Switchgear Market Size, Share & Trends Analysis Report By Voltage Type (Low, Medium, High), By Insulation (Air, Gas), By Installation, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-115-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

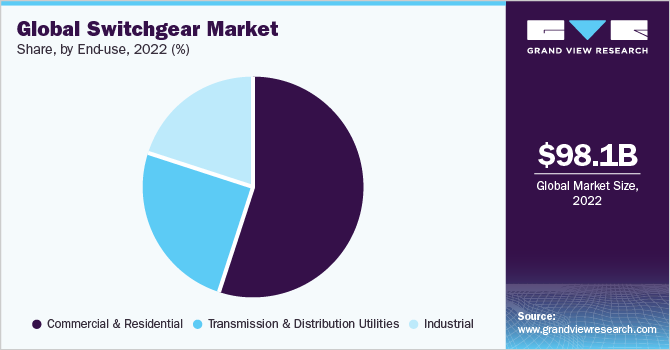

The global switchgear market size was valued at USD 98.12 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. A major factor expected to drive the global market for switchgear is the increasing emphasis on developing smart grid infrastructure. Governments of developed and emerging economies are focused on upgrading the present electric grid infrastructure to ensure an efficient electricity supply and reduce electric component failure during power transmission. Switchgear aids in lowering the damage to the components that are connected to the power supply during the event of a power surge by interrupting the power flow.

Due to rapid urbanization and industrialization, the increasing demand for power from emerging economies has led to a high emphasis on developing efficient power transmission and distribution networks, ultimately increasing demand for switches, fuse, and circuit breakers. This high demand for products from the power sector is expected to drive the growth of the global market for switchgear.

According to the United Nations, in 2020, 55.0% of the world’s population resided in urban areas, and this number is projected to increase to 68.0% by 2050. The rate of urbanization is higher in developing countries, where urban populations are expected to double by 2050. Also, according to the International Energy Agency (IEA), in 2022, global electricity consumption was around 24,398 Terawatt hours (TWh), almost three times the consumption in 1981, when it stood at 8,132 TWh.

Outdated power transmission and distribution infrastructure calls for replacement with advanced and efficient solutions such as switchgear that encompasses various devices that control and protect the electrical devices connected to power by isolating electrical equipment in power systems. Also, it offers multiple advantages that contribute to grid modernization as it enables precise control and monitoring of power flows, further enhancing grid efficiency.

Switchgear systems often demand significant upfront investments, which impede potential buyers from considering their implementation. The substantial expenses associated with purchasing, installing, and maintaining switchgear systems can limit their widespread adoption, particularly in developing regions where financial constraints are prevalent. The requirement of substantial financial resources to deploy switchgear solutions can act as a major impediment to switchgear market growth, especially in segments that are sensitive to price considerations.

The initial investment required for switchgear systems encompasses various elements, including purchasing the necessary equipment and components, installation costs, and ongoing maintenance expenses. These expenditures can accumulate to substantial sums, making the overall cost of switchgear solutions quite high. As a result, such factors restrain the market growth for switchgear.

Significant strides in switchgear technologies, including gas-insulated switchgear (GIS), and solid-state switchgear, have revolutionized the landscape of electrical infrastructure. The seamless integration of digital technologies, such as the Internet of Things (IoT) and advanced analytics, has ushered in a new era of switchgear management. These rapid advancements in switchgear technologies, coupled with the integration of digital solutions, have spurred substantial growth in the switchgear industry. Benefits such as improved operational efficiency, reduced maintenance costs, and increased system reliability have made the adoption of these technologies highly desirable for industries across the board. As a result, such factors provide lucrative opportunities for the growth of the market for switchgear in the coming years.

Voltage Type Insights

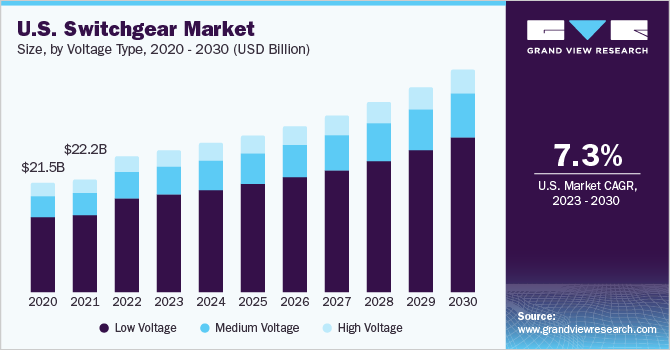

With regard to the voltage type, the low voltage segment accounted for the largest market share of nearly 69.0% in 2022. The segment provides a link between power sources and end-users, ensuring the safe and efficient distribution of electricity. The rising focus on renewable energy sources and the integration of decentralized power generation has necessitated a demand for flexible and smart switchgear systems that can accommodate these evolving energy landscapes.

