- Home

- »

- Plastics, Polymers & Resins

- »

-

Sustainable Electrostatic Discharge Packaging Market Report 2030GVR Report cover

![Sustainable Electrostatic Discharge Packaging Market Size, Share & Trends Report]()

Sustainable Electrostatic Discharge Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastics), By Product (Bags & Pouches, Trays & Inserts), By Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-319-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

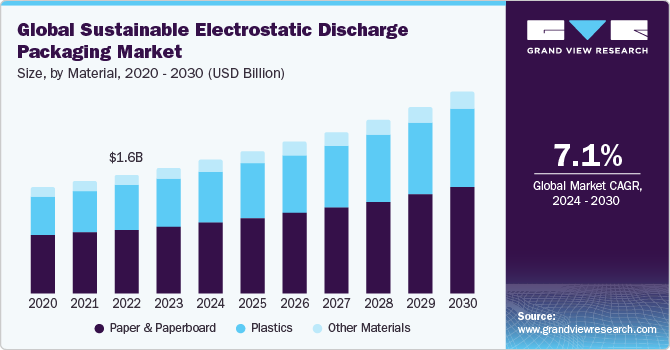

The global sustainable electrostatic discharge packaging market size was estimated at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 7.1% from 2024 to 2030. Growing semiconductor industry and rising awareness for sustainability in electronics industry are expected to drive the growth of the market during the forecast period. The market growth is anticipated to be propelled by significant advancements and innovation in the electronics industry. The emergence of smart ESD solutions, which offer real-time detection and neutralization of static charges, enhances protection, and improves efficiency. Additionally, nanotechnology is transforming electrostatic discharge packaging (ESD) protection with the help of nanomaterials that provide superior protection while maintaining a slim profile.

Further, the semiconductor industry drives the demand for advanced ESD packaging through its stringent requirements for component protection, high-value product nature, and rapid technological advancements. Semiconductor devices, being highly sensitive to electrostatic discharges, require robust packaging solutions to prevent damage during manufacturing, transportation, and handling.

The semiconductor industry has seen a significant increase in investments in recent years with more companies and governments investing in the development of cutting-edge semiconductor technologies. This rise in investment is driving the demand for sustainable electrostatic discharge packaging. The expansion of semiconductor manufacturing capacities, driven by these investments, translates to a higher volume of components that need protection throughout the supply chain, from fabrication to end-use. This directly increases the demand for high-quality ESD packaging solutions. Moreover, with the emerging new technologies, such as advanced chips for artificial intelligence, 5G networks, and the Internet of Things (IoT), the need for specialized ESD packaging that can handle the specific requirements of these applications has become prominent.

Moreover, Key players in the market are undertaking diverse strategies, including product introductions, mergers and acquisitions, joint ventures, and geographic expansion, to enhance their market presence and stimulate growth. For instance, in November 2022, Cortec Corporation developed the EcoSonic VpCI-125 HP Permanent ESD Film & Bags, a high-performance anti-static, corrosion-inhibiting film and bag for protecting static-sensitive multi-metal items, including electronics. This film combines effective multi-metal corrosion protection with strong static dissipative properties.

Market Characteristics & Concentration

Prominent sustainable electrostatic discharge packaging companies operating in market include NEFAB GROUP, Bondline Electronics Ltd, rose plastic, ITB Packaging, LLC, Ficus Pax Pvt. Ltd., GWP Conductive, DS Smith, Smurfit Kappa, Freudenberg Performance Materials, Synergy Packaging, TEGATAI, TRICOR AG, Hilltechs Pte Ltd, P.J Packaging Inc., Cortec Corporation, PakFactory, Malaster, and RS Components Ltd.

Companies operating in the sustainable electrostatic discharge packaging market are undertaking strategic initiatives such as expansion and mergers & acquisitions to strengthen their market presence. For instance, in November 2023, Conductive Containers, Inc. (CCI), a major provider of static control packaging for electronics and optics, acquired Crestline Plastics, Inc., a company specializing in thermoformed packaging for optical components and precision electronics.

