Surgical Drills Market Size, Share & Trends Analysis Report By Product (Instrument, Accessories), By Application (Orthopedic Surgeries, Dental Surgeries), By End Use, By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-408-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Surgical Drills Market Size & Trends

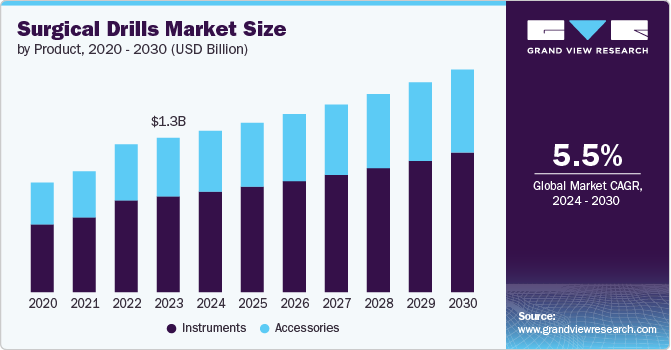

The global surgical drills market size was estimated at USD 1.27 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. Technological advancements, such as battery-operated and computer-assisted drills, enhance precision and efficiency, fueling the demand. The rising number of orthopedic, dental, and neurosurgical procedures, due to aging populations and increased trauma cases, also boosts the market.

Additionally, growing healthcare expenditure, particularly in developing regions, facilitates the adoption of advanced surgical equipment. The surge in minimally invasive surgeries, which often require specialized drills, and the increasing prevalence of chronic conditions like osteoporosis and arthritis further drive market growth, making surgical drills indispensable in modern medical practices.

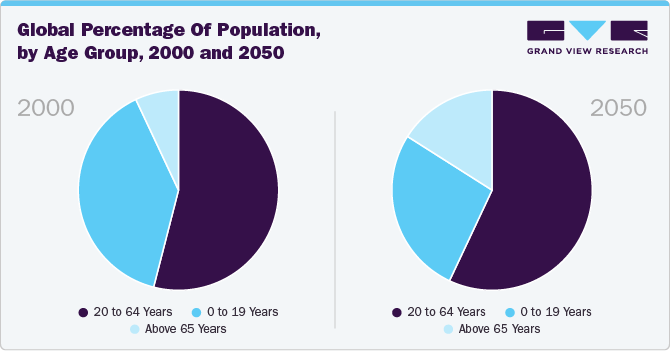

As bone density decreases and musculoskeletal disorders become more prevalent among individuals aged 55 and above, the demand for orthopedic solutions, including surgical drills, is rising. According to Our World in Data, approximately 10% of the global population is over 65 years old, and as the elderly demographic expands, so does the need for effective orthopedic interventions. The World Bank Data highlights that around 5.12 billion people are between 15-64 years, with many susceptible to conditions requiring surgical intervention.

Additionally, the WHO estimates that 1.71 billion people suffer from musculoskeletal disorders, and between 250,000 to 500,000 people experience spinal cord injuries annually. This growing patient population underscores the increased demand for advanced surgical drills to address orthopedic challenges, fueled by a rising life expectancy and a rapidly expanding senior demographic.

The market is experiencing significant growth driven by the increasing incidence of sports-related injuries. As more people engage in sports and fitness activities, the frequency of injuries, particularly in the lower extremities such as ankles and knees, is rising. For example, over a million young athletes are treated annually for sports injuries globally, with a notable percentage affecting the lower limbs. This trend is expected to continue as the number of individuals participating in sports grows, further boosting the demand for advanced orthopedic solutions, including surgical drills.

Additionally, road traffic accidents contribute to the expansion of the surgical drills market. With approximately 1.35 million fatalities and 20 to 50 million nonfatal injuries each year, the need for effective orthopedic treatments is increasing. Studies have shown that lower limb fractures are the most common orthopedic injuries resulting from such accidents. This high incidence of severe injuries drives the demand for innovative surgical drills to enhance treatment outcomes and support effective recovery, fueling market growth.

