Surgical Scissors Market Size, Share & Trends Analysis Report By Type (Reusable, Disposable), By Application (Cardiology, Orthopedics), By Material (Stainless Steel, Titanium), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-982-4

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Surgical Scissors Market Size & Trends

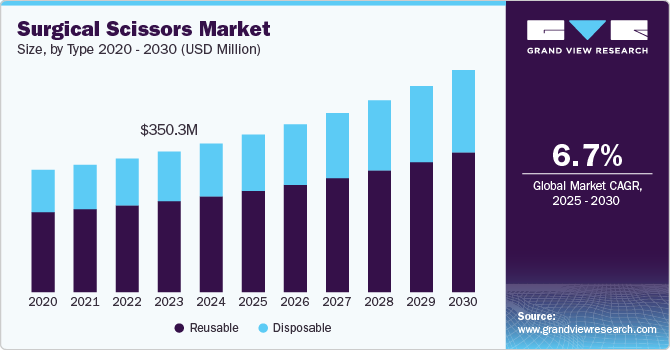

The global surgical scissors market size was valued at USD 370.2 million in 2024 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. The market is driven by increasing surgical procedures, advancements in surgical technology, and the rising prevalence of chronic diseases. The demand for precision instruments in minimally invasive surgeries is fueling growth, along with innovations in materials that enhance durability and functionality. The aging population and higher healthcare expenditure further boost the market. Additionally, the rising focus on outpatient surgeries and advancements in telemedicine are expanding opportunities. Regulatory approvals and the emergence of smart surgical instruments also contribute to market expansion as healthcare providers seek efficiency and improved patient outcomes.

A large number of surgical procedures are performed across the world. The volume of surgical procedures performed at ambulatory surgeries, especially in the U.S., has grown consistently over the past quarter century. ASCs majorly offer surgical procedures at rates 35% to 50% less than hospitals. Such reduced costs of surgical procedures in ASCs across the U.S. help save the U.S. healthcare system USD 40 billion each year. In 2019, around 5,700 ASCs operating in the U.S. performed about 23 million surgical procedures and made approximately USD 35 billion in revenue. Hence, the increasing volume of surgical procedures is predicted to propel the demand for surgical scissors.

The constant rise in the geriatric population is increasing the financial burden on the healthcare system. According to the Population Reference Bureau, the number of Americans aged 65 and above is expected to nearly double from 52 million in 2019 to 95 million by 2060. Thus, the geriatric population is expected to account for up to 50% of the surgeries. Increasing life expectancy and declining birth rate have contributed to the increase in the elderly population. As life expectancy continues to increase, the number of elderly patients affected with surgically correctable diseases is expected to grow. A high prevalence of comorbidities, such as cardiac and neuro conditions, among geriatric patients can make surgeons choose surgical scissors during surgical procedures.

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and autoimmune disorders necessitates regular and accurate medication administration, enhancing the demand for surgical scissors. In addition, the increasing number of elderly individuals is expected to drive the need, as older adults are more prone to chronic illnesses and often require surgeries. Around 70% of rheumatoid arthritis cases occur in females, typically starting between ages 30 and 50, though they can affect people of any age. For instance, the UK is experiencing a rise in cardiovascular diseases, with conditions like coronary heart disease and stroke becoming increasingly prevalent due to factors such as the aging population, unhealthy diets, and sedentary lifestyles. This trend underscores the growing public health challenge and the need for effective preventive measures and treatments. The table below summarizes the number of people dying from cardiovascular diseases (CVD) in 2022, the number of those under 75 years old affected, and the estimated population living with CVD,

