- Home

- »

- Renewable Energy

- »

-

Syngas Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Syngas Market Size, Share & Trends Report]()

Syngas Market Size, Share & Trends Analysis Report By Production Technology (Steam Reforming, Partial Oxidation), By Feedstock (Natural Gas, Coal), By Gasifier Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-257-5

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Syngas Market Size & Trends

The global syngas market demand was estimated at 230.05 million Nm3/hr in 2023 and is expected to grow at a CAGR of 11.3% from 2024 to 2030. Rising demand for cleaner alternatives fuels is expected to drive market growth. Growing government support for clean energy initiatives, including tax credits and renewable portfolio standards, incentivizes investments in syngas technologies, fostering market expansion. In addition, stringent environmental regulations, such as the Clean Air Act and carbon emission reduction targets are driving demand for cleaner alternatives in various industries. Syngas can help industries in forming compliance with these regulations by offering a lower-emission fuel alternative.

Continuous advancements in gasification technologies are leading to more efficient syngas production processes, reducing costs and improving economic viability of syngas projects. Potential for utilizing waste-to-energy conversion technologies for syngas production offers a cost-effective solution for waste management while generating valuable energy.

Fluctuations in natural gas prices, which is a primary feedstock for syngas production, can impact economic competitiveness of syngas compared to other energy sources. However, technological advancements and exploration of alternative feedstock can help mitigate this dependence.

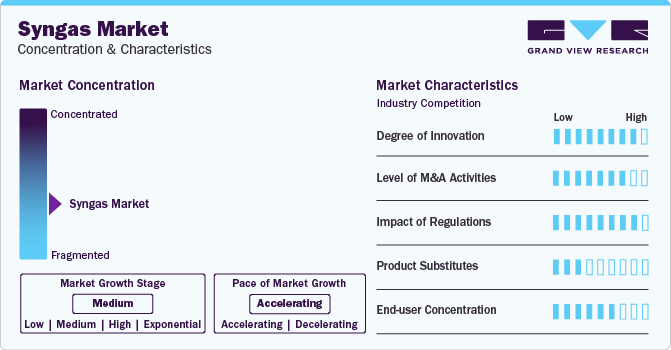

Market Concentration & Characteristics

Market is a dynamic and competitive space with established players and innovative new entrants vying for dominance. Furthermore, the industry is facing fierce competition from established players in various sectors. Leading market participants such as Sasol Limited, Haldor Topsoe, Air Liquide, and Air Products and Chemicals Inc. have been in industry for years now, boasting extensive experience and established customer base. They often specialize in specific applications, such as air liquide for methanol production. Startups and smaller companies are entering fray with innovative technologies and disruptive business models.

Companies are increasingly focusing on expansion of syngas facility in order to increase their foothold in market. For instance, in September 2023, BASF SE started construction of its syngas plant at the Verbund site in Zhanjiang, China. Plant is expected to commence with the operations by 2025. Facility will produce syngas and hydrogen for captive use within BASF’s production Verbund.

In June 2023, Uniper SE announced that it is planning to build syngas facility in Netherlands. Particular plant is in early development phase, and is expected to start its first phase in 2027. Facility is being built to utilize biomass and produces biogenic CO2, which is then further converted to syngas.

Production Technology Insights

Steam reforming emerged as the largest segment with a market share of nearly 48% in 2023 and is expected to witness robust growth over forecast period. Steam reforming is a widely used technology for producing syngas from various feedstock, including natural gas, biogas, and even coal. Process involves heating feedstock in a controlled environment with steam, typically at high temperatures ranging from 700°C to 1000°C. This reaction breaks down complex molecules in feedstock into simpler components like hydrogen, carbon monoxide, and carbon dioxide, forming syngas mixture.

Biomass gasification segment is anticipated to grow at the fastest rate over forecast period. This process involves thermochemical conversion of organic matter like wood chips, agricultural residues, and even municipal waste into a gaseous mixture primarily composed of hydrogen, carbon monoxide, and methane.

Feedstock Insights

Natural gas segment dominated market and accounted for largest market share of 46.5% in 2023. Natural gas serves as a crucial and widely utilized feedstock in syngas market, playing a pivotal role in production of synthesis gas. Methane, primary component of natural gas, undergoes a process known as steam methane reforming (SMR) to generate syngas. Given abundance and relatively low cost of natural gas, it has become a preferred feedstock for syngas production, offering a cost-effective and efficient means to meet growing demand for industrial gases and chemicals.

