- Home

- »

- Homecare & Decor

- »

-

Synthetic Rope Market Size, Share And Growth Report, 2030GVR Report cover

![Synthetic Rope Market Size, Share & Trends Report]()

Synthetic Rope Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Polypropylene, Polyester, Nylon, PE, Specialty Fibers), By Application (Marine & Fishing, Oil & Gas, Industrial Construction), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-243-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Rope Market Summary

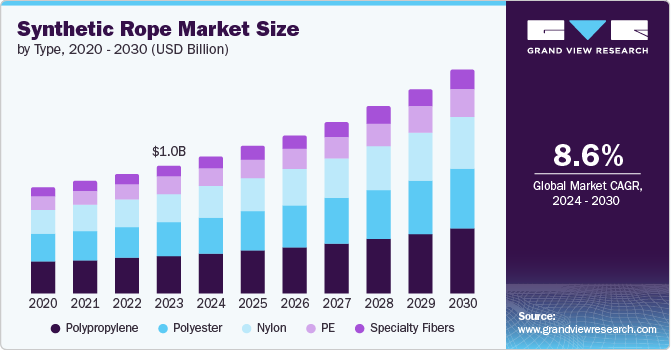

The global synthetic rope market size was valued at USD 1.02 billion in 2023 and is projected to reach USD 1.80 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. Superior properties associated with synthetic rope for industrial usage have led to prominent growth in the market.

Key Market Trends & Insights

- The synthetic rope market in Asia Pacific dominated the global market and accounted for a share of 70.6% in 2023.

- The China synthetic rope market held a substantial market share in 2023.

- By type, polypropylene segment accounted for a share of 29.5% in 2023.

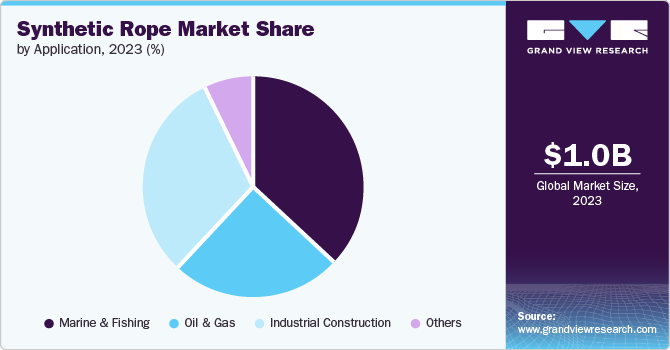

- By application, marine & fishing segment dominated the synthetic rope market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.02 Billion

- 2030 Projected Market Size: USD 1.80 Billion

- CAGR (2024-2030): 8.6%

- Asia Pacific: Largest market in 2023

Increased usage in different industries owing to its improved ability to handle heavy materials is attributed to the growing popularity of synthetic rope. In addition, these products exhibit properties including durable and lightweight as compared to conventional ones, which is expected to widen the product scope into different industries.

Rising displacement of hard fiber ropes with synthetic has advanced at a rapid scale in developed countries owing to the commercial utilization of polyolefin fiber. Industry faces a revolution of changes with the adoption of synthetic ropes. The synthetic rope market is also witnessing the replacement of traditional materials such as steel wire and nylon. In addition, wide application of these products in the maritime industry provides benefits in industrial operations. It provides benefits such as mooring, ship-assist, inland towing, and hoisting lines to exhibit properties such as strong, lightweight, floatable, and less susceptible to corrosion.

Type Insights

Polypropylene dominated the market and accounted for a share of 29.5% in 2023. Polypropylene rope is used in many different industrial applications due to its various advantages. Polypropylene rope offers high strength while remaining lightweight. This property makes them suitable for numerous application such as lifting, boating, securing loads. These ropes are highly water and chemical resistant which prevents degradation in harsh environments extending their lifespan and reliability. They also exhibit floating properties, and since it is easily able to be retrieved from water surface, it is an obvious choice to be used around water. Therefore, polypropylene rope made from synthetic materials is expected to witness significant growth owing to its vast usage over the forecast period.

Nylon is anticipated to witness the fastest CAGR during the forecast period. Nylon ropes are known for their high tensile strength, which allows them to withstand heavy loads and harsh environmental conditions. This strength makes them valuable in applications where reliability and safety are critical, such as marine, construction, and industrial settings. In addition, nylon ropes offer excellent resistance to water, chemicals, and UV rays, enhancing their durability and reliability. Their flexibility and elasticity contribute to their ability to absorb shocks and vibrations, making them suitable for various tasks, including industrial, construction, marine and oil & gas activity.

