- Home

- »

- Medical Devices

- »

-

Surgical Navigation Systems Market Size, Share Report 2030GVR Report cover

![Surgical Navigation Systems Market Size, Share & Trends Report]()

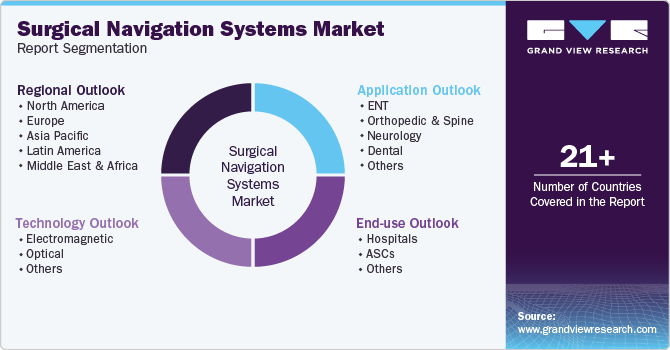

Surgical Navigation Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (ENT, Orthopedic, Neurology, Dental), By Technology (Electromagnetic, Optical), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-526-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Navigation Systems Market Summary

The global surgical navigation systems market size was estimated at USD 8.38 billion in 2024 and is projected to reach USD 18.47 billion million by 2030, growing at a CAGR of 14.00% from 2025 to 2030. The increasing demand for robot-assisted surgery, the growing need for minimally invasive surgical procedures, and the rising prevalence of target disorders are primarily expected to propel the growth.

Key Market Trends & Insights

- North America dominated the global industry and accounted for a 41.80% share in 2024.

- The U.S. surgical navigation systems market held a significant share in 2024.

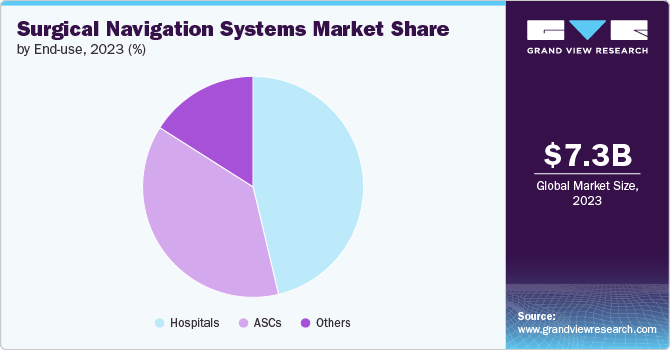

- By end use, the hospital segment dominated the market with a 46.1% share in 2024.

- By technology, the electromagnetic segment accounted for the largest market share of 40.7% in 2024.

- By application, the neurology segment accounted for the largest market share of 36.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.38 Billion

- 2030 Projected Market Size: USD 18.47 Billion

- CAGR (2025-2030): 14.00%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

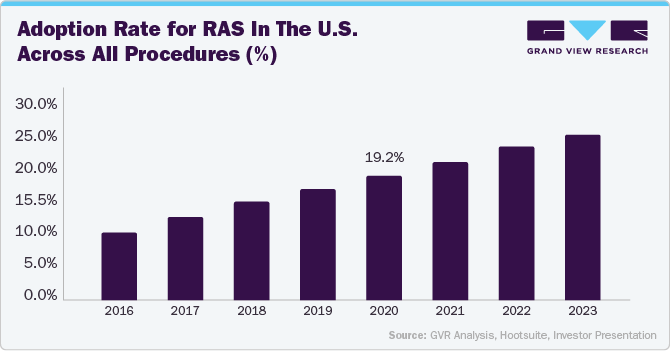

According to Intuitive Surgical's 2023 annual report, the installed base of da Vinci systems reached 8,606 units worldwide, with a substantial proportion located in key healthcare markets such as the U.S., Europe, and Asia. Moreover, an estimated 2,286,000 surgical procedures were completed using this technology in 2023 alone, highlighting the pivotal role of RAS in modern healthcare.

