- Home

- »

- Next Generation Technologies

- »

-

Sustainable Manufacturing Market Size & Share Report 2030GVR Report cover

![Sustainable Manufacturing Market Size, Share & Trends Report]()

Sustainable Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Recycled Plastics, Green Hydrogen), By Vertical (Automotive, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sustainable Manufacturing Market Summary

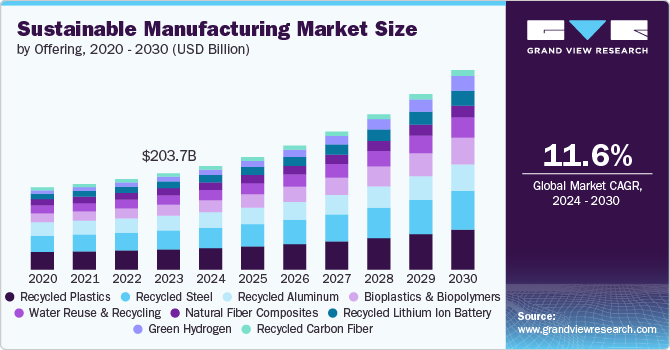

The global sustainable manufacturing market size was estimated at USD 203.65 billion in 2023 and is projected to reach USD 422.12 billion by 2030, growing at a CAGR of 11% from 2024 to 2030. Increasing environmental regulations and policies aimed at reducing carbon emissions and waste are pushing manufacturers to adopt more sustainable practices.

Key Market Trends & Insights

- North America sustainable manufacturing market dominated with a revenue share of over 30.0% in 2023.

- The Asia Pacific sustainable manufacturing market is anticipated to register the highest CAGR over the forecast period.

- In terms of offering, the recycled plastics segment led the market, accounted for over 21.0% share of the global revenue in 2023.

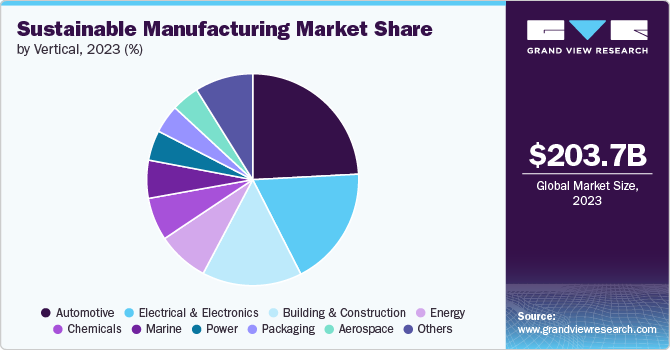

- Based on vertical, the automotive segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 203.65 Billion

- 2030 Projected Market Size: USD 422.12 Billion

- CAGR (2024-2030): 11%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Growing consumer awareness and preference for environmentally friendly products are driving companies to adopt sustainable manufacturing practices to meet market expectations. Sustainable manufacturing often leads to cost savings through improved resource efficiency, reduced waste, and lower energy consumption. Innovations in technologies, such as renewable energy, energy-efficient machinery, and recycling technologies, are enabling more sustainable manufacturing processes.

Companies are increasingly integrating sustainability into their Corporate Social Responsibility (CSR) strategies to enhance their brand reputation and meet investor expectations. As global supply chains become more complex, there is a growing emphasis on ensuring that manufacturing processes are sustainable and ethical across the entire supply chain. Increased investment in sustainable technologies and practices by governments, private investors, and venture capitalists is driving growth in the sustainable manufacturing market.

The need to address climate change and reduce greenhouse gas emissions is prompting manufacturers to adopt sustainable practices to minimize their environmental impact. The need to manage and conserve finite resources, such as raw materials and water, is encouraging the adoption of sustainable practices to ensure long-term availability. Ongoing research and development in sustainable materials, processes, and technologies are creating new opportunities for growth and efficiency in the manufacturing sector.

Offering Insights

The recycled plastics segment led the market, accounted for over 21.0% share of the global revenue in 2023. Stricter regulations on plastic waste management and recycling are encouraging companies to adopt recycled plastics as part of their manufacturing processes. Increasing consumer preference for eco-friendly products and sustainable packaging is driving demand for recycled plastic materials.The push towards a circular economy, which focuses on reusing and recycling materials, is increasing the use of recycled plastics in manufacturing.

The green hydrogen segment is predicted to foresee the highest CAGR from 2024 to 2030. Governments and industries are setting ambitious targets for reducing greenhouse gas emissions, and green hydrogen is seen as a key solution for achieving these goals, especially in sectors hard to decarbonize. Green hydrogen is produced using renewable energy sources such as wind or solar power, aligning with the broader shift towards renewable energy in manufacturing processes. Improvements in electrolyzing technology and other hydrogen production methods are making green hydrogen more efficient and cost-effective.

Vertical Insights

The automotive segment accounted for the largest revenue share in 2023. Growing consumer awareness and preference for environmentally friendly vehicles are pushing automakers to focus on sustainable manufacturing processes and materials.Innovations in battery technology, lightweight materials, and energy-efficient manufacturing processes are enhancing the sustainability of automotive production. The adoption of circular economy principles, including recycling and reusing materials, is gaining traction in the automotive industry to minimize waste and resource use.Various governments offer incentives, grants, and subsidies for the production and purchase of electric and hybrid vehicles, which supports sustainable manufacturing practices.

