- Home

- »

- Next Generation Technologies

- »

-

Surveillance Camera Market Size And Share Report, 2030GVR Report cover

![Surveillance Camera Market Size, Share & Trends Report]()

Surveillance Camera Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (IP Based, Cellular Camera, Analog Camera), By Deployment, By Resolution Capacity, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-129-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surveillance Camera Market Summary

The global surveillance camera market size was estimated at USD 43.65 billion in 2024 and is projected to reach USD 81.37 billion by 2030, growing at a CAGR of 11.2% from 2025 to 2030. The market growth is primarily driven by the increasing need for enhanced security and safety measures across various sectors.

Key Market Trends & Insights

- Asia Pacific dominated the surveillance camera market with the largest revenue share of 58.20% in 2024.

- The surveillance camera market in U.S. is expected to register at a moderate CAGR during the forecast period.

- By product type, the IP based segment led the market with the largest revenue share of 45.04% in 2024.

- By deployment, the outdoor deployment segment led the market with the largest revenue share of 73.3% in 2024.

- By resolution capacity, the high definition (HD) segment led the market with the largest revenue share of 40.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.65 Billion

- 2030 Projected Market Size: USD 81.37 Billion

- CAGR (2025-2030): 11.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

In response to accelerating concerns about security and occurrences of criminal activities, enterprises, governments, and individuals are pursuing reliable surveillance solutions to monitor their premises and deter potential risks effectively. In addition, growing urbanization and infrastructure development across the globe are further driving the demand for surveillance camera systems to monitor critical facilities and ensure public safety. Due to rapid urbanization, there is an increasing demand for commercial, residential, and infrastructure projects. This increase in demand is also attracting a larger population toward urban areas. Moreover, rapid urban growth requires the construction of tall structures, housing units, multiplexes, workspaces, and transportation networks to accommodate the increasing population and improve economic advancement. Consequently, infrastructure development has emerged as a significant cause propelling construction endeavor and thereby stimulating the need for surveillance cameras.

The increasing demand for advanced, solar-powered, and cellular connectivity-based surveillance cameras to improve the security of individuals and their property is propelling the growth of the market. For instance, in March 2023, Dahua Technology Co., Ltd. launched a 4G solar power network camera. The camera features are built-in solar panel, high-performance 4G modules, passive infrared detection, lithium battery, light and sound alarm linkage, and other useful features. Owing to these features, it is ideal for situations that lack electricity supply lines and wired networks.

The capacity of 5G technology to provide reduced latency and high data speeds compared to previous network generations acts as a notable driver for market growth. The capability for rapid data transfer enables quick and efficient transmission of large video files from surveillance cameras to monitoring centers or cloud storage platforms. In addition, the increased adoption of artificial intelligence (AI) driven cameras performing real-time video analysis is also playing a significant role in the market's growth. Cameras powered by AI provide features such as facial recognition, object detection, and behavioral analysis, thereby enhancing the efficiency of surveillance systems.

The high initial installation cost of surveillance cameras is a major factor that is expected to restrain the market growth. Setting up a comprehensive surveillance system requires significant investment in purchasing high-quality cameras, storage devices, networking infrastructure, and other essential equipment. Apart from hardware costs, installation, and setup-related costs, such as labor, cabling, and integration with existing security systems, can further contribute to the overall initial investment. These financial expenses can pose challenges for organizations operating on tight budgets or with limited resources, making it difficult to justify the return on investment.

Product Type Insights

The IP based segment led the market with the largest revenue share of 45.04% in 2024. The segment is further bifurcated into wired and Wi-Fi. Internet Protocol (IP) cameras offer digital video surveillance by sending and receiving video recordings over the Local Area Network (LAN) or Internet. Increasing demand for IP cameras to improve security and safety in businesses, schools, government, healthcare, industrial, and military organizations is attributed to the segment’s growth.

The cellular camera segment is expected to grow at the fastest CAGR during the forecast period. The segment includes 4G and 5G connectivity-based surveillance cameras. Factors such as the growing demand for 5G technology, rising development of 5G infrastructure, and adoption of 5G networks in video surveillance applications due to its increased bandwidth potential are propelling the growth of the segment. Furthermore, the adoption of 4G cellular surveillance cameras for business security is growing as they deliver a scalable and cost-effective surveillance solution, allowing business owners to monitor their assets and premises.

Deployment Insights

Based on deployment, the outdoor deployment segment led the market with the largest revenue share of 73.3% in 2024. Outdoor surveillance cameras are crucial in ensuring a premise's security and safety, serving as both surveillance tools and preventive measures. The expansion of this segment can be attributed to the rising need and adoption of advanced security cameras for outdoor monitoring in various settings such as commercial establishments, residential properties, toll collection points, roadways, vehicles, and diverse public spaces encompassing both urban and rural areas. In addition, outdoor surveillance cameras offer benefits to businesses and property, such as access and perimeter monitoring, deterrence of criminal activity, and monitoring of property labor.

