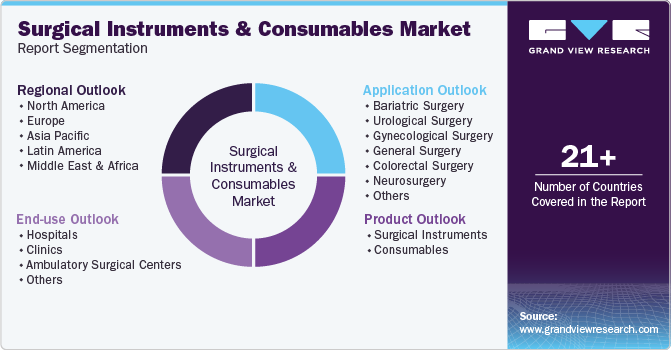

Surgical Instruments And Consumables Market Size, Share & Trends Analysis Report By Product (Surgical Instruments, Consumables), By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-471-7

- Number of Report Pages: 230

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

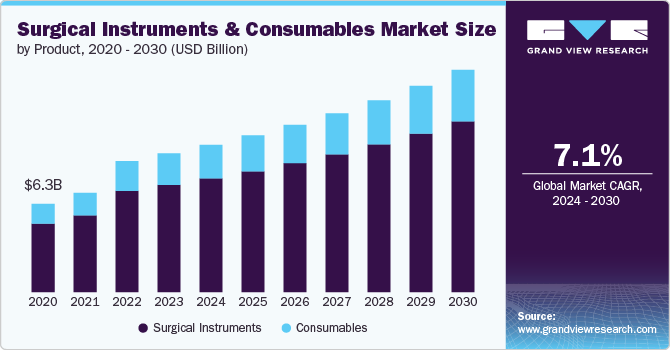

The global surgical instruments and consumables market size was estimated at USD 6.73 billion in 2023 and is projected to grow at a CAGR of 7.11% from 2024 to 2030. An increase in the number of surgical procedures, including minimally invasive surgeries, drives demand for various surgical instruments and consumables. Continuous innovations in surgical technologies, such as robotic-assisted surgeries and enhanced imaging techniques, boost the need for advanced surgical instruments. Increasing investment in healthcare infrastructure and rising health expenditure in emerging economies support the growth of the surgical instruments market. Additionally, a growing elderly population, which often requires more surgical interventions, significantly contributes to market expansion.

The growing number of surgical procedures is a key driver of the surgical instruments and consumables market. With advancements in medical technology and improved healthcare infrastructure, surgical interventions have become more accessible and safer. This has resulted in an increase in both elective surgeries, such as cosmetic and orthopedic procedures, and necessary surgeries, including those related to cardiovascular and cancer treatments. For example, McLeod Health reported that in 2022, a total of 18,577,953 orthopedic procedures were conducted in the U.S.

Additionally, the rising prevalence of chronic diseases and conditions that require surgical intervention, such as diabetes and obesity, is contributing to the global increase in surgeries. In Canada, knee and hip replacement procedures have seen a noticeable rise in recent years. Factors such as fractures, osteoarthritis, osteoporosis, and an aging population are driving this trend. According to the Canadian Institute for Health Information (CIHI), approximately 55,300 hip and knee replacement surgeries were performed by hospitals in Canada during the 2020-2021 period.

There is an increasing emphasis on patient safety and high-quality care in the healthcare industry. This focus encourages the adoption of advanced surgical instruments that are designed to enhance safety, reduce complications, and improve patient outcomes. Instruments that offer better ergonomics, precision, and reliability are increasingly favored, driving market growth.

The trend toward single-use surgical instruments has gained momentum due to concerns over infection control and sterilization challenges. Disposable instruments help minimize the risk of cross-contamination and are often more cost-effective for healthcare facilities. This shift drives demand for a variety of disposable surgical consumables, contributing to market expansion.

Various global health initiatives and funding programs aimed at improving healthcare access, particularly in developing countries, enhance the availability of surgical services. These initiatives often include investments in surgical infrastructure and equipment, increasing the need for surgical instruments and consumables in underserved regions.

