- Home

- »

- Next Generation Technologies

- »

-

Sustainability Management Software Market Report, 2030GVR Report cover

![Sustainability Management Software Market Size, Share & Trends Report]()

Sustainability Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Software (Carbon Management Software, Resource Management, Waste Management), By Deployment, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-454-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sustainability Management Software Market Summary

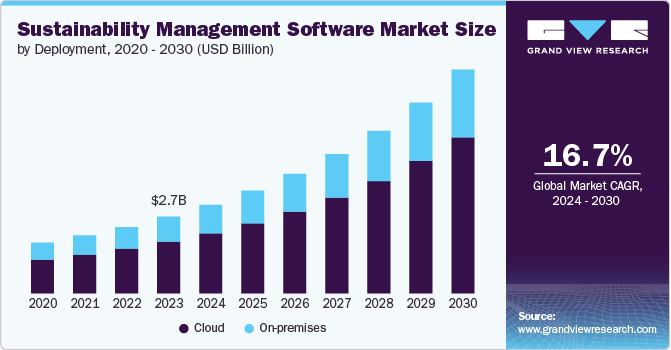

The global sustainability management software market size was estimated at USD 2.75 billion in 2023 and is projected to reach USD 8.03 billion by 2030, growing at a CAGR of 16.7% from 2024 to 2030. Driven by heightened regulatory pressures, investor expectations, and a growing public awareness of climate change, organizations are turning to advanced software solutions to track, manage, and report their sustainability initiatives.

Key Market Trends & Insights

- North America dominated with a revenue share of over 35.0% in 2023.

- The sustainability management software market in U.S. is expected to grow significantly from 2024 to 2030.

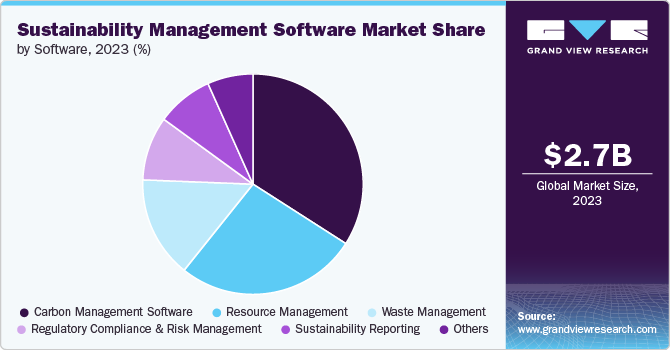

- By software, the carbon management software segment led the market in 2023, accounting for over 33.0% share of the global revenue.

- By deployment, the cloud segment accounted for the largest market revenue share in 2023.

- By verticle, the energy & utilities segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.75 Billion

- 2030 Projected Market Size: USD 8.03 Billion

- CAGR (2024-2030): 16.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The market's expansion is further fueled by advancements in technology, such as Artificial Intelligence (AI) and big data analytics, which enhance the capabilities of these platforms. Companies across various sectors, from manufacturing to finance, are integrating sustainability software to not only mitigate risks but also capitalize on new business opportunities and improve their competitive edge. As more industries adopt these solutions, the market is projected to continue its upward trajectory, driven by the increasing need for transparency and accountability in sustainability efforts.

The adoption of sustainability management software is also being driven by the increasing integration of ESG metrics into financial reporting and strategic planning. As more organizations recognize the value of managing their environmental impact and enhancing their social governance, the demand for comprehensive and user-friendly software solutions is expected to continue to grow, shaping the future landscape of corporate sustainability. With ongoing innovations and a growing emphasis on corporate responsibility, the sustainability management software market is set to play a pivotal role in shaping a more sustainable future. These tools offer a range of functionalities, including carbon footprint analysis, resource optimization, and compliance reporting, enabling companies to enhance their environmental performance and meet regulatory requirements more efficiently.

Cloud-based solutions are gaining traction in the market for sustainability management software due to their scalability and flexibility. These solutions allow companies to customize their software to meet specific needs and are generally more cost-effective than on-premises alternatives, providing significant savings while ensuring robust environmental compliance. In addition, cloud-based systems are typically easier to deploy and manage compared to traditional on-premise setups, making them a more appealing choice for organizations seeking a quick and efficient implementation of sustainability management solutions.

Software Insights

The carbon management software segment led the market in 2023, accounting for over 33.0% share of the global revenue. This high share is attributed to a heightened global focus on carbon reduction amid increasing regulatory pressures and climate commitments. As governments and organizations set ambitious carbon neutrality goals, companies are investing heavily in tools that enable accurate measurement, tracking, and reduction of their carbon footprints. Carbon management software provides essential capabilities for calculating emissions, setting reduction targets, and ensuring compliance with evolving regulations. In addition, it supports corporate sustainability strategies and reporting, meeting both regulatory demands and stakeholder expectations.

