- Home

- »

- Medical Devices

- »

-

Suture Needles Market Size & Trends Report, 2021-2028GVR Report cover

![Suture Needles Market Size, Share & Trends Report]()

Suture Needles Market (2021 - 2028) Size, Share & Trends Analysis Report By Shape (Straight Shaped, J Shape), By Type (Tapercut, Conventional Cutting), By Application (Cardiovascular, Veterinary Procedures), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-674-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global suture needles market size was valued at USD 469.8 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028. A surge in the number of surgical procedures for cardiovascular diseases and the increasing prevalence of chronic diseases are fueling the market growth. Furthermore, the market for suture needles will benefit from the development of advanced technological solutions. For instance, in May 2020, Healthium Medtech released Truglyde SN2355, a suture needles combination designed specifically for COMOC MG, a new surgical approach for managing Postpartum Hemorrhage (PPH), which is one of the leading causes of maternal death.

According to the WHO, in May 2020, there have been more than 42,48,389 COVID-19 reported cases and 2,94,046 deaths globally. The pandemic has severely interrupted global healthcare delivery, including treatments to address chronic illnesses such as heart diseases. In comparison to the previous year, there was a 64% decrease in cardiology diagnostic procedures across all regions. On the other hand, a shortage of personal protective equipment (PPE) and high-filtration masks for medical personnel was also noted in 22% of centers, limiting their capacity to perform treatments. The market for suture needles has suffered as a result of this supply shortage.

The rising prevalence of cardiovascular illnesses around the world is predicted to drive up the demand for surgical treatment. According to the WHO, cardiovascular diseases resulted in the deaths of 17.9 million people worldwide in 2019, accounting for 32% of all deaths. Furthermore, heart attacks and strokes may account for a significant portion of these deaths.

Various initiatives such as acquisitions, mergers, and product launches by major market players are anticipated to boost market growth. For instance, in August 2017, The ProxiSure (TM) Suturing Device, an innovative laparoscopic suturing device integrating Ethicon endomechanical, suture, and curved needle technology, has been launched in the United States by Ethicon, which is part of the Johnson & Johnson Medical Devices Companies. ProxiSure (TM) is developed to provide precision suturing in restricted locations and is particularly suited for bariatric, general, colorectal, and gynecological operations, with a highly intuitive tissue healing experience.

A surgeon's ability to suture a variety of tissue layers, including flat surfaces, is also improved by the device's curved needle. Hence, the market for suture needles is expected to grow as a result of such new introductions.

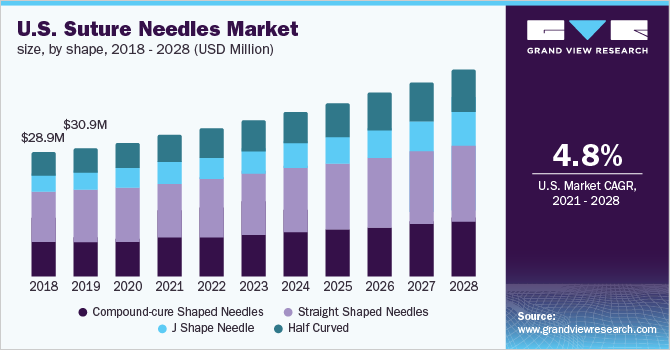

Shape Insights

Straight-shaped needles accounted for the largest revenue share of over 40.0% in 2020. The segment growth can be linked to the increasing popularity of abdominal surgery and rhinoplasty. It is also used in microsurgery for nerve and vascular healing. Unlike other needle types, the straight-body needle is used to suture tissue that is easily accessible and can be operated by hand.

The half-curved needle segment is expected to grow at a rapid pace over the forecast period. This is because a half-curved needle follows a predictable course through tissue and takes up less space than a straight needle. As a result, the market is predicted to grow in the near future due to the increasing demand for the product in skin closure surgeries and its handling qualities.

Type Insights

Tapercut needle accounted for the largest revenue share of over 35.0% in 2020. The taper-point needle is used to puncture easily penetrated tissues (such as subcutaneous layers, dura, peritoneum, and abdominal viscera) while minimizing fascia tearing, which is anticipated to boost the demand for suture needles.

The blunt point needle segment is expected to grow at a rapid pace over the forecast period. Blunt point needle is recommended as an alternative to taper point needles as it significantly decreases the risk exposures during surgical procedures and can be used in place of traditional curved needles, which is projected to fuel the market expansion in the near future.

Application Insights

The cardiovascular segment accounted for the largest revenue share of over 35.0% in 2020. This is due to an increase in the frequency of cardiovascular diseases and technical breakthroughs in diagnosis, surgical equipment, and imaging.

The others segment includes gastrointestinal surgery, obstetrics surgery, urology, and oral surgery. This category is expected to grow significantly over the projected period due to an increase in the number of women's health difficulties and an increase in the number of obese people.

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2020 owing to the high prevalence of cardiovascular illnesses and the high rate of adoption of minimally invasive treatments for cardiovascular and orthopedic diseases, which currently account for more than one-third of all deaths in the United States. In addition, cardiovascular diseases are expected to remain the leading cause of mortality and morbidity for the elderly, whose numbers are expected to double between now and 2030, according to the American Heart Association.