The packaging segment is anticipated to exhibit the highest CAGR from 2024 to 2030. Increasing regulations aimed at reducing plastic waste and encouraging recycling are pushing companies to adopt sustainable packaging solutions. Growing consumer demand for eco-friendly and recyclable packaging is driving manufacturers to explore and implement sustainable packaging materials and designs. Various manufacturing companies are setting targets to reduce their environmental footprint, leading them to invest in sustainable packaging options as part of their overall sustainability strategies.

Regional Insights

North America sustainable manufacturing market dominated with a revenue share of over 30.0% in 2023. Businesses in North America are setting sustainability targets, including reducing carbon footprints and integrating more sustainable materials and processes. Moreover, innovations in technology, such as energy-efficient manufacturing equipment, renewable energy sources, and advanced recycling processes, are making sustainable manufacturing more viable and cost-effective.

U.S. Sustainable Manufacturing Market Trends

The U.S. sustainable manufacturing market is anticipated to exhibit a significant CAGR over the forecast period. The push for energy efficiency and reduction in operational costs is driving the adoption of sustainable manufacturing practices in the country. Furthermore, increasing consumer awareness and preference for eco-friendly products are driving companies to implement sustainable manufacturing practices to meet market expectations and enhance brand reputation.

Europe Sustainable Manufacturing Market Trends

The sustainable manufacturing market in the Europe region is expected to witness significant growth over the forecast period. Europe has stringent environmental regulations and targets for reducing greenhouse gas emissions and waste, such as the European Green Deal and the Circular Economy Action Plan. These policies drive manufacturers to adopt sustainable practices. European consumers are highly aware of environmental issues and increasingly demand products with sustainable packaging and production processes, influencing companies to align with these preferences.

Asia Pacific Sustainable Manufacturing Market Trends

The Asia Pacific sustainable manufacturing market is anticipated to register the highest CAGR over the forecast period. As global supply chains become more complex, there is increasing pressure for manufacturers to adopt sustainable practices throughout their operations and supply chains. Ongoing research and development in sustainable manufacturing technologies and materials are creating new opportunities for growth and efficiency in the region.

Key Sustainable Manufacturing Company Insights

Key market companies include 3M, Braskem, and Cirba Solutions. Companies active in the sustainable manufacturing market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in November 2023, EDF, an electric utility company, partnered with REEL, selected Veolia’s technological solution for creating, producing, and setting up mobile units to address contaminated water in the event of a nuclear accident. The solution would minimize environmental impact by treating the primary circuit water stored in the reactor building tanks on-site in the event of a pipe rupture.

Key Sustainable Manufacturing Companies:

The following are the leading companies in the sustainable manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Braskem

- Cirba Solutions

- NatureWorks LLC

- Schneider Electric

- Siemens

- Tesla

- Umicore

- Unilever

- Veolia

Recent Developments

-

In May 2024, Saltigo, a chemicals company, introduced “Net Zero Custom Manufacturing”, sustainable manufacturing products. Saltigo's Net Zero Custom Manufacturing prioritizes the utilization of sustainably produced energy and environmentally friendly raw materials.

-

In April 2024, Veolia Huafei subsidiary of the Veolia collaborated with L'Oreal Group to assist in numerous environmental metrics. Veolia Huafei is assisting L'Oreal Group in expedited transformation towards a circular economy for plastics.

-

In April 2024, Cirba Solutions introduced SustainABILITY 10,000. The "SustainABILITY 10,000" initiative, led by Cirba Solutions and its team, aims to transform communities into knowledgeable advocates of eco-friendly living through a commitment to 10,000 hours of community engagement, promoting sustainable practices, and providing education in various communities across North America.

Sustainable Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 218.93 billion

Revenue forecast in 2030

USD 422.12 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

3M; Braskem; Cirba Solutions; NatureWorks LLC; Schneider Electric; Siemens; Tesla; Umicore; Unilever; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global sustainable manufacturing market report based on offering, vertical, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Recycled Lithium Ion Battery

-

Water Reuse and Recycling

-

Recycled Plastics

-

Green Hydrogen

-

Recycled Steel

-

Recycled Aluminium

-

Recycled Carbon Fibre

-

Bioplastics & Biopolymers

-

Natural Fibre Composites

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive

-

Energy

-

Electrical & Electronics

-

Packaging

-

Building & Construction

-

Marine

-

Aerospace

-

Power

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

Frequently Asked Questions About This Report

b. The global sustainable manufacturing market size was estimated at USD 203.65 billion in 2023 and is expected to reach USD 218.93 billion in 2024.

b. The global sustainable manufacturing market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 422.12 billion by 2030.

b. North America dominated the sustainable manufacturing market with a share of 33.8% in 2023. Businesses in North America are setting sustainability targets, including reducing carbon footprints and integrating more sustainable materials and processes. Moreover, innovations in technology, such as energy-efficient manufacturing equipment, renewable energy sources, and advanced recycling processes, are making sustainable manufacturing more viable and cost-effective.

b. Some key players operating in the sustainable manufacturing market include 3M, Braskem, Cirba Solutions, NatureWorks LLC, Schneider Electric, Siemens, Tesla, Umicore, Unilever, and Veolia.

b. Growing consumer awareness and preference for environmentally friendly products are driving companies to adopt sustainable manufacturing practices to meet market expectations. Sustainable manufacturing often leads to cost savings through improved resource efficiency, reduced waste, and lower energy consumption. Innovations in technologies, such as renewable energy, energy-efficient machinery, and recycling technologies, are enabling more sustainable manufacturing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.