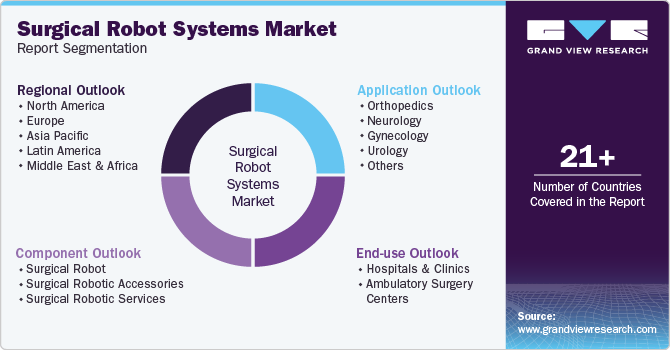

Surgical Robot Systems Market Size, Share & Trends Analysis Report By Component (Surgical Robotic Accessories, Surgical Robotic Services), By Application (Orthopedics, Neurology), By End-use (Hospital & Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-366-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Surgical Robot Systems Market Trends

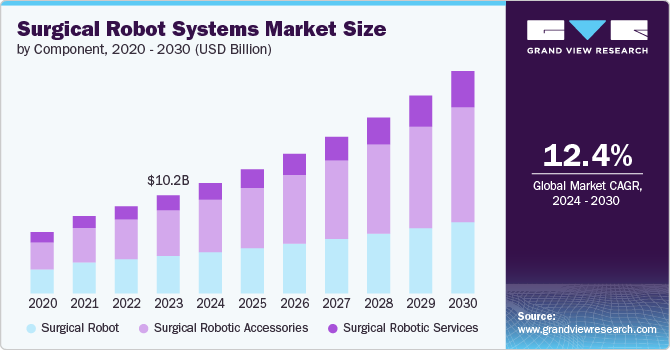

The global surgical robot systems market size was estimated at USD 11.48 billion in 2024 and is projected to grow at a CAGR of 12.4% from 2025 to 2030. The market is driven by several factors, such as technological advancement, the rising preference for minimally invasive procedures, improved outcomes, greater precision, and reduced human errors in surgical procedures. This development is a significant advancement in medical technology, combining innovation with a commitment to enhancing the safety and efficacy of surgical operations. Moreover, an increasing number of knee and hip replacement surgeries due to rising cases of osteoporosis and arthritis are anticipated to drive growth. For instance, according to data published by the Agency for Healthcare Research and Quality, over 450,000 total hip replacement surgeries are conducted annually in the U.S.

The rising demand for minimally invasive procedures has been a key driver for adopting surgical robot systems. Minimally invasive surgeries offer patients benefits such as shorter hospital stays, faster recovery times, lower risk of complications than traditional open surgeries, and reduced pain. Robotic systems enable surgeons to perform complex procedures through small incisions with greater precision and control. For instance, in July 2024, AcuSurgical completed its first clinical study with the Luca surgical robot for vitrectomy procedures. This robotic system provides precision of up to 10 microns. The system is able to allow surgeons to treat more patients, expedite training, address a broader range of pathologies, and increase safety and accuracy.

Furthermore, Various surgical robot systems market companies are expanding into Ambulatory Surgical Centers (ASCs) to capitalize on the growing demand for minimally invasive procedures in outpatient settings. This expansion is driven by the cost-efficiency and faster recovery times associated with ASCs, making them attractive alternatives to traditional hospital-based surgeries. Companies such as Intuitive Surgical, Johnson & Johnson’s Ethicon, and Medtronic actively target ASCs with compact, cost-effective robotic systems tailored for smaller facilities. The trend is further supported by advancements in robotic technology, such as AI integration and modular designs, which enhance procedural accuracy and adaptability in outpatient environments.

Industry Perspectives

Several companies and experts have expressed their support for the transition towards ASCs:

-

Intuitive Surgical, a leader in robotic surgery systems, emphasizes that expanding into ASCs allows for broader access to robotic-assisted procedures. Their systems are designed to improve operational efficiency while maintaining high standards of patient care.

-

Medtronic, another major player in the surgical robotics field, has noted that the integration of robotic systems into ASCs can streamline workflows and enhance patient throughput without compromising safety or quality.

-

Surgical Care Affiliates (SCA) has reported that the adoption of robotic technology in their ASCs has led to improved patient satisfaction scores due to quicker recovery times and less postoperative pain.

