- Home

- »

- Medical Devices

- »

-

Surgical Sealants And Adhesives Market Size Report, 2030GVR Report cover

![Surgical Sealants And Adhesives Market Size, Share & Trends Report]()

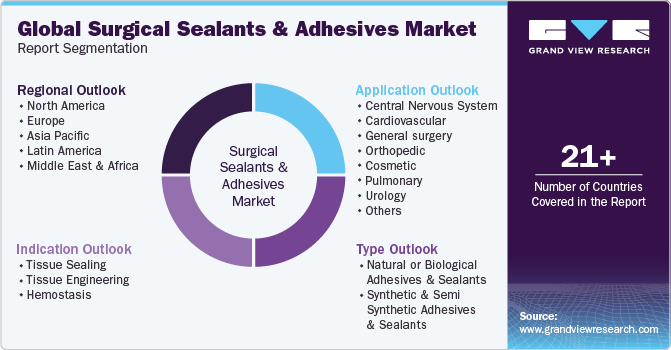

Surgical Sealants And Adhesives Market Size, Share & Trends Analysis Report By Type (Natural Or Biological, Synthetic And Semi Synthetic), By Application (Central Nervous System, General Surgery), By Indication, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-411-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global surgical sealants and adhesives market size was estimated at USD 2.50 billion in 2023 and is projected to grow at a CAGR of 11.8% from 2024 to 2030. Sealants and adhesives have evolved to become useful accompaniments in modern surgical procedures. They are widely preferred because of their safety, efficacy, and usability in repairing injured tissues and supporting wounds obtained during surgery.

The market is expected to witness lucrative growth over the next seven years owing to the increasing use of technologically advanced products and a rise in the number of surgical procedures worldwide. According to an article published by the National Library of Medicine, in May 2023, every year approximately 234 million major surgical procedures are performed worldwide. Thus, the large number of surgeries conducted each year is expected to drive market growth from 2024 to 2030.

Furthermore, the increase in the number of various surgeries, such as cosmetic surgery and cardiac surgery, is expected to support the market expansion. According to an article published by the American Society of Plastic Surgeons in September 2023, around 26.2 million surgical, minimally invasive reconstructive, and cosmetic procedures were performed in the U.S. in 2022, which is a 19% rise from 2019. Surgical procedures are generally accompanied by the risk of excessive bleeding, wound infection, or tissue damage. These risks associated with surgeries can help boost the demand for products such surgical sealants and adhesives.

The manufacturers and industry participants are focusing on developing advanced products. For instance, in January 2023, Grifols, a major plasma medicine player, revealed a positive topline result from a phase 3b study of its fibrin sealant (FS) for treating bleeding in surgeries of pediatric patients. Such positive results from various studies and investigations undertaken by key manufacturers are expected to encourage the introduction of novel products to the market.

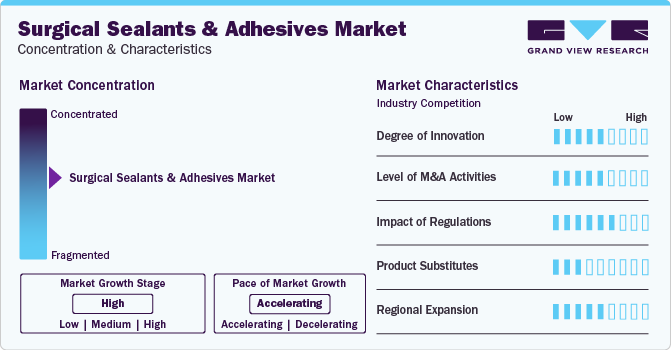

Market Characteristics & Concentration

The market growth stage is high and the pace of the growth is accelerating due to the presence of various well-established players and numerous initiatives undertaken by them.

The market growth can be attributed to the development of advanced products and increased adoption of minimally invasive procedures. Companies are innovating continuously to improve product offering. The regulatory bodies are also supporting innovation by providing approvals for clinical trials and marketing. For instance, in December 2023, RevBio, a U.S.-based company, obtained authorization from the Food and Drug Administration (FDA) to initiate a first-in-human (FIH) clinical trial for its bone adhesive, Tetranite, developed for cranial flap fixation. Tetranite is a synthetic, regenerative, self-setting, patented, osteoconductive, and injectable bone adhesive biomaterial. The regulatory support and advancements in materials are expected to drive innovation in the industry.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain a competitive advantage and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms operating across the industry. For instance, in May 2022, a key industry player, Ethicon, acquired GATT Technologies—a Netherlands-based company. The company uses differentiated synthetic polymers to create hemostatic and sealant products with the acquisition.

