- Home

- »

- IT Services & Applications

- »

-

Switzerland Managed Print Services Market Size Report 2030GVR Report cover

![Switzerland Managed Print Services Market Size, Share & Trends Report]()

Switzerland Managed Print Services Market (2025 - 2030) Size, Share & Trends Analysis Report, By Channel (Printers, System Integrators, Independent Software Vendors), By Deployment (Cloud, On-premise), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-495-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Switzerland MPS Market Size & Trends

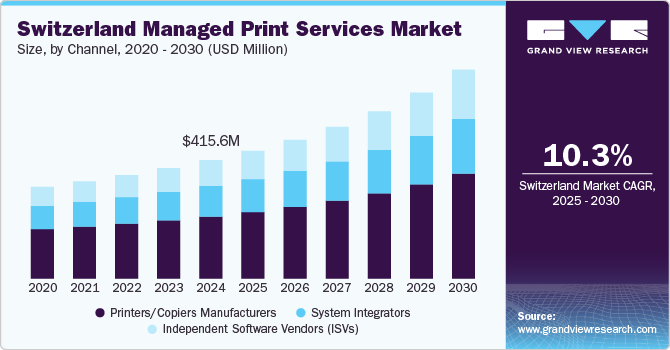

The Switzerland managed print services market size was estimated at USD 415.6 million in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2030. The market growth can be attributed to the increasing demand for cost-efficient printing solutions and streamlined document workflows, the growing adoption of digital transformation initiatives across various industries, and the subsequent shift toward managed services to optimize printing processes and reduce environmental impact. Rising concerns over data security in document management are also driving the adoption of MPS. On the other hand, the integration of AI-enabled solutions, cloud-based printing, and analytics, among other advanced solutions, is transforming the market landscape and opening new opportunities for market players.

The adoption of cloud-based solutions also contributes to the managed print services (MPS) market's growth. With the increasing shift toward digital transformation, businesses are adopting cloud-based document management systems that integrate with their printing infrastructure. MPS providers leverage the cloud to offer more scalable, flexible, and efficient print management solutions. Cloud integration enables businesses to manage their print operations remotely, monitor usage, and gain real-time insights into printing activities. Furthermore, cloud-based MPS solutions can be easily scaled to meet the needs of growing organizations, adding to the appeal of MPS for businesses of all sizes. For instance, in February 2024, Xerox Corporation launched new solutions and services to enhance digital transformation, productivity, and security in the hybrid workplace while streamlining time management and minimizing IT complexities. Xerox MPS features cloud-native printer fleet maintenance, supplies management, and automated driver deployment for any printer brand. This cloud-first approach is tailored to accommodate the needs of clients of all sizes. Updates to fleet security management allow for detecting suspicious activities, enabling quick responses to potential incidents.

The rise of remote and hybrid work models has also accelerated the adoption of MPS. As companies adopt flexible work environments, ensuring employees have access to print resources regardless of location has become essential. MPS providers offer solutions that cater to this new way of working, allowing employees to print from home, in satellite offices, or on the go while maintaining centralized control and monitoring. This flexibility has made MPS a valuable solution for businesses with remote or dispersed workforces. According to Zoom Video Communications, in 2024, professionals working in a hybrid model have increased engagement rates, at 35%, compared to those who are fully remote, at 33%, and in-office employees, at 27%.

The rise in small and medium-sized enterprises (SMEs) in Switzerland also contributes significantly to the growth of the MPS market. SMEs often lack the resources to manage complex print environments independently, making them prime candidates for outsourcing their print management to MPS providers. Tailored MPS solutions for SMEs focus on reducing costs, simplifying device management, and providing access to advanced features without substantial upfront investments. This democratization of advanced print technology enables smaller organizations to compete with larger firms by enhancing efficiency and reducing operational burdens. According to the Federal Statistical Office (FSO) of Switzerland, Small and Medium-sized Enterprises (SMEs) form the backbone of the Swiss economy. In 2021, they employed nearly 3.1 million individuals, marking an increase of 64,000 jobs compared to 2020. Over the decade from 2011 to 2021, the share of enterprises with fewer than ten employees grew.

Channel Insights

The system integrators segment accounted for the largest market share of over 54% in 2024. This channel provides end-to-end solutions by integrating hardware, software, and services to meet the unique needs of businesses. System integrators play a critical role in Switzerland’s MPS market, especially for large enterprises requiring customized solutions aligned with their existing IT ecosystems. These integrators specialize in secure and scalable deployments that optimize document workflows and ensure compliance with Swiss and EU regulations, such as GDPR. Switzerland’s highly regulated industries, including BFSI, telecom, and healthcare, drive the demand for system integrators. Their ability to deliver bespoke solutions tailored to complex IT infrastructures makes them indispensable for organizations that value customization and integration.