The resource management segment is predicted to foresee significant growth in the coming years. As organizations increasingly focus on improving operational efficiency and sustainability, effective management of resources such as energy, water, and raw materials has become essential. This segment’s high growth is also attributed to its ability to help companies meet regulatory requirements, reduce costs, and enhance their environmental performance. The growing emphasis on sustainability goals and the need for accurate data to drive decision-making have further boosted the adoption of resource management software, making it a key component in the broader sustainability management landscape.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. This high share is primarily attributed to the scalability, flexibility, and cost-effectiveness offered by cloud solutions. Cloud-based platforms allow organizations to easily scale their sustainability management tools to match their specific needs and growth while also reducing the upfront costs associated with on-premises deployments. In addition, cloud solutions facilitate seamless integration with other systems and enable real-time data access and collaboration from any location, enhancing efficiency and responsiveness. The reduced need for on-site hardware and IT maintenance further contributes to lower overall costs, making cloud deployment an attractive choice for companies looking to implement and manage their sustainability initiatives effectively.

The on-premises segment is predicted to foresee significant growth in the coming years, driven by the growing demand for enhanced security, data control, and customization. Organizations with stringent data protection requirements and regulatory compliance needs often prefer on-premises solutions to maintain complete control over their data and infrastructure. In addition, on-premises deployments offer greater customization options and integration capabilities with existing IT systems, which can be crucial for complex and highly regulated industries.

Vertical Insights

The energy & utilities segment accounted for the largest market revenue share in 2023. This industry is under significant pressure to reduce carbon emissions and optimize resource use, driving substantial investment in sustainability management solutions. Energy and utility companies rely on advanced software to monitor energy consumption, manage emissions, and integrate renewable energy sources effectively. The need for compliance with stringent environmental regulations and the pursuit of cost savings through improved energy management further fuel the sector's demand for specialized sustainability software.

The transportation & logistics segment is anticipated to exhibit the highest CAGR over the forecast period. This sector faces substantial pressure to reduce its carbon footprint and improve operational efficiency due to environmental regulations and consumer expectations for greener practices. Advanced sustainability management software helps transportation and logistics companies optimize routes, reduce fuel consumption, and enhance overall supply chain transparency. In addition, the integration of technologies such as IoT and AI in logistics operations supports real-time data analysis and decision-making, further boosting the demand for advanced sustainability solutions. The sector's focus on reducing emissions and improving sustainability aligns with the growing adoption of these software solutions, contributing to its rapid growth.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2023. The region boasts a high concentration of major corporations and early adopters of sustainability technologies driven by stringent environmental regulations and corporate sustainability goals. In addition, significant investments in green technology and infrastructure, coupled with a well-established tech industry, have fostered rapid innovation and adoption of sustainability management solutions. Moreover, governmental incentives and support for sustainability initiatives have further accelerated market growth.

U.S. Sustainability Management Software Market Trends

The sustainability management software market in U.S. is expected to grow significantly from 2024 to 2030. The country's leadership in technological innovation and its robust corporate sector have accelerated the adoption of advanced sustainability management solutions. Stringent environmental regulations and ambitious corporate sustainability goals have spurred significant demand for these software tools.

Europe Sustainability Management Software Market Trends

The sustainability management software market in the European region is expected to witness significant growth over the forecast period. Stringent environmental regulations and ambitious climate targets set by the European Union, such as the Green Deal and various sustainability directives, have created a strong demand for advanced sustainability management tools. European companies are increasingly committed to integrating sustainability into their business models, influenced by both regulatory requirements and consumer expectations. In addition, significant investments in green technology and a supportive policy environment have fostered market growth.

Asia Pacific Sustainability Management Software Market Trends

The sustainability management software market in the Asia Pacific region is anticipated to register rapid growth over the forecast period, driven by rapid industrialization and increasing environmental awareness across the region. The significant growth in the manufacturing and energy sectors has heightened the need for effective sustainability management solutions to meet stringent regulations and enhance operational efficiency. In addition, many governments in the Asia Pacific are implementing policies and incentives to promote green practices and reduce carbon footprints, further driving demand.