Regulations are overseen by governing bodies such as the Food and Drug Administration (FDA) in the U.S. and similar agencies globally. The authorities have published a regulatory framework to assure product safety, effectiveness, and quality standards. The regulatory bodies are also involved in clinical trials and marketing approval of surgical sealants and adhesives. For instance, in June 2023, the U.S. Food and Drug Administration (FDA) authorized the Pre-Market Approval (PMA) of LiquiBandFix8, a device that consists of a Cyanoacrylate adhesive and can be used in hernia surgery.

Sutures, stitches, and hemostats serve as substitutes for surgical sealants and adhesives.

Key market players such as Johnson & Johnson, Integra Life Sciences Corporation, Baxter, and Medtronic PLC hold substantial shares in the market. Their dominant presence is largely due to their financial position, well-established brands, extensive distribution networks, and product portfolio. For instance, Johnson & Johnson's offers diverse products for tissue sealing under its ENSEAL brand.

The market is experiencing robust global expansion due to the growing volume of surgical procedures performed and the increasing focus of industry participants on improving the accessibility of products in various countries. For instance, in 2021, BD acquired Tissuemed, a provider of surgical sealant solutions, to expand its offerings for surgeons outside the U.S.

Product Insights

The natural/biological sealants segment led the market with the largest revenue share of 61.92% in 2023. This dominance can be attributed to the broad applications of various natural or biological sealants in medical practice. Fibrin sealants have effective applications in thoracic, cardiovascular, orthopedic, neuro, and reconstructive surgeries. Fibrin has received approval from the FDA to be used under all three groups, namely, sealants, hemostats, and adhesives. Such approvals can boost the demand for fibrin products, which is expected to propel the segment’s growth.

The synthetic & semi-synthetic segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to the increasing demand for cyanoacrylates, owing to their high-speed drying rate. Furthermore, the strong mechanical strength and ease of adhesion are anticipated to boost the adoption of cyanoacrylates in surgical practices worldwide.

Indication Insights

The tissue sealing segment led the market with the largest revenue share in 2023. This is due to the rise in surgical interventions and product launches from major players. The key companies and manufacturers are launching tissue sealers that can help in surgeries. For instance, in April 2022, Ethicon, a surgical solutions provider, launched the ENSEAL X1 Straight Jaw Tissue Sealer. Such product launches for tissue sealing are expected to propel the segment growth in the coming years.

The tissue engineering segment is anticipated to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing demand for tissue regeneration in cases of burn or skin injuries. The rising cosmetic surgeries across the world are expected to support the growth of the tissue engineering segment.

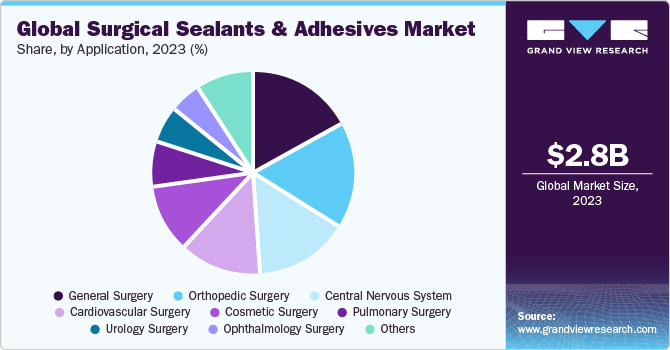

Application Insights

The general surgery segment led the market with the largest revenue share of 17.53% in 2023. This is primarily due to the high volume of surgeries conducted annually. According to the article published by the National Library of Medicine in January 2022, about 530,000 general thoracic surgeries are performed every year in the U.S. The availability of several certified general surgeons is expected to further boost the segment growth. According to an article published by the American Board of Surgery, Inc., in September 2022, out of 34,000 certified surgeons, around 31,579 general surgeons were certified by the American Board of Surgery (ABS) to perform general surgery.