The adoption of minimally invasive surgeries to diagnose and treat various conditions is gaining wide acceptance globally. The introduction of image-guided systems and robotic systems for performing interventional procedures has resulted in surgeons' increased acceptance of minimally invasive surgeries. These procedures are an economical alternative to open surgeries. Moreover, healthcare budgets have slightly decreased as MIS costs are lower than open surgeries. Thus, increasing adoption of MIS aids in controlling healthcare-associated costs, thereby driving market growth.

Moreover, signs of aging, such as weakening of bones due to excessive loss of bone mass, common between 25 and 54 years of age, decreasing bone density, which becomes more prominent from 55 years & above, and the rapidly aging population is propelling the demand for orthopedic solutions globally. According to WHO's estimates published in October 2022, by 2030, one in six people worldwide will be aged 60 or above. People aged 60 and above will increase from 1 billion in 2020 to 1.4 billion in 2022. By 2050, the senior population aged 60 and above globally will double to 2.1 billion.

The growing recognition and support from government and regulatory bodies worldwide are driving the adoption of these systems. For instance, in January 2024, the National Safety Council, in collaboration with Amazon, introduced the MSD Solutions Index Pledge Community Report. This report highlights advancements in reducing musculoskeletal disorders in workplaces. Through a survey involving more than 50 prominent companies, the analysis pinpoints positive developments and areas needing improvement in preventing the most common workplace injury, which results in an annual cost of around USD 17 billion for employers. These factors are contributing to the growth of the surgical navigation systems market revenue.

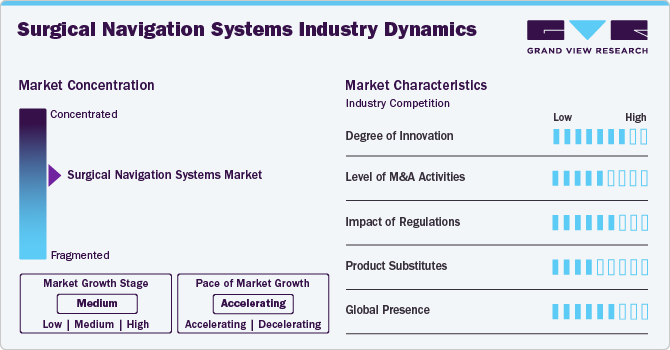

Market Concentration & Characteristics

The surgical navigation systems industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as the integration of artificial intelligence (AI) and remote monitoring. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure, the growing prevalence of chronic disorders, and the growing adoption of healthcare solutions.

The market is characterized by a high degree of innovation. Integrating Artificial Intelligence (AI) and Machine Learning (ML) in surgical navigation systems represents a significant advancement in modern medical technology. AI and ML algorithms enhance the precision and efficiency of these systems by analyzing vast amounts of data from preoperative imaging & real-time surgical data. This integration enables more accurate mapping of anatomical structures, reducing the likelihood of errors during surgery. For instance, AI-driven navigation systems can assist surgeons in planning complex procedures, predicting potential complications, and making real-time adjustments during surgery.

Regulations significantly impact the surgical navigation systems industry by ensuring patient safety, product quality, and efficacy. Companies invest substantial resources in R&D activities and regulatory submissions to obtain regulatory approval for pipeline products. For instance, in July 2023, Stryker announced the launch of its Q Guidance System, which offers cranial guidance software. It was further approved by the U.S. FDA in early 2023. This system aims to assist surgeons during cranial surgeries, such as craniotomies, skull base & transsphenoidal procedures, shunt placements, and biopsies. The software provides real-time guidance, enabling surgeons to accurately position instruments and identify patient anatomy.

Mergers and acquisitions in the industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in January 2023, Orthofix, a global medical device company working majorly on spine and orthopedics, and SeaSpine, a medical technology company focusing on surgical disorders related to the spine, announced the completion of the merger of equals. The merger catalyzes Orthofix Medical, Inc. as the leading global orthopedics and spine company.

The substitutes for surgical navigation systems are fluoroscopy, ultrasound imaging, and robotic-assisted surgery systems. The presence of these substitutes creates competition which can drive innovation and improvements in existing systems as manufacturers strive to differentiate their products and maintain a competitive edge. Additionally, product substitutes may provide cost-effective alternatives, potentially influencing healthcare providers’ purchasing decisions. However, the introduction of substitutes could also fragment the market and create challenges for standardization and interoperability between different systems.

