- Home

- »

- Animal Health

- »

-

Swine Vaccines Market Size & Share, Industry Report, 2030GVR Report cover

![Swine Vaccines Market Size, Share & Trends Report]()

Swine Vaccines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Inactivated, Modified/Attenuated Live), By Type (Pseudorabies, Porcine Circovirus Type 2), By Route Of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-728-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swine Vaccines Market Summary

The global swine vaccines market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 2.41 billion by 2030, growing at a CAGR of 5.51% from 2025 to 2030. Some of the key factors attributing to the market growth include the growing food security concerns with rising disease outbreaks and zoonoses coupled with the wide adoption of antibiotic-free disease preventive approaches.

Key Market Trends & Insights

- North America dominated the swine vaccines market with the largest revenue share of 38.46% in 2024.

- The swine vaccines market in the U.S. accounted for the largest revenue share in North America in 2024.

- By product, the Inactivated (Killed) segment led the market with the revenue share of 52.03% in 2024.

- By disease type, the PRRS (Porcine Reproductive and Respiratory Syndrome) led the market with a share of 14.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2030 Projected Market Size: USD 2.41 Billion

- CAGR (2025-2030): 5.51%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Some highly contagious diseases, such as porcine reproductive and respiratory syndrome (PRRS) and swine influenza, remain highly prevalent among herds of Asian, European, and American regions contributing to severe economic loss. Therefore, to curb the effect, swine producers are widely implementing biosecurity measures and vaccination processes.The growing prevalence of African Swine Fever (ASF) across multiple regions globally has emerged as a significant driver for the market. For instance, between January 2022 and August 2024, ASF has been reported in 61 countries across five regions, impacting over 704,000 pigs and 21,600 wild boars, with total animal losses exceeding 1.7 million. This alarming spread underscores the urgent need for effective preventive measures, driving investment in vaccine development and adoption.

Innovation and development of new vaccines, along with their regulatory approvals, play crucial roles in driving growth by promoting the best preventive measures and advancements in pig immunization. For instance, in September 2024, MSD Animal Health received marketing authorization from the EMA for PORCILIS PCV M Hyo ID. It is a ready-to-use intradermal vaccine that offers protection against two major pathogens, Porcine Circovirus Type 2 (PCV2) and Mycoplasma hyopneumoniae (M. hyo), enhancing convenience and effectiveness for swine producers. Leveraging advanced needle-free IDAL technology, the vaccine ensures efficient administration with a low-volume dose, addressing both animal welfare and operational efficiency. Such advancements in vaccine technology not only improve disease prevention but also boost demand by meeting the evolving needs of modern swine farming.

In addition, the increasing global demand for pork is a significant factor propelling the market growth. As highlighted by the World Population Review’s Pork Consumption Data 2024, current pork consumption is at 112.6 kilotons and is projected to reach 129 kilotons by 2031. This growing demand, particularly in key regions such as Asia-Pacific, Europe, and North America, places pressure on pig producers to ensure herd health and productivity. To meet these demands, the adoption of effective vaccines has become essential, driving growth as producers prioritize disease prevention to safeguard supply and quality.

Product Insights

The Inactivated (Killed) segment led the market with the largest revenue share of 52.03% in 2024. This is attributed to its easy availability, low cost, and stability advantages over live-attenuated vaccines. They minimize the risk of virulence reversion after vaccination, as it prevents the replication process of pathogens. Moreover, it offers pigs better immunization with a rapid cell-mediated immune response. Immunity obtained from Inactivated (Killed) can be further enhanced with adjuvants such as certain types of oils or aluminum hydroxide. However, considerable care must be taken while preparing, storing, and handling Inactivated (Killed) for effective results.

The other segment is estimated to witness at the fastest CAGR over the forecast period. The vaccines such as recombinants are anticipated to assist in achieving vaccination against numerous virus strains, as recombinants can carry several gene inserts. IngelvacCircoFLEX from Boehringer Ingelheim International GmbH is a pig recombinant vaccine that provides active immunization for pigs over 2 weeks of age. Such formulated vaccines can improve stability, increase viability, and also help avoid the need for adjuvants. Some of the recombinant vaccines available for pigs are those against pseudorabies, porcine circovirus type 2, and CSF.

