Synthetic Dyes Market Size, Share & Trends Analysis Report By Product (Reactive Dyes, Vat Dyes, Acid Dyes), By End-use (Textile, Pulp & Paper) By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-354-8

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Synthetic Dyes Market Size & Trends

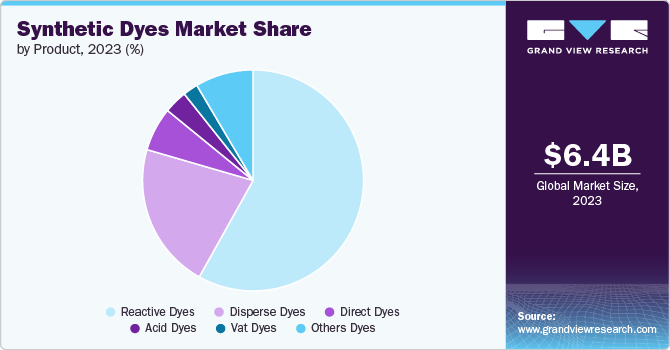

The global synthetic dyes market size was estimated at USD 6.35 billion in 2023 and is projected to reach at a CAGR of 6.8% from 2024 to 2030, owing to its rising consumption across various industries, including textiles, plastics, printing inks, and paints. The growth of the digital printing industry and increasing demand for high-performance pigments drive the product demand globally. Synthetic dyes are favored for their wide range of colors, affordability, and extended shelf life, making them popular choices across various applications. Furthermore, heightened demand from the packaging sector and the increasing need for advanced pigments are expected to propel the product demand worldwide.

In addition, the growing use of plastics in various applications, such as packaging, consumer goods, and construction, has increased product demand. The versatility of plastics has expanded the range of applications for the product. For example, color-stable products are used to produce colored plastic products, such as toys, household items, and automotive parts. The use of specialized products can enhance the performance of plastic products, such as UV stability, weather resistance, and flame resistance. Moreover, the demand for innovative and high-quality plastic products is driving the development of new products, resulting in increased opportunities for the product market.

The global product market is forecasted to grow positively during the forecast period. Despite their increasing demand and growth of the end-use industries, the market growth is expected to be hindered by stringent government regulations.Factors such as high-water consumption in the textile industry to rinse dye, solubility of the product, high metal content in pigments, and water pollution during the manufacturing process are the major environmental threats caused by the product market

End-use Insights

The textile segment dominated the market with a revenue share of 62.9% in 2023.The product is used in the textile industry to color fibers, fabrics, and garments. They are applied during the manufacturing process to impart color to the final product.

Different products are used for different types of fibers, such as natural fibers (e.g. cotton, wool) or synthetic fibers (e.g. polyester), and the choice of dye depends on factors such as the fiber type, desired color intensity, and fastness to light and washing. The product can be applied using various methods, including dipping, padding, spraying, and printing.

In printing inks, the product is used as colorants to produce bright and vivid prints. The product is suspended in a liquid carrier, usually a solvent, to create an ink that can be transferred to a substrate such as paper or fabric. The ink adheres to the substrate and the solvent evaporates, leaving behind a brightly colored print. The type of product used can affect the quality of the print and the longevity of the ink, with some products being more resistant to fading than others.

The product is used in the leather industry to color leather and make it more attractive. The product is applied to the surface of the leather using various techniques such as dipping, padding, spray, or brush. Different types of products such as aniline, pigmented, or metallic can be used, depending on the desired effect and the type of leather being used. The dyes penetrate the leather fibers, providing long-lasting color and resistance to fading.

Product Insights

The reactive type of the product dominated the market with a revenue share of 58.1% in 2023. It is a synthetic product used for coloring textiles, specifically for cellulosic fibers like cotton and rayon. They are called "reactive" because they react chemically with the fibers, forming covalent bonds and producing a permanent color. These products are considered one of the best quality products for cellulosic fibers, as they produce bright and intense colors that are resistant to fading and washing.

Disperse type of the product is used to color synthetic fibers such as polyester, nylon, and acrylic. They are water-insoluble and must be dispersed in the form of very fine particles to color the fabric. They are commonly used in the textile industry due to their bright colors and good colorfastness. Disperse type of the product can also be applied using heat transfer printing, which is a digital printing process.

Regional Insights

The North America synthetic dyes market is expected to grow at a significant share from 2024 to 2030. The demand for specialty and high-performance products, such as UV-resistant and heat-resistant pigments, is growing in this region, driven by their increasing use in industries such as automotive, packaging, and construction.