Application Insights

Marine & fishing dominated the synthetic rope market in 2023. Synthetic ropes are widely used in the marine, fishing, and shipment industries on account of its lightweight properties, reduction in knocking up and preparing for downtime, easy handling, floatable, and avoidance of re-lubing. These ropes assist with great insulation capacity, provide resistance in chemically affected environment, no absorption, and is made available in different forms and colors. Moreover, these products are used in the fishing industry as fishing nets and twines. These are used in trawling applications on account of better resistance to abrasion, high breaking strength, and high strength-to-weight ratio.

Industrial construction is expected to witness the fastest CAGR during the forecast period in 2023 owing to rising infrastructural developments and advancements in technologies. The rising infrastructure developments globally including, construction of bridges, roads, commercial buildings, and industrial facilities is likely to drive the demand for synthetic ropes. These ropes are increasingly preferred for their superior performance characteristics such as light weight, easier to transport and handle, chemical and erosion resistance, ability to absorb shocks and highly suitable for harsh environments.

Regional Insights

North America synthetic rope market was identified as lucrative in 2023. Growing awareness regarding safety aspects of synthetic ropes, increasing demand for oil & gas extraction activities, and increasing construction activities in the region are expected to propel the market growth.

Europe Synthetic Rope Market Trends

The synthetic rope market in Europe held a significant market share in 2023 owing to increasing application of synthetic ropes in fishing and maritime operations. Europe accounts 42% of coastal regions and around 40% of population lives in coastal areas in Europe. Moreover, Europe has a strong maritime tradition, with significance in shipping, fishing and offshore industries. The UK synthetic rope market accounted largest revenue share in 2023. The dominance can be attributed to the growing renewable energy sector and ongoing infrastructural development.

The Germany synthetic rope market is expected to witness the fastest CAGR during the forecast period, driven by maritime & fishing activity. Offshore and marine activities are the major end user of synthetic ropes in Germany as they are required for operations such as securing heavy loads, lifting and towing.

Asia Pacific Synthetic Market Trends

The synthetic rope market in Asia Pacific dominated the global market and accounted for a share of 70.6% in 2023, owing torapid urbanization, rising infrastructural and construction in emerging countries such as India, China, Indonesia, and Philippines. The rising population and increasing urbanization led to infrastructure development in emerging countries.

The China synthetic rope market held a substantial market share in 2023, owing to rise in infrastructural development and construction activities in the country. China is 2nd largest economy in the world. The rising infrastructural projects and rapid industrial growth is driving the demand for synthetic ropes in the nation.

The synthetic rope market in India is expected to witness significant growth during the forecast period, owing to rapid urbanization and rising development such as roads, buildings, bridges, business industries in country. India has very long coastline, measuring about 7,516.6 km including 9 coastal states, Bay of Bengal in the east, Indian ocean on the south and Arabian sea on the west, thus creating demand for synthetic ropes which are crucial in marine and fishing operations.

Key Synthetic Rope Company Insights

Some of the key companies in the synthetic rope market include Wireco World Group, TEUFELBERGER, Cortland Limited and others.

- WireCo offers innovative solutions for industrial, mining, energy, fishing, maritime and other sectors. The organization has various brands including Oliveira, that manufactures high-strength synthetic rope that can be used for the toughest application in various industries.

Key Synthetic Rope Companies:

The following are the leading companies in the synthetic rope market. These companies collectively hold the largest market share and dictate industry trends.

- WireCo WorldGroup

- Cortland Limited

- Bridon-Bekaert

- Southern Ropes

- MAGENTO, INC.

- Marlow Ropes

- TEUFELBERGER

- Yale Cordage

- LANEX a.s.

Recent Developments

-

In May 2024, WireCo announced a collaboration with Lankhorst Ropes (one of the Wireco’s brands) and Sensor Technologies, maritime technology solutions provider. They unveiled “Sureline Systems,” a product to drive maritime operations in the coming years.

-

In May 2024, Baekaert announced the acquisition of BEXCO, a synthetic rope company for offshore energy production both renewable & conventional. The combination of BEXCO and Bekaert’s mooring activities is expected to create an offshore rope solutions provider to assist in the growth of offshore energy industry.

Synthetic Rope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.09 billion

Revenue forecast in 2030

USD 1.80 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia & New Zealand, Brazil, South Africa.

Key companies profiled

WireCo WorldGroup; Cortland Limited; Bridon-Bekaert; Southern Ropes; MAGENTO, INC.; Marlow Ropes; TEUFELBERGER; Yale Cordage; LANEX a.s.; Katradis Marine Ropes Ind. S.A.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Rope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic rope market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyester

-

Nylon

-

PE

-

Specialty Fibers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Marine & Fishing

-

Oil & Gas

-

Industrial Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.