The cosmetic surgery segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This is due to the increasing number of cosmetic procedures and the availability of numerous surgical sealants and adhesives that can be used in cosmetic surgeries. Surgical adhesives are more beneficial in cosmetic procedures than other alternatives like stitches. For instance, according to an article published by SpecialChem in January 2022, skin grafts using cyanoacrylate adhesives can heal with much less scarring than those with stitches. Such benefits associated with surgical sealant and adhesives are anticipated to propel the segment growth.

Regional Insights

North America dominated the surgical sealants and adhesives market with a revenue share of 39.6% in 2023. This is due to the high prevalence of chronic diseases such as cardiovascular disorders and cancer, which drive the demand for advanced medical solutions, including surgical adhesives and sealants, to manage surgical interventions effectively. For instance, according to an article published by the Mass General Brigham Incorporated in August 2023, over 900,000 cardiac surgeries, including coronary bypass surgeries, are performed in the U.S. every year. Thus, the large number of surgical procedures conducted across the region is anticipated to support the regional market growth.

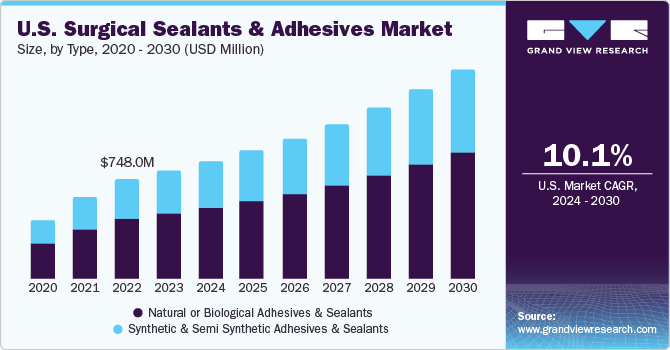

U.S. Surgical Sealants And Adhesives Market Trends

The surgical sealants and adhesives market in the U.S. accounted for a significant share in North America in 2023, due to its advanced healthcare infrastructure, presence of key players, and significant research and development (R&D) investments. The major market participants operating in the country include Baxter; CryoLife, Inc.; Medtronic PLC; and Cardinal Health. Moreover, the rising number of cosmetic surgeries in the U.S. is also anticipated to boost the market growth in the country.

Europe Surgical Sealants And Adhesives Market Trends

The surgical sealants and adhesives market in Europe was identified as a lucrative region, due to the growing need for effective blood loss management in patients coupled with the large number of surgeries performed every year. Moreover, the companies are launching several products in the UK. For instance, in May 2023, Olympus launched the POWERSEALTM Sealer/Divider in various regions including Europe.

The UK surgical sealants and adhesives market is expected to grow over the forecast period, primarily due to the growing adoption of advanced surgical procedures that need efficient tissue sealing solutions. In addition, the presence of players like Olympus offering various products is expected to support the industry growth in the UK.

The surgical sealants and adhesives market in France is expected to grow from 2024 to 2030, due to the rising investment from companies operating in the country, like Tissium, for developing and expanding product portfolios of surgical sealants and adhesives. In addition, the growing geriatric population in the country is expected to propel the market growth as older people are at higher risk of injuries and chronic conditions.

The Germany surgical sealants and adhesives market is expected to grow over the forecast period, due to the prevalence of chronic diseases and increased associated surgeries. The rise in surgeries is boosting the demand for surgical sealants and adhesives in Germany.

Asia Pacific Surgical Sealants And Adhesives Market Trends

The surgical sealants and adhesives market in Asia Pacific is expected to witness the fastest CAGR during the forecast period. This progress is driven by the increasing geriatric population, prevalence of chronic diseases, and advancements in healthcare infrastructure. Moreover, the rising number of surgical procedures and awareness regarding the benefits of tissue sealing agents are contributing to the regional growth.

TheJapan surgical sealants and adhesives market is expected to witness a significant CAGR during the forecast period. Japan has a robust regulatory environment for medical devices, which is anticipated to boost the development and adoption of surgical adhesives and sealants. Moreover, the country's aging population leads to a high demand for these medical devices, further driving the country's growth. According to an article published by the European Parliament in December 2020, around 28.7 % of the Japan individuals are 65 or older.