The indoor deployment segment is expected to register at a moderate CAGR during the forecast period. The utilization of indoor surveillance cameras has witnessed substantial growth in recent years. This growth is primarily attributed to several factors, such as integrating these cameras into smart home systems, the escalating security concerns within residential and commercial applications, and the ongoing advancements in video surveillance technologies. Furthermore, the growth of this segment is also propelled by the rise in home renovation projects within urban localities and the accelerating demand for smart home devices.

Resolution Capacity Insights

Based on resolution capacity, the high definition (HD) segment led the market with the largest revenue share of 40.4% in 2024. The HD surveillance camera records and captures video footage at a higher resolution (720p (1280x720 pixels) or higher) than standard-definition cameras. It delivers more detailed and clearer videos and images. Increasing adoption of HD surveillance cameras owing to their benefits, such as high-quality images and video footage, improved crime deterrence, and high-quality alarm systems, is fueling the segment’s growth.

The ultra-high definition (UHD) (4K) segment is expected to grow at the fastest CAGR during the forecast period. A UHD or 4K surveillance camera provides a 4K resolution, translating to an image resolution of approximately 3840 x 2160 pixels. These cameras provide enhanced image quality and finer details, making them suitable for applications demanding precise and top-notch video recording. In addition, due to their wide-angle lenses, 4K or UHD surveillance cameras can capture a broader frame and more area than lower-resolution cameras.

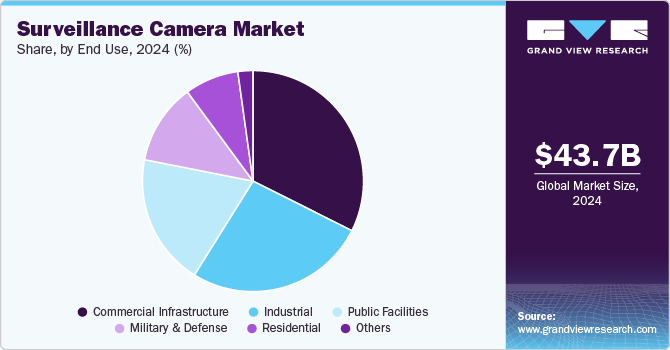

End-use Insights

Based on end-use, the commercial infrastructure segment led the market with the largest revenue share of 32.4% in 2024. The growing adoption rate of surveillance cameras for monitoring commercial spaces, such as corporate offices, commercial real estate, shopping centers/malls, retail shops, and other business establishments is attributed to the segment’s growth. Surveillance cameras in the abovementioned commercial spaces offer a strong deterrence against theft, vandalism, and unauthorized access, ensuring the safety of assets, customers, and employees. Furthermore, increasing development and investment in commercial infrastructure across the globe is expected to drive the demand for surveillance cameras over the forecast period.

The industrial segment is anticipated to grow at a rapid CAGR during the forecast period. Industrial applications of surveillance cameras include their use in manufacturing plants, construction sites, mining sites, and electricity distribution sites, among other places. Video surveillance plays an important role in enhancing the safety, effectiveness, and efficiency of manufacturing operations at factories, plants, or mills. For instance, in the mining industry, these cameras play a crucial role in the security and safety of mine workers, equipment, and machinery. They offer real-time video monitoring capabilities, allowing operators to observe ongoing activities in the mine site.

Regional Insights

The surveillance camera market in North America is expected to grow at the fastest CAGR during the forecast period. The adoption of surveillance cameras in North America has been consistently on the rise in recent years. Several factors contribute to this trend, including increasing concerns about security, increasing incidence of urban area crimes, and a growing demand for improved surveillance and safety measures. Enterprises, governments, and individuals are acknowledging the significance of surveillance cameras in deterring criminal actions and facilitating investigations and evidence compilation.

U.S. Surveillance Camera Market Trends

The surveillance camera market in U.S. is expected to register at a moderate CAGR during the forecast period. In the U.S., surveillance cameras are prevalent in private-sector retail and commercial establishments, including hotels, restaurants, and office complexes. The market is experiencing a growing trend of smart home security cameras, potentially broadening the market's reach.

Europe Surveillance Camera Market Trends

The surveillance camera market in Europe is anticipated to witness at a steady CAGR over the forecast period. Europe has witnessed increased adoption of surveillance cameras in recent years. In urban areas, surveillance cameras are widely deployed in public spaces, transportation hubs, and city centers to monitor crowds, deter criminal activities, and aid in emergency response. Moreover, businesses across industries such as retail, banking, and hospitality have integrated surveillance cameras to safeguard assets, prevent theft, and enhance employee safety.

The UK surveillance camera market is expected to witness at a notable CAGR during the forecast period. The use of surveillance cameras in city centers and high-traffic areas is driving market growth in the country. Major cities such as London, Manchester, and Birmingham have extensive networks of surveillance cameras in public squares, shopping areas, and transportation hubs. These cameras are vital for deterring crime, enhancing public safety, and aiding law enforcement in their investigations.