There has been a notable shift towards outpatient surgeries, where patients can undergo procedures and return home the same day. This trend reduces the burden on hospitals and emphasizes the need for efficient, effective surgical instruments that facilitate quicker recovery times. The increasing popularity of outpatient procedures contributes to the growing market for surgical consumables designed for these settings.

The rise of e-commerce platforms has transformed the procurement process for surgical instruments and consumables. Healthcare providers can now easily access a broader range of products online, enhancing their purchasing options and reducing costs. Digital tools, including supply chain management software, further streamline operations, making it easier for hospitals and clinics to manage their surgical inventories effectively.

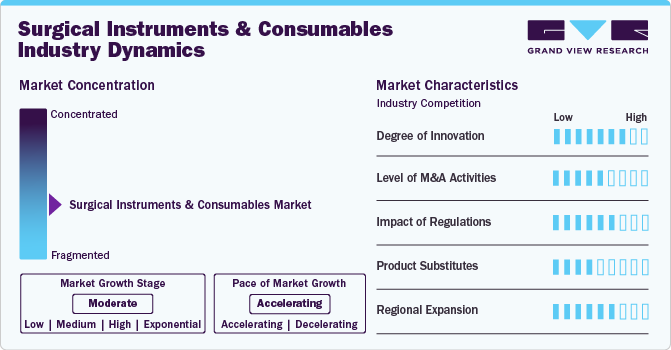

Market Concentration & Characteristics

The surgical instruments and consumables market is characterized by moderate to high concentration, with a few key players dominating the landscape. Major companies include Medtronic, Johnson & Johnson, Stryker Corporation, and B. Braun Melsungen AG, holding a significant market share. The market requires substantial investment in research and development, regulatory compliance, and quality assurance. New entrants often struggle to compete with established brands that have established trust and recognition.

The degree of innovation in the surgical instruments and consumables market is substantial, driven by the need for improved surgical outcomes, enhanced safety, and cost-effectiveness. As technology continues to evolve, the industry is poised for ongoing advancements that will further transform surgical practices and enhance patient care. This dynamic environment encourages continuous research and development, making innovation a cornerstone of the market. For instance, in September 2024, Alesi Surgical, a UK-based company specializing in smoke management technology for surgical tools, has raised USD 5.58 million in a funding round led by Mercia Ventures, joined by existing investors IP Group and Panakès Partners. This latest funding increases the total raised to over USD 23.44 million. Alesi has also received FDA clearance for the IonPencil, the first surgical tool to feature its technology, which is applicable in about 80% of all surgical procedures.

Regulatory bodies, such as the FDA in the U.S. and the EMA in Europe, set strict guidelines to ensure that surgical instruments and consumables are safe and effective for use. Compliance with these standards is essential for market entry, often requiring extensive testing and clinical trials. While regulations can enhance patient safety, they may also hinder innovation. Stringent requirements can lead to increased development costs and longer timelines, which may discourage smaller companies from pursuing new technologies.

As companies seek to enhance their market share and competitiveness, consolidation is common. Larger firms often acquire smaller companies with innovative technologies or niche products to expand their product portfolios and reach. With rapid advancements in surgical technologies, companies are acquiring firms with cutting-edge innovations. This allows them to stay ahead of the competition and quickly integrate new solutions into their offerings. For instance, in September 2024, Medline Industries announced the acquisition of Ecolab Inc.'s surgical solutions business. This move aims to expand Medline's infection prevention and surgical product offerings. The acquisition was expected to enhance Medline's capabilities in serving healthcare providers with comprehensive surgical solutions.

The surgical instruments and consumables market faces competition from several substitutes that enhance patient outcomes and reduce invasiveness. Minimally invasive techniques, such as laparoscopic and endoscopic tools, provide alternatives to traditional open surgery, while robotic-assisted systems such as da Vinci Surgical System offer precision in complex procedures.

The surgical instruments and consumables market is experiencing significant regional expansion. In North America, high surgical volumes and a robust healthcare infrastructure drive growth, while Europe benefits from an aging population and increased healthcare investments. The Asia-Pacific region, particularly China and India, is seeing rapid growth due to economic development and rising chronic diseases. Meanwhile, Latin America and the Middle East are emerging markets, bolstered by improved healthcare standards and a growing medical tourism industry. This expansion reflects a global trend of increasing healthcare investments and rising demand for surgical interventions.