In July 2023, NEFAB GROUP, a prominent global provider of industrial packaging and logistics services, revealed a new manufacturing facility in Chihuahua, Mexico. This establishment aims to effectively meet the increasing demand for wood and plywood crates, thermoformed, and corrugated solutions in the country. The 45,208-square-foot plant is equipped with cutting-edge machinery. The facility is anticipated to enhance the company’s capacity to deliver sustainable packaging and logistics solutions to customers in consumer electronics, aerospace, and automotive sectors.

Material Insights

Based on material, the global market has been segmented into paper & paperboard, plastics, and other materials. Plastics is anticipated to dominate the overall market with a market share of over 53.0% in 2023. Many plastic materials used in ESD packaging, such as polyethylene (PE), polypropylene (PP), and anti-static additives, have inherent electrostatic dissipative properties. These materials can safely drain static electricity, preventing damage to sensitive electronic components.

Furthermore, paper & paperboard material segment is expected to witness robust growth with a CAGR of 7.4% over the forecast period. Compared to specialized ESD-safe plastics or alternative materials, paper and paperboard are generally more cost-effective, making them an economical choice for ESD packaging applications, particularly for cost-sensitive industries.

Product Insights

Based on the type, the market is segmented into bags & pouches, trays & inserts, tubes, boxes & containers, foams, and other products. Bags & pouches product segment dominated the market and accounted for largest revenue share of over 31.0% in 2023 and is expected to witness robust growth with a CAGR of 8.1% over the forecast period. ESD bags and pouches can accommodate a wide range of products, from small electronic components to larger devices and equipment. This versatility makes them suitable for various industries that require ESD protection, such as electronics, semiconductor, aerospace, and healthcare.

On the other hand, foams are excellent cushioning materials that can absorb shocks and impacts during transportation and handling. This protective property is crucial for ensuring the safe transit of delicate electronic products, preventing physical damage caused by vibrations, drops, or collisions. Moreover, many foam materials used in ESD packaging are made from recyclable or renewable materials, such as polyethylene (PE) or polyurethane (PU). These materials can be recycled or reused, contributing to a more sustainable and environmentally friendly packaging solution.

Type Insights

Based on the type, the market is segmented into recyclable packaging, reusable packaging, and biodegradable packaging. Recyclable packaging segment dominated the market and accounted for largest revenue share of 62.0% in 2023. Many countries and regions have implemented regulations and policies that encourage or mandate the use of recyclable packaging to reduce landfill waste. ESD packaging manufacturers have responded by developing recyclable options to comply with these regulations, thus driving the growth of market.

Besides, biodegradable packaging is anticipated to observe robust growth during the forecast period. Biodegradable packaging materials can decompose naturally by microorganisms, reducing the accumulation of non-biodegradable waste in landfills and the environment. This aligns with the principles of sustainability and circular economy, where products and materials are designed to minimize waste and environmental impact.

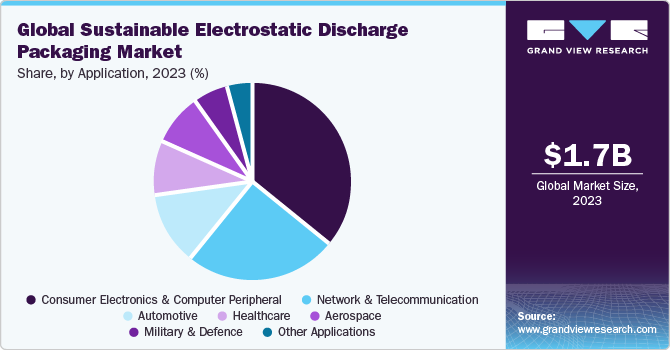

Application Insights

Based on the application, the market is segmented into network & telecommunication, consumer electronics & computer peripheral, automotive, military & defence, healthcare, aerospace, and other applications. Consumer electronics & computer peripheral application segment dominated market and accounted for largest revenue share of over 35.0% in 2023 and is anticipated to observe robust growth with a CAGR of 8.1% during the forecast period. The consumer electronics and computer peripheral industries have stringent requirements for ESD protection during manufacturing, transportation, and storage. ESD packaging materials, such as anti-static bags, conductive containers, and dissipative films, are essential to prevent electrostatic buildup and discharge, ensuring the safe handling and transportation of sensitive electronic components.