The surgical sealants and adhesives market in China is expected to grow over the forecast period, due to increasing surgical procedures, which demand the use of surgical adhesives and sealants. Moreover, the rising healthcare expenditure in developing countries, including China, is another factor contributing to this market’s expansion in China.

The India surgical sealants and adhesives market is expected to grow over the forecast period, due to a surge in surgical procedures, advancing healthcare infrastructure, and an increased focus on efficient wound management.

Saudi Arabia Surgical Sealants And Adhesives Market Trends

The surgical sealants and adhesives market in Middle East & Africa is expected to grow at a significant CAGR over the forecast period. Surgical sealants and adhesives offer advantages over traditional sutures, enabling minimally invasive procedures. This leads to quicker recovery times, less pain for patients, and reduced hospital stays, propelling market growth. The rising prevalence of chronic conditions such as cardiovascular diseases, obesity, and diabetes leads to a higher number of surgeries. This increased surgical activity directly fuels demand for surgical sealants and adhesives in Middle East and Africa.

The Saudi Arabia surgical sealants and adhesives market is expected to grow over the forecast period, due to the rising elderly population in the country, which has led to an increased demand for advanced medical procedures and related equipment used in surgeries.

The surgical sealants and adhesives market in Kuwait is expected to grow over the forecast period, due to the increasing demand for effective blood loss management during surgeries and growing prevalence of chronic diseases, including cardiovascular and cancer, across the country.

Key Surgical Sealants And Adhesives Company Insights

The competitive scenario in the surgical sealants and adhesive industry is driven by both established players and new entrants, with market expansion, partnerships, and innovative product launches being key strategies. Companies are focusing on developing advanced products that provide superior performance and patient comfort. In addition, the rising investments are influencing product development in the industry.

Key Surgical Sealants And Adhesives Companies:

The following are the leading companies in the surgical sealants and adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson (Ethicon)

- Artivion, Inc (CryoLife, Inc.)

- C.R. Bard, Inc. (BD)

- Medtronic

- B. Braun SE

- Mallinckrodt

- Cardinal Health

- Baxter

- Integra LifeSciences Corporation

- Stryker

Recent Developments

-

In November 2023, Ethicon, a Johnson & Johnson's MedTech division launched a hemostatic sealing patch, Ethizia, for controlling bleeding in surgeries

-

In November 2023, Pramand LLC, introduced the CraniSeal Dural Sealant System in the U.S. market. This system is used in cranial surgery

-

In March 2023, Animus Surgical introduced a new transparent, biodegradable, non-toxic hydrogel wound sealant

Surgical Sealants And Adhesives Market Report Scope

Report Attrifbute

Details

Market size value in 2024

USD 2.76 billion

Revenue forecast in 2030

USD 5.39 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report updated

March 2024

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, indication, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson (Ethicon); Artivion, Inc (CryoLife, Inc.); C.R. Bard, Inc. (BD); Medtronic; B. Braun SE; Mallinckrodt; Cardinal Health; Baxter; Integra LifeSciences Corporation; Stryker

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Sealants And Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical sealants and adhesives market report based on type, indication, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural or Biological Adhesives and Sealants

-

Fibrin Sealants

-

Collagen Based Adhesives

-

Gelatin Based Adhesives

-

-

Synthetic and Semi Synthetic Adhesives and Sealants

-

Cyanoacrylates

-

Polymeric Hydrogels

-

Urethane Based Adhesives

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Sealing

-

Tissue Engineering

-

Hemostasis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Nervous System

-

Cardiovascular

-

General surgery

-

Orthopedic

-

Cosmetic

-

Pulmonary

-

Urology

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical sealants and adhesives market size was estimated at USD 2.5 billion in 2023 and is expected to reach USD 2.76 billion in 2024.

b. The global surgical sealants and adhesives market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 5.39 billion by 2030.

b. The general surgery segment in application accounted for the largest market share in the year 2023 with a market share of more than 17.0%.

b. Some key players operating in the surgical sealants and adhesives market include Baxter International, Inc.; CryoLife, Inc.; C.R. Bard, Inc.; Medtronic PLC; B. Braun Melsungen AG; Cohera Medical, Inc.; Ethicon, Inc. [J&J]; Mallinckrodt plc; and Cardinal Health.

b. Key factors that are driving the surgical sealants and adhesives market growth include rising demand for surgical services and increasing concerns to reduce surgical wounds.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."