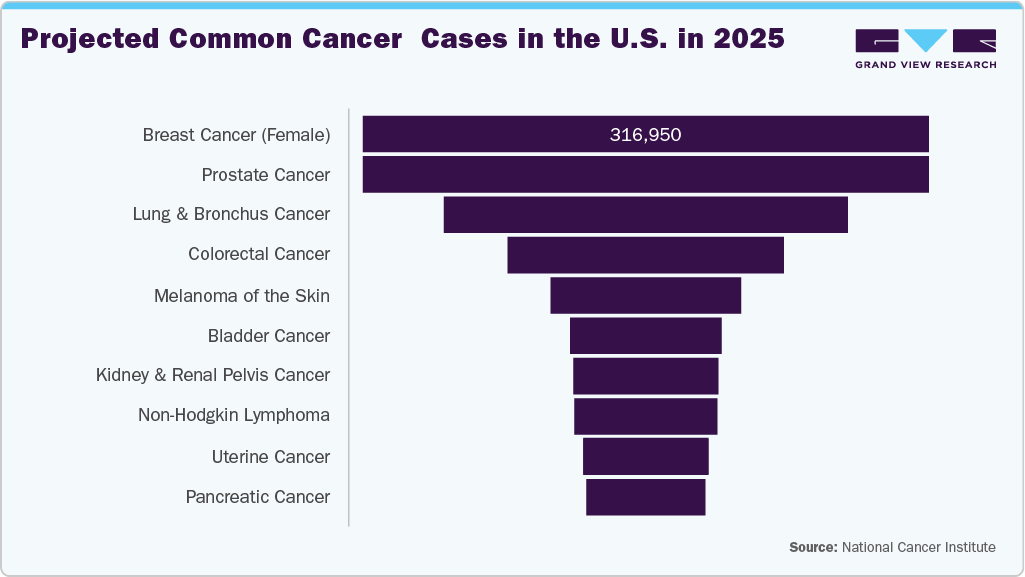

The syringes market in the U.S. is anticipated to grow significantly, fueled by rising vaccine demand, increased use of self-administered drug therapies, and continuous technological innovations in syringe design. The growing prevalence of chronic diseases like diabetes and cancer, which necessitate frequent injections, is also expected to drive market expansion. For example, the National Cancer Institute estimates that in 2025, approximatel 2,041,910 new cancer cases will be diagnosed in the U.S., with 618,120 related deaths. In addition, greater adoption of safety syringes and ongoing advancements in syringe technology further support this upward growth.

Europe Syringes Market Trends

The syringes market in Europe is set for significant growth in the coming years, fueled by a well-established healthcare infrastructure, a growing prevalence of chronic diseases, and rising demand for prefilled syringes. To meet this increasing demand, companies are ramping up their production capabilities within Europe and securing approvals from European regulatory authorities. For example, in February 2025, Tjoapack commenced its first production of prefilled syringes in the region.

The UK syringes market is expected to grow substantially in the coming years, driven by a strong national healthcare system (the NHS) and rising incidences of chronic and lifestyle-related diseases. Market expansion is further driven by government efforts to enhance vaccination coverage, an aging population, and continuous advancements in syringe design and manufacturing. For instance, according to NHS England , as of 8 May 2024, 51.8% of all older adult care home residents had received a spring vaccination-highlighting the growing emphasis on immunization and the corresponding demand for syringes.

The syringes market in Germany is witnessing steady growth, driven by a strong pharmaceutical manufacturing base, rising demand for prefilled syringes, and expanding biologics production. In November 2024, WuXi Biologics announced plans to enhance its drug product capabilities at its Leverkusen facility by installing a new sterile filling line for prefilled syringes using isolator technology. This development reflects growing investment in advanced syringe technologies and supports Germany’s position as a hub for innovative drug delivery solutions in Europe.