The independent software vendors (ISVs) segment is expected to grow at a significant rate during the forecast period.ISVs are gaining traction due to the growing adoption of cloud-based services and advanced analytics tools. Their software enables businesses to monitor print usage, reduce waste, and optimize costs, which is particularly appealing to SMEs and cost-conscious sectors like education and retail. ISVs are also critical for industries requiring enhanced data security and compliance, offering features like user authentication, encryption, and audit trails. As companies increasingly prioritize digital transformation, ISVs are positioned to play a key role in supporting scalable, efficient, and secure print environments.

Deployment Insights

The on-premise segment accounted for the largest market share of over 52% in 2024. The growth of on-premises Switzerland-managed print services (MPS) is driven by the need for advanced data protection and the desire for localized control over the print infrastructure. Large enterprises and government institutions that handle vast amounts of sensitive information prefer on-premise solutions for their ability to offer robust security measures like encryption, user authentication, and access control. However, the segment also faces challenges such as high upfront costs, maintenance requirements, and scalability limitations. Despite these drawbacks, advancements in on-premise software, including improved analytics and automation, continue to enhance its appeal, especially in compliance-driven sectors.

The cloud-based segment is expected to grow at a significant rate during the forecast period, driven by cost efficiency, ease of integration, and compatibility with emerging technologies such as artificial intelligence and IoT. Small and medium enterprises (SMEs) are major adopters of cloud-based MPS, as the model allows them to access advanced capabilities without significant capital investment. Additionally, sectors like telecom and IT benefit from cloud solutions for their ability to handle complex networks and high-volume printing. As Switzerland continues to focus on digital transformation and sustainability, cloud-based MPS solutions are likely to see widespread adoption across industries.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024, primarily driven by the increasing focus on sustainability, workflow automation, and analytics. Large enterprises are investing in advanced MPS solutions to reduce waste, optimize print usage, and achieve environmental goals, aligning with Switzerland's green initiatives. Moreover, the need for integration with enterprise IT systems, combined with robust data security measures, makes MPS an indispensable part of corporate strategies. As businesses embrace digital transformation, large enterprises are expected to lead the adoption of AI-driven and cloud-integrated MPS solutions.

The small & medium enterprise segment is expected to grow at a significant rate during the forecast period. The adoption of Managed Print Services (MPS) among small and medium-sized enterprises (SMEs) is driven by increasing awareness of the benefits of MPS, including cost reduction, enhanced workflow efficiency, and improved document security. SMEs across sectors like education, retail, and healthcare are adopting pay-as-you-go models and subscription-based MPS to align with their operational budgets. The rising adoption of digital tools and the shift toward paperless workflows further support demand, making SMEs a key growth driver for the MPS market in Switzerland.

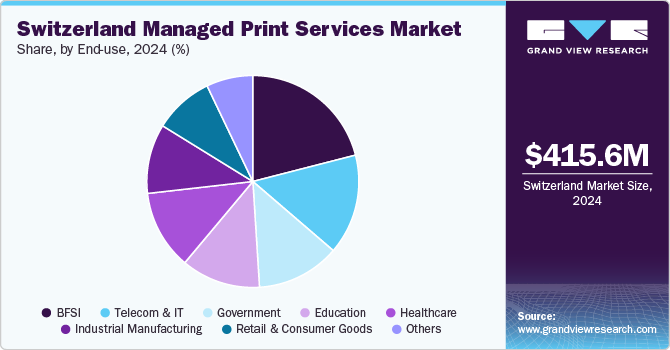

End-use Insights

The BFSI end use segment accounted for the largest market share of over 21% in 2024. In BFSI industry, growth factors include the digitization of workflows, cost optimization, and sustainability initiatives. BFSI organizations increasingly rely on analytics-driven MPS to monitor print usage, reduce costs, and enhance operational efficiency. The sector's demand for robust solutions that integrate with enterprise IT systems and support hybrid work environments further contributes to its dominance in the MPS market.Similarly, banks, insurance companies, and financial institutions require high-security features such as encryption, user authentication, and audit trails to handle sensitive information and meet regulatory requirements, including those set by the Swiss Financial Market Supervisory Authority (FINMA).

