- Home

- »

- Plastics, Polymers & Resins

- »

-

Sustainable Pharmaceutical Packaging Market Report, 2030GVR Report cover

![Sustainable Pharmaceutical Packaging Market Size, Share & Trends Report]()

Sustainable Pharmaceutical Packaging Market Size, Share & Trends Analysis Report By Material (Plastics, Glass), By Product (Primary, Secondary), By Process (Reusable, Recyclable), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-390-6

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

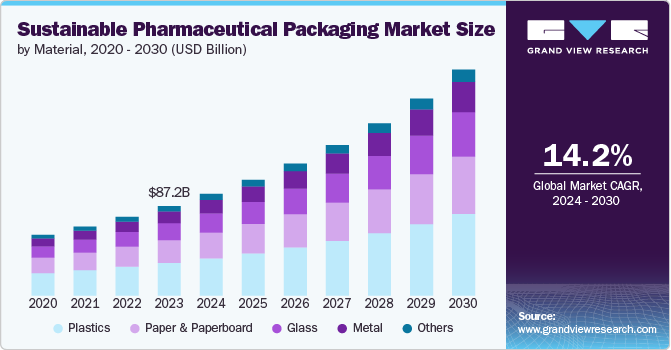

The global sustainable pharmaceutical packaging market size was estimated at USD 87.24 billion in 2023 and is expected to grow at a CAGR of 14.2% from 2024 to 2030. The market is driven by several key factors, reflecting a growing awareness of environmental issues and regulatory pressures. One of the primary drivers is the increasing focus on reducing plastic waste and carbon footprint across industries, including pharmaceuticals. This has led to a surge in demand for eco-friendly packaging materials such as biodegradable plastics, recycled paper, and plant-based alternatives.

In addition, regulatory changes and government initiatives are crucial in shaping the sustainable pharmaceutical packaging landscape. Many countries have implemented stricter regulations on single-use plastics and are encouraging the use of recyclable materials. For instance, the European Union's Circular Economy Action Plan aims to make all packaging reusable or recyclable by 2030, pushing pharmaceutical companies to innovate their packaging designs. This has led to the development of solutions like blister packs made from mono-materials that are easier to recycle.

Consumer awareness and preferences are another significant driving factor for the market. As patients become more environmentally conscious, there's a growing demand for pharmaceuticals packaged in sustainable materials. This trend pushes companies to adopt greener packaging and communicate their sustainability efforts to consumers.

Major companies in the market are undertaking multiple strategic initiatives to enhance their competitive position and capitalize on market opportunities. These strategies include launching new products, engaging in mergers and acquisitions, forming partnerships & collaborations, and expanding into new geographic regions. For instance, in February 2024, Sanofi Consumer Healthcare joined the Blister Pack Collective, formed by PA Consulting and PulPac, to develop recyclable fiber-based blister packs to reduce plastic waste in pharmaceutical packaging. The initiative seeks to replace problematic plastics like PVC, which contribute to the 100,000 tonnes of plastic used annually in medical packaging, with PulPac's Dry Molded Fiber technology, which boasts an 80% lower CO2 footprint than traditional materials. Hence, this strategic decision was intended to enhance the sustainability of its packaging product and inspire industry-wide changes towards environmentally friendly packaging solutions.

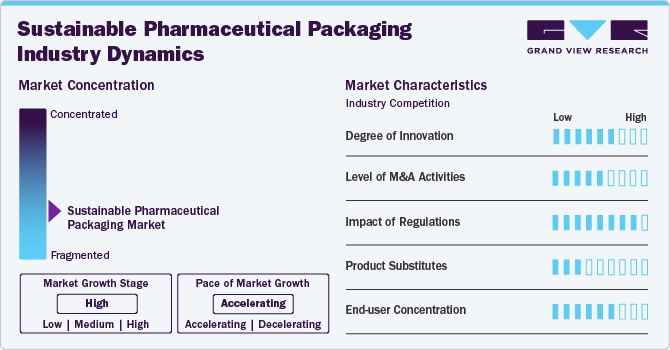

Market Concentration & Characteristics

Major sustainable pharmaceutical packaging companies operating in industry include Amcor plc, Berry Global Inc., Sonoco Products Company, WestRock Company, CCL Healthcare, SGD Pharma, OLIVER, Gerresheimer AG, West Pharmaceutical Services, Inc.; Nottingham Spirk, Crown Packaging Corp., Nipro Europe Group Companies, Origin Pharma Packaging, Syntegon Technology GmbH, and Bormioli Pharma S.p.A.

