- Home

- »

- Medical Devices

- »

-

Surgical Imaging Market Size, Share & Trends Report, 2030GVR Report cover

![Surgical Imaging Market Size, Share & Trends Report]()

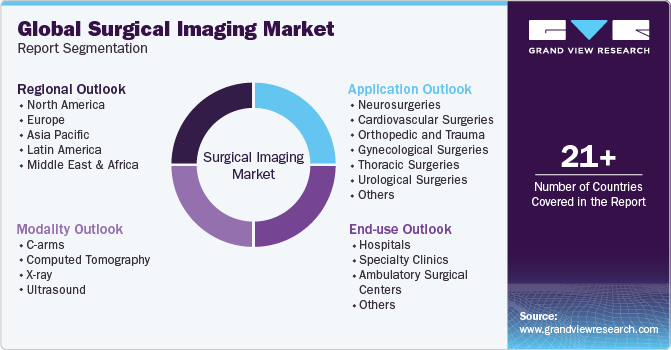

Surgical Imaging Market Size, Share & Trends Analysis Report By Modality (C-arms, CT, X-ray, Ultrasound), By Application (Neurosurgery, Cardiovascular, Orthopedic & Trauma, Gynecological, And Thoracic Surgeries), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-023-1

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2025

- Industry: Healthcare

Surgical Imaging Market Size & Trends

The global surgical imaging market size was estimated at USD 5.1 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The increasing prevalence of chronic diseases, growing geriatric population, and rising awareness regarding radiography procedures are the key factors responsible for market growth. In addition, technological developments are likely to drive the market over the projection period.

The increasing prevalence of age-related conditions requiring surgical interventions has significantly expanded the demand for surgical imaging technologies. These conditions include cardiovascular diseases, cancer, orthopedic disorders, and neurological ailments. The aging population is a major challenge across all the countries in the world. The World Health Organization (WHO) projects that by 2050, 80% of older people are expected to be resided in low- and middle-income nations. The rate of population aging is much faster than in the past. Research from the National Council on Aging (NCOA) indicates that almost 95% of individuals aged 60 and above suffer from at least one chronic illness, and close to 80% are dealing with two or more chronic conditions.

Moreover, advancements in surgical imaging technologies such as real-time imaging, 3D visualization, and image-guided surgery have enhanced surgical outcomes by providing surgeons with precise navigation, improved visualization, and better decision-making capabilities. This has led to a widespread adoption of these technologies across various medical specialties, further driving market growth. For instance, in June 2023, GE Healthcare's OEC 3D Imaging System improved surgical imaging accuracy and effectiveness, especially in spine procedures. This portable CBCT imaging solution effortlessly allows intraoperative 2D and 3D volumes of high-definition imaging across a broad anatomical field.

The shift towards minimally invasive surgeries (MIS) has also fueled the demand for surgical imaging systems. MIS techniques offer several benefits including reduced post-operative complications, shorter hospital stays, and faster recovery times, all of which contribute to increased patient satisfaction and healthcare cost savings. According to Joseph Spine Institute in July 2023, the MaxView 4K Video Imaging Platform enhances visualization during minimally invasive spine surgery by providing surgeons with a clear, magnified view of the surgical field on a head-up monitor display, improving the operative experience and efficiency. It comprises a single-use, retractor-based 4K camera and a reusable 4K Image Control Box (ICB), offering a cost-effective solution without significant capital investment.

Furthermore, rising healthcare expenditure, particularly in developed regions, and expanding healthcare infrastructure in emerging economies have facilitated the adoption of advanced surgical imaging technologies.