Moreover, modern automobiles are equipped with a significant number of electronic components and systems, such as engine control units, sensors, infotainment systems, and advanced driver assistance systems (ADAS). These electronic components are highly sensitive to electrostatic discharge, which can cause permanent damage or malfunction. ESD packaging is crucial for protecting these components during manufacturing, transportation, and storage.

Regional Insights

North America, particularly the U.S., is home to several major electronics and semiconductor manufacturing companies. These companies have stringent requirements for ESD protection during the manufacturing, handling, and transportation of their sensitive electronic components and devices, driving the demand for ESD packaging solutions. Moreover, the region has well-established regulations and standards related to ESD control and prevention, such as those set by organizations such as the Electrostatic Discharge Association (ESDA) and the International Electrotechnical Commission (IEC). These regulations mandate the use of proper ESD packaging and handling procedures, contributing to the growth of the market.

U.S. Sustainable Electrostatic Discharge Packaging Market Trends

The U.S. is expected to witness robust growth due several factors, including the presence of a large number of electronics manufacturing companies, stringent regulations regarding ESD protection, and a high level of awareness about the importance of ESD control measures. The presence of major electronics manufacturing hubs in the country is one of the primary reasons responsible for the growth of the market in the country. For instance, Silicon Valley located in California, is home to numerous technology giants, such as Apple Inc., Intel Corporation, and NVIDIA Corporation, among others. These companies manufacture a wide range of electronic products, from smartphones and computers to semiconductor chips and automotive electronics. To ensure the safe handling and transportation of these sensitive electronic components, they heavily rely on ESD packaging solutions, driving the demand for such products in the country.

Canada sustainable electrostatic discharge packaging market held a significant revenue share in 2023 due to several factors, including a robust manufacturing sector, a strong focus on technological advancements, and a commitment to environmental sustainability. Additionally, the presence of well-established electronics and semiconductor industry in the country is benefiting the market in the country. These industries heavily rely on ESD packaging solutions to protect sensitive components from electrostatic discharge, which can cause irreparable damage. Companies such as Celestica Inc., Sanmina Corporation, and BlackBerry Limited, among others, have operations in Canada and require reliable ESD packaging solutions. This high demand has driven Canadian manufacturers to innovate and produce high-quality ESD packaging products to meet the needs of these industries.

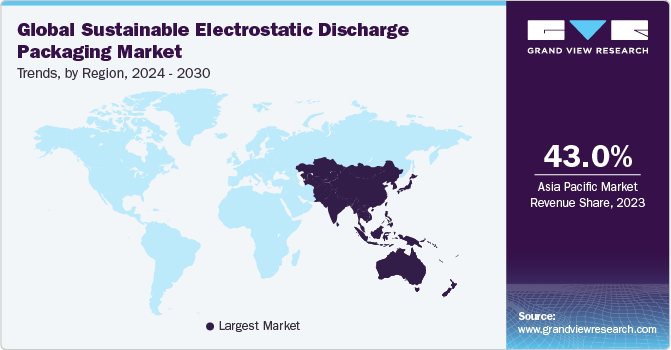

Asia Pacific Sustainable Electrostatic Discharge Packaging Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 43.0% in 2023. Rapid urbanization, increased transportation needs, and rising consumer spending have boosted the growth of the transportation sector, thereby propelling the demand for automobiles in the region. This outlook is expected to positively influence the market. According to the data published by the International Organization of Motor Vehicle Manufacturers (OICA) in 2023, Asia Pacific is the largest transportation market in the world with the presence of numerous automobile manufacturers, which ensures a steady growth in automobile production in the region. Asia Pacific witnessed a growth of 10% in vehicle production in 2023 compared to 2022, and the region’s automotive production reached 55.1 million units in 2023.

