- Home

- »

- Healthcare IT

- »

-

Surgical Simulation Market Size, Share, Industry Report 2030GVR Report cover

![Surgical Simulation Market Size, Share & Trends Report]()

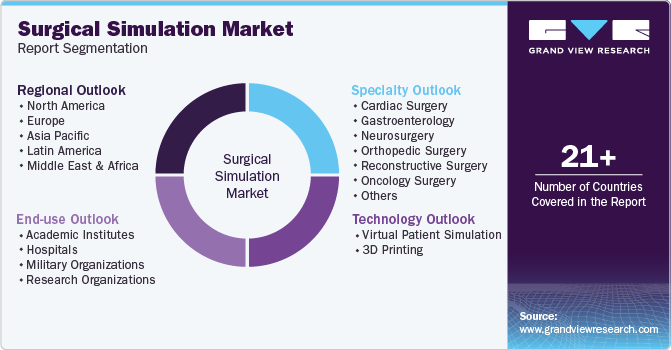

Surgical Simulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Specialty, By Material (Virtual Patient Simulation, 3D Printing), By End Use (Academic Institutes, Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-827-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Simulation Market Summary

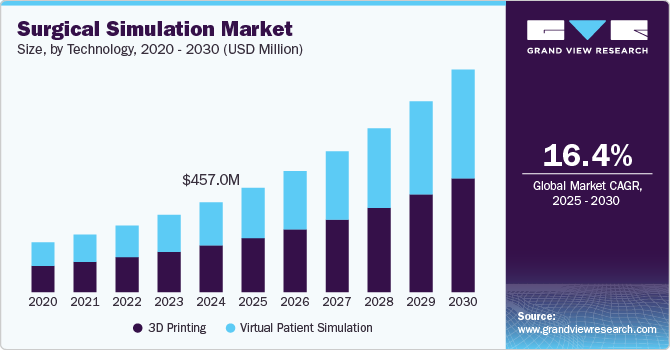

The global surgical simulation market size was estimated at USD 457.0 million in 2024 and is projected to grow at a CAGR of 16.4% from 2025 to 2030. The growth of the surgical simulation industry is driven by advancements in medical technology, increasing demand for minimally invasive procedures, and a focus on enhancing surgical training and patient safety.

Key Market Trends & Insights

- North America dominated the global surgical simulation market with the largest revenue share of 35.88% in 2024.

- The surgical simulation market in the U.S. led the North America market and held the largest revenue share in 2024.

- By specialty, the orthopedic surgery segment led the market, holding the largest revenue share of 31.75% in 2024.

- By technology, the 3D printing segment held the dominant position in the market in 2024.

- By end use, the hospitals segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 457.0 Million

- 2030 Projected Market Size: USD 1,134.1 Million

- CAGR (2025-2030): 16.4%

- North America: Largest market in 2024

Simulation technology provides healthcare professionals with a risk-free environment to practice complex surgical techniques, which have proven essential in improving outcomes and reducing medical errors. Furthermore, the surgical simulation industry is a rapidly growing segment of the healthcare and medical technology sector, driven by the increasing demand for enhanced surgical training.

Safe surgical care is a critical yet often overlooked component of health systems, with around 5 billion people lacking access. According to the Lancet Commission on Global Surgery 2030, only 6% of global surgeries are performed in the poorest nations, which account for one-third of the world’s population. A major issue is workforce training; low- and middle-income countries (LMICs) face severe shortages of certified surgeons, posing significant barriers to care. The global shortage of skilled surgeons, combined with the increasing complexity of surgeries, has intensified the need for advanced training tools that simulate real-life scenarios.

The Lancet Commission recommends expanding the surgical, anesthetic, and obstetric workforce in LMICs to 40 per 100,000 people by 2030. However, traditional training in high-income countries can take over seven years, with up to 30% of trainees reporting a lack of readiness for independent practice post-residency. This gap in surgical education is driving the demand for surgical simulation solutions to improve workforce readiness and patient outcomes.