Companies are increasingly focusing on introducing sustainable packaging practices in the pharmaceutical packaging industry. For instance, in June 2024, Keystone Folding Box Co launched a new line of paper-based blister packs for the pharmaceutical industry, offering an eco-friendly alternative to traditional plastic blister packs. The paper-based packs are made from renewable materials and are designed to provide the same level of protection and functionality as plastic packs while reducing the environmental impact of packaging waste.

In June 2022, Constantia Flexibles introduced a new recycle-ready polypropylene laminate called PERPETUA ALTA. This laminate features improved chemical resistance and is designed for pharmaceutical products. It is claimed to be a mono-material, making it easier to recycle. PERPETUA ALTA can withstand various chemical conditions, including hydro-alcoholic gel, under accelerated aging conditions, similar to aluminum-containing multi-material packaging performance.

Material Insights

Based on material, the market has been segmented into plastics, paper & paperboard, glass, metal, and others. Plastic dominated the overall market, with a market share of 36.79% in 2023. This positive outlook can be attributed to its versatility, cost-effectiveness, and ability to meet stringent regulatory requirements while offering eco-friendly alternatives. The lightweight nature of plastic packaging also contributes to its popularity in sustainable pharmaceutical packaging.

Paper & paperboard material is growing due to its recyclability and biodegradability. Paper-based pharmaceutical packaging includes folding cartons, labels, and inserts. Also, these materials can be easily printed with essential information, providing a practical solution for labeling and branding while maintaining compliance with strict regulatory standards. Companies such as GSK plc and Pfizer Inc. adopted paper-based packaging solutions to meet their sustainability goals, showcasing the material's reliability and effectiveness.

Product Insights

Based on the product, the market is segmented into primary, secondary, and tertiary packaging. The primary pharmaceutical packaging product segment dominated the market and accounted for the largest revenue share of 75.97% in 2023. This outlook is due to its critical role in ensuring pharmaceutical products' safety, efficacy, and integrity. Primary packaging in sustainable pharmaceutical packaging refers to the materials that come into direct contact with the medication or drug product. This includes blister packs, bottles, vials, ampoules, and sachets made from eco-friendly materials.

Secondary packaging includes the packaging used to group and protect primary packages. This typically includes prescription containers and pharmaceutical packaging accessories. In sustainable pharmaceutical packaging, secondary packaging often utilizes recycled paperboard, minimizes the use of inks and adhesives, and incorporates designs that reduce material waste. Tertiary packaging, also known as transit packaging, is used for bulk handling, warehouse storage, and shipping of pharmaceutical products. This includes corrugated boxes, pallets, and shrink wrap. Sustainable approaches in tertiary packaging focus on using recycled and recyclable materials, optimizing package design to reduce space and improve shipping efficiency, and exploring reusable options such as plastic pallets or returnable transit packaging systems.

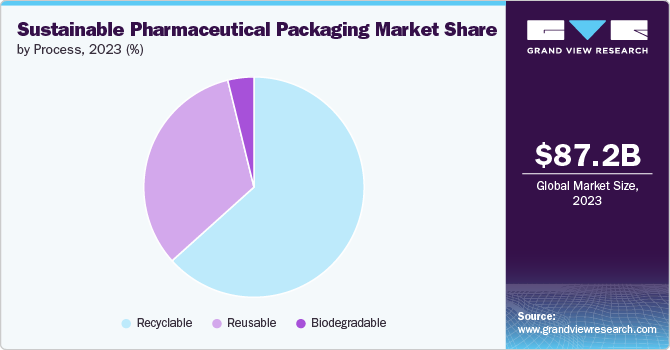

Process Insights

Based on the process, the market is segmented into recyclable, reusable, and biodegradable. The recyclable process segment dominated the market and accounted for the largest revenue share of 63.34% in 2023 and is projected to progress at the fastest CAGR of 14% over the forecast period. This category includes glass bottles, aluminum containers, and certain types of plastic that can be collected, cleaned, and repurposed into new packaging or other products. Recyclable packaging helps reduce waste and conserve resources by keeping materials in circulation longer, though the effectiveness depends on proper disposal and recycling infrastructure.