Disease Type Insights

Based on disease type, the PRRS (Porcine Reproductive and Respiratory Syndrome) led the market with the largest revenue share of 14.26% in 2024. This is owing to its large prevalence in major pig-raising countries. This disease exists in both endemic and epidemic forms in the U.S. and a few Asian countries. The disease has been considered an epidemic for over 30 years in the U.S. and more than 20 years in China, the leading pig industry. There is considerable heterogeneity in the viral genome due to inherent errors common in RNA transcription. Therefore, the variability of isolates is challenging to control, even within the same country.

The FMD segment is anticipated to witness at the fastest CAGR of 6.24% over the forecast period. The rising emphasis on FMD prevention, particularly in pig farming areas, is expected to drive the fastest growth. For instance, the launch of the 4th round of the FMD Vaccination Mission in Nagaland is a significant step toward controlling and eradicating FMD in India, particularly among pig, which are highly susceptible to the virus. With the government’s goal to eradicate FMD by 2030 under the National Animal Disease Control Programme (NADCP), the demand for FMD vaccines in the pig sector is poised to grow rapidly.

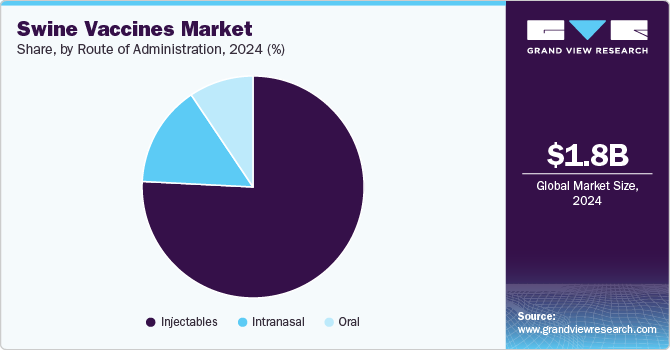

Route Of Administration Insights

Based on route of administration, the injectable segment led the market with the largest revenue share of 75.79% in 2024, due to its efficiency and effectiveness in providing long-lasting protection against major diseases in pigs. Injectable vaccines, such as those targeting PCV2, Mycoplasma hyopneumoniae, and other common pathogens, offer a convenient and reliable solution for farmers to ensure the health and productivity of their herds. These vaccines typically require fewer doses, often providing extended protection with a single injection, which is both time-efficient and cost-effective for large-scale operations. As the industry focuses on improving disease management and biosecurity, the injectable segment is expected to continue driving growth, catering to the growing demand for effective disease prevention in pig farming.

The oral segment is projected to grow at the fastest CAGR over the forecast period, driven by the increasing adoption of products like Enterisol Ileitis, a one-dose live vaccine that is orally delivered through the water supply. This vaccine targets Lawsonia intracellularis, the causative agent of ileitis, a significant disease in pigs. The ease of administration, particularly via drinking water, makes oral vaccines highly appealing in large-scale pig farming operations, where reducing labor costs and simplifying vaccination protocols are key priorities. Moreover, oral vaccines offer a non-invasive alternative to injectables, minimizing animal stress and increasing overall herd health compliance. As more oral vaccines are developed to combat various diseases, this segment is expected to experience rapid growth, particularly in regions with large pig populations and limited veterinary resources.

Distribution Channel Insights

Based on distribution channel, the hospital/clinic pharmacies segment accounted for the largest revenue share in 2024, due to their direct engagement with end-users, immediate vaccination services, and comprehensive healthcare solutions, ensuring timely vaccine distribution and effective disease management in the livestock sector. This direct access to veterinary professionals fosters trust and compliance among producers, further solidifying the dominance of veterinary hospitals and clinics in the pig vaccine distribution channel.

