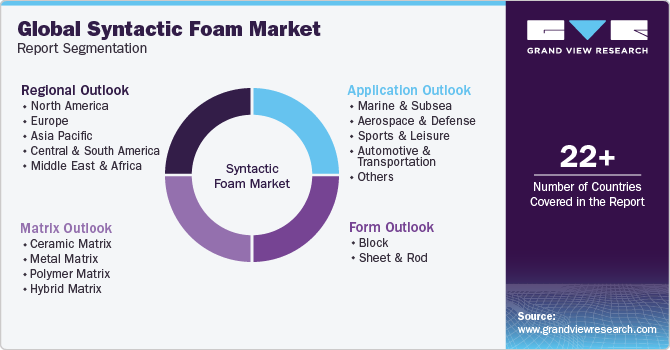

Syntactic Foam Market Size, Share & Trends Analysis Report By Matrix (Ceramic Matrix, Metal Matrix, Polymer Matrix, Hybrid Matrix), By Form (Block, Sheet & Rod), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Syntactic Foam Market Size & Trends

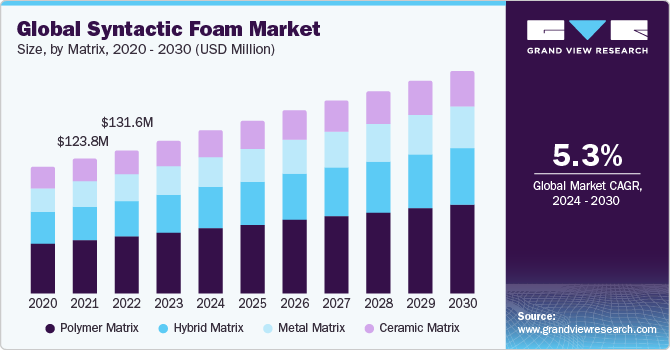

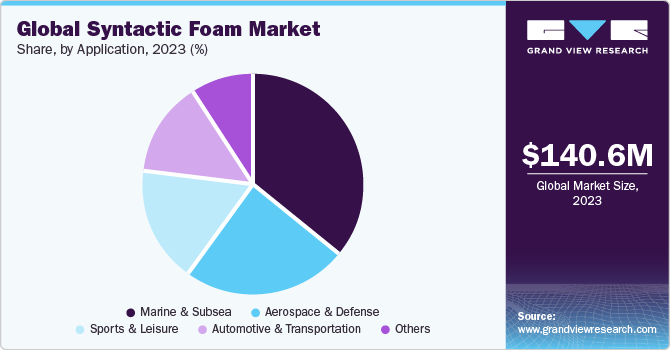

The global syntactic foam market size was estimated at USD 140.58 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The market has witnessed significant growth, due to increased activity in ultra and deep-sea environments accounting to its superior properties such as high specific strength and low coefficient of thermal expansion. With readily available onshore oil and gas reserves rapidly depleting, major oil and gas companies are gradually increasing investments in offshore exploration and production (E&P) platform development. Increasing investments in ultra-deep-water exploration and production (E&P) are expected to create significant demand for pipe insulation and buoyancy modules and hence demand for syntactic foam during the forecast period.

Syntactic Foams are widely used in marine and subsea applications due to their buoyancy and low moisture absorption. They are used in the production of underwater vehicles, spacecraft, pipe insulation, boat hulls, and others. The rapidly growing consumption of syntactic foam in the marine and offshore industries. The subsea industry provides a huge market opportunity to the key players operating in the global market.

One of the major challenges faced by the market includes the fluctuation in raw material prices. Syntactic foam is a composite material that is made by filling a polymer, ceramic, or metal with preformed hollow glass or ceramic spheres. Raw material costs, synthesis procedures, and specific production techniques are expected to impact the cost of the material, thus restraining the market growth.

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include Trelleborg AB, SynFoam, Diab International AB, Acoustic Polymers Limited, Advanced Insulation, and Deepwater Buoyancy, among others. Several players are engaged in framework development to improve their market share.

Regulatory measures and policies aimed at reducing plastic pollution and promoting a circular economy contribute to the growth on syntactic foam adoption in buoyancy applications. Syntactic foams comprise of a resin matrix and hollow glass spheres, are one of the viable solutions for structures requiring both improved structural and thermal insulation properties. Governments and environmental agencies worldwide are implementing measures to reduce the plastic weight, owing to the rise in carbon emissions, is likely to boost the demand for syntactic foams.

Growing demand for lightweight materials is boosting the market growth. However, the abundance presence of traditional resin based foam along with the low costs of traditional foam is likely to hamper the adoption of syntactic foam.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for syntactic foam in several industries including marine and subsea, aerospace and defense, and sports.

Matrix Insights

Based on matrix, the polymer segment led the market with the largest revenue share of 39.85% in 2023, due to the widespread adoption of polymer matrix in marine and subsea applications. Polymer matrix offers several characteristics including abrasion resistance, wear resistance, low density, high strength, high stiffness, high fracture resistance, impact resistance, corrosion resistance, and high fatigue resistance.

Moreover, with the development of various lightweight and high performance aircraft that are driving the market for polymer matrices. Various industries are planning to improve the performance of materials at minimal cost, which is driving the market growth.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period, due to its superior mechanical strength and gradual adoption in the aerospace and defense industries.

Form Insights

Based on foam, the block segment led the market with a substantial revenue share of 51.85%, in 2023. With the widespread use of buoyancy modules in designs used in the offshore and offshore drilling industries, the block segment has dominated the global market.

