Synthetic Small Molecule API Market Size, Share & Trends Analysis Report By Manufacturer (In-house, Outsourced), By Application (Oncology, Pulmonology, CNS, Endocrinology), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-976-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Synthetic Small Molecule API Market Trends

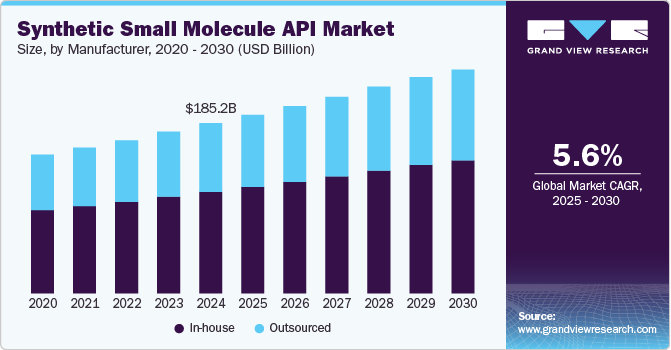

The global synthetic small molecule API market size was valued at USD 185.2 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The increasing demand for small molecule APIs and the growing trend of outsourcing production are major factors driving market growth. In addition, the expiration of patents for major drugs has further opened opportunities for new entrants. This has led to increased competition and market expansion.

Synthetic small molecules help develop various drugs to treat chronic diseases such as cancer and diabetes. According to information published by the World Health Organization, approximately 14% of adults aged 18 years and older had diabetes in 2022. The well-established manufacturing processes, efficacy, and ability of the small API molecules to target specific pathways in the human body are major factors driving their market demand.

In addition, the aging population worldwide, their susceptibility to diseases, and the increasing prevalence of lifestyle-related diseases continue to drive the demand for innovative and affordable solutions in both developed and emerging markets. According to the WHO statistics, the population of 60 years and above is expected to increase to 2.1 billion by 2050. This demographic shift has resulted in a growing need for effective treatments for age-associated and chronic conditions, likely boosting the demand for synthetic APIs in pharmaceutical production.

The expiration of patents for major drugs has created significant opportunities for the development of generic medications. According to a study conducted by the Department of Pharmaceuticals, Ministry of Chemicals & Fertilizers (Government of India), approximately 24 major drug patents are estimated to expire from 2022 to 2030. This shift is likely to create demand in the market and provide opportunities for new players to enter it.

Manufacturer Insights

The in-house segment accounted for the largest market share of 59.7% in 2024. Producing APIs in-house allows manufacturers to maintain strict oversight of the production process, ensuring compliance with regulatory standards and safeguarding technologies. Several key companies are also expanding their in-house production capacities to meet growing demand and capitalize on the benefits of vertically integrated operations, which further drive segment growth. For instance, in July 2024, Pfizer announced the expansion of its Active Pharmaceutical Ingredient (API) manufacturing facility, which is expected to focus on producing various small molecule APIs for its oncology, pain, and antibiotic medicines.

The outsourced segment is expected to grow at the fastest CAGR of 5.7% over the forecast period from 2025 to 2030. Outsourcing can help reduce operational costs, accelerate time-to-market, and focus on core activities such as drug discovery and marketing. CDMOs can offer advanced facilities, technical expertise, and regulatory compliance, which is likely to add to their increasing demand. In October 2024, Recipharm, a contract development and manufacturing organization, announced its expansion plans focusing on small molecule APIs. Such development activities are further likely to drive segment growth in the market.

Application Insights

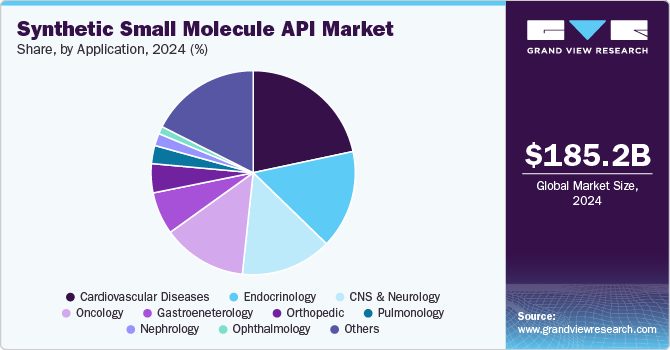

Cardiovascular diseases accounted for the largest market share of 21.7% in 2024 owing to their chronic nature and high global prevalence. As per the information published by the World Health Organization, cardiovascular diseases account for approximately 17.9 million deaths every year. Synthetic APIs are essential for widely used cardiovascular therapeutics. The expansion of the generic drug market, coupled with advancements in API synthesis that enhance efficacy and safety, is further likely to drive demand to make treatments more accessible, particularly in emerging markets.

Oncology is projected to grow at the fastest CAGR of 7.3% over the forecast period, owing to the rising global prevalence of cancer and the increasing demand for advanced and effective treatments. The increase in cancer cases, driven by aging populations, lifestyle changes, and environmental factors, has further led to significant investments in oncology drug research and development, which is likely to add to the growth of the synthetic small molecule API market.