Biomass segment is projected to progress at the fastest CAGR of 15.0% over forecast period. Biomass, including agricultural residues, forestry waste, and dedicated energy crops, presents a promising alternative to traditional fossil fuels for syngas production.

Gasifier Type Insights

Fluidized bed segment dominated market and accounted for volume share of 59.3% in 2023. Segment is likely to consolidate its position over forecast period. Fluidized bed gasification is used for converting various feedstock, including biomass, coal, and waste materials, into syngas. Fluidized beds enable efficient conversion of feedstock into syngas with a good control over product gas composition. They can handle a wide range of feedstock qualities and sizes, making them adaptable to different project requirements. It operates at lower temperatures, resulting in reduced emissions of pollutants like nitrogen oxides and sulfur oxides. This characteristic aligns well with growing demand for cleaner energy solutions in syngas market.

Market for fixed bed gasifier type is anticipated to grow at the fastest rate over forecast period. Fixed bed gasifiers operate by passing feedstock, like biomass or coal, through a fixed bed of inert material while introducing an oxidizing agent (air, oxygen, or steam). Process generates a combustible gas mixture called syngas, containing hydrogen, carbon monoxide, and other gases.

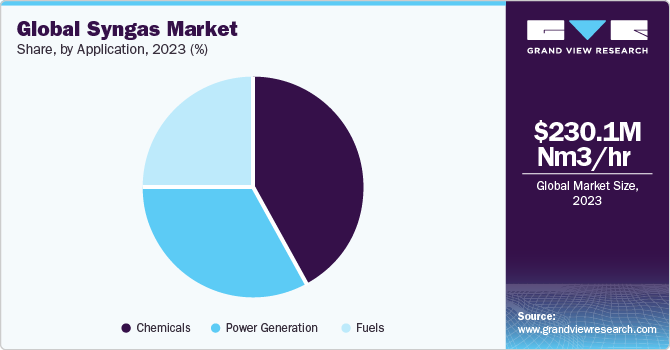

Application Insights

Chemicals segment dominated global market in terms of volume, accounting for a market share of more than 42.0% in 2023. Syngas serves as a valuable feedstock for producing various essential chemicals, including methanol, which is a versatile chemical used in production of plastics, formaldehyde, and various other chemicals. Ammonia is a crucial ingredient in fertilizers, explosives, and various industrial processes and acetic acid is used in production of solvents, paints, and pharmaceuticals.

Leading chemical producers like BASF, Dow, and DuPont are actively exploring syngas as a feedstock for manufacturing various chemicals. Their extensive experience in chemical production, established market presence, and research & development capabilities position them well to capitalize on growth opportunities in this segment.

Several innovative startups are developing and deploying novel syngas-to-chemicals technologies. These companies, such as LanzaTech, Syngaschem, and Carbon Engineering, are focusing on developing efficient and cost-effective processes for converting syngas into valuable chemicals like methanol, ethanol, and olefins. Their agility and focus on technological advancements can potentially disrupt traditional landscape in this segment. These factors are expected to spur syngas market potential in future.

Regional Insights

The North American syngas market is experiencing steady growth, driven by several key factors such as clean energy push wherein, environmental concerns and stricter regulations on energy sources are propelling demand for cleaner alternatives. Syngas, with its ability to be derived from biomass and generate fewer emissions compared to traditional fossil fuels, is finding favor in various industries. Also, North America's rising electricity needs are creating a market for syngas in power generation. Syngas-fueled power plants offer an efficient and cleaner alternative to traditional options, contributing to the overall growth of the syngas market.

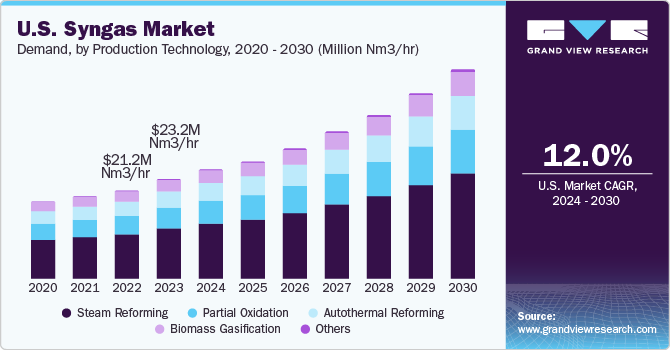

U.S. Syngas Market Trends

U.S. syngas market is expected to grow at a CAGR of 12.0% from 2024 to 2030. Key factors contributing to growth of market are increasing adoption of syngas in combined heat and power (CHP) plants for efficient energy generation and continuous advancements in gasification technologies leading to more efficient syngas production processes.