The industry is experiencing robust global expansion. Companies are implementing various strategies, such as distribution agreements, geographic expansion, and new product development, to improve their market penetration. For instance, in February 2024, Smith+Nephew announced a deal with NAVBIT for the exclusive distribution of the NAVBIT SPRINT in Australia. This technology is a compact, single-use, and user-friendly solution that provides orthopedic surgeons with a reliable navigation system for hip arthroplasty.

Technology Insights

The electromagnetic segment accounted for the largest market share of 40.7% in 2024. Electromagnetic systems are less expensive and provide a better line of sight compared to other surgical navigation systems which drives the segment growth. Electromagnetic Navigation (EMN) is a cutting-edge technology that has revolutionized the field of minimally invasive surgery. By providing real-time guidance to surgeons, EMN enables them to perform complex procedures with enhanced precision, leading to improved patient outcomes. According to a study by National Center for Biotechnology Information (NCBI), EMN is proven to be a safe and efficient method for percutaneous pedicle screw placement. The EMN system offers advantages over robot-assisted systems, including faster guidewire placement and reduced X-ray exposure.

The optical segment is anticipated to witness the fastest growth over the forecast period. Optical technologies offer high precision and accuracy, allowing for real-time tracking of surgical instruments and providing detailed anatomical information during procedures which drive the segment growth. For instance, NDI’s Polaris optical trackers have been widely adopted in the medical field due to their high performance and reliability. They are used for various applications such as orthopedic, neuro, ENT, spinal, and CMF surgeries. The trackers use infrared light to determine the position and orientation of surgical tools, providing accurate real-time feedback to surgeons.

Application Insights

The neurology segment accounted for the largest market share of 36.6% in 2024. Substantial investments by private companies in neurology equipment, increasing R&D in the field of neurotherapy, the rising incidence of neurological illnesses, and the rapidly aging population are driving the segment growth. As per data published by the World Federation of Neurology in October 2023, neurological disorders are the second-highest cause of mortality and disability worldwide. According to a Global Burden of Disease (GBD) study, it is estimated that the number of individuals living with neurological disorders will double by 2050.

The ENT segment is anticipated to grow at the fastest CAGR over the forecast period. The rising prevalence of target disorders, such as ENT disorders, along with the increasing geriatric population is expected to propel segment growth. According to WHO, by 2050, about 2.5 billion individuals, or one in every four people, will have some degree of hearing loss. Furthermore, at least 700 million of these people are likely to require ear and hearing care, as well as other rehabilitative services, which is projected to drive the market growth.

End-use Insights

The hospital segment dominated the market with a 46.1% share in 2024. Technologically advanced medical devices are extensively used in hospitals to improve Point-of-Care. These devices simplify the treatment procedures and enable faster & more accurate results. Hospitals also provide a large array of treatment options for pain management and orthopedic procedures. Owing to these factors, the segment is expected to continue witnessing steady growth. Furthermore, ongoing technological innovations in medical devices can be attributed to the growing adoption of navigation systems over the forecast period.

The ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest rate during the forecast period. High adoption of ASCs in developed countries, shortage of hospital beds, and scarce economic resources are some of the factors expected to boost the segment growth. Advantages of daycare surgery include a shorter waiting list, quick discharge, reduced procedural cost, and higher efficiency. These factors are expected to further fuel growth.

Regional Insights

North America surgical navigation systems market dominated the global industry and accounted for a 41.80% share in 2024. Factors such as growing investment in advancing healthcare infrastructure and adopting advanced medical technologies contribute to the increasing adoption of surgical systems. For instance, in May 2022, post extensive review and collaboration with experts nationwide, the Healthcare Information and Management Systems Society, Inc. proposed an investment of approximately USD 36.7 billion over a decade to modernize state, local, territorial, and tribal public health infrastructure. This funding aims to enhance readiness for existing and emerging public health emergencies.

