- Home

- »

- Plastics, Polymers & Resins

- »

-

Sustainable Packaging Market Size And Share Report, 2030GVR Report cover

![Sustainable Packaging Market Size, Share & Trends Report]()

Sustainable Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard, Glass, Metal), By Type, By Packaging Format, By Process, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-265-9

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sustainable Packaging Market Summary

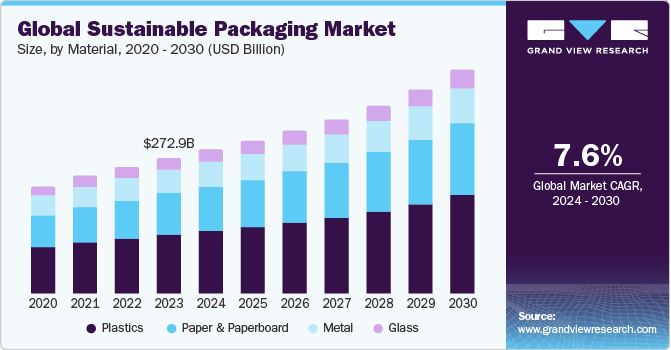

The global sustainable packaging market size was estimated at USD 272.93 billion in 2023 and is projected to reach USD 448.53 billion by 2030, growing at a CAGR of 7.6% from 2024 to 2030. Rising awareness about the environmental impact of traditional packaging materials, especially plastics, has led to increasing demand for sustainable packaging solutions across the world.

Key Market Trends & Insights

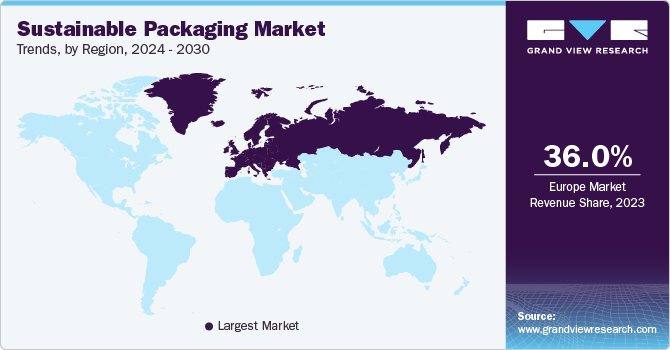

- Europe dominated the market and accounted for the largest revenue share of over 36.0% in 2023.

- The sustainable packaging market in the U.S. is expected to witness robust CAGR over the forecast period.

- By material, the plastics segment dominated the overall market, with a revenue share of over 43% in 2023.

- By type, the rigid type segment dominated the market and accounted for revenue share of over 60% in 2023.

- By packaging format, the primary packaging segment accounted for a revenue share of over 76% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 272.93 Billion

- 2030 Projected Market Size: USD 448.53 Billion

- CAGR (2024-2030): 7.6%

- Europe: Largest market in 2023

In addition, bans on single-use plastics, extended producer responsibility (EPR) laws, and incentives for using environmentally friendly packaging materials are expected to contribute to the market growth during the forecast period.According to the Environmental Protection Agency (EPA), in 2021, the U.S. generated approximately 40 million tons of plastic waste, of which only 5% to 6% (about two million tons) was recycled. This recycling rate signifies a significant challenge in plastic waste management. Plastics take hundreds of years to decompose in landfills. More plastic waste means more landfill space being used up more quickly. Recycling reduces plastic landfill waste. Hence, increasing plastic waste is expected to positively influence the sustainable packaging market in the U.S.

Consumer preferences also play a pivotal role in driving the market growth. There has been a noticeable shift in consumer behavior, with an increasing number of individuals opting for products that are packaged in an environmentally responsible manner. Demand for sustainable packaging is driving companies to incorporate eco-friendly materials and practices into their supply chains to enhance their brand image and meet consumer expectations. Consumers are likely to continue influencing market trends by favoring products aligning with their values.

Furthermore, stringent regulations and policies aimed at curbing single-use plastics are pushing companies to adopt sustainable practices. Governments globally are implementing measures to reduce the use of traditional plastics and encourage the adoption of recyclable, biodegradable, or compostable alternatives. As a result, businesses are compelled to invest in sustainable packaging solutions to comply with evolving regulatory landscapes. This regulatory push is acting as a catalyst for the adoption of environmentally friendly materials and reshaping the competitive landscape of the sustainable packaging industry.