Advancements in surgical drills, such as improved precision, ergonomic designs, and integration of smart technologies, are driving market growth. Innovations like battery-powered drills, robotic-assisted systems, and enhanced safety features cater to increasing demand for minimally invasive procedures, boosting efficiency, and expanding the market’s scope. For instance, in March 2024, Northwestern Medicine pioneered the use of a new bedside neurosurgical drill designed to improve access and safety during brain surgeries. This cutting-edge drill, introduced at Northwestern Memorial Hospital, offers several key advancements over traditional methods. It is engineered to provide quicker, more precise access to the brain, enhancing the efficiency of neurosurgical procedures.

The innovative drill integrates advanced technology to ensure safer and more controlled operations. It features a streamlined design that reduces the risk of complications and minimizes the time required for surgical interventions. This development represents a significant leap forward in neurosurgery, where precision and safety are paramount.

By using this new drill, surgeons can now achieve better outcomes with fewer risks. The drill's design also supports a faster recovery process for patients, aligning with the growing trend towards less invasive surgical techniques. Northwestern Medicine’s adoption of this technology underscores its commitment to advancing medical practices and improving patient care through technological innovation.

This advancement not only positions Northwestern Medicine at the forefront of neurosurgical technology but also sets a new standard for the field, potentially influencing surgical practices and outcomes globally.

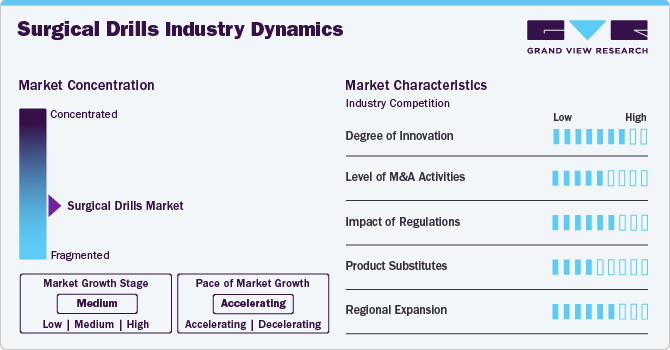

Market Concentration & Characteristics

The market is characterized by moderate industry concentration, with a mix of established multinational companies and emerging players. Major companies dominate with advanced technology, extensive distribution networks, and substantial R&D investments. This includes leaders like Stryker and DePuy Synthes. The market features high innovation, driven by technological advancements such as improved ergonomics and integration of smart sensors. Additionally, there is a strong focus on precision and minimally invasive procedures. Emerging players contribute by introducing novel solutions and driving competition. The market is influenced by regulatory standards and the need for continuous product development to meet evolving clinical demands.

The degree of innovation in the market is notably high, driven by advancements in technology and growing demands for precision and efficiency. For instance, in March 2023, SLAM Orthopedic has introduced an innovative drill designed specifically for trauma surgeons. This advanced tool offers enhanced precision and user-friendliness, addressing common challenges in orthopedic procedures. The drill aims to improve surgical outcomes by incorporating cutting-edge technology and ergonomic features tailored to trauma care needs.

Regulations significantly impact the market by ensuring device safety, efficacy, and quality. Stringent regulatory standards, such as those from the FDA and CE marking in Europe, mandate rigorous testing and compliance before market entry. These regulations ensure that surgical drills meet high safety and performance standards, enhancing patient outcomes. Compliance with these regulations can drive innovation, as manufacturers must integrate advanced technologies and materials. However, navigating complex regulatory processes can also increase development time and costs, potentially affecting market dynamics. Overall, while regulations uphold safety and efficacy, they also shape the market by influencing product development and market access.

Mergers and acquisitions in the market are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in January 2022, Smith+Nephew acquired Engage Surgical and its cement-less knee system, strengthening its presence in the U.S. market.

In the market, product substitutes include manual drills, traditional hand tools, and alternative energy-powered devices. Manual drills, while less advanced, are still used in certain settings due to their simplicity and lower cost. Traditional hand tools are occasionally preferred for their precision in specific procedures. Additionally, emerging technologies like laser-based and robot-assisted surgical tools offer alternatives to conventional drills, providing greater precision and reducing human error. These substitutes impact the market by driving innovation in drill technology and influencing pricing strategies. Companies must continually advance their products to remain competitive amidst these alternatives.