Technological advancements in the surgical simulation industry, such as Virtual Reality (VR), have improved accessibility and reduced hardware costs, overcoming key adoption barriers. For instance, research by Vantari VR in June 2022 found that their medical VR training programs lowered medical errors by 40%. In addition, a University of Wollongong study conducted with Vantari VR reported a 32% improvement in student clinician performance and a 39% boost in adherence to safety and hygiene protocols. These results underscore VR technology’s significant potential to enhance surgical education and improve patient care outcomes.

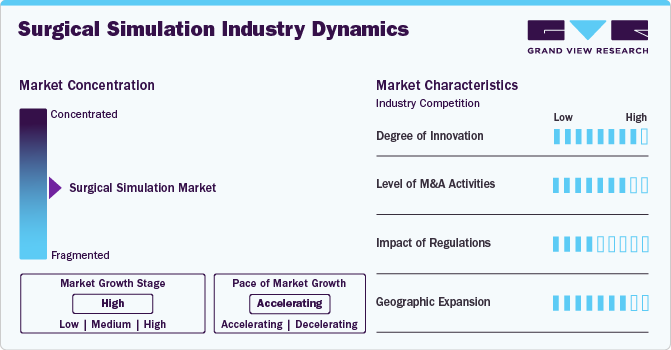

Market Concentration & Characteristics

The degree of innovation in the surgical simulation industry is high. This is attributed to the advancements in VR, artificial intelligence, and haptic feedback. This technology offers realistic, risk-free training environments for medical professionals, enhancing skills and precision. For instance, in November 2023, Ethicon, a Johnson & Johnson MedTech company, introduced an AI-driven Surgical Simulation Platform designed to enhance skill development for current and future surgeons at the American Association of Gynecological Laparoscopists Global Congress. This technology utilizes artificial intelligence and augmented reality for training, offering real-time data and actionable feedback.

The level of partnership & collaboration is high in the industry. For instance, in October 2023, Hologic, Inc. partnered with the American Association of Gynecologic Laparoscopists and Inovus Medical. As part of this collaboration, Hologic will be the primary supplier of hysteroscopes for the AAGL's Essentials in Minimally Invasive Gynecologic Surgery training program aimed at OB-GYN residents.

The impact of regulations is moderate in the surgical simulation industry. Regulations significantly shape the market by setting safety, efficacy, and data privacy standards. Compliance with medical device regulations ensures product quality and patient safety, fostering trust in simulation technologies.

The geographical expansion is significant as market players engage in strategic initiatives to strengthen their positions in the global market. For example, in July 2024, Maximum Fidelity Surgical Simulations, which specializes in lifelike cadaveric models for realistic surgical training, raised USD 2.25 million in a seed funding round. This funding was primarily led by St. Louis Arch Angels, the Missouri Technology Corporation, and BioGenerator Ventures. The capital is expected to be used for entering new markets, hiring full-time staff, and advancing technology development.

Case Study & Insights

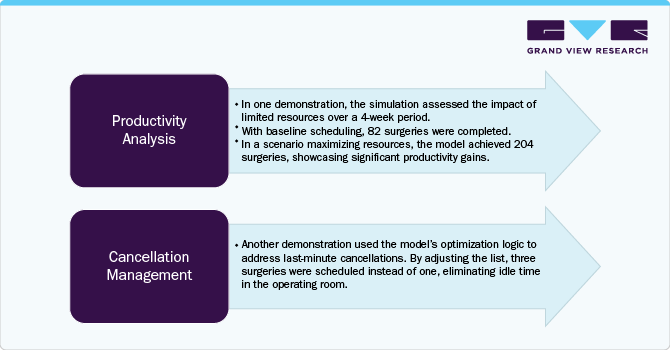

Case Study: Enhancing Surgical Planning with Real-World Simulation

Problem:

TCC-CASEMIX faces challenges with traditional simulations for optimizing operating room efficiency, which often fell short, as assumptions and lack of real-world data limited accuracy and reliability.Solution:

TCC-CASEMIX implemented a new approach by reversing the typical logic: rather than simulating the real world, the real world was adapted to follow a refined simulation model. Users could experiment with various parameters impacting surgery, set these as operational constraints, and use them to optimize real-world conditions.In collaboration with AnyLogic, TCC-CASEMIX developed an elective surgery planning model that could evaluate patient risk and surgical factors, combining agent-based and discrete-event simulation with their custom optimization engine. The simulation was designed with user-friendly interfaces and AnyLogic Cloud access, allowing users to control outputs without requiring technical expertise.