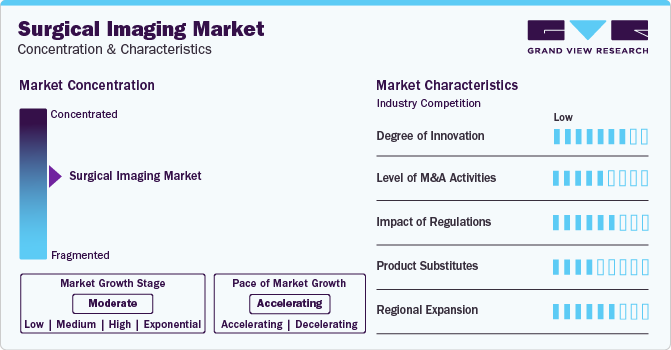

Market Concentration & Characteristics

The surgical imaging industry is accelerating at a moderate growth rate. Characteristics include rapid technological advancements, such as real-time imaging and 3D visualization, enhancing surgical precision and outcomes. The industry is driven by increasing demand for minimally invasive procedures, particularly in developed regions. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing prevalence of chronic diseases requiring surgical interventions.

The surgical imaging industry is characterized by a high degree of innovation, with companies consistently developing products that enhance efficiency and safety. For instance, in February 2024, MIT engineers developed a small ultrasound adhesive that can evaluate the firmness of internal organs when applied to the skin, offering potential insights into conditions such as liver and kidney failure and the progression of solid tumors.

Regulations significantly impact the surgical imaging industry by ensuring patient safety, product quality, and efficacy. Compliance with regulatory standards, such as FDA approval in the U.S. and CE marking in Europe, is essential for market entry and commercial success. Regulatory requirements drive innovation and product development, encouraging companies to meet stringent safety and performance criteria.

Mergers and acquisitions in the surgical imaging industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in July 2022, Canon Medical Systems USA, Inc., a branch of Canon Medical Systems Corporation, has finalized the purchase of NXC Imaging, a company based in Minneapolis, Minnesota, specializing in medical devices and services.

Direct substitutes can be challenging to find, considering the specialized nature of surgical imaging equipment. However, alternatives often depend on the specific needs of the procedure and the part of the body being treated. Endoscopy, intraoperative ultrasound, fluoroscopy, optical coherence tomography (OCT), and portable or handheld imaging devices can be used as an alternative. Factors such as cost, accessibility, and patient preference influence their selection. However, while these alternatives provide valuable diagnostic information, they may not always match the detail of surgical imaging, affecting treatment decisions.

The surgical imaging industry is experiencing robust global expansion due to as increasing healthcare expenditure, technological advancements, and growing demand for diagnostic services. For instance, in December 2022, Fujifilm Healthcare Americas Corporation, a global provider of enterprise and diagnostic imaging solutions announced that it will present its latest medical technology developments and range of medical imaging solutions, at the 2022 Radiological Society of North America (RSNA) annual meeting.

Modality Insights

The c-arm surgical imaging segment accounted for the largest market share of 42.5% in 2023. These mobile fluoroscopy units provide real-time imaging during surgeries, offering surgeons enhanced visualization and guidance, leading to improved patient outcomes. The increasing prevalence of minimally invasive procedures, coupled with technological advancements such as flat-panel detectors and 3D imaging capabilities, has further fueled the adoption of C-arm systems across different specialties, including orthopedics, cardiology, and trauma surgery. Developing portable and compact C-arm systems has also increased their accessibility in ambulatory surgical centers and smaller healthcare facilities. For instance, in February 2024, Royal Philips unveiled the introduction of their Zenition 90 Motorized mobile C-arm system for image-guided therapy, aimed at enabling surgeons to provide superior care to a broader patient population, during the European Congress of Radiology (ECR) annual meeting.

The X-ray segment shows the fastest CAGR over the forecast period. A portable digital X-ray machine is equipped with high-tech features, which allows technologists to obtain high-quality images quickly. The laser scanner of the imaging device does not use a film and rather consists of cassettes & phosphor plates. Moreover, technologists can also enhance the image quality in the workstation, which is connected over the portable unit. In addition, portable X-ray units take less than 20 minutes to show results, which can be accessed in real-time.