U.S. Surgical Navigation Systems Market Trends

The U.S. surgical navigation systems market held a significant share in 2024. The growth is attributed to the rising prevalence of osteoarthritis, osteoporosis, ENT issues, and neurological conditions. The increasing geriatric population in developed economies, such as the U.S. and Canada, is expected to propel the market. Furthermore, technological advancements in surgical navigation systems contribute to market growth. Incorporating artificial intelligence, machine learning, robotics, and real-time imaging technologies has greatly enhanced the precision and efficiency of surgeries. These technological improvements have minimized the risk of surgical complications and led to better patient outcomes. Thus, surgeons and healthcare facilities tend to adopt surgical navigation systems quickly, boosting market growth.

Europe Surgical Navigation Systems Market Trends

The surgical navigation systems market in Europe is witnessing growth fueled by greater healthcare spending and a growing older population with a higher incidence of bone injuries and obesity. Moreover, Europe has facilitated the integration of advanced surgical navigation systems in hospitals and clinics. In addition, the growing prevalence of chronic diseases and the rapidly aging population have necessitated more complex and specialized surgical procedures, fueling the demand for advanced navigation systems.

The UK surgical navigation systems market is one of the major markets in the European region. The growth is attributed to the increasing number of regulatory approvals; growing adoption of minimally invasive surgical procedures; agreements, partnerships, & collaborations among market players; rising incidence of neurological and orthopedic disorders; and high prevalence of ENT disorders. For instance, according to Brain Research UK, around 11 million people live with a neurological condition in the country. One in six UK individuals has a neurological condition. Thus, all the factors contribute to the growth of the market.

The surgical navigation systems market in Germany is projected to expand during the forecast period. The rising number of robot-assisted surgeries nationwide is expected to drive the demand for surgical navigation systems. According to NLM’s July 2023 article, the utilization of robot-assisted systems in general surgery has grown in recent years, with Germany showcasing a rapid increase in installations. In 2018, approximately 100 robot-assisted systems were in operation in German hospitals, and by 2022, this number had surged to over 200.

Asia Pacific Surgical Navigation Systems Market Trends

The Asia Pacific surgical navigation systems market is expected to grow at the fastest CAGR from 2025 to 203. This growth can be attributed to an increasing aging population, growing healthcare awareness, and rapidly developing economies. The geriatric population is more susceptible to orthopedic disorders, presenting a large target population in the region, with Japan, China, and India being the major regional contributors. In addition, high-untapped opportunities, rising interest of companies in expanding their presence in this region, and continuous R&D activities by key market players for better innovative products are expected to fuel the market. For instance, in June 2023, Zeta Surgical successfully treated the first patient using its cranial navigation system in a pioneering human trial at the National Neuroscience Institute (NNI), Singapore.

China surgical navigation systems market is expected to grow at the fastest rate. The increasing demand for advanced surgical navigation systems for minimally invasive surgery encourages manufacturers to develop technologically advanced surgical navigation systems. Furthermore, favorable government initiatives and strategies propel market growth. For instance, according to the country’s National Healthcare Security Administration, China’s healthcare security system provided medical assistance to 250 million patients in 2023. Moreover, China’s medical assistance funds increased from USD 0.18 billion in 2005 to USD 10.2 billion in 2023. Thus, the rise in such programs can fuel market growth.

The India surgical navigation systems market holds a significant share of the Asia Pacific regional market revenue. The growing geriatric population and the rising prevalence of diseases, such as osteoarthritis and diabetes, are expected to drive the surgical navigation systems market in India. In addition, increasing road accidents are expected to drive the market during the forecast period. For instance, according to an article published by the International Journal of Health Sciences and Research in October 2023, India experiences a significantly higher rate of proliferative osteoarthritis on a global scale, with the occurrence of knee osteoarthritis in the country ranging between 22% and 39%.

Lating America Surgical Navigation Systems Market Trends

The surgical navigation systems market in Latin America is experiencing significant growth due to the presence of a large pool of healthcare human resources and tech entrepreneurs in the region. In addition, the use of immersive Augmented Reality (AR) in surgical navigation is a significant development in medical technology. According to a PR Newswire article published in November 2023, the first cranial surgery in Latin America was conducted using immersive AR surgical navigation, which signifies a major advancement in medical technology adoption in the region.