Results:

Conclusion:

This model empowered surgical service managers to make data-driven decisions, improving KPIs and enhancing predictability in planning. The approach also strengthened stakeholders' confidence in simulation-based tools for efficient surgical management.

Specialty Insights

The orthopedic surgery segment dominated the market with a revenue share of 31.75% in 2024. The market growth is attributed to the increasing number of cases of orthopedic conditions, including osteoporosis, osteoarthritis, rheumatoid arthritis, and ligamentous knee injuries globally. According to a study published by NCBI in 2023, the anterior cruciate ligament (ACL) is the most frequently injured in the knee, accounting for nearly 50% of all knee injuries. In the U.S., the annual incidence of ACL injuries is roughly 1 in 3,500 individuals, with about 400,000 ACL reconstruction procedures performed each year.

This rising prevalence fuels the demand for enhanced knee injury treatment, encouraging market players to develop advanced simulations to train surgeons. Swemac specializes in developing simulators for teaching orthopedic surgeons and manufacturing their products within fracture treatment. ArthroVision and TraumaVision are orthopedic simulator systems offered by Swemac.

However, the reconstructive surgery segment is anticipated to witness the fastest CAGR of 17.20% over the forecast period. The growth is attributed to the rising demand for enhanced training solutions in complex reconstructive procedures, including facial, craniofacial, and breast reconstruction. High-fidelity simulators help surgeons hone their skills with precision, improving patient outcomes. Moreover, advanced 3D modeling and VR technologies enable realistic practice environments, further contributing to market growth.

Technology Insights

The 3D printing segment dominated the market with the largest share of over 50% in 2024. The increasing awareness regarding the benefits of 3D printing simulation, coupled with companies undertaking various strategic initiatives to sustain their position in the market, is driving market growth. In April 2023, 3D Systems partnered with Clarkson College to establish a 3D Printing and Training Center of Excellence focused on healthcare innovation, education, and patient care. This collaboration seeks to enhance access to 3D printing and visualization technologies for healthcare facilities in the Omaha area.

The virtual patient simulation segment is expected to grow at the fastest CAGR over the forecast period. The market growth is attributed to the technological advancements in immersive learning. This technology enables healthcare professionals to practice surgical procedures in a risk-free environment, enhancing skill acquisition and patient safety. Using AI and VR, virtual patient simulators offer realistic, interactive experiences, allowing for personalized, repetitive training. Rising demand for remote education and better training tools further fuels the growth.

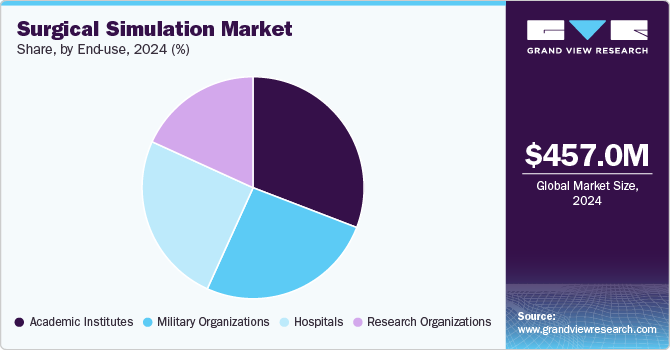

End Use Insights

The research organizations segment dominated the market with the largest revenue share in 2024. Research institutions drive innovations by testing and refining simulators and exploring applications like VR and AI to enhance procedural accuracy and training effectiveness. These institutes support evidence-based improvements in simulation technology, engaging in partnerships with medical device companies to accelerate product development and facilitate realistic, advanced training environments for healthcare professionals.