The growing emphasis on energy efficiency and the need to reduce carbon emissions has led to the implementation of energy management systems that leverage low-voltage switchgear to optimize power distribution and minimize energy wastage. Hence, these drivers are fueling segment growth on a global scale. The medium voltage segment is anticipated to register the highest CAGR over the forecast period. With increasing urbanization, industrialization, and the rapid expansion of renewable energy sources, there is a rising demand for efficient and reliable electrical distribution systems.

Medium-voltage ensures safe and efficient power distribution, protection, and control in medium-voltage-type networks. Moreover, upgrading aging electrical infrastructure, particularly in emerging economies, presents substantial market potential. Additionally, the increasing focus on grid resilience, smart grid technologies, and the integration of advanced digital solutions are driving the demand for innovative medium-voltage products and solutions.

Insulation Insights

Based on insulation, the others segment accounted for the largest market share exceeding 54.0% in 2022, and is further expected to register the highest CAGR over the forecast period. This segment includes vacuum and oil. They offer superior insulation properties and enhanced safety features, making them suitable for accommodating the complexities of renewable energy systems.

Furthermore, the aging infrastructure in many regions is propelling the replacement and upgrade of outdated switchgear with modern, more efficient alternatives. The development of smart grids and the proliferation of electric vehicles also contribute to the demand for oil and vacuum, as these technologies necessitate reliable and high-performance electrical systems.

The gas segment is expected to expand at a significant CAGR over the forecast period. The growing demand for reliable and efficient power distribution infrastructure, particularly in developing economies, is fueling the expansion of the gas segment. These advanced switchgear systems offer numerous advantages, including enhanced safety features, compact size, and superior environmental performance. Additionally, the increasing focus on renewable energy sources and the integration of smart grid technologies are driving the adoption of gas insulation, as they provide seamless integration with renewable power generation and enable efficient monitoring and control of electricity networks.

Installation Insights

In terms of installation, the outdoor segment accounted for the largest market share of over 76.0% in 2022. The increasing demand for reliable and efficient power distribution systems in various industries and utility sectors has fueled the need for robust outdoor installations. These installations provide enhanced protection against harsh environmental conditions, such as extreme temperatures, moisture, and dust, ensuring uninterrupted power supply.

The rapid expansion of renewable energy generation adoption, including solar and wind power, has necessitated outdoor deployment to connect these decentralized energy sources to the grid efficiently. Additionally, the growing focus on electrification and the modernization of existing infrastructure in emerging economies has led to the adoption of outdoor switchgear solutions for distribution networks in urban and rural areas.

The indoor segment is expected to register the highest CAGR over the forecast period. The growing emphasis on safety and reliability in electrical systems has led to an increased demand for indoor installations, as they offer enhanced protection against environmental elements and unauthorized access. The rising adoption of smart grid technologies and the integration of renewable energy sources has spurred the need for advanced indoor solutions capable of efficiently managing power distribution and accommodating complex grid configurations. Additionally, the ongoing urbanization & expansion of infrastructure in developing economies has fueled the demand for indoor switchgear installations, as they provide space-saving benefits and can be easily integrated into compact urban environments.

End-use Insights

Amongst the end-use, the commercial and residential segment accounted for the largest market share of over 54.0% in 2022 and is further expected to register the highest CAGR over the forecast period. Rapid urbanization and industrialization in the segment are key factors driving the demand for switchgear, as they require efficient electrical distribution and protection systems. Additionally, the expansion of data centers, the adoption of smart grids, and the growing emphasis on renewable energy sources contribute to market growth.

In the residential sector, factors such as increasing disposable incomes, rising urban population, and the need for enhanced safety measures propel the demand for switchgear. Moreover, the ongoing digitalization and home automation trends, coupled with the growing demand for electric vehicles and energy-efficient solutions further boost the market demand, as residential consumers seek reliable electrical infrastructure and advanced control systems.

The transmission & distribution utilities segment is anticipated to expand at a considerable growth rate over the forecast period. The increasing demand for reliable and uninterrupted power supply drives the need for efficient switchgear to manage and control electrical power distribution. Additionally, expanding renewable energy sources and integrating smart grid technologies require advanced switchgear systems to accommodate complex power flows and ensure grid stability.