|

Nation |

No. of People Dying from CVD (2022) |

No. of People Under 75 Years Old Dying from CVD (2022) |

Estimated Number of People Living with CVD (latest estimate) |

|

England |

142,690 |

39,164 |

6.4 million |

|

Scotland |

18,077 |

5,354 |

700,000 |

|

Wales |

9,570 |

2,739 |

340,000 |

|

Northern Ireland |

4,079 |

1,131 |

225,000 |

|

UK total |

174,884 |

48,694 |

7.6 million |

Technological advancements are also reshaping the surgical scissors market. The rise of minimally invasive surgery (MIS) has revolutionized traditional surgical practices, making instruments designed for these procedures increasingly popular. An example is the Endo Shears by Medtronic, which are specifically designed for laparoscopic surgeries. These scissors enable surgeons to cut and dissect tissues with remarkable precision, resulting in reduced recovery times and fewer complications for patients. Additionally, innovations like ergonomic designs and improved materials enhance the functionality and safety of these instruments.

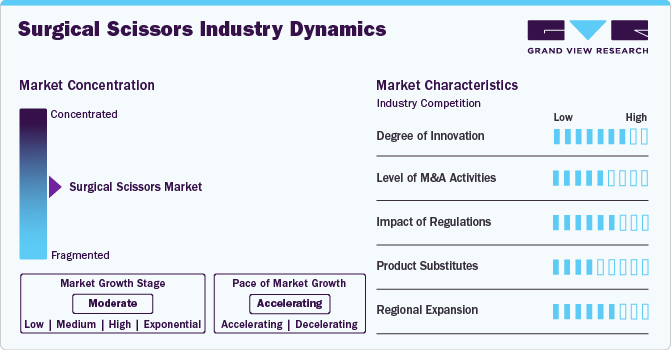

Market Concentration & Characteristics

The surgical scissors industry is characterized by moderate concentration, with several key players dominating the market. Major companies like Medtronic, Stryker, and Johnson & Johnson lead in innovation and product quality, while smaller manufacturers also contribute specialized offerings. The market features a diverse range of products, including straight, curved, and specialized scissors for various surgical applications. Key characteristics include a focus on precision, durability, and ergonomic design to enhance surgical outcomes. Additionally, regulatory compliance and continuous advancements in technology, such as the integration of smart features, are crucial for companies to maintain competitive advantages in this evolving industry.

The surgical scissors industry exhibits a high degree of innovation, driven by advancements in technology and the demand for improved surgical outcomes. Companies are increasingly integrating smart technologies, such as sensors, for real-time feedback and enhanced precision. Innovations also include ergonomic designs and the use of advanced materials, such as titanium and specialty alloys, which enhance durability and performance. The development of specialized scissors for minimally invasive procedures is another notable trend, allowing for greater flexibility and efficiency in surgeries.

Regulations significantly impact the surgical scissors industry by ensuring medical devices' safety, efficacy, and quality. Regulatory bodies, such as the FDA in the U.S. and the EMA in Europe, impose stringent guidelines for the manufacturing, testing, and marketing of surgical instruments. Compliance with these regulations requires manufacturers to conduct thorough clinical evaluations and maintain high-quality standards, which can increase production costs. However, adherence to rules also enhances consumer trust and market acceptance. Additionally, regulatory approvals can be a competitive advantage, enabling companies to differentiate their products in a crowded market while ensuring patient safety.

Mergers and acquisitions in the surgical scissors industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in September 2023, the Acrotec Group, a Swiss company specializing in high-precision components, acquired Friedrich Daniels, a German manufacturer of surgical instruments and comprehensive solutions located in Solingen.

In the surgical scissors industry, product substitutes include a range of cutting instruments such as scalpels, electrosurgical devices, and advanced robotic surgical tools. Scalpels offer precision for incisions, while electrosurgical devices provide cutting and coagulation in one instrument, reducing the need for multiple tools during procedures. Additionally, robotic surgical systems, like those from Intuitive Surgical, enhance dexterity and precision, potentially replacing traditional scissors in minimally invasive surgeries. However, despite these alternatives, surgical scissors remain essential for various tasks due to their versatility, ease of use, and ability to provide precise control in different surgical contexts.