The biodegradable segment is expected to grow at the fastest CAGR during the forecast period. Biodegradable pharmaceutical packaging is made from materials that can naturally decompose into non-toxic components when exposed to environmental conditions. These may include packaging derived from plant-based materials, such as corn starch or sugarcane, or specially designed polymers that break down more quickly than traditional plastics. Reusable pharmaceutical packaging is designed for multiple uses without significant degradation. This category may include durable containers, refillable dispensers, or packaging systems that can be sanitized and repurposed. Reusable options often have a higher upfront cost but can lead to long-term savings and reduced environmental impact by minimizing the need for single-use packaging.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 35.20% in 2023. Stringent regulations and environmental policies in the region drive pharmaceutical companies to adopt more sustainable packaging solutions. The United States Environmental Protection Agency (EPA) and Health Canada have implemented strict guidelines for reducing packaging waste and promoting recyclable materials. This regulatory pressure has led many pharmaceutical firms to invest in eco-friendly packaging alternatives, such as biodegradable plastics, recycled materials, and reduced packaging designs. For instance, Johnson & Johnson Services, Inc. aims to make 100% of its packaging reusable, recyclable, or compostable by 2025. These major companies set trends and push the entire market towards more sustainable practices.

U.S. Sustainable Pharmaceutical Packaging Market Trends

The sustainable pharmaceutical packaging market in the U.S. is primarily driven by the growing consumer awareness and demand for sustainable products in the U.S. healthcare sector. Patients and healthcare providers are increasingly considering environmental factors when making purchasing decisions. This has prompted pharmaceutical companies to prioritize sustainable packaging as a competitive advantage. For instance, in June 2023, Cabinet Health, P.B.C., a New York-based sustainable healthcare company, launched a nationwide pill bottle recycling program to tackle the environmental impact of pharmaceutical plastics. With an estimated 165 billion plastic pill bottles entering landfills and oceans annually, this program seeks to raise awareness about plastic waste and promote sustainable pharmaceutical packaging solutions.

Asia Pacific Sustainable Pharmaceutical Packaging Market Trends

The sustainable pharmaceutical packaging market in Asia Pacific is projected to expand at the fastest CAGR of 17.6% from 2024 to 2030. Rapid industrialization and economic growth in countries such as China, India, and Southeast Asian nations have led to increased pharmaceutical production and consumption. This growth has created a need for sustainable packaging solutions to mitigate environmental impacts. Governments in these countries are implementing stricter regulations on plastic usage and waste management, pushing pharmaceutical companies to adopt eco-friendly packaging alternatives, thus driving market growth in the region.

Southeast Asia sustainable pharmaceutical packaging market is rapidly growing due to the expanding pharmaceutical industry, increasing environmental awareness, and supportive government policies. One of the primary drivers is the region's aging population, which has led to increased demand for pharmaceuticals. Singapore, Malaysia, and Thailand have invested heavily in their healthcare infrastructure, thus creating a need for more sustainable packaging solutions.

Europe Sustainable Pharmaceutical Packaging Market Trends

The sustainable pharmaceutical packaging market in Europeheld a revenue market share of 25.63% in 2023. Europe has implemented stringent regulations and policies promoting sustainability across industries, including pharmaceuticals. The European Union's Circular Economy Action Plan and the European Green Deal have set ambitious targets for reducing waste and improving recyclability. This regulatory environment has pushed pharmaceutical companies to invest in sustainable packaging solutions. For instance, companies such as Novartis AG and Merck KGaA have committed to making 100% of their packaging recyclable or reusable by 2025 and 2030, respectively.

The UK sustainable pharmaceutical packaging market has implemented stringent regulations and policies promoting sustainability across industries. The government's commitment to reducing plastic waste and carbon emissions has pushed pharmaceutical companies to adopt eco-friendly packaging solutions. For example, the UK Plastics Pact, a collaborative initiative between businesses, NGOs, and the government, has set ambitious targets for reducing plastic waste, directly impacting the country's pharmaceutical packaging practices.

Central & South America Sustainable Pharmaceutical Packaging Market Trends

The sustainable pharmaceutical packaging market in CSA is projected to expand at a moderate CAGR from 2024 to 2030, owing to a growing awareness of environmental issues and stricter regulations on plastic use and waste management in the region. Countries such as Brazil, Argentina, and Colombia have implemented policies to reduce single-use plastics and promote sustainable packaging solutions. This regulatory push has incentivized pharmaceutical companies to adopt eco-friendly packaging options. For instance, Brazil's National Solid Waste Policy has encouraged using recyclable and biodegradable materials in pharmaceutical packaging.

Middle East & Africa Sustainable Pharmaceutical Packaging Market Trends

The sustainable pharmaceutical packaging market in the MEAis influenced by growing environmental awareness and stricter regulations in the region. A significant increase in healthcare investments across the Middle East, particularly in countries such as Saudi Arabia, UAE, and Qatar, is expected to positively influence the market in the region.