The e-commerce segment is projected to grow at the fastest CAGR over the forecast period. This expansion is driven by the increasing adoption of digital platforms by veterinarians and pig producers, seeking convenient access to a broader range of vaccine products. The rise of e-commerce and D2C channels in the pig circovirus vaccine is reshaping traditional distribution models. This shift is expected to enhance market reach and operational efficiency, contributing to the overall market growth.

Regional Insights

North America dominated the swine vaccines market with the largest revenue share of 38.46% in 2024. This is attributed to the region's advanced veterinary healthcare infrastructure and the launch of innovative combination vaccines. For instance, in June 2023, Boehringer Ingelheim Animal Health Canada Inc. introduced a unique vaccine that protects pigs against PCV2 and PRRSv in a single dose. This advancement, enabled by a proprietary purification process, allows the seamless mixing of Ingelvac CircoFLEX with Ingelvac PRRS MLV without compromising efficacy. Such offerings address critical health challenges while enhancing operational efficiency, thus driving market growth in the region.

U.S. Swine Vaccines Market Trends

The swine vaccines market in the U.S. accounted for the largest revenue share in North America in 2024, primarily due to the increasing prevalence of pig diseases and substantial investments in research and development to create advanced vaccines. The highly organized farming structures in the U.S. have led to a rise in the use of pig vaccines to maintain herd health and productivity. For instance, in March 2022, the USDA's National Institute of Food and Agriculture granted USD 642,000 to Cornell University to develop swine influenza vaccines.

Europe Swine Vaccines Market Trends

The swine vaccines market in Europe is being driven by the introduction of advanced vaccines by established players. For instance, in October 2024, Ceva Animal Health's Cirbloc M Hyo recently received European marketing authorization. This innovative vaccine targets the PCV2d genotype, the most prevalent strain in the field, and the Mycoplasma hyopneumoniae strain BA 2940, which are both significant contributors to the Porcine Respiratory Disease Complex. By offering a single 2 mL injection that protects pigs from 6 to 26 weeks of age, Cirbloc M Hyo ensures comprehensive coverage throughout the fattening period. Such advancements are meeting the region’s growing demand for efficient disease management solutions, thus driving market growth.

The UK swine vaccines market is anticipated to grow at the fastest CAGR during the forecast period. One major factor propelling the market in the UK is the government and non-government initiatives to combat swine diseases. For instance, in May 2024, The Pirbright Institute partnered with researchers at The Vaccine Group to accelerate the development of safe and effective ASF vaccines. With the extensive pig and pork export market of the country, safeguarding pigs against ASF outbreaks is critical to protect economic interests, ensuring food security, and preserving farmer livelihoods. Such collaborative efforts highlight the growing demand for advanced vaccines to address these pressing challenges.

Asia Pacific Swine Vaccines Market Trends

The swine vaccines market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The market is driven especially due to the advancements in biotechnology and regional efforts to address endemic swine diseases. For instance, in May 2024, the Indian Institute of Technology-Guwahati successfully transferred the technology to produce India’s first recombinant vaccine against classical swine fever. It was developed in collaboration with Assam Agricultural University. This vaccine represents a significant step in improving disease management in swine populations. With classical swine fever posing a major threat to pig farming in the region, such innovations are expected to enhance herd health and drive market growth in Asia-Pacific.

The Japan swine vaccines market is experiencing significant growth, driven by the resurgence of classical swine fever (CSF) and the increasing adoption of advanced vaccine technologies. This growth is further supported by the increasing prevalence of swine diseases, which underscores the need for robust vaccination strategies to ensure herd health and maintain the stability of the swine industry in Japan.

Latin America Swine Vaccines Market Trends

The swine vaccines market in Latin America, particularly in countries such as Brazil, is poised for growth due to increased government support for research and development in pig farming. In December 2024, the Brazilian government has recently allocated funding through the Growth Acceleration Program (PAC) to Embrapa Swine and Poultry, a research institute that plays a crucial role in the country’s swine production sector. With this funding, the institute will enhance its capabilities, including upgrading laboratories for disease research, which will likely lead to the development of more effective vaccines. Brazil’s substantial contribution to global pork exports, which reached 1.2 million tons in 2023, further emphasizes the need for advanced vaccine solutions to protect the swine industry from diseases, thereby driving market demand for swine vaccines.