The surgical scissors industry is witnessing significant regional expansion, driven by increasing healthcare demands and advancements in surgical techniques. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to rising investments in healthcare infrastructure and a growing number of surgical procedures. For instance, in January 2024, Surgical Instruments plans to establish a USD 27.7 million manufacturing facility in Hyderabad. This investment aims to enhance production capacity and meet growing demand in the medical sector. The facility is expected to create job opportunities and strengthen the region's position as a hub for medical device manufacturing.

Type Insights

Based on type, the surgical scissors market is classified into reusable and disposable. The reusable segment held the largest market share, accounting for around 64.5% in 2024, owing to their increasing preference and adoption rates across the globe. Reusable stainless steel surgical scissors are considered the most eco-efficient choice by several healthcare professionals. The surge in adoption of robust and cost-effective surgical scissors and the wide availability of reusable surgical scissors are the key factors anticipated to augment the segment growth.

The disposable surgical scissors segment holds a significant market share and is projected to experience the fastest CAGR over the forecast period. This surge is driven by increasing demand for cost-effective and sterile surgical instruments, particularly in outpatient settings and minimally invasive procedures. The rising focus on infection control and the convenience of single-use products are key factors contributing to this trend. Additionally, advancements in materials and manufacturing technologies are enhancing the performance and safety of disposable scissors. As healthcare providers prioritize efficiency and patient safety, the disposable surgical scissors market is expected to expand significantly.

Application Insights

Based on application, the market is segmented into cardiology, orthopedics, oral & throat, dermatology, neurology, gastroenterology, and others. Cardiology is among the leading segments, holding around 22.0% of the market share in 2024. Surgical equipment such as scissors, forceps, specialty retractors, peripheral vascular, aorta & anastomosis clamps, and rib, sternum, & valve retractors are most commonly used during cardiovascular surgeries. Thus, this segment is expected to gain considerable market share during the forecast period owing to a rise in the prevalence of cardiovascular diseases globally.

The orthopedics segment in the surgical scissors market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. With an aging population, the prevalence of orthopedic disorders is also expected to increase, which is expected to further boost the demand for surgical scissors. According to the CDC, high school athletes account for an estimated 2 million sports-related injuries every year in the U.S. Hence, these chronic diseases and associated surgeries create huge demand for surgical instruments, especially surgical scissors, thereby driving the overall market growth.

Material Insights

The stainless-steel segment accounted for the largest revenue share of 26.8% in 2024. This is primarily due to stainless steel's exceptional durability, corrosion resistance, and ease of sterilization, making it the preferred material for surgical instruments. Its ability to maintain sharpness and precision during procedures further enhances its appeal among healthcare professionals. As the demand for high-quality surgical tools increases, manufacturers are investing in advanced stainless-steel alloys and innovative designs to improve performance. The segment's strong presence in various surgical applications, coupled with a growing emphasis on safety and reliability, ensures its continued leadership in the market.

The ceramic segment in the surgical scissors market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. This growth is driven by ceramics' unique properties, such as exceptional sharpness, lightweight design, and resistance to corrosion and wear. As healthcare providers increasingly seek advanced materials that enhance precision and reduce the risk of contamination, ceramic surgical scissors are gaining popularity. Additionally, innovations in ceramic technology are improving product performance and expanding applications in various surgical settings. The rising focus on patient safety and instrument efficacy is expected to further propel the demand for ceramic surgical scissors.

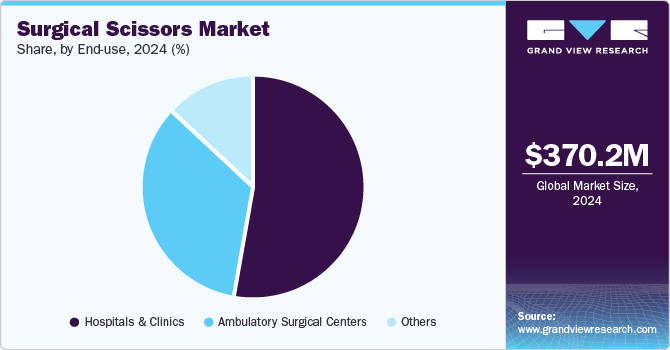

End Use Insights

The hospitals & clinics segment accounted for the largest revenue share of 53.3% in 2024. The number of surgeries performed in hospitals is higher than that in any other health setting, owing to the favorable reimbursement structure and availability of hospitals for primary care in several developing countries. Furthermore, investments in surgical instruments, including surgical scissors, are gradually growing in hospitals owing to the rising incidence of cardiac as well as neurological disorders, which is driving the market growth.