MEA Surgical Navigation Systems Market Trends

The surgical navigation systems market in the Middle East Africa is expected to witness significant growth over the forecast period. The growing adoption of advanced medical technologies is increasing awareness about the benefits of AR-based surgical navigation systems. This is expected to boost the demand for such advanced solutions in the region as healthcare providers seek to improve patient outcomes and surgical efficiency. For instance, in January 2022, an Omani hospital became the first in the Middle East and North Africa to adopt the ClarifEye AR spinal surgical navigation system. This development highlights the increasing acceptance and integration of cutting-edge navigation systems in healthcare.

Saudi Arabia surgical navigation systems market is anticipated to expand during the forecast period due to increasing awareness, knowledge, and training facilities provided. For instance, Surgical Navigation Technologies (SNT) provides crucial information driving the expansion of the surgical navigation systems market by educating healthcare professionals and institutions about the latest advancements & benefits. By highlighting its products’ precision, efficiency, and potential for improving surgical outcomes, SNT fosters confidence among surgeons & hospital administrators. Ultimately, by showcasing real-world applications and success stories, SNT’s website plays a pivotal role in driving adoption and growth within the surgical navigation systems market.

Key Surgical Navigation Systems Company Insights

The global market is highly competitive. Key companies deploy strategic initiatives, such as product development, launches, and sales & marketing strategies, to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key Surgical Navigation Systems Companies:

The following are the leading companies in the surgical navigation systems market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Corin Group

- Amplitude Surgical

- Siemens Healthineers AG

- DePuy Synthes

- KARL STORZ SE & CO.KG

- B. Braun Melsungen AG

- Zimmer Biomet

- Smith+Nephew

- Stryker

Recent Developments

-

In June 2024, KARL STORZ Endoscopy-America, Inc., a branch of KARL STORZ SE & Co. KG, agreed to merge with Asensus Surgical, Inc. This merger would create a leading surgical robotics division within KARL STORZ.

-

In April 2024, Medtronic introduced its NeuroSmartTM Portable Micro Electrode Recording (MER) Navigation system in India for the treatment of Parkinson’s disease using DBS.

-

In July 2023, Stryker introduced the Q Guidance System along with Cranial Guidance Software to give surgeons an image-based planning and intraoperative guidance system. This system helps surgeons position instruments and identify patient anatomy during cranial surgery.

Surgical Navigation Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.59 billion

Revenue forecast in 2030

USD 18.47 billion

Growth Rate

CAGR of 14.00% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico; UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Stryker; Medtronic; Corin Group; Amplitude Surgical; Siemens Healthineers AG; DePuy Synthes; KARL STORZ SE & CO.KG; B. Braun Melsungen AG; Zimmer Biomet; Smith+Nephew

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Navigation Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical navigation systems market report on the basis of technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electromagnetic

-

Optical

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ENT

-

Orthopedic and Spine

-

Neurology

-

Dental

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

ASCs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the surgical navigation systems market include Fiagon GmbH, B. Braun Melsungen AG, Medtronic, Stryker, OMNI, Brainlab AG, Siemens Healthineers, CAScination AG, Scopis GmbH, DePuy Synthes, and Zimmer Biomet.

b. Key factors that are driving the surgical navigation systems market growth include the rising demand for minimally invasive surgeries coupled with the increasing prevalence of target disorders such as osteoarthritis, brain cancer, and ENT disorders.

b. The global surgical navigation systems market size was estimated at USD 8.38 billion in 2024 and is expected to reach USD 9.59 billion in 2025.

b. The global surgical navigation systems market is expected to grow at a compound annual growth rate of 14.00% from 2025 to 2030 to reach USD 18.47 billion by 2030.

b. North America dominated the surgical navigation systems market with a share of 41.8% in 2024. This is attributable to the rising prevalence of orthopedic, ENT, and neurological disorders in this region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.