Regional Insights

North America dominated the synthetic small molecule API market with the largest market share of 38.1% in 2024. The advanced pharmaceutical infrastructure, significant investments in research and development, and the presence of major pharmaceutical companies and contract manufacturing organizations (CMOs) in the region are major factors driving market growth.

U.S. Synthetic Small Molecule API Market Trends

The U.S. market accounted for a 91.8% share of the North America synthetic small molecule API market in 2024. The development of the pharmaceutical and biotechnology industries, extensive R&D activities, and a strong focus on innovation in the country are major drivers for market growth in the country. The strategy-making and development activities by the major players in the market are further expected to drive market growth in the country. For instance, in April 2022, Cambrex completed a USD 50 million expansion of its API manufacturing capabilities at its Iowa facility. The expansion is likely to increase the capacity of the API facility by 30%.

Europe Synthetic Small Molecule API Market Trends

The Europe synthetic small molecule API market is likely to grow significantly over the forecast period. The presence of established pharmaceutical hubs in the region, especially in countries such as Germany, Switzerland, and Italy, which focus on innovation and technological advancements, is driving the market growth in the region. In addition, the presence of a well-established regulatory framework, such as the European Medicines Agency, helps ensure the production of quality and safety of APIs. This further adds to the market growth.

The Germany synthetic small molecule API market accounted for the largest market share in 2024. The presence of key pharmaceutical companies such as Bayer, Merck & Co., Inc., and Boehringer Ingelheim International GmbH is driving the demand for small molecule API in the country. The strong focus on innovation, supported by significant investments in R&D, has further enabled the development of synthetic APIs for indications such as oncology, cardiovascular diseases, and rare disorders.

The UK synthetic small molecule API market is expected to grow significantly over the forecast period. The expansion of manufacturing and production facilities by different companies in the market is a major factor driving market demand. For instance, in August 2024, Sai Life Sciences announced the expansion of the research and development (R&D) laboratory in the Manchester site, UK, which operates as a center of excellence for the active pharmaceutical ingredient (API) process.

Asia Pacific Synthetic Small Molecule API Market Trends

The Asia-Pacific region is expected to grow at the fastest CAGR of 6.6% over the forecast period. The growth of the pharmaceutical industry, especially in developing countries such as India and China, cost-effective manufacturing capabilities, and increasing healthcare demand are major drivers for the market growth in the region. In addition, the rising chronic disease prevalence, improving healthcare infrastructure, and increasing focus on preventive care are also adding to the growing market demand.

The China synthetic small molecule API market accounted for a significant market share in 2024. The growing manufacturing capacity and industrial growth in the country are major drivers for market growth. The country is home to numerous API producers and contract manufacturing organizations (CMOs) that supply domestic and international pharmaceutical companies. In addition, various healthcare initiatives, such as “Healthy China 2030", emphasize improving healthcare access and innovation, which is further adding to the API demand for chronic disease treatments and generics.

The India synthetic small molecule API market is expected to grow significantly owing to the increasing investment activities by local and global players to develop the pharmaceutical industry in the country. For instance, in August 2020, Ajinomoto Bio-Pharma Services announced the expansion of its small molecule manufacturing capabilities at its facility in India.

Key Synthetic Small Molecule API Company Insights

Some of the key companies operating in the Synthetic Small Molecule API market are Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, and Albemarle Corporation. These companies engage in strategic initiatives such as expansion, collaborations, and mergers and acquisitions to gain a higher market share.

-

Bristol-Myers Squibb Company (BMS) is a global biopharmaceutical company that focuses on discovering, developing, and delivering innovative medicines for the treatment of chronic diseases such as cancer and cardiovascular conditions. The company offers various small-molecule therapies, such as Opdivo (nivolumab) for cancer and other heart failure and blood disorders therapies.

-

AbbVie, Inc., is a global company that discovers, develops, and commercializes drugs for various chronic diseases, including immunology, oncology, neuroscience, and virology indications. The company also makes R&D investments and acquisitions to enhance its manufacturing capabilities.

Key Synthetic Small Molecule API Companies:

The following are the leading companies in the synthetic small molecule API market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Albemarle Corporation

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In October 2024, SK Pharmteco announced an investment of about USD 260 million to expand its global small molecule peptide production capabilities.

-

In February 2024, Bristol Myers Squibb Company announced opening its innovation hub in Hyderabad, India. This step is expected to help the company expand its global drug development, information technology, and digital capabilities.

-

In January 2024, WuXi AppTec. Expanded its manufacturing capabilities by opening new plants at its Changzhou facility and Taixing site. The peptide plant at Taixing is expected to facilitate the manufacturing of synthetic molecules.

Synthetic Small Molecule API Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 196.0 billion |

|

Revenue forecast in 2030 |

USD 257.4 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Manufacturer, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Albemarle Corporation, Boehringer Ingelheim International GmbH, Cipla, Inc., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Synthetic Small Molecule API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic small molecule API market report based on manufacturer, application, and region:

-

Manufacturer Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases

-

Oncology

-

CNS and Neurology

-

Orthopedic

-

Endocrinology

-

Pulmonology

-

Gastroenterology

-

Nephrology

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."