Asia Pacific Synthetic Dyes Market Trends

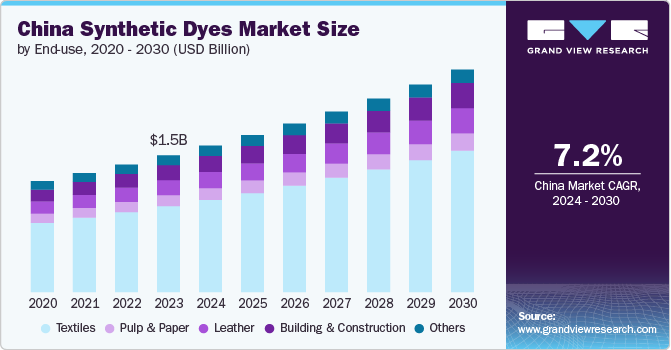

The synthetic dyes market in Asia Pacific dominated the market with a revenue share of 70.5% in 2023. Asia Pacific is a key region in terms of textile production, and thus, it held the highest share in the global product market. Factors such as robust demand, policy support, increasing investments, and competitive advantage are driving the textile industry, especially in Asian countries, such as China which is further positively affecting the product market in the region.

China synthetic dyes market is the largest textile producer in the world, accounting for around 36% of global textile production in 2023 as per International Institute for Sustainable Development, Other major textile producers include India, Bangladesh, and Vietnam.

The synthetic dyes market in India is anticipated to expand at a CAGR of 10%, reaching an estimated USD 350 billion by 2030 as per India Brand Equity Foundation (IBEF). India currently stands as the world's third-largest exporter of textiles and apparel. As the textile industry continues to develop, it is expected to stimulate domestic demand for the product market in the country.

Europe Synthetic Dyes Market Trends

The Europe synthetic dyes market is growing, driven by the increasing demand for high-quality, colorfast products in the packaging industry. This has fueled the need for superior pigments in printing and packaging applications. The automotive sector is also driving demand for high-performance products that can withstand harsh conditions and maintain color stability. The use of cutting-edge technologies like nanotechnology and biotechnology in the production of products is boosting product performance and improving production efficiency.

Key Synthetic Dyes Company Insights

Some of the key players operating in the market include Huntsman International LLC, BASF SE, LANXESS, SHAH INDUSTRIES, KIWA Chemical Industry Co., Ltd, Kiri Industries Ltd., Archroma, Atul Ltd and The Chemours Company among others.

-

Huntsman International LLC is a multinational chemical manufacturing company that produces a variety of chemical products such as polyurethanes, performance products, and advanced materials. The Company operates in more than 100 countries with production facilities in 69 countries. The dyes and pigments segment of the company offers high-performance products for a wide range of industries, including textiles, coatings, plastics, and graphic arts.

-

Lanxess is manufacturer and distributor for additives, chemical intermediates, plastics, and specialty chemicals. It currently operates through three major business segments, namely the performance polymers segment, the advanced intermediates segment, and the performance chemicals segment.

Key Synthetic Dyes Companies:

The following are the leading companies in the synthetic dyes market. These companies collectively hold the largest market share and dictate industry trends.

- Huntsman International LLC

- BASF SE

- LANXESS

- SHAH INDUSTRIES

- KIWA Chemical Industry Co., Ltd

- Kiri Industries Ltd.

- Archroma

- Atul Ltd

- The Chemours Company

Recent Developments

-

In March 2022, the global chemical company, Archroma developed and launched two new acid dyes which are metal and halogen-free.

-

In October 2023, The Center for Science in the Public Interest reported that the carcinogenic food dye Red 3 is banned in California. This landmark legislation also includes provisions to phase out the use of brominated vegetable oil, potassium bromate, and propylparaben by the year 2027.

Synthetic Dyes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.78 billion |

|

Revenue forecast in 2030 |

USD 10.06 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

Huntsman International LLC; BASF SE; LANXESS SHAH INDUSTRIES; KIWA Chemical Industry Co., Ltd; Kiri Industries Ltd.; Archroma, Atul Ltd; The Chemours Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Synthetic Dyes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic dyes market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reactive Dyes

-

Vat Dyes

-

Acid Dyes

-

Direct Dyes

-

Disperse Dyes

-

Other dyes

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Textiles

-

Pulp & Paper

-

Leather

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global synthetic dyes market size was estimated at USD 6.35 billion in 2023 and is expected to reach USD 6.78 billion in 2024.

b. The global synthetic dyes market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 10.06 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 70.5% in 2023. Asia Pacific is a key region in terms of textile production, and thus, it held the highest share in the global product market.

b. Some key players operating in the synthetic dyes market include Huntsman International LLC, BASF SE, LANXESS, SHAH INDUSTRIES, KIWA Chemical Industry Co., Ltd, Kiri Industries Ltd., Archroma, Atul Ltd, The Chemours Company

b. Key factors that are driving the market growth include its rising consumption across various industries, including textiles, plastics, printing inks, and paints.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."