The major driver for surgical robot systems is the ability to improve patient surgical outcomes. Robotic-assisted surgery increases accuracy and precision during procedures, reducing blood loss. Robotic surgery results in better clinical outcomes and higher patient satisfaction than traditional methods. For instance, in July 2024, Sovato Health Inc., with its Sovato remote surgery platform, conducted a series of remote robotic-assisted surgical procedures. Seven surgeons across four specialties conducted hysterectomy, nephrectomy, cholecystectomy, and colectomy procedures as part of the preclinical tests on pigs across about 500 miles between Lincoln and Chicago, Neb.

Another significant driver for the industry is surgical robot systems’ potential to reduce human errors in the operating room. Robotic systems offer steady hands and precise movements that minimize human error risk during delicate surgical procedures. Robotic platforms help mitigate factors such as hand tremors or fatigue that affect procedural accuracy by providing surgeons with enhanced visualization and dexterity. For instance, over 1,700 da Vinci Systems are installed in healthcare settings across the globe, and over 775,000 patients across the globe have had a da Vinci procedure.

The rising number of regulatory approvals and patent grants propels the surgical robot industry by accelerating product launches and technological progress. Streamlined pathways from authorities such as the FDA and CE Mark have enabled the rapid entry of advanced surgical systems. Simultaneously, increased patent filings highlight ongoing innovation, such as AI-driven enhancements and minimally invasive designs. For example, CMR Surgical holds 1,053 global patents across 272 unique families, with 979 active patents showcasing continuous R&D efforts driving global market expansion and competition.

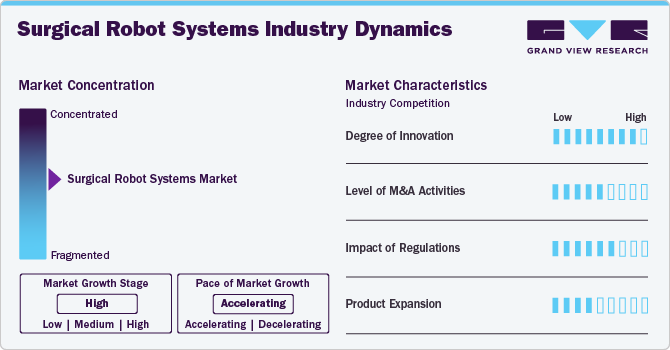

Market Concentration & Characteristics

The global surgical robot systems market is characterized by a high degree of innovation, owing to rising investments in product development and growing research activities. For instance, in April 2024, spaceMIRA, a surgical robot developed by Virtual Incision and the University of Nebraska, was sent to the International Space Station (ISS) for remote testing. This space-focused version of Virtual Incision's miniaturized robotic-assisted surgery system, MIRA, is designed for compactness and convenience. The device's modifications allowed long-distance remote surgery, demonstrating significant advancements in medical technology.

The surgical robot systems market is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for surgical robot systems and to maintain a competitive edge. For instance, in August 2024, Asensus Surgical , Inc., a provider of robotic-assisted surgical technology, merged with the KARL STORZ Group.

Regulatory guidelines established by various authorities significantly influence market growth. Before being introduced to the market, surgical robot systems must meet strict regulatory requirements to ensure that they meet high standards of quality, safety, and effectiveness. For instance, The U.S. FDA regulates all surgical robots as Class II (moderate risk) devices. When classified by the regulatory system, about 90% of surgical robots received 510(k) clearance from the U.S. FDA.

Several market players are expanding their business by launching new products to strengthen their market position and portfolio. For instance, in November 2024, Johnson & Johnson MedTech reported that the U.S. FDA has approved the investigational device exemption (IDE) for the OTTAVA robotic surgical system, enabling the beginning of clinical trials at U.S. locations. The company is now set to prepare clinical trial sites to accept OTTAVA systems, enroll patients, and initiate surgical procedures.

Component Insights

The surgical robotic accessories segment held the largest revenue share of 47.6% in 2024. The market comprises various supplementary devices and parts essential for the operation of surgical robots in medical procedures. These additional elements enhance accuracy, better visualization, and support the smooth execution of surgeries. Robotic accessories encompass end-effectors, robotic arms, wristed tools, surgery cameras, control panels, and specialized instruments. For instance, in September 2022, eCential Robotics, a company specialized in surgical robotics, received U.S. FDA clearance for its unified robotic platform, featuring 3D imaging, navigation, and a robotic arm, facilitating its expansion into the U.S. market.