Collaborations between stakeholders, including sustainable packaging manufacturers, raw material suppliers, and recycling facilities, are benefiting the overall sustainable packaging ecosystem. For instance, in April 2023, Transcend Packaging, a UK-based sustainable packaging company, strategically joined forces with ITOCHU Corporation, one of Japan’s prominent companies and a global provider of molded pulp and paper products. This strategic partnership is intended to deliver a broad range of paper and molded fiber-based sustainable packaging products for food service applications to markets across the UK and Europe.

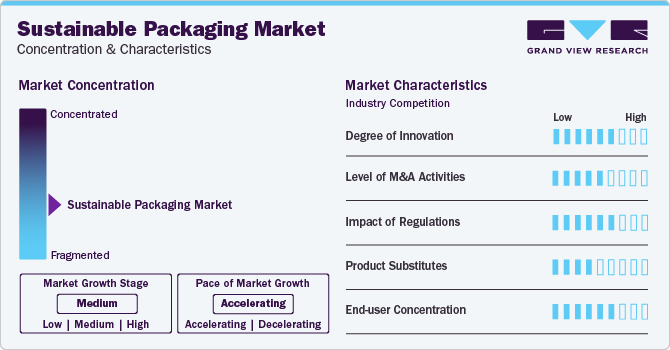

Market Concentration & Characteristics

Prominent sustainable packaging companies operating in market include Amcor plc; Sealed Air; Sonoco Products Company; Smurfit Kappa; Berry Global Inc.; Tetra Pak; Elevate Packaging; Huhtamaki Oyj; Mondi; DS Smith; Atlantic Packaging; UFlex Limited; Constantia Flexibles; Genpak; Reynolds Packaging; Crown Holdings, Inc.; Gerresheimer AG; Novamont S.p.A.; WestRock Company; Ernest Packaging Solutions; NEFAB GROUP; Scholle IPN; Farnell Packaging; Greiner Packaging; and Greendot Biopak.

Companies are increasingly focusing on introducing recyclable packaging products in the sustainable packaging market. For instance, in May 2023, Constantia Flexibles, Premji Invest, and SB Packagings formed a joint venture (JV)-SB-Constantia Flexibles-to establish a significant sustainable packaging platform in India and South Asia. This collaboration has received regulatory approval from the Competition Commission of India. The JV forged together two prominent leaders in the flexible packaging industry, with Premji Invest as a shareholder. By leveraging the distinctive strengths and resources of each company, the JV seeks to achieve greater success in the Indian market.

In March 2023, Electrolux Group launched new, more sustainable packaging to reduce environmental impact. This initiative includes recycled and paper-based packaging with 70% less ink to promote sustainability while ensuring product protection during transportation. The group's global packaging working group is focused on developing packaging solutions that are both eco-friendly and functional, ensuring products are adequately contained, protected, and marketed.

Material Insights

Plastics dominated the overall market, with a revenue share of over 43% in 2023. Plastic packaging materials are generally lightweight, reducing transportation costs and carbon emissions associated with shipping. Additionally, plastics are relatively inexpensive to produce compared to other materials such as glass or metal.

The paper & paperboard material segment is expected to witness robust growth at a CAGR of 8.1% over the forecast period. Paper and paperboard are highly recyclable materials, with well-established recycling infrastructure and processes in place globally. This aligns with the principles of sustainability and circular economy.

Type Insights

The rigid type segment dominated the market and accounted for largest revenue share of over 60% in 2023. Rigid plastic packaging offers excellent protection to products. It can withstand external pressures, impacts, and other environmental factors, ensuring that the contents remain intact and undamaged. This is particularly important for fragile or sensitive packaged items.

The flexible plastic packaging segment is expected to witness robust growth at a CAGR of 7.9% over the forecast period. Flexible packaging typically requires less material as compared to rigid packaging options. This results in less plastic being used to create the packaging, resulting in a lower environmental impact.

Packaging Format Insights

The primary packaging segment accounted for the largest revenue share of over 76% in 2023 and is anticipated to register robust growth at a CAGR of 7.9% during the forecast period. Primary packaging helps preserve the freshness, flavor, and overall quality of the product. It prevents exposure to elements that could lead to spoilage, contamination, or degradation of the product's sensory attributes.