Companies are targeting various regions due to the rising prevalence of chronic respiratory conditions, increasing healthcare investments, and improving medical infrastructure. Regional diversification not only boosts global market presence for companies but also enhances access to advanced wearable patches in underserved areas, promoting overall healthcare improvements. For instance, in June 2022, Smith+Nephew expanded its orthopedic business by opening a manufacturing unit in Malaysia. It was an investment of more than USD 100 million.

Product Insights

The instruments segment, comprising electric drills, battery-powered drills, and pneumatic drills, holds the largest revenue share of 62.2% in 2023 and is expected to show the fastest CAGR from 2024 to 2030. This dominance is primarily due to the diverse applications and advantages offered by these drill types. Electric drills are favored for their high precision and consistent power, making them ideal for intricate surgeries. Battery-powered drills provide enhanced portability and convenience, crucial for both operating room flexibility and remote surgical settings. For instance, in March 2023, Stryker introduced a new battery-powered surgical drill, the CD NXT System, designed for enhanced efficiency and flexibility. The drill offers improved portability and precision, addressing the needs of modern surgical procedures. Its advanced battery technology ensures longer operational time and consistent performance, making it a valuable tool in diverse surgical settings.

Pneumatic drills, known for their robustness and reliability, are preferred in high-demand surgical environments where consistent performance is essential. The widespread adoption of these drills is driven by their ability to cater to different surgical needs, technological advancements, and improvements in patient outcomes. As surgical procedures become more complex and minimally invasive, the demand for these advanced drilling instruments is expected to grow, reinforcing their significant market share.

Application Insights

The orthopedic surgeries segment accounted for the largest revenue share of 43.2% in 2023, due to the increasing prevalence of musculoskeletal disorders and the growing demand for orthopedic procedures. Factors such as an aging population, rising incidence of bone fractures, and the prevalence of conditions like osteoarthritis and osteoporosis contribute significantly to this dominance. Orthopedic surgeries often involve precise drilling for implants and require advanced surgical drills to ensure accuracy and effectiveness. For instance, in November 2022, McGinley Orthopedics launched the Intellisense Drill, a cutting-edge orthopedic tool designed to enhance precision during surgeries. This advanced drill integrates innovative technology to improve accuracy in bone drilling, addressing the growing need for precision in orthopedic procedures and marking a significant advancement in surgical drill technology.

The dental surgeries segment is expected to grow at the fastest CAGR from 2024 to 2030. This rapid growth is driven by increasing dental procedures, advancements in dental drill technology, and a rising demand for aesthetic and reconstructive dental treatments. Factors such as an aging population requiring more dental interventions, heightened awareness about oral health, and the growing prevalence of dental disorders are contributing to this trend. Technological innovations, including the development of more precise, efficient, and patient-friendly dental drills, are further accelerating market expansion in the dental surgery sector.

End use Insights

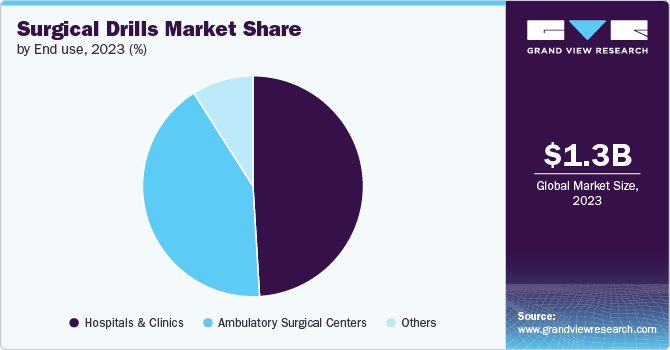

The hospitals & clinics segment accounted for the largest revenue share of 49.1% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. This is primarily due to the high volume of surgical procedures performed in these settings, which drives significant demand for surgical drills. Hospitals and clinics are equipped with advanced medical technologies and frequently invest in modern surgical tools to ensure the best outcomes for patients. For instance, in July 2022, researchers at the Royal United Hospitals Bath NHS Foundation Trust began testing an innovative medical device—a drill guidance system (DGS)—designed to enhance the precision of drilling screw holes into bones during surgical procedures.