End-use Insights

The hospitals segment accounted for the largest revenue share of 39.2% in 2023. The growing population of patients afflicted with various disorders, including ischemic and hemorrhagic stroke, brain aneurysm, traumatic brain injury, arteriovenous malformation, cataracts, and cancer, is expected to drive the expansion of this segment. For instance, according to the World Stroke Organization, approximately one in four individuals aged 25 and above is projected to suffer from a stroke during their lifetime.

Annually, it is estimated that 13.7 million individuals will experience their initial stroke, with 5.5 million resulting in mortality. Without appropriate intervention, this annual mortality figure is forecasted to rise to 6.7 million. Additionally, the escalating number of hospital admissions further supports the surgical imaging market. Consequently, the subsequent rise in global patient numbers, coupled with the introduction of advanced technological products, is generating substantial demand for hospital treatments.

The ambulatory surgical centers segment is expected to showcase the fastest CAGR over the forecast period. Advancements in portable and cost-effective imaging technologies are facilitating the expansion of imaging services within ASCs, catering to the rising demand for minimally invasive surgeries in these facilities. This factor is anticipated to bode well for the growth of the segment.

Application Insights

The orthopedic and trauma segment accounted for the largest market share of 25.7% in 2023. Orthopedic imaging techniques such as X-rays, CT scans, and MRI play a vital role in diagnosing fractures, joint injuries, and degenerative conditions, facilitating precise treatment planning and monitoring. According to the American Association for the Surgery of Trauma, in the U.S., injury accounts for more than 150,000 deaths and around 3 million non-fatal injuries every year, whereas trauma is responsible for over 5 million deaths each year globally, while many more are injured.

Additionally, key players are involved in the continuous development of novel products to enhance market penetration. For instance, in January 2024, Orthofix Medical Inc. collaborated with MRI guidance to provide its BoneMRI imaging software in the U.S. They've completed eight cases using this software with the 7D's FLASH Navigation System, which utilizes visible light to quickly create 3D surgical guidance images. This system is unique for its camera-based technology and machine-vision algorithms, improving spinal procedures' speed and effectiveness.

The cardiovascular surgeries segment is expected to showcase the fastest CAGR over the forecast period. An increase in cardiovascular conditions, such as cardiac arrest, coupled with rising cardiovascular surgical cases, is projected to boost segment growth. As per the American Heart Association, it is estimated that approximately 23.6 million people in the world will die of cardiovascular disorder by 2030. This is expected to boost the demand for cardiovascular surgeries worldwide, which indirectly boosts the demand for surgical imaging equipment such as CT, ultrasound, or C-arm.

Regional Insights

North America dominated the overall global market and accounted for a 34.1% revenue share in 2023. This can be attributed to various factors, such as increased adoption of surgical imaging technology in primary care settings, improved accessibility, and the presence of high healthcare spending in countries with efficient reimbursement policies. The increasing incidence of chronic diseases in this region, including breast cancer, cardiovascular disorders, and neurological diseases, has created a high demand for imaging analysis. The region is expected to maintain its dominance over the forecast period. Technological innovations and the growing incidence of chronic conditions are anticipated to further propel the market growth in the region.

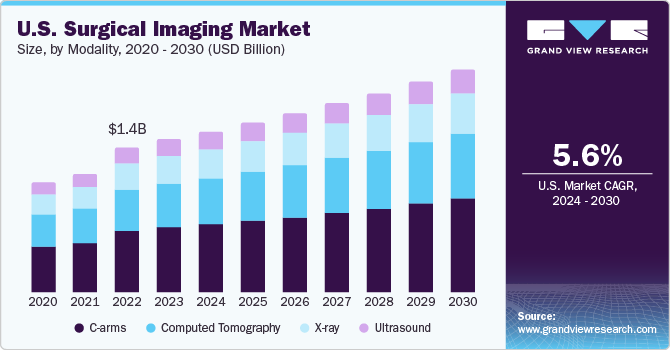

U.S. Surgical Imaging Market Trends

The surgical imaging market in the U.S. held a significant share of North America in 2023, driven by factors such as advancing technologies, changing patient care strategies, and evolving epidemiological patterns. In the U.S., the number of ultrasound unit installations has significantly increased over the years. For instance, in October 2020, GE Healthcare collaborated with St. Luke's University Health Network to install 76 ultrasound systems as part of an AI-powered technology fleet, making it GE Healthcare's largest single-order ultrasound contract in the country worth USD 11 million.