Saudi Arabia sustainable pharmaceutical packaging market is expected to grow significantly over the forecast period. According to the National Industrial Development Center (NIDC), in August 2023, Saudi Arabia's pharmaceutical sector is set for substantial growth following the signing of a trilateral memorandum of understanding by the Kingdom's National Industrial Development Center, Jubail Pharma and RR Holding Co. This agreement aims to enhance the local production of chemical compounds essential for manufacturing pharmaceutical products. Hence, the partnership is expected to trigger the demand for pharmaceutical packaging products, thus positively influencing the country's market.

Key Sustainable Pharmaceutical Packaging Company Insights

The market is fragmented, with large multinational companies and numerous smaller regional and local players. Over the past few years, the market has witnessed a significant number of new product launches, mergers and acquisitions, and expansions.

Key Sustainable Pharmaceutical Packaging Companies:

The following are the leading companies in the sustainable pharmaceutical packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Berry Global Inc.

- Sonoco Products Company

- WestRock Company

- CCL Healthcare

- SGD Pharma

- OLIVER

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Nottingham Spirk

- Crown Packaging Corp.

- Nipro Europe Group Companies

- Origin Pharma Packaging

- Syntegon Technology GmbH

- Bormioli Pharma S.p.A.

Recent Developments

-

In February 2024, Schreiner Group, a Germany-based company specializing in pharmaceutical labeling and packaging solutions, launched a new sustainable closure seal called Needle-Trap Closure Seal. This product is designed to prevent needles from being reused and to ensure the integrity of pharmaceutical packaging. The closure seal is made from recyclable materials and is intended to contribute to the company's sustainability efforts while maintaining the safety and security of its products.

-

In August 2023, Amcor plc announced the acquisition of a scalable, flexible packaging plant in the high-growth Indian market. This strategic move involves the acquisition of Phoenix Flexibles, expanding the company’s capacity in India. The company already operates four flexible packaging plants in India. This acquisition aligns with the company’s position as a global leader in developing sustainable packaging solutions.

Sustainable Pharmaceutical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 99.18 billion

Revenue forecast in 2030

USD 220.39 billion

Growth rate

CAGR of 14.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, process, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Berry Global Inc.; Sonoco Products Company; WestRock Company; CCL Healthcare; SGD Pharma; OLIVER; Gerresheimer AG; West Pharmaceutical Services, Inc.; Nottingham Spirk; Crown Packaging Corp.; Nipro Europe Group Companies; Origin Pharma Packaging; Syntegon Technology GmbH; Bormioli Pharma S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Pharmaceutical Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable pharmaceutical packaging market report based on material, product, process, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Polyethylene terephthalate (PET)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Bioplastics

-

Others

-

-

Paper & Paperboard

-

Glass

-

Metal

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Primary

-

Plastic Bottles

-

Caps & Closures

-

Parenteral Containers

-

Blister Packs

-

Prefillable Inhalers

-

Pouches

-

Medication Tubes

-

Others

-

-

Secondary

-

Prescription Containers

-

Pharmaceutical Packaging Accessories

-

-

Tertiary

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Recyclable

-

Reusable

-

Biodegradable

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sustainable pharmaceutical packaging market was estimated at USD 87.24 billion in 2023 and is expected to reach USD 99.18 billion in 2024.

b. The global sustainable pharmaceutical packaging market is expected to grow at a compound annual growth rate of 14.2% from 2024 to 2030, reaching around USD 220.39 billion by 2030.

b. The recyclable process segment dominated the market and is projected to progress at the fastest CAGR of 14% over the forecast period. This category includes glass bottles, aluminum containers, and certain types of plastic that can be collected, cleaned, and repurposed into new packaging or other products.

b. Key players in the market include Amcor plc, Berry Global Inc., Sonoco Products Company, WestRock Company, CCL Healthcare, SGD Pharma, OLIVER, Gerresheimer AG, West Pharmaceutical Services, Inc., Nottingham Spirk, Crown Packaging Corp., Nipro Europe Group Companies, Origin Pharma Packaging, Syntegon Technology GmbH, and Bormioli Pharma S.p.A.

b. The global sustainable pharmaceutical packaging market is driven by the growing emphasis on reducing plastic waste and carbon footprint across various industries, including pharmaceuticals. This has significantly increased demand for eco-friendly packaging materials such as biodegradable plastics, recycled paper, and plant-based alternatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."