Asia Pacific is expected to expand at the highest CAGR of 5.8% from 2021 to 2028, owing to factors such as the introduction of technologically superior products as a result of market participants’ investments in the region, rising consumer disposable income, and a large volume of surgeries.

For instance, in August 2021, Healthium completed the acquisition of Shri SGK Labs' AbGel gelatin sponge company from Mumbai, expanding its post-surgical and surgical care product line. This acquisition has bolstered their product portfolio, which now includes hemostats, a urology portfolio, a patented arthroscopy, gloves, surgical sutures, needles, hernia meshes, surgical staplers, ligation clips, and other wound closure devices, with the demand for suture needles expected to rise soon.

In addition, the Asia Pacific region's major markets are China, Japan, and India. The important element driving the market in emerging countries is the increase in the number of surgical procedures and medical tourism. As a result, market growth is likely to accelerate in the near future.

Key Companies & Market Share Insights

Companies are focusing on improving their product offerings and increasing their distribution networks through partnerships and collaborations to get a larger portion in the market. For instance, in August 2017, Ethicon, a subsidiary of Johnson & Johnson Medical Devices, launched the ProxiSure Suturing Device in the United States, a sophisticated laparoscopic suturing device that incorporates Ethicon endomechanical, suture, and curved needle technology. The new product launch is anticipated to increase the revenue of the company. Some prominent players in the global suture needles market include:

-

Medtronic

-

Futura Surgicare Pvt. Ltd.

-

Johnson & Johnson Medical N.V.

-

Aurolab

-

Natsume Seisakusho Co., Ltd.

-

Alfresa Pharma Corporation

-

Bear Medic Corporation

-

SUTUREX & RENODEX

-

Teleflex Incorporated

-

Smith & Nephew

-

Hu-Friedy Mfg. Co., LLC

-

FSSB Chirurgische Nadeln GmbH

-

Burtons Medical Equipment Ltd.

-

Advin Health Care

Suture Needles Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 494.6 million

Revenue forecast in 2028

USD 740.9 million

Growth Rate

CAGR of 5.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Shape, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China; India; Australia; South Korea; Afghanistan; North Korea; New Zealand; Brazil; Mexico; Colombia; Argentina; Chile; South Africa; Saudi Arabia; UAE; Turkey; Iran

Key companies profiled

Medtronic; Futura Surgicare Pvt. Ltd.; Johnson & Johnson Medical N.V.; Aurolab; Natsume Seisakusho Co., Ltd.; Alfresa Pharma Corporation; Bear Medic Corporation; SUTUREX & RENODEX; Teleflex Incorporated; Smith & Nephew; Hu-Friedy Mfg. Co., LLC; FSSB Chirurgische Nadeln GmbH; Burtons Medical Equipment Ltd.; Advin Health Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global suture needles market report on the basis of shape, type, application, and region:

-

Shape Outlook (Revenue, USD Million, 2016 - 2028)

-

Compound-cure Shaped Needles

-

Straight Shaped Needles

-

J Shape Needle

-

Half Curved

-

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Tapercut Needle

-

Blunt Point Needle

-

Reverse Cutting Needle

-

Round Bodied Needle

-

Conventional Cutting Needle

-

Spatula Needle

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Cardiovascular

-

General Surgery

-

Orthopedic Procedures

-

Gynecological Procedures

-

Veterinary Procedures

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Afghanistan

-

New Zealand

-

North Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

Iran

-

-

Frequently Asked Questions About This Report

b. The suture needle market size was estimated at USD 469.8 million in 2020 and is expected to reach USD 494.6 million in 2021.

b. The suture needle market is expected to grow at a compound annual growth rate of 5.2% from 2021 to 2028 to reach USD 740.9 million by 2028.

b. North America dominated the suture needle market in 2020 during the forecast period and is expected to witness a growth rate of 4.9% over the forecast period. This is due high prevalence of cardiovascular illnesses and the high rate of minimally invasive treatments adoption for cardiovascular and orthopedic disease, which currently accounts for more than one-third of all deaths in the U.S., are major factors driving the market growth of suture needles in this region

b. Prominent key players operating in the suture needle market include Medtronic, Futura Surgicare Pvt. Ltd., Johnson & Johnson Medical N.V., Aurolab, Natsume Seisakusho Co., Ltd., Alfresa Pharma Corporation, Bear Medic Corporation, SUTUREX & RENODEX, Teleflex Incorporated, Smith & Nephew, Hu-Friedy Mfg. Co., LLC, FSSB Chirurgische Nadeln GmbH, Burtons Medical Equipment Ltd. and Advin Health Care.

b. Key factors that are driving the suture needle market growth include Surge in the number of surgical procedures for cardiovascular diseases, and increasing prevalence of chronic diseases. In addition, the rising geriatric population, increasing various initiatives by major key market players such as acquisitions, mergers, product launches are anticipated to boost the market are further fuelling the growth of the suture needle market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.