Moreover, the need to upgrade aging infrastructure and replace outdated switchgear with more efficient and environmentally friendly alternatives is a significant driver in the market. The rising focus on enhancing grid resilience and mitigating the risks of power outages and electrical faults drives the adoption of advanced switchgear technologies with enhanced safety features.

Regional Insights

North America led the market for switchgear with a revenue share of over 35.0% in 2022. The increasing demand for electricity, driven by population growth, industrialization, and urbanization, has amplified the need for efficient power distribution and transmission systems in the region. This has created a significant market for switchgear, which plays a crucial role in controlling, protecting, and isolating electrical equipment.

Moreover, the aging infrastructure and the growing focus on grid modernization and renewable energy integration are further propelling the demand for advanced switchgear solutions in North America. Additionally, the emergence of smart grids and the rapid adoption of digital technologies, such as IoT and cloud computing, present opportunities for integrating intelligent switchgear systems that enhance energy management and optimize operational efficiency.

The Asia Pacific region is expected to register the highest CAGR of 8.1% over the forecast period. Rapid industrialization and urbanization across the region are boosting the demand for electricity, thereby fueling the need for efficient and reliable switchgear solutions. The growing focus on renewable energy sources and the integration of smart grid technologies are leading to the adoption of advanced switchgear systems capable of handling complex power distribution networks.

Moreover, the expansion of industries such as oil and gas, manufacturing, and construction, coupled with investments in infrastructure development projects, are further propelling the demand for switchgear products in the Asia Pacific region. The rising awareness about the importance of electrical safety and the need for uninterrupted power supply are creating opportunities for market growth, as end-users are prioritizing the installation of reliable switchgear systems to safeguard their operations and ensure uninterrupted power flow.

Key Companies & Market Share Insights

Key players in the global market for switchgear include ABB Ltd., Alstom, Crompton Greaves, Eaton Corporation, Larsen & Toubro Limited, Legrand, and Mitsubishi Electric Corporation, among others. These companies are leveraging several growth strategies, including partnerships, mergers & acquisitions, and geographical expansions, to stay afloat in the competitive market scenario.

For instance, in April 2023, Havells India Ltd. announced a strategic partnership with Swedish tech startup Blixt Tech AB to bring the solid state circuit breaker (SSCB) technology to the domestic market. This strategic move reinforces Havells India Ltd.'s presence in the switchgear segment and underscores its commitment to delivering innovative and future-proof solutions. Some prominent players in the global switchgear market include:

-

ABB Ltd.

-

Alstom

-

Areva Inc.

-

Bharat Heavy Electricals Limited (BHEL)

-

Crompton Greaves

-

Eaton Corporation

-

General Electric

-

Hitachi Limited

-

Larsen & Toubro Limited

-

Legrand

-

Mitsubishi Electric Corporation

-

NR Electric Co., Ltd.

-

Powell Industries

Switchgear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 102.42 billion |

|

Revenue forecast in 2030 |

USD 160.07 billion |

|

Growth rate |

CAGR of 6.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Voltage type, insulation, installation, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ABB Ltd.; Alstom; Areva Inc.; Bharat Heavy Electricals Limited (BHEL); Crompton Greaves; Eaton Corporation; General Electric; Hitachi Limited; Larsen & Toubro Limited; Legrand; Mitsubishi Electric Corporation; NR Electric Co., Ltd.; Powell Industries |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Switchgear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global switchgear market report on the basis of voltage type, insulation, installation, end-use, and region:

-

Voltage Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Insulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air

-

Gas

-

Others

-

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transmission & Distribution Utilities

-

Commercial & Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global switchgear market size was estimated at USD 98.12 billion in 2022 and is expected to reach USD 102.42 billion in 2023.

b. The global switchgear market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 160.07 billion by 2030.

b. North America dominated the switchgear market with a share of 35.0% in 2022. This is attributable to the increasing demand for electricity and growing industrialization & urbanization.

b. Some key players operating in the switchgear market include ABB Ltd; Alstom; Areva Inc.; Bharat Heavy Electricals Limited (BHEL); Crompton Greaves; Eaton Corporation; General Electric; Hitachi Limited; Larsen & Toubro Limited; Legrand; Mitsubishi Electric Corporation; NR Electric Co., Ltd; and Powell Industries.

b. Key factors that are driving the market growth include the growing renewable energy integration, increasing power generation & transmission Infrastructure, and increasing focus on grid modernization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."