The sheet & rod form segment is projected to grow at a significant CAGR of 5.1% over the forecast period, as they can be easily machined using standard tools and is a lightweight, durable and economical alternative to wood, aluminum and Delrin. Syntactic sheet & rod foam offers high durability and toughness, and are easy to machine and polish.

Application Insights

In terms of application, the marine & subsea segment led the market with the largest revenue share of 36.38% in 2023. Due to their ability to withstand exceptionally high hydrostatic pressure and corrosion caused by seawater, synthetic foams are often used in a wide range of marine and subsea applications.

The aerospace segment is anticipated to grow at a substantial CAGR of 5.4% during the forecast period. The growing adoption of composites in various aerospace components is expected to be a key factor driving the segment's growth. Rising production of aircrafts in major developed economies including the U.S., Germany, and Japan is expected to boost the market growth.

Regional Insights

North America dominated the syntactic foam market with largest revenue share of 34.16% in 2023. The market is also expected to grow at a significant CAGR over the forecast period. The rising need for high-performance lightweight materials in the aerospace and marine industries is propelling the expansion of the North American market.

U.S. Syntactic Foam Market Trends

The syntactic foam market in U.S. is expected to grow at the fastest CAGR over the forecast period. The main driver of market growth was a significant increase in investment by the largest American oil and gas companies in the construction of deepwater and ultra-deepwater drilling and production capacities.

Asia Pacific Syntactic Foam Market Trends

The syntactic foam market in Asia Pacific accounted for the revenue share of over 22% in 2023, and is also expected to grow at the significant CAGR over the forecast period. Asia-Pacific countries, particularly China, Japan, and India, have made considerable investments in their marine & subsea, and aerospace industries. The rapid development and manufacturing of high performing components, along with the rising activities of shipments and trading is expected to create consumption and production demand for syntactic foam in marine and subsea application.

The China syntactic foam market held a significant share in the Asia Pacific region. The market is anticipated to register at a fastest CAGR of 5.5% over the forecast period. Significant increase in offshore exploration and production in the South China Sea coupled with rapid growth of the aerospace and defense industry in the region is expected to propel the market growth during the forecast period.

Europe Syntactic Foam Market Trends

The syntactic foam market in Europe is expected to witness at the fastest CAGR over the forecast period. The majority of offshore exploration and production assets in Europe are located in the North Sea. These offshore applications require highly effective insulation of deep-sea pipes and buoyancy modules that can withstand the challenging environmental conditions of the surrounding area. This is expected to drive the market growth across the region.

The Germany syntactic foam market held a significant share in Europe. The market is anticipated to register at the fastest CAGR of 5.9% over the forecast period. Germany is well-known for its research institutions, universities, and corporations specializing in materials science, polymer chemistry, and innovative manufacturing technology. The rise in R&D activities across the country in the production of high-performance materials is expected to propel the market growth.

Central & South America Syntactic Foam Market Trends

The syntactic foam market in Central & South America is expected to witness at a significant CAGR over the forecast period. Central and South American governments are investing in infrastructure development projects, such as transportation, shipments and aerospace developments. These factors are likely to boost the market growth over the forecast period.

Middle East & Africa Syntactic Foam Market Trends

The syntactic foam market in Middle East & Africa is expected to witness at a significant CAGR over the forecast period. Several factors influence the market growth in the Middle East and Africa (MEA) region, including industrialization, economic expansion, technological advancements, and market dynamics.

Key Syntactic Foam Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Syntactic Foam Companies:

The following are the leading companies in the syntactic foam market. These companies collectively hold the largest market share and dictate industry trends.

- Trelleborg AB

- SynFoam

- Diab International AB

- Acoustic Polymers Limited

- Advanced Insulation

- Deepwater Buoyancy

- CMT Materials

- Acoustic Polymers Limited

- Engineered Syntactic Systems

- Balmoral Comtec Ltd

Recent Developments

-

In February 2023, Globe Composite Solutions, a subsidiary of ESCO Technologies Inc. announced the acquisition of CMT Materials, LLC and its affiliate Engineered Syntactic Systems, LLC (CMT). CMT, based in Attleboro, Massachusetts. They are experts in the design and manufacture of customized syntactic foam components and systems that are used in industrial, oceanographic, military and naval applications

Syntactic Foam Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 149.82 million |

|

Revenue forecast in 2030 |

USD 204.23 million |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Matrix, form, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

|

Key companies profiled |

Trelleborg AB; SynFoam; Diab International AB; Acoustic Polymers Limited; Advanced Insulation; Deepwater Buoyancy; CMT Materials; Acoustic Polymers Limited; Engineered Syntactic Systems; Balmoral Comtec Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Syntactic Foam Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global syntactic foam market report based on matrix, form, application, and region:

-

Matrix Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ceramic Matrix

-

Metal Matrix

-

Polymer Matrix

-

Hybrid Matrix

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Block

-

Sheet & Rod

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Marine & Subsea

-

Aerospace & Defense

-

Sports & Leisure

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global syntactic foam market size was estimated at USD 140.58 million in 2023 and is expected to reach USD 149.82 million in 2024.

b. The global syntactic foam market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 204.23 million by 2030.

b. North America emerged as the largest regional segment and accounted for 34.16% of the market in 2023. The rising need for high-performance, lightweight materials in the aerospace and marine industries is propelling the expansion of the North American syntactic foam market.

b. Some of the key players operating in this industry include Trelleborg AB, SynFoam, Diab International AB, Acoustic Polymers Limited, Advanced Insulation, Deepwater Buoyancy, and CMT Materials, among others

b. The syntactic foam market has witnessed significant growth due to increased activity in ultra- and deep-sea environments accounting to its superior properties such as high specific strength and low coefficient of thermal expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."