The increasing prevalence of chronic conditions, such as osteoarthritis and osteoporosis, coupled with a rise in orthopedic surgeries, further propels the demand for surgical drills in these facilities. Additionally, the trend towards minimally invasive surgeries, which require specialized drill equipment, contributes to the segment’s growth. Hospitals and clinics are also the primary locations for complex and high-frequency procedures, reinforcing their central role in the surgical drills market. The sector's substantial investment in healthcare infrastructure and technology advancements continues to support its leading market position.

Regional Insights

North America surgical drills market dominated the overall global market and accounted for 36.9% of revenue share in 2023. The North American surgical drills market is driven by several factors, including increased use of orthopedic devices, a rise in trauma and fracture cases, and a growing number of middle-aged and elderly patients opting for these devices. Additionally, the prevalence of low bone density and the introduction of biodegradable and internal fixation devices contribute to market growth. According to the Administration for Community Living, the population aged 65 and above is projected to grow by 36%, from 39.6 million in 2009 to 54.1 million in 2019, reaching 94.7 million by 2060. This aging population's demand for advanced orthopedic devices fuels market expansion. Rapid technological advancements and improving healthcare facilities further enhance the market's growth potential during the forecast period.

U.S. Surgical Drills Market Trends

The surgical drills market in the U.S. held a significant share of North America's surgical drill market in 2023. The U.S. market for surgical drills is driven by factors such as an increase in healthcare expenditure across the globe, and an increase in the applications of 3D printing in the healthcare sector. Increasing investments in the technological advancement of surgical drills and rising R&D spending are factors contributing to the growth of the market in this region. Companies offering various types of devices are increasingly adopting expansion strategies, such as product launches, mergers, acquisitions, partnerships, and collaborations. For instance, in May 2023, Hubly Surgical has received FDA 510(k) clearance for its cranial and orthopedic drills. This approval marks a significant milestone, allowing Hubly to market and distribute its advanced drill in the U.S. healthcare market, enhancing surgical precision and patient outcomes in cranial and orthopedic procedures.

Europe Surgical Drills Market Trends

The European surgical drills market is experiencing significant growth, driven by an expanding healthcare infrastructure and a thriving medical tourism sector. Over the forecast period, the market is projected to grow due to increased healthcare spending and an aging population with higher rates of osteoarthritis, osteoporosis, bone injuries, and obesity.

The surgical drills market in the UK is expected to grow due to the increasing prevalence of osteoporosis and osteoarthritis, along with a rise in sports and road injuries. The Hip Fracture Database annual report for 2023 indicates that approximately 76,000 hip fractures occur annually in the UK. Additionally, the market may see new growth opportunities over the forecast period from medical device manufacturers reconfiguring supply chain models and rising demand for organs for transplantation.

France surgical drills market is expected to grow due to new government initiatives. In March 2022, France launched the Innovative Medical Devices plan as part of the France 2030 project, investing USD 450 million in the MedTech industry. The market is supported by local companies and increasing foreign sales divisions, with rapid growth in imports and re-exportation further driving expansion.

The surgical drills market in Germany is driven by the prevalence of osteoarthritis, which is the second most common reason for hip surgeries in individuals aged 70 to 79. Emerging trends like minimally invasive surgeries are also contributing to market growth. In 2019, Germany had one of the highest rates of hip and knee replacement procedures, indicating that the rising incidence of such conditions is boosting the surgical drills market in the country.

Asia Pacific Surgical Drills Market Trends

The Asia-Pacific surgical drills market is witnessing substantial growth due to the rapidly advancing healthcare infrastructure in key countries like India, China, and Japan, alongside a thriving medical tourism sector. Increasing orthopedic implant procedures, driven by a rise in chronic orthopedic conditions and better diagnostic tools, are boosting demand. Additionally, a projected rise in fractures and joint replacement cases from growing sports accidents is expected to further propel the market. Technological advancements, including 3D printing and smart sensors, along with heightened R&D efforts, are also contributing to market expansion.

The surgical drills market in Japan is set for rapid growth due to rising musculoskeletal issues, an increasing elderly population, and greater demand for joint replacements. Japan’s advanced medical device industry benefits from cutting-edge manufacturing technologies and cost-effective resources, supporting local production. With about 28% of the population over 65 in 2020, expected to exceed one-third by 2036, the aging demographic drives demand for surgical drills.