Asia Pacific Syringes Market Trends

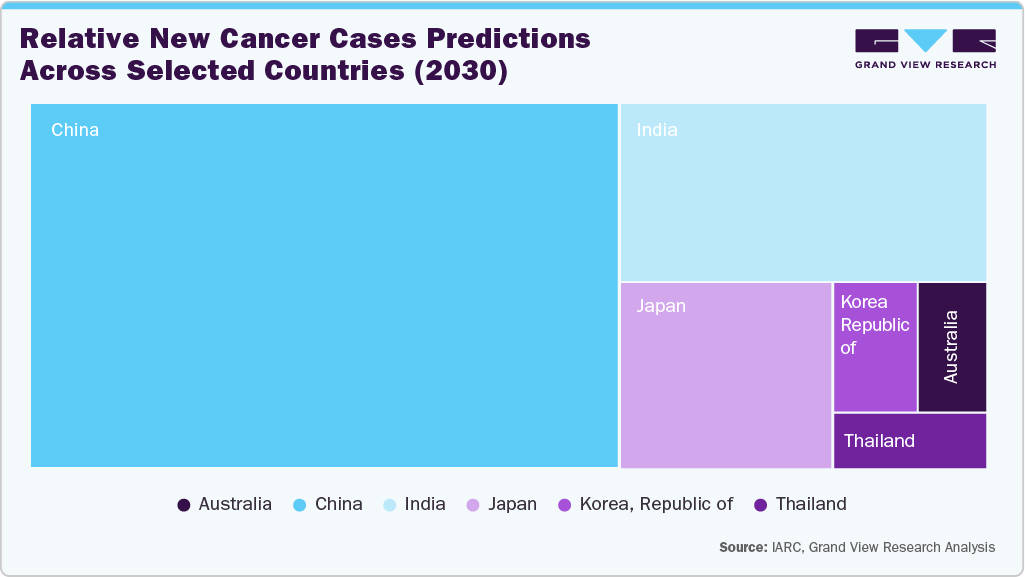

The syringes market in Asia Pacific is projected to witness the fastest growth during the forecast period, driven by several key factors. Numerous manufacturers' presence and supportive government regulations for syringe production foster market expansion. Furthermore, the rising incidence of chronic and infectious diseases-particularly in countries like China, India, and Japan-is significantly increasing the demand for syringes across the region.

India syringes market is experiencing strong growth, driven by numerous domestic and international manufacturers, ongoing innovations in syringe technology, and strong government-led vaccination initiatives. The growing aging population and rising prevalence of chronic diseases further contribute to increased syringe demand. According to India’s Minister of Finance and Corporate Affairs, over 2.2 billion vaccine doses were administered under the COVID-19 vaccination program until January 2023, reflecting the scale of syringe usage and ongoing demand in the healthcare sector.

The syringes market in Japan is experiencing continuous growth, driven by advanced healthcare infrastructure, a high aging population, and increasing demand for injectable treatments. The rising prevalence of chronic conditions such as kidney disease and cancer further fuels syringe usage, particularly in hospital and dialysis settings. Companies are launching novel products. For instance, in December 2023, KORSUV IV Injection Syringe was launched in Japan to treat pruritus in patients undergoing hemodialysis, highlighting the growing adoption of specialized injectable therapies and prefilled syringe formats in the country.

Latin America Syringes Market Trends

The syringes market in Latin America is driven by increasing healthcare expenditure, expanding vaccination programs, and rising prevalence of chronic and infectious diseases across the region. Growing awareness about safe injection practices and government initiatives to improve immunization coverage also contribute to market growth. For instance, in 2024, Brazil launched a nationwide campaign to increase COVID-19 vaccinations, resulting in a substantial surge in syringe demand. Moreover, expanding manufacturing capabilities and partnerships with global syringe producers further support the market’s expansion in Latin America. For instance, in April 2024, Moderna, Inc. signed a contract with Brazil’s Ministry of Health to supply its mRNA COVID-19 vaccine for its 2024 national vaccination campaign.

Middle East and Africa Syringes Market Trends

The syringes market in the Middle East and Africa is expected to experience steady growth, driven by increased healthcare investments, expanding vaccination programs, and heightened awareness of safe injection practices. Rising prevalence of chronic and infectious diseases and ongoing improvements in healthcare infrastructure further boost demand. Government initiatives to improve immunization coverage across the region also play a vital role in market expansion. For example, in July 2025, South Africa’s Department of Health announced a vaccination campaign against Mpox disease in response to a gradual rise in laboratory-confirmed cases..

Saudi Arabia syringes market is poised for strong growth, driven by a growing elderly population, rising healthcare awareness, and increasing adoption of advanced technologies like prefilled syringes. In addition, expanding private healthcare facilities and government support for pharmaceutical manufacturing contribute to market growth. The country’s efforts to combat infectious diseases and improve immunization coverage significantly boost syringe demand.

Key Syringes Company Insights

Companies are expanding their portfolios of syringes and increasing their manufacturing capacities to meet the growing demand. Moreover, industry players are also launching novel agents to gain a competitive advantage.

Key Syringes Companies:

The following are the leading companies in the syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Hindustan Syringes & Medical Devices Ltd

- Wuxi Yushou Medical Appliances Co., Ltd

- Nipro Europe Group Companies

- Abu Dhabi Medical Devices Company

- B. Braun SE

- BD

- Sharps Technology, Inc.

- Cardinal Health

- Vita Needle Company

- Terumo Europe NV

- Taisei Kako Ltd

- ulti med Products

- Henke Sass Wolf GmbH

- ITO CORPORATION

- Retractable Technologies, Inc.