The ambulatory surgical centers segment is projected to witness the fastest CAGR over the forecast period.An increase in preference for same-day surgery, a reduction in significant cost savings & wait times, and a rise in the number of patients requiring surgical interventions are among the factors driving the demand for minimally invasive surgical instruments, including surgical scissors in ambulatory surgery centers. In addition, there has been an increase in hospital-physician ASC joint ventures, which is also expected to drive market growth. Hospitals are undertaking strategies to relocate simple care to ambulatory surgery centers. Thus, investments in surgical equipment, including surgical scissors in ambulatory surgery centers, are expected to increase in the coming years.

Regional Insights

North America surgical scissors market dominated the overall global market and accounted for the 42.4% revenue share in 2024. This can be attributed to the increasing incidence of chronic diseases such as cardiovascular & neurological diseases, dermatology, and orthopedic disorders is a major factor propelling the market growth in North America. In addition, an increase in the number of surgical procedures due to accidents, burns, and trauma cases is one of the major factors driving the surgical scissors market in the region.

U.S. Surgical Scissors Market Trends

The surgical scissors market in the U.S. held a significant share of North America's surgical scissors market in 2024. Demand for innovative, high-quality instruments is driven by advancements in technology and a focus on patient safety. The market features a mix of established manufacturers and emerging players.

Europe Surgical Scissors Market Trends

The surgical scissors market in Europe is witnessing growth. As COPD cases rise, the demand for precise medical instruments, including surgical scissors for procedures related to medication administration, will increase. According to the European Respiratory Society, COPD is projected to increase by 35.2% in patients and 39.6% in prevalence by 2050, from an estimated 36.6 million in 2020 to 49.5 million. With projections indicating a substantial increase in COPD patients by 2050, the surgical scissors market will likely expand to meet the requirements of healthcare providers focused on improving patient adherence and treatment outcomes, fostering overall growth in the medical device sector.

The UK surgical scissors market is witnessing significant growth due to the rising incidence of chronic diseases like diabetes, the expanding elderly population, and the adoption of biosimilars. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The surgical scissors market in France is witnessing growth and benefits from a comprehensive healthcare system and advanced medical technology adoption. With an aging population and increasing chronic respiratory conditions, including COPD and neurological disorders, there is a growing demand for surgical scissors. French healthcare policies emphasizing patient-centered care and technological advancements support market expansion.

Germany surgical scissors market is undergoing significant growth, driven by the country's manufacturers, who have built a strong reputation for delivering high-quality medical devices. This positive trend reflects a growing demand for reliable surgical instruments as healthcare providers prioritize quality and precision in their tools. German manufacturers are continuously innovating to meet the needs of the medical community, reinforcing their position as leaders in the global market. As a result, the industry is well-positioned for continued expansion in response to advancements in healthcare practices and technologies.

Asia Pacific Surgical Scissors Market Trends

The surgical scissors market in Asia Pacific is witnessing significant growth driven by rising healthcare investments, an expanding elderly population, and an increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC surgical scissors market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

Japan surgical scissors market is poised for substantial growth, driven by the rising incidence of chronic diseases and heightened focus on patient safety and convenience. Regulatory reforms and incentives, along with advancements in biologics and biosimilars, are attracting pharmaceutical companies to invest in the Japanese market. Furthermore, expedited approval processes are facilitating quicker market entry for innovative products, further enhancing investment opportunities and stimulating growth within the surgical instruments sector.