Europe Surgical Imaging Market Trends

The surgical imaging market in Europe is witnessing growth fueled by increased investments in research and development from the public and private sectors. Moreover, the escalating demand for healthcare equipment and the prevalence of chronic and pain-related conditions in the region are key drivers expected to further boost market expansion.

The surgical imaging market in the UK is one of the major markets in the region. The UK has several small and medium sized companies that significantly contribute to the economy. The turnover from these companies is valued at about 99.5% of all businesses currently operating in the UK. The country has a reputation for quality applications, and thus, in-house manufactured devices are anticipated to witness significant demand in the coming years.

The France surgical imaging market is expected to grow over the forecast period. The French government is undertaking initiatives to improve the healthcare structure in France. The French Commonwealth Fund helps hospitals in France add staff & improve their services. This can create a greater demand for surgical imaging in France. The government recently promised a fund of EUR 1.5 billion (~USD 1.62 billion) over 3 years for staffing services, which is expected to improve the country’s healthcare industry.

The surgical imaging market in Germany is projected to expand in the forecast period owing to a rapidly aging population, growing prevalence of chronic diseases, presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. Germany has a lucrative environment for technologically innovative startups. Around 80% of the surgical device manufacturers, including companies of surgical imaging devices in the country are SMEs. The presence of major market players, such as Siemens Healthcare GmbH, is anticipated to create lucrative opportunities in Germany.

Asia Pacific Surgical Imaging Market Trends

Asia Pacific surgical imaging market region is expected to grow at the fastest growth rate during the forecast period. This can be attributed to the rapid growth of the population and increased R&D activity in this region. In addition, there is a high need for traditional and advanced devices in Asia Pacific.

The surgical imaging market in Japan is expected to grow at the fastest. The market is expected to expand steadily in the foreseeable future due to the aging population and the ongoing need for advanced medical technologies in Japan. Moreover, the government's initiatives to support the healthcare industry are anticipated to sustain market growth.

The China surgical imaging market is expected to grow in the Asia Pacific in 2023. Companies interested in entering China should recognize that they must overcome existing barriers in an ambiguous and changing regulatory environment. The country also offers momentous potential for U.S. companies interested in expanding and entering Chinese surgical imaging market.

The surgical imaging market in India is expected to grow over the forecast period. Surgical imaging manufacturers are getting involved in setting up a new manufacturing facility in India owing to a favorable regulatory climate and significant population. The presence of several local players in India also aids in securing the market position. India also has some world-class technologies, doctors, and clinics, which will subsequently drive the demand for surgical imaging.

Latin America Surgical Imaging Market Trends

The surgical imaging market in Latin America is experiencing significant growth attributed to various factors, such as the increasing awareness in the region about chronic disease has led to a substantial number of diagnosed cases, boosting the demand for early disease diagnosis. Furthermore, clinical education through conferences, symposiums, and webinars is becoming crucial in improving the adoption rate of surgical imaging devices. For instance, Bracco, a global leader in diagnostic imaging, and the European Society of Radiology (ESR), a non-profit professional organization committed to enhancing and consolidating European radiology, are pleased to announce a renewed collaboration to introduce "Next Generation Radiology" at the European Congress of Radiology (ECR) 2024. Thus, such initiatives are expected to increase the application & reach and awareness of ultrasound technology in Mexico, thereby fueling market growth.