Europe Syngas Market Trends

Syngas market in Europe region is expected to witness moderate growth over forecast period as region is actively exploring alternative feedstock like biomass and waste for syngas production, reducing dependence on traditional fossil fuels like coal and natural gas.

Germany syngas market held over 32.0% share in the European market due to various factors such as robust chemical industry, supportive clean energy initiatives through various funding programs and incentive schemes.

Syngas market in France is anticipated to grow at a CAGR of over 5.0%. This growth can be attributed to stringent environmental regulations in France, like the Energy Transition for Green Growth Law, incentivize industries to adopt cleaner technologies. Syngas, with its lower carbon footprint compared to traditional fossil fuels, can help industries comply with these regulations and contribute to France's ambitious climate goals.

Italy syngas market is growing at a significant rate of 4.5% over forecast period. Growth can be attributed due increasing focus on circular economy principles in Italy may boost adoption of syngas in waste valorization and recycling processes. Syngas production from organic waste and biomass aligns with circular economy goals by converting waste materials into valuable energy resources.

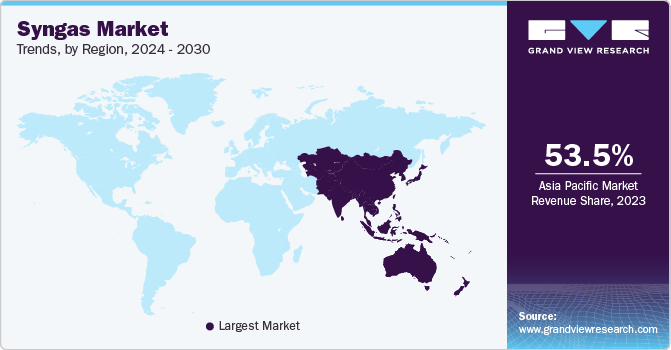

Asia Pacific Syngas Market Trends

Asia Pacific dominated market and accounted for the largest volume share of 53.5% in 2023. Region is likely to dominate industry over forecast period as well. Governments in region such as China, India, Japan, and South Korea are at forefront of this growth, driven by supportive policies, increasing disposable incomes, and growing environmental concerns. These countries are actively promoting clean energy solutions and waste-to-energy initiatives. Syngas, with its potential for cleaner burning and waste utilization, aligns well with these goals, attracting government support and investments. Asia Pacific syngas market is poised for significant growth, exceeding a projected CAGR of 13.2% between 2024 and 2030. This boom is driven by factors like rising demand for chemicals and fuels, stringent emission regulations pushing for cleaner alternatives, and growing investments in gasification technologies.

China syngas market held significant share of about 45.0% in the Asia Pacific region in 2023. This surge is driven by a potent mix: rising power generation needs, booming chemical and fertilizer industries, and increasing demand for liquid and gaseous fuels. Major players are expanding their production capacity, while companies like Air Products are securing long-term contracts to fuel major projects.

Syngas market in India is anticipated to register a CAGR of 7.2% over forecast period. This surge is driven by factors like rising demand for chemicals like olefins and fertilizers, growing awareness of cleaner fuel alternatives, and government initiatives promoting gasification technologies.

Middle East & Africa Syngas Market Trends

Middle East & Africa syngas market is expected to grow at a CAGR of approximately 4.7% over forecast period. This growth is fueled by two key trends: rising demand for electricity and a booming chemical industry. Governments across region are investing heavily in power generation infrastructure, often utilizing syngas-fired plants due to their flexibility and ability to integrate renewable energy sources. Simultaneously, chemical industry sees syngas as a valuable feedstock for producing methanol, ammonia, and other essential chemicals, further driving market expansion.

Syngas market in Saudi Arabia hold a dominant share of about 35.0% in Middle East & Africa region in 2023. Growing demand for cleaner power generation via Integrated Gasification Combined Cycle (IGCC) plants and synthetic natural gas (SNG) production fuels this market. Government initiatives towards economic diversification and attracting investments in petrochemicals create further opportunities.