The surgical robotic services segment is anticipated to grow at the fastest CAGR over the forecast period. The use of surgical robots became increasingly common in surgeries involving the liver, gastrointestinal tract, pancreas, and other areas of the abdomen. The ability of these robots to conduct intricate general surgical procedures with great precision renders them exceptionally beneficial. To maintain their accuracy and performance, they need prompt training and implementation services and regular maintenance. For example, Intuitive Surgical offers a Da Vinci Complete Care Service Plan, which includes Parts Exchange, Software Updates, System Inspections, etc.

Application Insights

The orthopedic segment held a significant revenue share of 22.5% in 2024. The increasing prevalence of orthopedic disorders such as osteoarthritis, rheumatoid arthritis, and osteoporosis primarily drives the orthopedics segment. For instance, according to the Australian Commission on Safety and Quality in Health Care, over 2.1 million Australians are anticipated to have osteoarthritis, making it the most common form of arthritis in Australia. Moreover, the growing adoption of various strategies by market players to offer better services fuels market growth. For instance, in February 2024, THINK Surgical partnered with Waldemar Link GmbH & Co. KG to add the LinkSymphoKnee System to its ID-HUB, a proprietary data bank of implant modules for use with its TMINI Miniature Robotic System, enhancing implant options for more precise orthopedic surgeries.

The neurology segment is expected to grow at the fastest CAGR over the forecast period. The rise in neurological disorders such as Parkinson’s and epilepsy fuels the demand for advanced surgical robot systems in neurology aimed at improving precision and outcomes in neurosurgical procedures. The trend towards minimally invasive surgeries propels the development of neuro-specific robotic technology, offering greater accuracy and reducing complication risks in complex surgeries such as brain tumor removals. For instance, in September 2024, ZEISS Medical Technology introduced the KINEVO 900 S with the best digital visualization, connected intelligence, and collaborative assistant functions for complex surgical procedures in neurosurgery and other surgical disciplines.

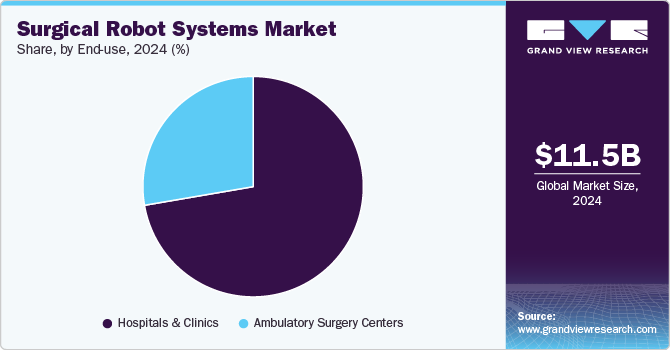

End-use Insights

The hospitals & clinics segment held the largest revenue share of 72.3% in 2024 and segment is expected to witness the fastest CAGR over the forecast period. The demand for surgical robots in hospitals is growing due to the rising number of chronic diseases that require complex surgeries, which results in hospital stays. This increase is primarily seen in cases of heart disease, cancer, and neurological conditions, thereby boosting the need for robotic-assisted surgical procedures in inpatient environments. For instance, in April 2024, Cheshire Medical Center, part of Dartmouth Health, acquired Intuitive Surgical's first robotic surgical platform, the da Vinci Xi. It enabled the center to conduct various minimally invasive surgeries annually. Initially, it would be utilized for general, bariatric, and gynecological surgeries such as gallbladder removal, hysterectomies, and sleeve gastrostomies.

The ambulatory surgery centers segment is expected to witness a significant CAGR over the forecast period, owing to the increasing preference for ambulatory surgery centers and daycare centers in surgical procedures. For instance, according to Definitive Healthcare, as of February 2024, almost 9,600 active ambulatory surgery centers in the U.S. Outpatient facilities offer advantages such as quick discharge, reduced waiting times, enhanced efficiency, and lower procedural costs. In addition, they provide patients with adequate postoperative pain control, minimal side effects, rapid discharge, and overall cost containment.

Regional Insights

North America surgical robot systems market dominated with over a 50% revenue share in 2024. In North America, a key driver in the surgical robot systems market is the high adoption rate of advanced medical technologies and robotics. The region has a well-established healthcare infrastructure and a strong focus on technological advancements, leading to a higher adoption of robotic-assisted surgeries. For instance, in June 2024, Texas Health augmented its fleet of surgical robots to boost surgeons' precision, aiming to improve patient outcomes throughout the system. Texas Health aimed to equip 12 hospitals with the da Vinci 5 robotic systems by June.