The hospitals segment is expected to witness the fastest CAGR over the forecast period. An increased focus on advanced learning primarily drives the growth. Moreover, introducing advanced simulation technologies, the extensive application of simulation models in surgeries, and an increased need to reduce errors contribute to market growth. For instance, in January 2023, Attikon University General Hospital inaugurated a Surgical Simulation Lab designed to facilitate the training of general and orthopedic surgeons.

Regional Insights

North America surgical simulation market held the largest global revenue share of 35.88% in 2024. The market growth is attributed to the region's availability of technologically advanced healthcare infrastructure. Furthermore, increasing investment in the healthcare sector, coupled with prominent players in the market, is fueling the market growth. For instance, in September 2024, the Health Resources and Services Administration, part of the U.S. Department of Health and Human Services, allocated approximately USD 75 million to enhance healthcare services in rural areas. The Biden-Harris Administration has implemented various initiatives to improve health in rural communities, including investments in medical training for physicians in these regions.

U.S. Surgical Simulation Market Trends

The U.S. surgical simulation market dominated the North America market in terms of revenue share. The market growth is attributed to the emergence of advanced technologies, favorable government policies, a rise in chronic conditions, and the presence of key players in the market. In November 2023, at the Global Congress meet of the American Association of Gynecological Laparoscopists (AAGL), the Medical Devices Business Services, Inc., the MedTech subsidiary of J&J known as Ethicon, introduced an AI-powered surgical simulation platform. This innovative platform aims to improve skill development for both existing and aspiring surgeons.

The Canada surgical simulation market is driven by the increased demand for minimally invasive procedures. Moreover, Canada’s investment in simulation-based education prioritizes patient safety and practical training, especially for high-risk surgeries. In addition, initiatives from organizations like Simulation Canada promote standardized simulation training, further driving its adoption across medical institutions.

Asia Pacific Surgical Simulation Market Trends

The Asia Pacific surgical simulation market is anticipated to grow at the fastest CAGR from 2025 to 2030. Market growth is driven by rising demand for innovative technologies, minimally invasive treatments, and solutions focused on patient safety. Moreover, increasing number of studies proving the surgical simulation efficiency significantly contributed to the market growth. For instance, a February 2022 study published by the Hokkaido University’s Graduate School of Medicine in Japan highlighted that.

The Japan surgical simulation market is expected to grow rapidly in the coming years. The developments in healthcare education, an increased focus on patient safety, rising awareness, and the adoption of simulation technology for surgeries are anticipated to drive market growth in Japan during the forecast period.

For instance, in October 2023, Clinician-scientists from the National University of Health (NUH) and National University of Singapore (NUS) Medicine in Singapore utilized Japan's first surgical robot to perform a simulated gastrectomy, transmitting their movements in real-time from Singapore to a robotic unit in Japan over a dedicated international fiber-optic network. Leveraging the robotic surgery expertise of FHU, this initiative seeks to assess and address potential challenges in remote surgical procedures.

The surgical simulation market in Chinaheld a substantial market share in 2024. The growth is attributed to the increasing number of surgeries along with the shortage of skilled doctors and surgeons. In addition, the rising number of local startups and the launch of technologically advanced simulations significantly fueled the market growth.

Key Surgical Simulation Company Insights

The surgical simulation industry is highly competitive with key players such as Materialise, Stratasys, CAE Inc., Surgical Science, Mentice, Gaumard Scientific, and Simulab Corporation. These companies engage in various business strategies, such as new product launches, acquisitions, and partnerships, to achieve a competitive advantage over one another.

Key Surgical Simulation Companies:

The following are the leading companies in the surgical simulation market. These companies collectively hold the largest market share and dictate industry trends.

- Materialise

- Stratasys

- CAE Inc.