China surgical drills market is highly competitive due to the country’s rapidly aging population and increasing use of minimally invasive surgical procedures. The growing elderly demographic, which constituted about 19.8% of the population in 2023 according to the National Bureau of Statistics, is driving demand for surgical drills. Additionally, China’s rising focus on health and fitness has led to more sports activities, boosting the need for surgical drills for sports-related injuries. Government investments in healthcare infrastructure and initiatives supporting minimally invasive surgeries further enhance the market. The growth of China’s medical device industry is also contributing to a surge in innovative and cost-effective surgical drill solutions from local manufacturers.

The surgical drills market in India is highly competitive, driven by factors such as the expanding availability of minimally invasive procedures, a rising elderly population, and a growing incidence of conditions like osteoporosis, osteoarthritis, and obesity. The National Family Health Survey-5 (NFHS-5) from 2022 reports that one in four Indians is obese, with obesity rates climbing among both men and women.

Latin America Surgical Drills Market Trends

The Latin American surgical drills market is driven by the growing elderly population. As people age, they become more susceptible to various chronic conditions, increasing the need for surgical interventions. This, along with the rising demand for medical treatments, is boosting market growth in the region.

The surgical drills market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Surgical Drills Company Insights

The competitive scenario in the market is highly competitive, with key players such as B. Braun SE, Medtronic; and ConvaTec Group holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Surgical Drills Companies:

The following are the leading companies in the surgical drills market. These companies collectively hold the largest market share and dictate industry trends.

- Arthrex, Inc.

- B. Braun SE

- Medtronic

- Johnson & Johnson Services, Inc.

- Stryker

- Apothecaries Sundries Manufacturing Co.

- ConMed Corporation

- 3M

- MicroAire

- Zimmer Biomet

Recent Developments

-

In January 2024, Myron Meditech launched a new website dedicated to orthopedic bone drills. This platform offers detailed information about their advanced bone drill technology, enhancing accessibility for healthcare professionals and facilitating informed purchasing decisions. The launch signifies the company's commitment to innovation and customer engagement in the medical device industry.

-

In June 2024, Osteotec partnered with Additive Surgical to distribute spinal implants in the UK. This collaboration aims to enhance the availability of advanced, additively manufactured spinal implants, improving patient outcomes and expanding Osteotec's product offerings in the orthopedic market.

-

In February 2023, McGinley Orthopedics received an Innovative Technology contract from Vizient for its Intellisense Orthopedic Drill. This recognition highlights the drill's advanced capabilities in enhancing surgical precision and efficiency, potentially leading to improved patient outcomes and streamlined orthopedic procedures within Vizient's extensive healthcare network.

Surgical Drills Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.33 billion |

|

Revenue forecast in 2030 |

USD 1.83 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Arthrex, Inc.; B. Braun SE; Medtronic; Johnson & Johnson Services, Inc.; Stryker; Apothecaries; Sundries Manufacturing Co.; ConMed Corporation; 3M; MicroAire; Zimmer Biomet |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surgical Drills Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical drills market report based on the product, application end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Pneumatic Drill

-

Electric Drill

-

Battery Powered Drill

-

-

Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgeries

-

Dental Surgeries

-

ENT Surgeries

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical drills market size was estimated at USD 1.27 billion in 2023 and is expected to reach USD 1.33 billion in 2024.

b. The global surgical drills market is expected to grow at a compound annual growth rate of 5.50% from 2024 to 2030 to reach USD 1.83 billion by 2030.

b. North America held the largest market share of 36.9% in 2023. The North American surgical drills market is driven by several factors, including increased use of orthopedic devices, a rise in trauma and fracture cases, and a growing number of middle-aged and elderly patients opting for these devices.

b. Major market players included in the surgical drills market are Arthrex, Inc., B. Braun SE, Medtronic, Johnson & Johnson Services, Inc., Stryker, Apothecaries, Sundries Manufacturing Co., ConMed Corporation, 3M, MicroAire, Zimmer Biomet

b. Key factors that are driving growth are technological advancements, such as battery-operated and computer-assisted drills, enhance precision and efficiency, fueling demand. The rising number of orthopedic, dental, and neurosurgical procedures, due to aging populations and increased trauma cases, also boosts the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."