U.S. Surgical Robot Systems Market Trends

The surgical robot systems market in the U.S. is expected to grow over the forecast period. Factors include increasing research and development activities and substantial investments in healthcare innovation to boost market growth. Various companies in the country are also adopting strategies to expand their foothold in the market. For instance, in July 2024, Microbot Medical, a LIBERTY Endovascular Robotic Surgical System provider, partnered with the Baptist Hospital of Miami for a clinical trial. This follows Institutional Review Board approval and the signing of a Clinical Trial Agreement. The trial involves Miami Cardiac & Vascular Institute and Miami Cancer Institute, featuring Microbot's LIBERTY device under its Investigational Device Exemption.

Europe Surgical Robot Systems Market Trends

Europe surgical robot systems industry is anticipated to register a considerable growth rate during the forecast period. In Europe, a significant driver for the growth of surgical robot systems is the increasing emphasis on precision medicine, favorable reimbursement policies that reduce patients' out-of-pocket expenditures, and personalized healthcare solutions. Countries such as Germany, France, and the UK invest heavily in healthcare digitization and automation to enhance patient outcomes and optimize surgical procedures. Moreover, ongoing research on robotics in the region is anticipated to drive market growth over the forecast period.

The surgical robot systems market in the UK is anticipated to register a considerable growth rate during the forecast period. Factors such as a rise in several product launches and approval from regulatory authorities propel market growth. For instance, in October 2024, CMR Surgical, a UK-based surgical robotics company, received U.S. FDA marketing authorization for the Versius Surgical System (Versius) in the U.S.

Asia Pacific Surgical Robot Systems Market Trends

The Asia Pacific surgical robot systems industry is anticipated to be the fastest-growing region over the forecast period. Asia Pacific’s surgical robot systems market is driven by rising healthcare expenditure, improving access to advanced medical technologies, and a growing patient pool seeking quality healthcare services. Countries such as Japan, South Korea, and China are witnessing a growth in robot-assisted surgeries due to their aging populations and increasing prevalence of chronic diseases.

The surgical robot systems market in China is anticipated to register a considerable growth rate during the forecast period. Medical professionals' growing exposure to new technologies is expected to boost market growth over the forecast period. Several organizations, such as the Shenzhen Institute of Advanced Integration Technology (SIIT), are engaged in research on spinal surgical robots to improve the accuracy of robotic equipment.

Latin America Surgical Robot Systems Market Trends

Latin America surgical robot systems industry is anticipated to register a considerable growth rate during the forecast period. The growing prevalence of chronic diseases, the easy availability of newer technologies and robots, and the increasing prevalence of osteoporosis drive market growth in this region. For instance, according to the International Osteoporosis Foundation, in Latin America, there are an estimated 655,648 hip fractures , and the economic burden of hip fractures is anticipated to cost USD 13 billion by 2050.

The surgical robot systems market in Brazil is anticipated to register a considerable growth rate during the forecast period, owing to its leading healthcare expenditure. Growing disposable incomes, increasing access for private healthcare companies to a large population pool, increasing government medical expenditure, and rapid expansion of healthcare R&D.

Middle East and Africa Surgical Robot Systems Market Trends

The Middle East and Africa surgical robot systems industry is anticipated to register a considerable growth rate during the forecast period. Improving healthcare infrastructure, rapid technological advancements, and the increasing prevalence of chronic diseases and illnesses, which leads to an increase in the number of surgical procedures, are among the factors boosting the surgical robot systems market in the country.

The surgical robot systems market in UAE is anticipated to register a considerable growth rate during the forecast period. Increasing adoption of surgical robots for performing minimally invasive surgeries is aiding market growth. For instance, in November 2024, The Cleveland Clinic reported that it had conducted the first robotic mastectomy at Cleveland Clinic Abu Dhabi as part of the M42 group.