Product Insights

The surgical instruments segment accounted for the largest market share of 77.3% in 2023. The surgical instruments segment is driven by technological advancements in design and materials. Surtex Instruments recently launched the “Infinex” series at MEDICA 2023, enhancing precision in microsurgery with features like diamond-dusted jaws and precision micro scissors. As hospitals adopt these advanced tools, demand for high-quality surgical instruments is expected to rise, boosting segment growth.

The consumables segment is expected to witness the fastest growth during the forecast period. This segment is set for growth as infection control and patient safety become priorities in surgical settings. Stricter hygiene regulations are driving demand for high-quality sterilization containers, which ensure safe storage and transport of surgical instruments. Innovations in materials enhance their effectiveness, leading to increased adoption in hospitals. Regulatory frameworks further reinforce the need for reliable consumables that meet safety standards.

Application Insights

The general surgery segment accounted for the largest market share of 32.7% in 2023. General surgery, encompassing procedures like abdominal surgeries and hernia repairs, is a crucial segment of the surgical instruments and consumables market, requiring specialized tools such as scalpels and forceps. Technological advancements are reshaping this field, particularly in minimally invasive techniques and robotic-assisted surgeries. For instance, in November 2023, Johnson & Johnson MedTech announced plans to seek FDA approval for its OTTAVA robotic surgical system, aimed at optimizing operating room workflows and enhancing surgical performance. This trend underscores the increasing adoption of advanced robotics in general surgery, improving patient outcomes.

The bariatric surgery segment shows the fastest CAGR over the forecast period. Bariatric surgery, aimed at weight loss for those with severe obesity, is expected to grow rapidly due to rising global obesity rates. The World Obesity Federation reports over one billion people live with obesity, increasing the demand for specialized surgical tools. Recent advancements, such as CAMC's first robotic bariatric surgery in July 2024, highlight the integration of robotics for better precision and outcomes. Additionally, growing awareness of obesity-related health risks is enhancing insurance coverage for these procedures, driving manufacturers to create ergonomically designed instruments for bariatric surgeons.

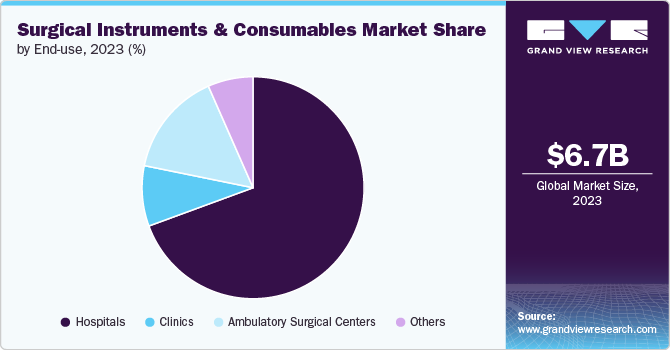

End-use Insights

The hospitals segment accounted for the largest revenue share of 69.4% in 2023. The segment is experiencing growth due to a rise in both cases and preventive surgeries. According to the CDC, there were approximately 125.7 million outpatient visits in the U.S. With an increase in surgical procedures like angioplasties and kidney and liver transplants, as well as trauma incidents, the demand for surgical equipment in hospitals has surged. Contributing factors include an aging population, unhealthy lifestyles, and habits such as smoking and alcohol use, leading to a higher prevalence of noncommunicable diseases like cancer, diabetes, and cardiovascular issues. The National Diabetes Statistics Report for 2022 estimates that around 37.3 million people in the U.S. are diabetic.

The ambulatory surgical centers segment shows the fastest CAGR over the forecast period. The segment is projected to grow significantly due to increasing preferences for same-day surgeries, cost savings, and reduced waiting times. These centers facilitate minimally invasive procedures and benefit from better reimbursement policies than hospitals. The number of active ambulatory surgical centers is also rising; as of 2024, there are approximately 9,600 in the U.S. This growth allows for a higher volume of surgeries in a shorter timeframe, further driving market expansion.

