- Home

- »

- Next Generation Technologies

- »

-

Synthetic Aperture Radar Market Size & Share Report, 2030GVR Report cover

![Synthetic Aperture Radar Market Size, Share & Trends Report]()

Synthetic Aperture Radar Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Receiver, Transmitter, Antenna), By Platform, By Frequency Band, By Mode, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-899-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Aperture Radar Market Summary

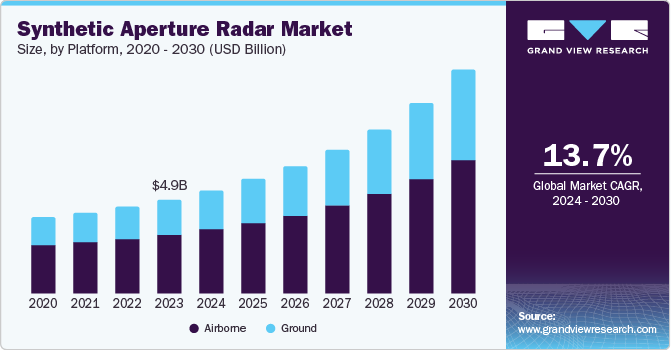

The global synthetic aperture radar market size was estimated at USD 4.91 billion in 2023 and is projected to reach USD 11.63 billion by 2030, growing at a CAGR of 22.01% from 2024 to 2030. This market's growth is primarily influenced by its large-scale application in environmental monitoring and earth observation, extensive use by the military and defense, and technological advancements leading to enhanced abilities.

Key Market Trends & Insights

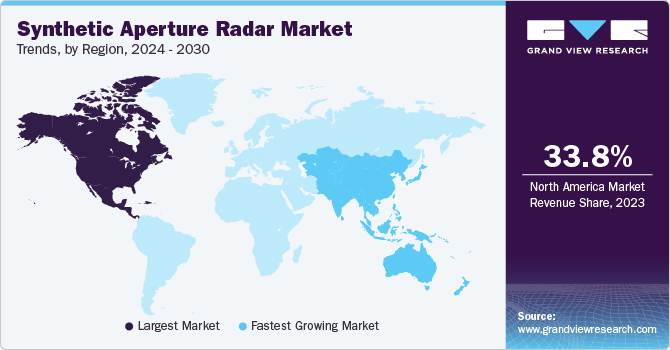

- North America synthetic aperture radar market dominated the global market and accounted for 33.8% in 2023.

- The U.S. synthetic aperture radar market held the largest revenue share of the regional industry in 2023.

- Based on components, the receivers segment dominated the global market at 37.6% in 2023.

- By platform, The airborne segment dominated the market in 2023.

- Based on the frequency band, the X band segment accounted for the largest revenue share of the industry in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.91 Billion

- 2030 Projected Market Size: USD 11.63 Billion

- CAGR (2024-2030): 13.7%

- North America: Largest market in 2023

Space administration & earth observation industry participants and government agencies working primarily on weather monitoring, geographical mapping, and meteorology prefer synthetic aperture radars for their extraordinary ability to deliver high-resolution images through day and night with the lowest attenuation in weather changes. For instance, in July 2024, NASA, The National Aeronautics and Space Administration agency of the U.S. Federal government, announced that its work on NISAR (NASA-ISRO Synthetic Aperture Radar) is nearing completion. NISAR (NASA-ISRO Synthetic Aperture Radar) is a joint earth-observation mission of the Indian Space Research Organization and NASA primarily aimed at agricultural monitoring and characterization, the study of Himalayan glaciers, landslides, coastal processes, coastal winds, soil moisture, etc., and monitoring hazards.

As every continent is impacted each year by events rooted in climate changes and global warming, technological superiority offered by Synthetic Aperture Radar (SAR) in tracking, monitoring, and predicting large weather change consequences such as floods, rain-triggered landfalls, and others is expected to drive growth for this market. Unlike other technologies, such as optical remote sensing, Synthetic Aperture Radar (SAR) can operate under extreme environmental conditions while penetrating through cloud covers to provide two-dimensional (2-D) images. These dimensions comprise range (cross-track) and azimuth (or along the track). SAR's ability to present comparatively fine azimuth resolution distinguishes it from others.

Ongoing research & development activities by organizations and institutions, innovation by key companies, and collaboration & partnerships of major market participants with government agencies are expected to drive the growth of this market. For instance, in November 2023, EDGE PJSC Group, one of the prominent organizations in the advanced technology and defense industry, signed a Memorandum of Understanding (MoU) with the UAE Space Agency to implement the Sirb program, which comprises an assemblage of three SAR satellites. EDGE is set to play the role of a primary contractor with a primary focus on Synthetic Aperture Radar (SAR) payload development.