The surgical scissors market in China is expected to grow as China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

India surgical scissors market is rapidly expanding, fueled by rising healthcare expenditures and an increasing number of surgical procedures. Key factors include growing awareness of hygiene and safety, leading to higher demand for quality instruments. The market features a mix of domestic and international players, with innovations in design and materials enhancing product offerings. Government initiatives to improve healthcare infrastructure further support market growth, making India a significant player in the surgical instruments sector.

Latin America Surgical Scissors Market Trends

The surgical scissors market in Latin America is experiencing growth driven by increasing surgical procedures and rising healthcare investments. Demand for high-quality, durable instruments is on the rise, alongside a focus on infection control and precision. Local manufacturers are emerging, enhancing competition and expanding product offerings in this developing region.

Saudi Arabia surgical scissors market is anticipated to expand over the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Surgical Scissors Company Insights

The competitive scenario in the surgical scissors market is highly competitive, with key players such as B. Braun Melsungen AG, BD; and Stryker holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Surgical Scissors Companies:

The following are the leading companies in the surgical scissors market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Melsungen AG

- Arthrex, Inc.

- BD

- Thermo Fisher Scientific

- World Precision Instruments

- Scanlan International

- Stryker

- Purple Surgical International

- Olympus Corporation

- Teleflex Incorporated

View a comprehensive list of companies in the Surgical Scissors Market

Recent Developments

-

In November 2023, Surtex introduced its Infinex surgical instrument series at the MEDICA trade fair. This cutting-edge line is designed with advanced features to meet a variety of surgical requirements. The Infinex series focuses on enhancing precision and efficiency, highlighting Surtex's dedication to quality and innovation in medical devices. The Infinex Maestro series includes meticulously crafted micro scissors, forceps, and needle holders, demonstrating Surtex’s commitment to exceptional performance and outstanding patient outcomes.

-

In September 2023, Charmant returned to the EANS 2023 Congress in Barcelona, Spain, in collaboration with IQ Group. They showcased the latest advancements in surgeon-oriented devices, including hybrid micro-scissors, surgical support systems, and various accessories.

-

In November 2022, Solvay partnered with French startup Ostium to develop innovative materials for single-use surgical instruments. This collaboration aims to enhance the performance and safety of surgical tools, promoting sustainability in the medical field. The partnership reflects Solvay’s commitment to advancing healthcare through advanced materials, technology and innovative solutions.

Surgical Scissors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 392.5 million |

|

Revenue forecast in 2030 |

USD 552.9 million |

|

Growth Rate |

CAGR of 6.7% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, material, end- use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

B. Braun Melsungen AG, Arthrex, Inc., BD, Thermo Fisher Scientific, World Precision Instruments, Scanlan International, Stryker, Purple Surgical International, Olympus Corporation, Teleflex Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surgical Scissors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical scissors market report on the basis of type, application, material, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Orthopedics

-

Gastroenterology

-

Dermatology

-

Neurology

-

Oral and Throat

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Titanium

-

Tungsten

-

Ceramic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical scissors market size was estimated at USD 370.21 million in 2024 and is expected to reach USD 392.54 million in 2025.

b. The global surgical scissors market is expected to grow at a compound annual growth rate of 7.09% from 2025 to 2030 to reach USD 552.94 million by 2030.

b. North America dominated the surgical scissors market with a share of 42.4% in 2024. This is attributable to the increasing prevalence of chronic disorders and the presence of a large number of suppliers for surgical scissors.

b. Some key players operating in the surgical scissors market include B.Braun Melsungen AG, Arthrex, Inc., BD, Thermo Fisher Scientific, World Precision Instruments, Scanlan International, Stryker, Purple Surgical International, Olympus Corporation, Teleflex Incorporated

b. Rising prevalence of chronic disorders, increasing preference for minimally invasive surgical procedures, rise in geriatric population base are the major factors anticipated to augment the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."