The industrial manufacturing segment is expected to grow at the fastest CAGR during the forecast period. In the industrial manufacturing sector, there is an increasing demand for efficient and durable printing solutions. Manufacturers need to ensure that their print infrastructure can withstand the rigors of industrial environments and produce high-quality documents consistently. MPS providers offer a range of solutions, including robust printers, durable inks and toners, and preventative maintenance services, to meet these requirements. The integration of MPS with enterprise resource planning (ERP) systems is another significant trend driving growth in this sector. By seamlessly connecting print management with other business processes, manufacturers can gain valuable insights into printing costs, usage patterns, and environmental impact. This data-driven approach enables them to make informed decisions and optimize resource allocation.

Key Switzerland Managed Print Services Company Insights

Key players operating in the Switzerland managed print services (MPS) industry include Brother International Corporation, Canon, HP Development Company, LP, Konica Minolta, KYOCERA Document Solutions Europe Management B.V., Lexmark International, Inc., Ricoh, Sharp Electronics, Toshiba Tec Europe, and Xerox Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Apogee Corporation Ltd, an HP Development Company, LP subsidiary, is strengthening its European operations through a strategic partnership with MCA. As part of this collaboration, Apogee has invested in MCA to establish a new entity, MCA-Apogee. This move aims to expand Apogee's European footprint, particularly within the U.K.'s managed print services market. The newly formed MCA-Apogee initially sought to acquire AM Trust's print management solutions business. Leveraging AM Trust Group's expertise in financing solutions, data management, and digital dematerialization, MCA-Apogee will enhance its service portfolio and deliver added value to new and existing customers.

-

In February 2023, Lexmark International, Inc. launched MPS Express, a cloud-based managed print services program for small and medium-sized businesses (SMBs). The program offers a streamlined solution designed to simplify document management and alleviate the burden of daily printer maintenance. While it does not fully customize enterprise-level managed print services (MPS), it is packaged to address the specific requirements of SMBs through a partner-based model and delivers a ready-to-deploy, cloud-based solution.

Key Switzerland Managed Print Services Companies:

- Brother International Corporation

- Canon

- HP Development Company, LP

- Konica Minolta

- KYOCERA Document Solutions Europe Management B.V.

- Lexmark International, Inc.

- Ricoh

- Sharp Electronics

- Toshiba Tec Europe

- Xerox Corporation.

Switzerland Managed Print Services Market Report Scope

Report Attribute

Details

Market size in 2025

USD 448.2 million

Revenue forecast in 2030

USD 732.9 million

Growth rate

CAGR of 10.3% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Channel, deployment, enterprise size, end-use, region

Country scope

Switzerland

Key companies profiled

Brother International Corporation; Canon; HP Development Company, LP; Konica Minolta; KYOCERA Document Solutions Europe Management B.V.; Lexmark International, Inc.; Ricoh; Sharp Electronics; Toshiba Tec Europe; Xerox Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Switzerland Managed Print Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Switzerland managed print services market report based on channel, deployment, enterprise size, end use, and region.

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Printers/Copiers Manufacturers

-

System Integrators

-

Independent Software Vendors (ISVs)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Education

-

Government

-

Healthcare

-

Industrial Manufacturing

-

Retail & Consumer goods

-

Telecom & IT

-

Others

-

Frequently Asked Questions About This Report

b. The Switzerland managed print services market size was estimated at USD 415.6 million in 2024 and is expected to reach USD 448.2 million in 2025.

b. The Switzerland managed print services market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 732.9 million by 2030.

b. Large Enterprises dominated the Switzerland managed print services market with a share of over 62% in 2024. Large enterprises are investing in advanced MPS solutions to reduce waste, optimize print usage, and achieve environmental goals, aligning with Switzerland's green initiatives. Moreover, the need for integration with enterprise IT systems, combined with robust data security measures, makes MPS an indispensable part of corporate strategies. As businesses embrace digital transformation, large enterprises are expected to lead the adoption of AI-driven and cloud-integrated MPS solutions.

b. Key players operating in the Switzerland managed print services (MPS) industry include Brother International Corporation, Canon, HP Development Company, LP, Konica Minolta, KYOCERA Document Solutions Europe Management B.V., Lexmark International, Inc., Ricoh, Sharp Electronics, Toshiba Tec Europe, and Xerox Corporation

b. The growth of the market can be attributed to the increasing demand for cost-efficient printing solutions and streamlined document workflows, the growing adoption of digital transformation initiatives across various industries, and the subsequent shift toward managed services to optimize printing processes and reduce environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.