UAE syngas market is expected to grow at a CAGR of about 8.0% over forecast period. This growth is further bolstered by rising demand for chemicals, alternative fuels, and clean electricity, creating a strong market for syngas & its derivatives across sectors like agriculture, transportation, and industrial manufacturing.

Key Syngas Company Insights

The market is moderately fragmented with presence of a sizable number of medium and large-sized companies. Key players mainly cater to chemicals, fuel and power generation industries. These market participants are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions as well as joint ventures, to maintain and enhance their market share.

-

In November 2023, Charwood Energy partnered with Verallia Group to develop a greenfield facility to produce syngas using pyrogasification of biomass. The strategy shall help company to increase its market share in syngas market.

-

In May 2023, Air Products and Chemicals, Inc. collaborated with the government of the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire a natural gas-to-syngas processing facility in Qashqadaryo Province, Uzbekistan for an amount of USD 1 billion.

Key Syngas Companies:

The following are the leading companies in the syngas market. These companies collectively hold the largest market share and dictate industry trends.

- A.H.T Syngas Technology NV

- Air Liquide

- Air Products and Chemicals Inc.

- Airpower Technologies Limited

- John Wood Group PLC

- KBR Inc.

- Linde Plc

- Sasol

- Shell Plc

- Topsoe AS

- Maire Tecnimont Spa

- Synthesis Energy Systems Inc.

- Chiyoda Corporation

- Dow Inc.

- Methanex Corporation

Syngas Market Report Scope

Report Attribute

Details

Market demand value in 2024

250.96 million Nm3/hr

Volume forecast in 2030

477.97 million Nm3/hr

Growth rate

CAGR of 11.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million Nm3/hr; and CAGR from 2024 to 2030

Report coverage

Volume Forecast, competitive landscape, growth factors and trends

Segments covered

Production technology, feedstock, gasifier type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

A.H.T Syngas Technology NV; Air Liquide; Air Products and Chemicals Inc.; Airpower Technologies Limited; John Wood Group PLC; KBR Inc.; Linde Plc; Sasol; Shell Plc; Topsoe AS; Maire Tecnimont Spa; Synthesis Energy Systems; Inc.; Chiyoda Corporation; Dow Inc.; Methanex Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Syngas Market Report Segmentation

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the syngas market report on the basis of production technology, feedstock, gasifier type, application, and region:

-

Production Technology Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

Steam Reforming

-

Partial Oxidation

-

Autothermal Reforming

-

Biomass Gasification

-

Others (Plasma Gasification, heat exchange reforming, and underground coal gasification)

-

-

Feedstock Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

Petroleum Byproducts

-

Coal

-

Natural Gas

-

Biomass/ Waste

-

Others (Petcoke, Plastic Wase, and Medical Waste)

-

-

Gasifier Type Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

Fixed Bed

-

Entrained Flow

-

Fluidized Bed

-

Others (Plasma Arc and Black Liquor) Others (Petcoke, Plastic Waste, and Medical Waste)

-

-

Application Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

Chemicals

-

Methanol

-

Ammonia

-

FT Synthesis Products

-

-

Fuels

-

Liquid

-

Gaseous

-

-

Power Generation

-

-

Regional Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global syngas market size was estimated at 230.05 million Nm3/hr in 2023 and is expected to reach 250.96 million Nm3/hr in 2024.

b. The global syngas market is expected to grow at a compounded annual growth rate of 11.3% from 2024 to 2030 to reach 477.97 million Nm3/hr by 2030.

b. The Asia Pacific dominated the syngas market with the highest share of about 53.0% in 2023. Governments in regions such as China, India, Japan, and South Korea are at the forefront of this growth, driven by supportive policies, increasing disposable incomes, and growing environmental concerns.

b. Some key players operating in the syngas market include A.H.T Syngas Technology NV, Air Liquide, Air Products and Chemicals Inc., Airpower Technologies Limited, John Wood Group PLC, KBR Inc., Linde Plc, Sasol, among others.

b. Key factors driving the syngas market growth include stringent environmental regulations, such as the Clean Air Act and carbon emission reduction targets, which are driving demand for cleaner alternatives in various industries. Syngas can help industries comply with these regulations by offering a lower-emission fuel option.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."