China sustainable electrostatic discharge packaging market is driven by rapid industrialization and infrastructure development. China is a global manufacturing hub, especially for electronics and electrical products. Many multinational corporations have their manufacturing facilities in China. The presence of a vast electronics manufacturing industry creates a significant demand for ESD packaging materials to protect sensitive electronic components from electrostatic discharge during production, transportation, and storage.

Europe Sustainable Electrostatic Discharge Packaging Market Trends

Europe is experiencing significant growth, driven by the region's strong focus on implementing advanced technologies and adhering to stringent regulations concerning the protection of electronic components and devices.

Europe is home to several prominent manufacturers of electronic components and devices, including major automotive, aerospace, and consumer electronics companies. These industries have stringent requirements for ESD protection during the manufacturing, transportation, and storage processes. As a result, the demand for effective ESD packaging solutions is high in the region. Companies such as Siemens, Robert Bosch GmbH, and AIRBUS, among others, heavily rely on ESD packaging to safeguard their sensitive electronic components from static electricity damage.

Germany sustainable electrostatic discharge packaging market places a significant emphasis on implementing robust electrostatic discharge (ESD) packaging solutions to protect sensitive electronic components and systems. The modern automobile is a complex assembly of numerous electronic control units (ECUs), sensors, and intricate wiring systems. These components are highly susceptible to damage from electrostatic discharge, which can lead to costly repairs or even complete system failures. German automotive giants such as Volkswagen, Mercedes-Benz, and BMW have recognized the importance of incorporating effective ESD packaging solutions into their manufacturing and supply chain processes. For instance, anti-static bags and conductive foams are widely employed to safely store and transport ECUs, ensuring their protection from static electricity during handling and transportation.

Central & South America Sustainable Electrostatic Discharge Packaging Market Trends

Central and South American countries, such as Brazil, Mexico, and Costa Rica, have emerged as prominent destinations for electronics manufacturing. Companies from various sectors, including automotive, consumer electronics, and telecommunications, have established manufacturing facilities in these regions. The presence of these industries has directly contributed to the increased demand for ESD packaging solutions to protect sensitive electronic components during manufacturing, transportation, and storage processes.

Brazil sustainable electrostatic discharge packaging market is expected to register a healthy growth rate over the forecast period. In 2024, Brazil launched a new industrial policy to boost investment, innovation, and sustainability in strategic areas such as defense, and to strengthen the neo-industrialization up to 2033. For the defense sector, the aim is to attain self-sufficiency in producing 50% of crucial technologies to bolster national sovereignty, with a focus on priority areas such as communication and sensing systems, propulsion systems, and autonomous and remotely controlled vehicles. In addition, Brazil has been receiving new orders in the aerospace sector. For instance, in November 2023, Canada's Porter Airlines placed an order for 25 jets from Embraer, a Brazilian multinational aerospace corporation.

Middle East & Africa Sustainable Electrostatic Discharge Packaging Market Trends

The Middle East & Africa marketdynamics are influenced by the rise in international trade and the growing emphasis on proper handling and transportation of electronic goods has contributed to the surge in demand for ESD packaging. Moreover, the rapid expansion of the electronics and semiconductor industries in the region has led to an increased demand for ESD packaging to protect sensitive electronic components from electrostatic discharge during transportation and storage. As these industries continue to grow, the need for reliable ESD packaging solutions becomes more pronounced, thus driving the market's expansion.

Saudi Arabia sustainable electrostatic discharge packaging market is being driven by the increasing demand for electronic products, growing awareness of ESD-related damage, adherence to safety and quality standards, and the government's initiatives to promote technological advancements. These factors collectively create a conducive environment for the expansion of the market in the country.