Besides, secondary packaging shields the primary packaging and the product from external factors such as impacts, vibrations, and environmental conditions. This helps ensure that the product reaches its destination in optimal condition.

Moreover, primary and secondary packaging is necessary for protecting individual products; however, tertiary packaging helps minimize overall packaging waste by consolidating multiple units into larger, more efficient loads. This can contribute to sustainability goals by optimizing the use of materials and reducing the environmental impact of packaging.

Process Insights

The recyclable process segment dominated the market and accounted for largest revenue share of over 63% in 2023. The adoption of recyclable packaging processes helps reduce the overall volume of plastic waste generated. This is particularly important in addressing the global plastic pollution crisis and the challenges associated with managing and disposing of non-recyclable plastics.

The biodegradable process segment is anticipated to grow at the fastest CAGR of 10% from 2024 to 2030. Biodegradable materials decompose more easily, posing fewer risks to wildlife and ecosystems compared to non-biodegradable counterparts. Besides, many biodegradable packaging materials are derived from renewable resources, such as plant-based sources, which helps reduce dependence on finite fossil fuels.

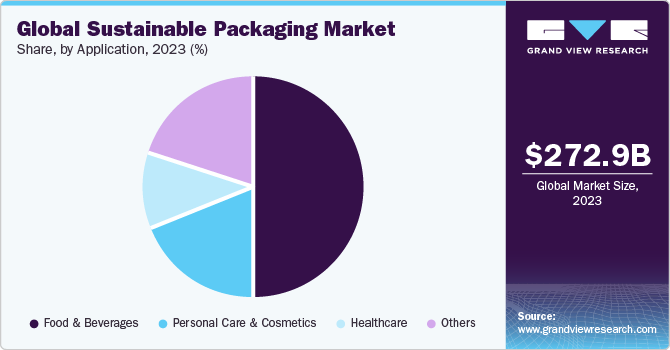

Application Insights

The food & beverages application segment dominated the overall market and accounted for largest revenue share of over 49% in 2023. Many countries and regions have implemented regulations and guidelines encouraging or mandating the use of sustainable packaging materials in the food and beverage industry. This regulatory push has driven the adoption of sustainable packaging solutions in this sector.

The healthcare application segment is projected to progress at the fastest CAGR of 8.1% over the forecast period. The healthcare industry's emphasis on product safety, regulatory compliance, environmental consciousness, and corporate social responsibility has driven the wide adoption of sustainable packaging solutions, making it a significant contributor to the growth of this market segment.

Regional Insights

The sustainable packaging market in North America held 27.44% of the global revenue in 2023. North America market is characterized by extensive research and development for developing innovative technologies and processes for manufacturing sustainable packaging solutions. Many North American-based big brands and retailers have made public commitments to use 100% reusable, recyclable or compostable packaging by 2025 - 2030. Companies such as Unilever, Nestlé, Walmart, Target, and PepsiCo are redesigning packaging to reduce plastic waste. This outlook is expected to provide growth opportunities within sustainable packaging industry over the forecast period.

U.S. Sustainable Packaging Market Trends

The sustainable packaging market in the U.S. is expected to witness robust growth from 2024 to 2030, due to the ban on single-use plastics, which leads to an increase in demand for recyclable, sustainable packaging products. For instance, in 2022, California passed a groundbreaking law aimed at reducing single-use plastics, making it the first state in the U.S. to implement such comprehensive restrictions. The new law requires a 25% reduction in single-use plastic by 2032, with at least 30% of plastic items sold or bought being recyclable by 2028. Producers will bear the economic responsibility, and fines of up to USD 50,000 a day may be imposed for non-compliance. The legislation also establishes a plastic pollution mitigation fund and mandates a 25% reduction in expanded polystyrene by 2023, escalating to 65% by 2032. By 2032, 65% of all plastic items distributed in California must be recyclable.

The Canada sustainable packaging market held a significant revenue share in 2023 due to its commitment to using recycled content in its packaging. In October 2023, the Coca-Cola Company in Canada launched 100% recycled PET (rPET) bottles for all 500-ml sparkling beverages, excluding caps and labels. By transitioning to 100% recycled plastic bottles, Coca-Cola aims to save new plastic usage, reduce CO2 emissions, and support a circular economy for plastic packaging.