Component Insights

Based on components, the receivers segment dominated the global market at 37.6% in 2023. The receiver is a key component of the SARs as it is mainly used in active imaging function, which creates images of the ground through sending signals and detecting backscattered waves. Innovations such as integrated receivers, which combine RF front ends with analog baseband chains and Analog-to-Digital Converters (ADCs), are expected to enhance the precision of the feature provided by SARs. Numerous initiatives by authorities and organizations associated with monitoring and tracking deforestation and observation of natural disasters such as floods and landslides to prevent loss of life or similar complications are expected to fuel demand for SAR receivers.

The transmitter segment is expected to experience the fastest CAGR during the forecast period. Technological advancements, such as the use of solid-state transmitters and the increasing application of SARs in various sectors, including military and defense, earth mapping, and civil infrastructure safety and management, mainly drive the growth of this segment. Synthetic aperture radars are also extensively used in the geology industry to explore and monitor terrains.

Platform Insights

The airborne segment dominated the market in 2023. This is attributed to the versatility feature offered by the platform, which allows user industries and organizations to utilize the SAR systems for various purposes such as military surveillance, monitoring environmental changes, earth observations, terrain monitoring, safety and security of urban infrastructures, monitoring critical infrastructure sites such as dams, gas pipelines, electricity grids and more. High spatial resolution and performance capabilities with less susceptibility to attenuations caused by weather fluctuations, innovations, and enhancements in signal processing technology are expected to fuel the growth of this market during the forecast period.

The ground based synthetic aperture radar (GB-SAR) segment is projected to witness the fastest CAGR from 2024 to 2030. These radars operate with similar principles as airborne radars, however with an extension of radar antenna that is mounted on a ground-based track or a linear rail. Advantages offered by the GB-SAR systems include cost effectiveness, flexibility, continuous monitoring to generate imagery in regular intervals, and more.

Frequency Band Insights

Based on the frequency band, the X band segment accounted for the largest revenue share of the industry in 2023. The X band radars operate at an 8-12 GHz frequency range, mainly to assist institutes, government agencies, organizations, and enterprises with precipitation measurements and monitor land subsidence. Its bandwidth ranges from 500 MHz up to 700 MHz. Innovations such as digital beamforming are developing a growing demand for the X band SARs. The emergence and use of TanDEM-X satellites equipped with solid-state mass memory (SSMM) have also contributed to growth.

The VHF/UHF band segment is anticipated to experience the fastest CAGR from 2024 to 2030. This is attributed to the extensive use of VHF in wide area surveillance, automated stationary artificial targets detection, and the ability to deliver high-resolution imagery by penetrating through potential barriers, including vegetation, foliage, and others. The military and defense industry uses synthetic aperture radars operating at Ultra High Frequency (UHF) and Very High Frequency (VHF) bands for effective communications with land forces and airborne deployments.

Mode Insights

The single mode segment accounted for the largest revenue share in 2023. The single mode SAR, or Stripmap (SM) mode, is commonly used to discover imagery of predetermined continuous paths or land. This develops a large strip of imagery with a 5 m by 5 m resolution. The mode is often utilized in urban infrastructure management, flood monitoring, crop assessments, oil spillage detection and tracking, rapid response assistance, surveillance, and more. It is also utilized by security forces and law enforcement agencies to monitor shipping routes continuously to prevent smuggling, fishing in unauthorized areas, and more.

The multimode synthetic aperture radar segment is projected to experience the fastest CAGR during forecast period. The multimode systems enhance the overall capacities of traditional SARs through integration of multiple operational modes. This empowers SARs with versatility, diverse data collection abilities, and expedited real time processing capabilities. Different modes include Stripmap, spotlight, Interferometric Wide Swath (IW), Extra Wide Swath (EW), wave and others.

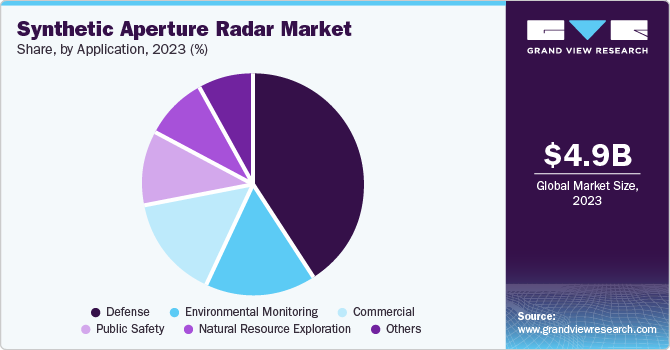

Application Insights

Based on application, the defense segment accounted for the largest revenue share of the global market in 2023. As tensions across multiple national borders rise and threats regarding internal security grow rapidly, numerous defense ministries have been deploying synthetic aperture radars for enhanced security, terrain monitoring, and border observations. The SARs have become one of the significant aspects of surveillance, reconnaissance, and intelligence in the defense industry. Recent innovations and capacity enhancements have improved the resolution and imaging capabilities of SARs. In addition, its integration with modern technologies such as Artificial intelligence and machine learning has enabled defense forces to monitor targets in real-time.