The surveillance camera market in Germany held a considerable market share in 2024. Increasing business expansion initiatives by several global companies can be attributed to the market’s growth. For instance, in June 2024, Verkada Inc., a U.S. manufacturer of cloud-based building security and operating systems, announced its expansion into Germany, Austria, and Switzerland (DACH), led by Benjamin Krebs. The company provides products such as video security cameras, environmental sensors, access control, workplace alarms, and intercoms that provide unparalleled building security through a secure, integrated cloud-based software platform. Such initiatives are expected to contribute to the market’s growth.

Asia Pacific Surveillance Camera Market Trends

Asia Pacific dominated the surveillance camera market with the largest revenue share of 58.20% in 2024. Numerous countries in this region are investing in smart city projects, encouraging the adoption of surveillance cameras for traffic control, urban development, and public safety. Integrating surveillance systems with Internet of Things (IoT) technology and cloud-driven solutions is progressively gaining traction in the market. This facilitates improved remote access, data storage, and scalability, addressing the evolving needs of enterprises and governmental bodies.

The surveillance camera market in Japan is expected to witness at a moderate CAGR during the forecast period. Surveillance camera solution providers in Japan are witnessing a shift toward innovative technologies that are reshaping the industry landscape. One notable trend is the integration of artificial intelligence (AI) into surveillance systems. Another emerging trend is the adoption of high-resolution cameras with advanced imaging capabilities.

The China surveillance camera market held a substantial market share in 2024. In China, surveillance camera solution providers are increasingly incorporating Artificial Intelligence (AI) technologies into their systems. AI-driven video analytics offer advanced features such as facial recognition, object detection, and behavior analysis. These capabilities improve the accuracy and efficiency of video surveillance, allowing for more proactive threat detection and incident response. Thus, rising demand for AI-powered surveillance cameras in the country is boosting the market’s growth.

Key Surveillance Camera Company Insights

Some of the key companies in the global market include Dahua Technology Co., Ltd., Cisco Systems, Inc., Honeywell International Inc., and Panasonic Holdings Corporation among others. Organizations are focusing on investing in research & development activities to create new and innovative products that offer improved features and benefits to customers. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Dahua Technology Co., Ltd. is a global video-centric AIoT solution and service provider. The company is investing in R&D and product development and provides comprehensive security solutions, systems, and services for city operations, corporate management, and consumers.

-

Cisco Systems, Inc. designs and sells an extensive range of technologies that power the internet. The company caters to businesses in multiple industries and sectors, such as automotive, consumer packaged goods, education, energy, finance, manufacturing, materials, mining, retail, and transportation. The company provides network-centric video surveillance hardware and software that supports video monitoring, transmission, recording, and management.

Key Surveillance Camera Companies:

The following are the leading companies in the surveillance camera market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Cisco Systems, Inc.

- Eye Trax

- Nokia Corporation

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Teledyne FLIR LLC

- Milesight

- Dahua Technology Co., Ltd.

- Swann

Recent Developments

-

In March 2024, Dahua Technology Co., Ltd. announced upgrades to its PTZ WizSense Series. The AII-NEW PTZ, which stands for 'AI In Enhanced WizSense PTZ', offers several intelligent functions, environmentally friendly packaging optimization, and significant hardware improvements.

-

In February 2023, Swann introduced the CoreCam Pro Wireless Spotlight Security Camera. The camera can be used as a standalone system or can be integrated with other devices for a comprehensive surveillance solution in smart homes. The CoreCam Pro provides improved 2K resolution and a sensor spotlight to prevent unwanted activity and aid with color night vision.

Surveillance Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.91 billion

Revenue forecast in 2030

USD 81.37 billion

Growth Rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, deployment, resolution capacity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Honeywell International Inc.; Cisco Systems, Inc.; Eye Trax; Nokia Corporation; Panasonic Holdings Corporation; Robert Bosch GmbH; Teledyne FLIR LLC; Milesight; Dahua Technology Co., Ltd.; and Swann

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surveillance Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surveillance camera market report based on product type, deployment, resolution capacity, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

IP Based

-

Wi-Fi

-

Wired

-

-

Cellular Camera

-

4G

-

5G

-

-

Analog Camera

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Resolution Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

High Definition (HD)

-

Full High Definition (FHD)

-

Ultra High Definition (UHD) (4K)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial Infrastructure

-

Public Facilities

-

Industrial

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surveillance camera market size was estimated at USD 43.65 billion in 2024 and is expected to reach USD 47.91 billion in 2025.

b. The global surveillance camera market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 81.37 billion by 2030.

b. Asia Pacific dominated the market in 2024. The regional market’s growth is accounted to the growing investments in smart city projects, encouraging the adoption of surveillance cameras for traffic control, urban development, and public safety in various countries in Asia Pacific.

b. Some key players operating in the surveillance camera market include Honeywell International Inc., Cisco Systems, Inc., Eye Trax, Nokia Corporation, Panasonic Holdings Corporation, Robert Bosch GmbH, Teledyne FLIR LLC, Milesight, Dahua Technology Co., Ltd., and Swann.

b. The growth of the surveillance camera market is primarily driven by the increasing need for enhanced security and safety measures across various sectors. In response to accelerating concerns about security and occurrences of criminal activities, enterprises, governments, and individuals are pursuing reliable surveillance solutions to monitor their premises and deter potential risks effectively.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.