Europe Sustainable Packaging Market Trends

Europe dominated the market and accounted for the largest revenue share of over 36% in 2023, owing to continuous innovations for promoting sustainable packaging. For instance, in November 2023, Nokia, a Finland-based company, took a significant step towards sustainability by transitioning to 100% recyclable packaging for its Fixed Networks Lightspan portfolio. This move aims to reduce packaging waste for its broadband access products. The new packaging is not only environmentally friendly but also more efficient, being 60% smaller and 44% lighter, which results in a reduction of CO2 emissions by up to 60%. Hence, this type of strategic decision is estimated to accelerate the growth of sustainable packaging market in Europe.

The Germany sustainable packaging market is primarily driven by the increasing efforts made by packaging companies to launch environmentally friendly packaging in order to reduce plastic pollution. For instance, in November 2023, tesa SE, a German manufacturer of adhesive tapes, introduced a more sustainable tape called tesa 51345. This new paper-based adhesive tape is designed to reinforce critical stress areas of cartons and packaging, such as side holes, flaps, or top holes. It features a strong paper-based backing and a reliable adhesive that provides a robust bond, enhancing the strength of packaging materials. The tesa 51345 tape aims to offer a more sustainable solution for packaging needs by utilizing paper-based materials.

Asia Pacific Sustainable Packaging Market Trends

The sustainable packaging market in Asia Pacificheld a major revenue share in 2023. The Asia Pacific region is rich in natural resources, including agricultural and forestry products, which can be used as raw materials for sustainable packaging solutions. Countries such as India, China, and Indonesia have a substantial biomass supply, facilitating the production of bioplastics and other plant-based packaging materials.

In December 2023, SABIC and CJ CheilJedang collaborated on the production of Hetbahn. These instant rice packaging bowls are manufactured using renewable polypropylene (PP) resins and are a part of their sustainable packaging initiatives in Asia Pacific. This partnership marks the launch of ISCC PLUS certified food packaging, emphasizing commitment to environmentally friendly practices. Such strategic initiatives are expected to benefit the regional market.

The India sustainable packaging market is expected to grow during the forecast period. In October 2023, Pakka Limited, a manufacturer specializing in compostable packaging solutions, introduced India's first compostable flexible packaging in collaboration with Brawny Bear, a nutrition company. This initiative marks a significant milestone in India's packaging industry, aiming to address environmental concerns associated with conventional non-biodegradable plastic-based flexible packaging. This initiative establishes Pakka Limited as a prominent player providing sustainable packaging solutions. This can create a ripple effect, encouraging other companies in the packaging industry to explore and invest in eco-friendly alternatives.

Central & South America Sustainable Packaging Market Trends

The sustainable packaging market in Central & South America is projected to expand at a moderate CAGR from 2024 to 2030, due to the abundant natural resources, favorable government initiatives, and growing consumer awareness. Many countries in this region are rich in renewable resources,such as wood, bamboo, and agricultural products, which serve as feedstock for sustainable packaging materials such as paper, molded fiber, and bioplastics.

The Argentina sustainable packaging market is expected to register a healthy growth rate over the forecast period. The Chacabuco aluminum bottle is a pioneering sustainable packaging solution that has been recognized for its eco-friendly features. This bottle is 100% recyclable, lightweight, durable, and aesthetically customizable, making it an ideal choice for brands looking to reduce their environmental impact. Notably, Chacabuco's aluminum bottle is the first of its kind used in the wine industry in Argentina, showcasing a commitment to innovation and sustainability.

Middle East & Africa Sustainable Packaging Market Trends

The market dynamics for sustainable packaging in Middle East & Africaare influenced by the growing population and government regulations related to plastic packaging. Several governments in the region have implemented regulations and initiatives to promote sustainable practices, including the use of eco-friendly packaging materials. For example, the UAE introduced stringent regulations on single-use plastics, encouraging the adoption of sustainable packaging alternatives.

The UAE sustainable packaging market growth can be attributed to initiatives taken by UAE-based packaging companies to achieve their sustainability goals. For instance, in April 2023, Hotpack Global, a UAE-based disposable packaging manufacturer, announced plans to establish a specialized food packaging project in Saudi Arabia worth approximately USD 266 million. This project aims to produce sustainable, recyclable, and biodegradable packaging products over a seven-year period, making it one of the largest specialized food packaging projects in Saudi Arabia. Hotpack Global will collaborate with the Saudi Ministry of Industry to utilize agricultural waste as a key component of raw materials for manufacturing. This initiative aligns with efforts to reduce packaging waste globally. The company's expansion into Saudi Arabia reflects its commitment to sustainable practices and growth in the region.