- Surgical Science

- Mentice

- Gaumard Scientific

- Simulab Corporation

- VirtaMed AG

- 3-Dmed Learning Through Simulation

- Laerdal Medical

- 3D Systems, Inc.

- Osteo3d

- AXIAL3D

- Formlabs

- Kyoto Kagaku Co., Ltd.

Recent Developments

-

In July 2024, Materialise acquired FEops to enhance efficiency and clinical outcomes in structural heart interventions. This acquisition enabled Materialise to broaden its cardiovascular solutions by integrating predictive simulation capabilities, thereby advancing personalized treatment options for patients with heart conditions.

"At Materialise, we are pioneering the advent of mass personalization in healthcare, using advanced visualization and 3D printing technologies to deliver precise, patient-specific solutions. By integrating FEops’ advanced predictive simulation technology with our Mimics Planner, we are expanding our cardiovascular solutions to provide clinicians with comprehensive insights into patient anatomy. This integration will not only enhance the accuracy and efficiency of structural heart interventions but also improve clinical outcomes and patient safety.”

-Brigitte de Vet, CEO, Materialise

-

In June 2024, Stratasys Ltd. launched the J5 Digital Anatomy 3D printer to meet the increasing need for affordable, high-accuracy anatomical models. This development supports hospitals, medical device manufacturers, and research institutions in improving patient outcomes, optimizing operations, and accelerating product development timelines.

-

In April 2022, Alcon launched the Alcon Fidelis Virtual Reality Ophthalmic Surgical Simulator. This VR tool is portable and is designed for cataract surgery trainees. Integrated within the Alcon Experience Academy, the simulator provides a realistic virtual operating room setting with haptic feedback to accurately replicate the experience of performing cataract surgery.

-

In September 2021, CAE Healthcare partnered with RCSI University of Medicine and Health Sciences to enhance healthcare technology, education, and research through simulation methodologies. The RCSI SIM Centre for Simulation Education and Research has been recognized as a certified Centre of Excellence, marking the first such designation in Europe.

Surgical Simulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 530.7 million

Revenue forecast in 2030

USD 1,134.1 million

Growth rate

CAGR of 16.40% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty, technology, end use, region,

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S., Canada, Mexico, UK, Germany, France, Spain, Italy, Sweden, Denmark, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Materialise, Stratasys, CAE Inc., Surgical Science, Mentice, Gaumard Scientific, Simulab Corporation, VirtaMed AG, 3-Dmed Learning Through Simulation, Laerdal Medical, 3D Systems, Inc., Osteo3d, AXIAL3D, Formlabs, Kyoto Kagaku Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Simulation Market Report Segmentation

This report forecasts revenue growth and provides regional and country level analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global surgical simulation market report based on specialty, technology, end use, and region:

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Surgery

-

Gastroenterology

-

Neurosurgery

-

Orthopedic Surgery

-

Reconstructive Surgery

-

Oncology Surgery

-

Transplant

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Patient Simulation

-

3D Printing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Institutes

-

Hospitals

-

Military Organizations

-

Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical simulation market size was estimated at USD 457.0 million in 2024 and is expected to reach USD 530.7 million in 2025.

b. The global surgical simulation market is expected to grow at a compound annual growth rate of 16.40% from 2025 to 2030 to reach USD 1,134.1 million by 2030.

b. North America dominated the surgical simulation market with a share of 34.88% in 2024. This growth is attributed to advancements in technology, increasing demand for minimally invasive surgeries, and increasing adoption of virtual reality (VR) and augmented reality (AR) technologies in surgical training.

b. Some of the key players in the surgical simulation market are Materialise, Stratasys, CAE Inc., Surgical Science, Mentice, Gaumard Scientific, Simulab Corporation, VirtaMed AG, 3-Dmed Learning Through Simulation, Laerdal Medical, 3D Systems, Inc., Osteo3d, AXIAL3D, Formlabs, Kyoto Kagaku Co., Ltd.

b. Key factors that are driving the surgical simulation market growth include increasing focus on patient safety, growing geriatric population, technological advancements, and shortage of skilled surgeons.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.