Key Sustainable Electrostatic Discharge Packaging Company Insights

The market is moderately fragmented, with several key players operating globally. Major companies in this space include names such as NEFAB GROUP, rose plastic, DS Smith, Freudenberg Performance Materials, and RS Components Ltd. These companies are continuously investing in research and development to introduce innovative and more sustainable ESD packaging solutions.

Key Sustainable Electrostatic Discharge Packaging Companies

The following are the leading companies in the sustainable electrostatic discharge packaging market. These companies collectively hold the largest market share and dictate industry trends.

- NEFAB GROUP

- Bondline Electronics Ltd

- rose plastic

- ITB Packaging, LLC

- Ficus Pax Pvt. Ltd.

- GWP Conductive

- DS Smith

- Smurfit Kappa

- Freudenberg Performance Materials

- Synergy Packaging

- TEGATAI

- TRICOR AG

- Hilltechs Pte Ltd

- P.J Packaging Inc.

- Cortec Corporation

- PakFactory

- Malaster

- RS Components Ltd.

Recent Developments

-

In April 2024, Good Natured Products, Inc. introduced advanced electrostatic discharge (ESD) protection for technology and pharmaceutical packaging applications. This innovation offers one of the highest ranges of ESD protection in the ESD packaging industry, with surface resistivity ranging from 10⁷ to 10¹⁰ ohm per square. This feature ensures the safeguarding of sensitive electronic components from static electricity, preventing potential damage and data loss.

-

In February 2023, Freudenberg Performance Materials introduced a new range of technical packaging textiles called Evolon ESD. These innovative products offer protective functions for various applications, including surface protection for automotive parts, such as molded plastic and painted parts. In addition, these textiles provide benefits such as improved surface protection, reduced reject rates, and enhanced durability, making them a sustainable and efficient choice for technical packaging needs.

Sustainable Electrostatic Discharge Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 2.65 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

NEFAB GROUP; Bondline Electronics Ltd; rose plastic; ITB Packaging, LLC; Ficus Pax Pvt. Ltd.; GWP Conductive; DS Smith; Smurfit Kappa; Freudenberg Performance Materials; Synergy Packaging; TEGATAI; TRICOR AG; Hilltechs Pte Ltd; P.J Packaging Inc.; Cortec Corporation; PakFactory; Malaster; RS Components Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Electrostatic Discharge Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable electrostatic discharge packaging market report based on material, product, type, application, and region:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Paper & Paperboard

-

Plastics

-

Other Materials

-

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Bags & Pouches

-

Trays & Inserts

-

Tubes

-

Boxes & Containers

-

Foams

-

Other Products

-

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Recyclable Packaging

-

Reusable Packaging

-

Biodegradable Packaging

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Network & Telecommunication

-

Consumer Electronics & Computer Peripheral

-

Automotive

-

Military & Defence

-

Healthcare

-

Aerospace

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The sustainable electrostatic discharge packaging market was estimated at around USD 1.66 billion in the year 2023 and is expected to reach around USD 1.76 billion in 2024.

b. The sustainable electrostatic discharge packaging market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach around USD 2.65 billion by 2030.

b. Consumer electronics & computer peripheral emerged as a dominating application in the sustainable ESD packaging market with a value share of around 35.0% in the year 2023 owing to the proliferation of electronic devices, which are highly susceptible to electrostatic discharge (ESD), which can cause permanent damage to sensitive components.

b. The key player in the sustainable electrostatic discharge packaging market includes NEFAB GROUP, Bondline Electronics Ltd, rose plastic, ITB Packaging, LLC, Ficus Pax Pvt. Ltd., GWP Conductive, DS Smith, Smurfit Kappa, Freudenberg Performance Materials, Synergy Packaging, TEGATAI, TRICOR AG, Hilltechs Pte Ltd, P.J Packaging Inc., Cortec Corporation, PakFactory, Malaster, and RS Components Ltd.

b. Growing semiconductor industry and rising awareness for sustainability in electronics industry is fueling the demand for sustainable electrostatic discharge packaging products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.