Key Sustainable Packaging Company Insights

The market is fragmented with the presence of a significant number of companies. Sustainable packaging industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

In January 2024, Sealed Air launched a compostable protein packaging tray at IPPE 2024, introducing the CRYOVAC brand compostable overwrap tray made from biobased, food-contact grade resin. This tray is certified as industrial compostable and soil and marine biodegradable, offering a sustainable alternative to traditional EPS foam trays. Company’s commitment to sustainability includes designing recyclable or reusable packaging solutions and incorporating recycled or renewable content. The tray's ability to withstand extreme temperatures and shipping environments without compromising performance makes it a significant innovation in the market for sustainable packaging.

-

In December 2023, Novolex, through its brand Waddington North America (WNA), introduced food packaging containers that are recyclable and made with a minimum of 10% post-consumer recycled (PCR) content. These new products include various items, such as dessert cups, tamper-evident containers, cake containers, and bakery clamshells. The containers are designed to enhance food presentation and come in different sizes and shapes to cater to various needs. This initiative aligns with Novolex's commitment to sustainability and reducing its environmental impact by supporting the circular economy.

Key Sustainable Packaging Companies:

The following are the leading companies in the sustainable packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa

- Berry Global Inc.

- Tetra Pak

- Elevate Packaging

- Huhtamaki Oyj

- Mondi

- DS Smith

- Atlantic Packaging

- UFlex Limited

- Constantia Flexibles

- Genpak

- Reynolds Packaging

- Crown Holdings, Inc.

- Gerresheimer AG

- Novamont S.p.A.

- WestRock Company

- Ernest Packaging Solutions

- NEFAB GROUP

- Scholle IPN

- Farnell Packaging

- Greiner Packaging

- Greendot Biopak

Sustainable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 289.01 billion

Revenue forecast in 2030

USD 448.53 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, packaging format, process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Sealed Air; Sonoco Products Company; Smurfit Kappa; Berry Global Inc.; Tetra Pak; Elevate Packaging; Huhtamaki Oyj; Mondi; DS Smith; Atlantic Packaging; UFlex Limited; Constantia Flexibles; Genpak; Reynolds Packaging; Crown Holdings, Inc.; Gerresheimer AG; Novamont S.p.A.; WestRock Company; Ernest Packaging Solutions; NEFAB GROUP; Scholle IPN; Farnell Packaging; Greiner Packaging; Greendot Biopak

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable packaging market report based on material, type, packaging format, process, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Glass

-

Metal

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Packaging Format Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Primary Packaging

-

Secondary Packaging

-

Tertiary Packaging

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Recyclable

-

Reusable

-

Biodegradable

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sustainable packaging market was estimated at around USD 272.93 billion in the year 2023 and is expected to reach around USD 289.01 billion in 2024.

b. The global sustainable packaging market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach around USD 448.53 billion by 2030.

b. Food & beverage emerged as a dominating application with a value share of around 49.0% in the year 2023 owing to the increasing implementation of regulations and guidelines regarding the use of sustainable packaging materials in the food & beverage industry.

b. Europe emerged as a dominating region with a value share of around 36.0% in the year 2023 owing to the continuous innovations for promoting sustainable packaging across the region.

b. The key player in the sustainable packaging market includes Amcor plc, Sealed Air, Sonoco Products Company, Smurfit Kappa, Berry Global Inc., Tetra Pak, Elevate Packaging, Huhtamaki Oyj, Mondi, DS Smith, Atlantic Packaging, UFlex Limited, Constantia Flexibles, Genpak, Reynolds Packaging, Crown Holdings, Inc., Gerresheimer AG, Novamont S.p.A., WestRock Company, Ernest Packaging Solutions, NEFAB GROUP, Scholle IPN, Farnell Packaging, Greiner Packaging, and Greendot Biopak.

b. Bans on single-use plastics, extended producer responsibility (EPR) laws, and incentives for using environmentally friendly packaging materials is triggering the growth of sustainable packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.