Regional Insights

North America surgical instruments and consumables market dominated the overall global market and accounted for the 40.1% revenue share in 2023. The North America market is growing rapidly due to technological advancements, an aging population, and the rising prevalence of chronic diseases. A robust healthcare infrastructure and strict regulatory standards further boost demand for high-quality products. Additionally, increased investment in research and development drives innovation, making North America a leader in this sector.

U.S. Surgical Instruments And Consumables Market Trends

The surgical instruments and consumables market in the U.S. is growing rapidly, driven by technological innovations, an aging population, and increasing chronic diseases. The demand for minimally invasive procedures and favorable reimbursement policies further boost market expansion. Ongoing R&D investments keep the U.S. at the forefront of surgical innovation.

Europe Surgical Instruments And Consumables Market Trends

Surgical instruments and consumables market in Europe is experiencing steady growth, fueled by advancements in medical technology and a rising emphasis on patient safety and infection control. The increasing prevalence of chronic diseases and a growing elderly population are driving demand for surgical procedures. Additionally, supportive regulatory frameworks and improved healthcare infrastructure contribute to market expansion, with a notable shift towards minimally invasive surgeries enhancing efficiency and patient outcomes.

The UK surgical instruments and consumables market is poised for growth, driven by advancements in surgical technologies and an increasing focus on patient safety. Rising rates of chronic diseases and an aging population are fueling demand for surgical procedures. The market also benefits from government investments in healthcare infrastructure and initiatives promoting minimally invasive techniques. Furthermore, regulatory support and innovations in sterilization and infection control are enhancing the adoption rate of surgical instruments and consumables across hospitals and surgical centers.

The surgical instruments and consumables market in France is growing steadily, driven by technological advancements and an aging population. Increasing chronic disease prevalence boosts demand for surgeries, while government investments in healthcare enhance facilities. Emphasis on infection control and regulatory compliance further promotes the adoption of high-quality surgical tools, particularly in specialized and ambulatory settings.

Germany surgical instruments and consumables market is growing steadily, fueled by a strong healthcare system and an increase in surgical procedures. The focus on innovation, especially in minimally invasive techniques, drives demand for advanced instruments. An aging population and rising chronic disease prevalence also contribute to higher surgical needs, while stringent regulatory standards enhance the adoption of quality consumables.

Asia Pacific Surgical Instruments And Consumables Market Trends

The Asia Pacific surgical instruments and consumables market is growing rapidly due to rising healthcare spending, a larger population, and increased chronic disease prevalence. Countries such as China and India are enhancing healthcare infrastructure, driving demand for minimally invasive surgeries and high-quality consumables. Improved regulatory frameworks and infection control awareness further support market expansion, positioning the region for significant growth.

Japan surgical instruments and consumables market is characterized by advanced technology adoption and a focus on precision in surgical procedures. With an aging population and rising healthcare demands, the market is expanding, particularly in minimally invasive surgeries. Government initiatives to improve healthcare access and efficiency are also driving growth. Furthermore, the emphasis on infection control and quality standards bolsters demand for high-quality surgical consumables, positioning Japan as a key player in the region.

Surgical instruments and consumables market in China is rapidly growing due to a rising population, increased healthcare spending, and advancements in technology. The demand is driven by the prevalence of chronic diseases, a shift toward minimally invasive surgeries, and government initiatives to improve healthcare infrastructure. As hospitals focus on infection control, the need for high-quality consumables is also increasing and solidifying China's role in the global surgical market.

India surgical instruments and consumables market is growing significantly due to rising healthcare investments, a growing population, and an increase in surgical procedures. The demand for both traditional and minimally invasive tools is fueled by chronic disease prevalence and improved healthcare infrastructure. Government initiatives and rising disposable incomes are enhancing access to surgical services, making the market increasingly competitive.

Latin America Surgical Instruments And Consumables Trends

Surgical instruments and consumables market in Latin America is growing due to increased healthcare investments and rising surgical procedures. While economic fluctuations and regulatory challenges exist, improvements in healthcare infrastructure and access to surgical services are expected to drive further growth.

The surgical instruments and consumables market in Saudi Arabia is experiencing growth driven by increased healthcare expenditure and a rising number of surgical procedures. The government's focus on enhancing healthcare infrastructure, coupled with a growing demand for advanced medical technologies, is boosting market prospects. Additionally, the trend towards minimally invasive surgeries is leading to greater adoption of specialized instruments and consumables in the region.