The natural resource exploration segment is projected to experience the fastest CAGR from 2024 to 2030. This is attributed to factors such as growing advancements in SAR technology used in earth observations and land explorations. The ability of SARs to penetrate clouds, vegetation, and foliage when necessary is driving its increasing applications in this segment.

Regional Insights

North America synthetic aperture radar market dominated the global market and accounted for 33.8% in 2023. This is attributed to the factors such as the presence of multiple manufacturers and vendors from radar development industry in the region, growing demand from space administration and earth monitoring industries, rising inclusion of SARs in terrain monitoring, surveillance, and related functions.

U.S. Synthetic Aperture Radar Market

The U.S. synthetic aperture radar market held the largest revenue share of the regional industry in 2023. This market is primarily driven by the presence of numerous key companies in the country such as Lockheed Martin Corporation, Northrop Grumman, and others. The growing demand from defense sector for surveillance, monitoring, airborne earth observation, and effective communication is contributing to the growth of this market.

Europe Synthetic Aperture Radar Market Trends

Europe is identified as a significant region for the global synthetic aperture radar market in 2023. Growth of this market is mainly driven by the aspects such as increasing demand from earth observation, space administration and surveillance & monitoring sector. The use of SAR technology by defense, weather monitoring, geology and meteorology industry is expected to fuel demand for this market during the forecast period.

Germany synthetic aperture market held significant revenue share of the regional industry. This is attributed to the presence of SAR technology in defense monitoring and surveillance networks. In addition, use to track and monitor precipitation, identify changes in weather condition, and for Disaster Risk Management (DRM) is likely to influence growth of this market.

Asia Pacific Synthetic Aperture Radar Market Trends

The Asia Pacific synthetic aperture radar market is anticipated to experience the fastest CAGR from 2024 to 2030. The technology advancements in countries such as India, Japan, China and others, growing application in weather monitoring & earth observations, rising inclusion in defense communication systems and use in space administration by federal space agencies in the region influence this market.

India synthetic aperture radar market held substantial revenue share of the regional industry in 2023. This is attributed to defense modernization, heavy investments in upgrading surveillance and monitoring capabilities, rising use in disaster management and rapid response assistance, and innovations such as dual-band SAR systems.

Key Synthetic Aperture Radar Company Insights

Some of the key companies involved in the synthetic aperture radar market include Lockheed Martin Corporation, AIRBUS, L3Harris Technologies, Inc., BAE Systems, Northrop Grumman, and others. To address growing application in various industries and rising demand for SAR technology, key market participants in the industry are adopting strategies such as innovation, new product developments, enhanced research & development efforts, and more.

-

Lockheed Martin Corporation, a key defense industry participant with a massive global footprint covering more than 300 locations and facilities, offers TRACER, dual-band (UHF/VHF), lightweight SAR, Pilotage Distributed Aperture Sensors(PDAS), and others.

-

Northrop Grumman, a major market player in aerospace and defense, offers range of products for precision surveillance and monitoring including AN/ZPY-1 STARLite Small Tactical Radar, Trinidad, AN/ASQ-236 Dragon's Eye Radar Pod and more.

Key Synthetic Aperture Radar Companies:

The following are the leading companies in the synthetic aperture radar market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- AIRBUS

- SDT Space & Defence Technologies Inc.

- BAE Systems

- General Atomics

- L3Harris Technologies, Inc.

- IMSAR LLC

- IAI

- Maxar Technologies

- Metasensing

- Northrop Grumman

- Saab

- SRC Inc.

Recent Developments

- In August 2024, ICEYE, a microsatellite manufacturer and earth observation expert, successfully deployed four new synthetic aperture radar (SAR) satellites. The launch of these four satellites adds further capabilities to the company's largest SAR constellation.

Synthetic Aperture Radar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.39 billion

Revenue Forecast in 2030

USD 11.63 billion

Growth rate

CAGR of 13.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, platform, frequency band, mode, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan,China, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Lockheed Martin Corporation; AIRBUS; SDT Space & Defence Technologies Inc.; BAE Systems; General Atomics; L3Harris Technologies, Inc.; IMSAR LLC; IAI; Maxar Technologies; Metasensing; Northrop Grumman; Saab; SRC Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Aperture Radar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the synthetic aperture radar market report based on component, platform, frequency band, mode, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Receiver

-

Transmitter

-

Antenna

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground

-

Airborne

-

-

Frequency Band Outlook (Revenue, USD Million, 2018 - 2030)

-

X Band

-

L Band

-

C Band

-

S Band

-

K, Ku, Ka Band

-

VHF/UHF Band

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Single

-

Multi

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

Commercial

-

Public Safety

-

Environmental Monitoring

-

Natural Resource Exploration

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.