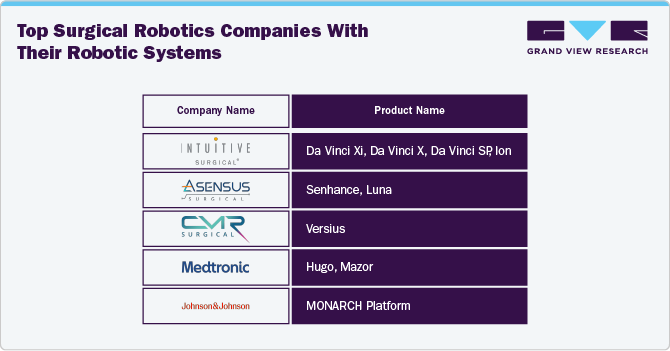

Key Surgical Robot Systems Company Insights

Key players operating in the surgical robot systems industry are undertaking various initiatives to strengthen their market presence and increase the reach of their components and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Surgical Robot Systems Companies:

The following are the leading companies in the surgical robot systems market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical

- THINK Surgical, Inc.

- Smith+Nephew

- Medtronic

- Stryker

- Zimmer Biomet

- CMR Surgical

- Asensus Surgical US, Inc.

- Renishaw PLC.

- MOON Surgical

Established and Emerging Players

|

Verticals |

Established Player |

Emerging Player |

|

Company Name |

Intuitive Surgical |

AcuSurgical |

|

Overview |

Intuitive Surgical develops, manufactures, and markets a robotic system to aid minimally invasive surgery. Globally, the company has successfully installed over 8,600 da Vinci surgical systems in hospitals worldwide, with the U.S. accounting for more than 5,000 of those installations and a growing number in emerging markets. Intuitive has over 12,100 employees and a presence in more than 60 countries. |

AcuSurgical is a France-based surgical robotics company. The company develops retinal microsurgery devices used in eye operations. The company's device is a robotic surgical assistant that aids in the treatment of retinal diseases such as age-related macular degeneration, helping surgeons increase the precision of current procedures, augment visualization, and filter tremors. |

|

Established Year |

1995 |

2020 |

|

Pipeline Product |

Da Vinci 5 |

Luca Robotic Surgery Platform |

Recent Developments

-

In June 2024, Asensus Surgical Inc., which specializes in developing augmented intelligence technology for intra-operative use in operating rooms, finalized a merger agreement with KARL STORZ Endoscopy-America Inc. This agreement aims to improve KARL STORZ's standing in the surgical robotics industry, particularly focusing on the advancement of the next-generation LUNA system by Asensus.

-

In June 2024, Moon Surgical's Maestro Robotic Surgery System received its second FDA clearance, designed to enhance soft tissue surgeries in the broad laparoscopy market. The system, notable for its adaptability and efficiency improvements, will see a limited release in the U.S. and Europe, with a broader launch planned for 2025.

-

In March 2024, Intuitive Surgical obtained FDA 510(k) clearance for its new multiport robotic system, da Vinci 5. This system advances the capabilities of the da Vinci Xi, previously used in over 7 million operations worldwide, setting a new standard for minimally invasive procedures.

Surgical Robot Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 12.92 billion |

|

Revenue forecast in 2030 |

USD 23.13 billion |

|

Growth rate |

CAGR of 12.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Intuitive Surgical; THINK Surgical, Inc.; Smith+Nephew; Medtronic; Stryker; Zimmer Biomet; CMR Surgical; Asensus Surgical US, Inc.; Renishaw PLC.; MOON Surgical |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surgical Robot Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical robot systems market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Robot

-

Laparoscopic robotic systems

-

Orthopedic robotic systems

-

Neurosurgical robotic systems

-

Other robotic systems

-

-

Surgical Robotic Accessories

-

Surgical Robotic Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Neurology

-

Gynecology

-

Urology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Ambulatory surgery centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical robot systems market size was estimated at USD 11.48 billion in 2024 and is expected to reach USD 12.92 billion in 2025.

b. The global surgical robot systems market is expected to grow at a compound annual growth rate of 12.4% from 2025 to 2030 to reach USD 23.13 billion by 2030.

b. The surgical robotic accessories segment held the largest market share of 47.6% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The market includes various supplementary parts and devices essential for the successful operation of surgical robots in medical procedures.

b. Some key players operating in the market include Intuitive Surgical; THINK Surgical, Inc.; Smith & Nephew; Medtronic; Stryker Corporation; Zimmer Biomet; Medrobotics Corporation; Asensus Surgical US, Inc. (Formerly known as TransEnterix Surgical, Inc.); Renishaw PLC

b. Surgical robot systems revolutionize surgery, driven by significant factors such as technological progress, the rising preference for minimally invasive procedures, improved outcomes, greater precision, and reduced human errors in operations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."