Key Surgical Instruments And Consumables Company Insights

The surgical instruments and consumables market is highly competitive, featuring key players like Stryker, Inc., Medtronic, and Olympus. These companies are actively pursuing a range of strategies, both organic and inorganic, including new product development, collaborations, acquisitions, mergers, and regional expansion to address their customers' unmet needs. Notable participants in this market include:

Key Surgical Instruments And Consumables Companies:

The following are the leading companies in the surgical instruments and consumables market. These companies collectively hold the largest market share and dictate industry trends.

- Integra Lifesciences Corporation

- B.Braun Melsungen AG

- Medtronic, plc.

- Johnson & Johnson Services, Inc.

- STERIS

- Richard Wolf GmbH

- Stryker

- Aspen Surgical

- Karl Storz Se & Co. Kg

- KLS Martin Group

- Medline Industries

Recent Developments

-

In March 2024, Steris introduced VeraFit Sterilization Bags and Covers to support compliance with the updated EU GMP Annex 1 guidelines. These new products are designed to maintain sterility during transportation and storage, helping pharmaceutical manufacturers meet the stringent requirements for cleanroom environments and sterile product handling.

-

In February 2024, Stryker’s Project C initiative delivers medical equipment to regions in need, focusing on underserved communities. This effort aims to enhance global healthcare access through strategic partnerships and efficient distribution networks.

-

In March 2022, B. Braun Melsungen AG launched the Aesculap Aicon Sterile Container System in the U.S. This new sterilization solution emphasizes modularity, enhanced performance, and a redesigned base and lid. The system aimed to ensure consistent and reliable sterilization processes, reflecting B.Braun's ongoing commitment to innovation in surgical instrument sterilization

Global Surgical Instruments And Consumables Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.14 billion |

|

Revenue forecast in 2030 |

USD 10.78 billion |

|

Growth rate |

CAGR of 7.1% from 2024 to 2030 |

|

Actual Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Integra Lifesciences Corporation; B.Braun Melsungen AG; Medtronic, plc.; Johnson & Johnson Services, Inc.; STERIS; Richard Wolf GmbH; Stryker; Aspen Surgical; Karl Storz Se & Co. Kg; KLS Martin Group; Medline Industries; |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surgical Instruments And Consumables Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical instruments and consumables market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Instruments

-

Open/General Instruments

-

Forceps

-

Retractors

-

Dilators

-

Graspers

-

Scalpels

-

Cannulas

-

Dermatomes

-

Kerrison Rongeurs

-

Others

-

-

Laparoscopic Instruments

-

Laparoscopic Needle Holders

-

Laparoscopic Scissors

-

Laparoscopic Graspers

-

Laparoscopic Forceps

-

Laparoscopic Dissectors

-

Laparoscopic Retractors

-

Laparoscopic Trocars

-

Others

-

-

-

Consumables

-

Sterilization Containers

-

Perforated

-

Non-Perforated

-

-

Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bariatric Surgery

-

Urological Surgery

-

Gynecological Surgery

-

General Surgery

-

Colorectal Surgery

-

Neurosurgery

-

Plastic Surgery

-

Cardiac Surgery

-

Other Surgeries

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical instruments and consumables market size was estimated at USD 6.73 billion in 2023 and is expected to reach USD 7.14 billion in 2024.

b. The global surgical instruments and consumables market is expected to grow at a compound annual growth rate of 7.11% from 2024 to 2030 to reach USD 10.78 billion by 2030.

b. North America dominated the surgical instruments and consumables market with a share of 40.1% in 2023.

b. Some of the key players operating in the surgical instruments and consumables market includeSteris, Johnson & Johnson Services, Inc.,, Integra Lifesciences Corporation, B. Braun Melsungen AG, Medtronic, plc., Stryker, Olympus Corporation, Karl Storz Se & Co. Kg, KLS Martin Group, Medline Industries

b. Key factors that are driving the surgical instruments and consumables market growth include the increase in the number of surgical procedures, including minimally invasive surgeries, drives demand for a variety of surgical instruments and consumables

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."