The Argentina swine vaccines market is expected to grow at a significant CAGR over the forecast period, driven by the launch of innovative products such as ERYSENG PARVO, a reproductive vaccine that offers strong immunity against Swine Erysipelas and Porcine Parvovirus. This vaccine, which was introduced in June 2024, is particularly significant for Argentina's swine industry, as it helps address two critical diseases that affect herd health and reproductive performance. As Argentine swine producers increasingly adopt such advanced solutions, the demand for vaccines is expected to grow, propelling the market forward.

MEA Swine Vaccines Market Trends

The swine vaccines market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. Several regional companies are innovating medicines due to growing pet health concerns. The increase in the launch of innovative vaccines for disease management in pigs is significantly driving market growth in the MEA. These innovations meet the increasing demand for practical solutions to manage chronic conditions in swine. They help expand the market and improve the overall market in this region.

The South Africa swine vaccines market is experiencing a significant boost following the approval of the country’s first African Swine Fever (ASF) vaccine, announced in July 2024. ASF has long been a persistent threat, disrupting the meat supply chain and severely impacting the pork industry. The market is expected to stabilize with such launches as they provide a critical solution to control ASF outbreaks. The approval, supported by both the FDA and the Department of Agriculture's Bureau of Animal Industry, is a pivotal moment for the industry. Encouraging local farmers to adopt vaccination programs will likely drive increased demand for swine vaccines, positioning the market for further growth in the region.

Key Swine Vaccines Company Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Swine Vaccines Companies:

The following are the leading companies in the swine vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Ceva

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Indian Immunologicals Ltd.

- BiogénesisBagó

- Phibro Animal Health

- KM Biologics

- HIPRA

- Virbac

Recent Developments

-

In September 2024, Merck & Co., Inc. received marketing authorization from the EMA for PORCILIS PCV M Hyo ID, an intradermal vaccine used in swine. Such milestones support total pig health and contribute to market growth.

-

In July 2024, South Africa took a groundbreaking step in combating African Swine Fever (ASF) with the FDA and DA BAI announcing the approval of the country's first ASF vaccine, aiming to stabilize the pork industry and protect the meat supply chain.

Swine Vaccines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.84 billion

Revenue forecast in 2030

USD 2.41 billion

Growth rate

CAGR of 5.51% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa.

Key companies profiled

Merck & Co., Inc.; Ceva; Zoetis; Boehringer Ingelheim GmbH; Elanco; Indian Immunologicals Ltd.; BiogénesisBagó; Phibro Animal Health; KM Biologics; HIPRA; Virbac

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Swine Vaccines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global swine vaccines market report based on product, disease type, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inactivated (Killed)

-

Modified/Attenuated Live

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Swine Influenza

-

Classical Swine Fever

-

Porcine Parvovirus

-

Porcine Circovirus Type 2

-

M.Hyo

-

Actinobacillus Pleuropneumonia

-

PRRS

-

Foot & Mouth Disease

-

Pseudorabies

-

PEDV

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectables

-

Intranasal

-

Oral

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospitals/Clinic Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global swine vaccines market size was estimated at USD 1.75 billion in 2024 and is expected to reach USD 1.84 billion in 2025.

b. The global swine vaccines market is expected to grow at a compound annual growth rate of 5.51% from 2025 to 2030 to reach USD 2.41 billion by 2030.

b. By region, Asia Pacific accounted for the largest revenue share of more than 38% in 2024. This is attributed to the advancements in biotechnology and regional efforts to address endemic swine diseases.

b. Some of the key players in the swine vaccines market are Merck & Co., Inc., Ceva, Zoetis, Boehringer Ingelheim GmbH, Elanco, Indian Immunologicals Ltd., BiogénesisBagó, Phibro Animal Health, KM Biologics, HIPRA, Virbac

b. Key factors that are driving the swine vaccines market growth include the growing food security concerns with rising swine disease outbreaks and zoonoses initiatives by key stakeholders, R&D initiatives, and focus on biosecurity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.