- kohope.com

- Al Shifa Medical Products Co

- Liaoning Kangyi Medical Equipment Co., Ltd

- CANÈ SPA

- SMB Corporation of India

- Lifelong Meditech Private Limited.

- OSAKA CHEMICAL Co.,Ltd

- JMS Co.Ltd

- APEX MEDICAL DEVICES

- Cartel Health Care Pvt. Ltd

- VEM Tooling Co.,Ltd. (VEM Thailand Co. Ltd)

- Revital

- Fresenius Kabi Canada Ltd

- ICU Medical, Inc.

Recent Developments

-

In April 2025, Minister of Health Dr. Sabin Nsanzimana inaugurated TKMD Rwanda’s auto-disable syringe manufacturing plant in Rwamagana District. The WHO-prequalified facility produces up to 1 million 0.5ml syringes daily and supplies UNICEF, supporting immunization programs across Africa while reducing costs and delivery times.

-

In January 2025, BD committed over USD 10 million to expand syringe, needle, and IV catheter manufacturing in Nebraska and Connecticut, enhancing safety‑engineered syringe capacity by over 40% and conventional syringe output by more than 50%.

-

In December 2024, Gerresheimer AG significantly invested at its Skopje, North Macedonia facility-adding a 7,600 m² production hall dedicated to glass syringes, doubling staff to roughly 500, and consolidating plastic and glass syringe production on-site.

Syringes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.32 billion

Revenue forecast in 2033

USD 35.61 billion

Growth rate

CAGR of 8.66% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Design, usage, application, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hindustan Syringes & Medical Devices Ltd; Wuxi Yushou Medical Appliances Co., Ltd; Nipro Europe Group Companies; Abu Dhabi Medical Devices Company; B. Braun SE; BD; Sharps Technology, Inc.; Cardinal Health; Vita Needle Company; Terumo Europe NV; Taisei Kako Ltd; ulti med Products; Henke Sass Wolf GmbH; ITO CORPORATION; Retractable Technologies, Inc.; kohope.com; Al Shifa Medical Products Co; Liaoning Kangyi Medical Equipment Co., Ltd; CANÈ SPA; SMB Corporation of India; Lifelong Meditech Private Limited.; OSAKA CHEMICAL Co., Ltd; JMS Co. Ltd; APEX MEDICAL DEVICES; Cartel Health Care Pvt. Ltd; VEM Tooling Co.,Ltd. (VEM Thailand Co. Ltd); Revital; Fresenius Kabi Canada Ltd; ICU Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Syringes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global syringes market report based on design, usage, application, material, end use, and region:

-

Usage Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable Syringes

-

Reusable Syringes

-

-

Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional Syringes

-

Safety Syringes

-

Retractable Safety Syringes

-

Non-Retractable Safety Syringes

-

-

Prefilled Syringes (PFS)

-

Smart Syringes

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines and Immunizations

-

Anaphylaxis

-

Rheumatoid Arthritis

-

Diabetes

-

Autoimmune Diseases

-

Oncology

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic Syringes

-

Glass Syringes

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Tenders

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the syringes market include Revital , Wuxi Yushou Medical Appliances Co., Ltd., Hindustan Syringes & Medical Devices Ltd, Abu Dhabi Medical Devices Company, Nipro Europe Group Companies, Sharps Technology, Inc. , B. Braun SE, BD, Cardinal Health , Vita Needle Company, Terumo Europe NV, ulti med Products, SMB Corporation of India , Henke Sass Wolf GmbH, Cartel Health Care Pvt. Ltd¸ VEM Tooling Co.,Ltd. (VEM Thailand Co. Ltd), APEX MEDICAL DEVICES, JMS Co.Ltd, OSAKA CHEMICAL Co.,Ltd, Lifelong Meditech Private Limited, Liaoning Kangyi Medical Equipment Co., Ltd, kohope.com , Retractable Technologies, Inc., Taisei Kako Ltd, ITO CORPORATION, Al Shifa Medical Products Co , CANÈ SPA , Fresenius Kabi Canada Ltd, and ICU Medical, Inc.

b. Key factors driving the market's growth include the increasing burden of chronic disorders, the rising number of surgical procedures, and the growing number of hospitalizations.

b. The global syringes market size was estimated at USD 17.03 billion in 2024 and is expected to reach USD 18.32 billion in 2025.

b. The global syringes market is expected to witness a compound annual growth rate of 8.66% from 2025 to 2033 to reach USD 35.61 billion by 2033.

b. North America dominated the syringes market with a share of 41.73% in 2024. Increasing cases of chronic diseases, rising demand for technologically advanced medical products, and presence of major players in this region is expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.