Key Sustainability Management Software Company Insights

Key sustainability management software companies include Benchmark Digital Partners LLC, ICONICS, Inc., Urjanet, Inc., and SAP SE Companies active in the sustainability management software market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ Pattern Type development. For instance, in July 2024, Vodafone Business, the digital communications division of Vodafone Limited, unveiled the Vodafone Business ESG Navigator. This innovative software solution is tailored to help companies meet their sustainability reporting requirements, with a particular focus on the EU's Corporate Sustainability Reporting Directive (CSRD). Developed in partnership with sustainability reporting software provider (Envoria) Financial Software Architects GmbH, the new tool is designed to streamline and enhance sustainability reporting processes.

Key Sustainability Management Software Companies:

The following are the leading companies in the sustainability management software market. These companies collectively hold the largest market share and dictate industry trends.

- Benchmark Digital Partners LLC

- ICONICS, Inc.

- Urjanet, Inc.

- SAP SE

- FigBytes

- HELLA GmbH & Co. KGaA

- Schneider Electric

- General Electric Company

- Microsoft

- Salesforce, Inc.

Recent Developments

-

In August 2024, Microsoft unveiled a new ESG reporting tool designed to simplify, streamline, and accelerate the reporting process as sustainability disclosure requirements expand. The Project ESG Reporting (preview) platform includes a variety of framework templates and pre-synced ESG standards, which can be filled in and reused for future reports. In addition, the tool allows companies to develop and utilize their own custom templates.

-

In July 2024, Schneider Electric, a prominent player in energy and automation digital solutions, introduced several enhancements to its EcoStruxure Resource Advisor platform. This updated energy and sustainability data and reporting tool features a suite of new solutions designed to help companies meet emerging sustainability reporting regulations. The enhancements come as corporate sustainability initiatives gain momentum, addressing key challenges such as implementing sustainability programs, streamlining ESG reporting, reducing carbon footprints, managing renewable energy projects, optimizing energy procurement, and improving operational efficiency through targeted energy-saving measures.

-

In March 2024, Oracle introduced Oracle Cloud EPM for Sustainability, a groundbreaking addition to Oracle Fusion Cloud EPM (Enterprise Performance Management). This new solution empowers organizations to measure and manage their sustainability initiatives effectively. It enables business leaders to strengthen their sustainability efforts by analyzing and connecting targets, data, and plans throughout their organizations, and by creating various scenarios to optimize outcomes.

Sustainability Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.17 billion

Revenue forecast in 2030

USD 8.03 billion

Growth rate

CAGR of 16.7% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Benchmark Digital Partners LLC; ICONICS, Inc.; Urjanet, Inc.; SAP SE; HELLA GmbH & Co. KGa; Schneider Electric; FigBytes; Schneider Electric; General Electric Company; Microsoft; Salesforce, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

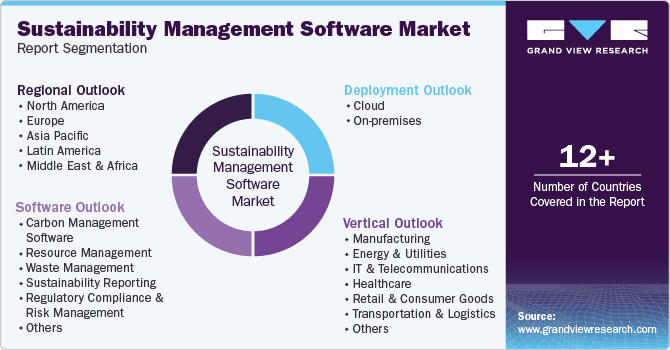

Global Sustainability Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global sustainability management software market report based on software, deployment, vertical, and region.

-

Software Outlook (Revenue, USD Billion, 2017 - 2030)

-

Carbon Management Software

-

Resource Management

-

Waste Management

-

Sustainability Reporting

-

Regulatory Compliance and Risk Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Energy & Utilities

-

IT & Telecommunications

-

Healthcare

-

Retail & Consumer Goods

-

Transportation & Logistics

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global sustainability management software market size was estimated at USD 2.75 billion in 2023 and is expected to reach USD 3.17 billion in 2024.

b. The global sustainability management software market is expected to grow at a compound annual growth rate of 16.7% from 2024 to 2030 to reach USD 8.03 billion by 2030.

b. North America dominated the sustainability management software market with a share of 35.7% in 2023. The region boasts a high concentration of major corporations and early adopters of sustainability technologies driven by stringent environmental regulations and corporate sustainability goals.

b. Some key players operating in the sustainability management software market include Benchmark Digital Partners LLC, ICONICS, Inc., Urjanet, Inc., SAP SE, HELLA GmbH & Co. KGa, Schneider Electric, FigBytes, Schneider Electric, General Electric Company, Microsoft, Salesforce, Inc.

b. Key factors that are driving the sustainability management software market growth include increasing stringent regulations and compliance requirements related to environmental sustainability, and corporate social responsibility, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.