MEA Surgical Imaging Market Trends

The surgical imaging market in the Middle East & Africa has been experiencing growth due to several factors, such as increasing demand for advanced healthcare facilities, a rise in the number of surgeries being performed, and a growing awareness of the benefits of minimally invasive procedures. These factors, combined with technological advancements in imaging equipment, are driving the market forward.

The surgical imaging market in Saudi Arabia is anticipated to expand in the forecast period due to technological innovation. The country is focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing. There are currently 150 health-tech startups in the country. Such advancements are resulting in shorter hospital stays and a rise in the number of surgical procedures, which, in turn, is driving the demand for surgical imaging devices.

The Kuwait surgical imaging market is expected to grow over the forecast period due to a favorable investment outlook, with the country focusing on investments in the private sector. Moreover, the country offers surgical imaging devices at subsidized rates in the public sector, owing to the plans of Kuwait’s Ministry of Health. This is expected to drive the demand for the surgical imaging and provide significant growth opportunities for the market players in the country.

Key Surgical Imaging Company Insights

The market scenario is highly competitive, with key players such as GE Healthcare; Siemens Healthineers; and Koninklijke Philips N.V. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Surgical Imaging Companies:

The following are the leading companies in the surgical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthcare GmbH

- Ziehm Imaging GmbH

- Shimadzu Corporation

- Hologic Corporation

- FUJIFILM Holdings America Corporation

- CANON MEDICAL SYSTEMS CORPORATION

- SAMSUNG HEALTHCARE

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Recent Developments

-

In January 2024, Probo Medical, a private equity-backed imaging services provider in Tampa, Florida, is rapidly expanding through acquisitions. They've recently entered a deal to acquire Alpha Source Group, enhancing their diagnostic imaging solutions platform.

-

In March 2024, SyntheticMR's latest imaging solution, SyMRI 3D, has obtained FDA clearance for clinical use in the U.S. This signifies a significant breakthrough in quantitative MRI technology, providing unparalleled resolution and accuracy for brain imaging.

-

In April 2023, a pioneering surgical imaging device developed by a medical technology company based in Seattle has become the first light-assisted navigation tool for spine surgery to receive clearance from the FDA.

-

In May 2022, a team of researchers from the Hamlyn Centre and Department of Surgery and Cancer has developed an intelligent imaging system for breast cancer surgery, employing fluorescence images of Indocyanine green (ICG) processing techniques to minimize the necessity for further surgical procedures.

Surgical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.4 billion

Revenue forecast in 2030

USD 7.6 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Hologic, Inc.; FUJIFILM Holdings America Corporation.; Ziehm Imaging GmbH; Shimadzu Corporation; SAMSUNG HEALTHCARE; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Imaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical imaging market report based on modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

C-arms

-

Computed Tomography

-

X-ray

-

Ultrasound

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgeries

-

Cardiovascular Surgeries

-

Orthopedic and Trauma

-

Gynecological Surgeries

-

Thoracic Surgeries

-

Urological Surgeries

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical imaging market size was estimated at USD 5.1 billion in 2023 and is expected to reach USD 5.4 billion in 2024.

b. The global surgical imaging market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 7.6 billion by 2030.

b. C-arms segment dominated the surgical imaging market with a share of 42.5% in 2023. The increasing prevalence of minimally invasive procedures, coupled with technological advancements such as flat-panel detectors and 3D imaging capabilities, has further fueled the adoption of C-arm systems across different specialties, including orthopedics, cardiology, and trauma surgery.

b. Some key players operating in the surgical imaging market include Koninklijke Philips N.V.; GE Healthcare, Inc.; Hitachi Ltd.; Shimadzu Corp.; Fujifilm Medical Systems; Siemens Healthcare; Canon Medical Systems Corporation; Carestream Health; Hologic, Inc.; and BioSign.

b. Key factors that are driving the market growth include growing geriatric population and awareness regarding radiography procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."