- Home

- »

- Clothing, Footwear & Accessories

- »

-

Surface Water Sports Equipment Market Size Report, 2030GVR Report cover

![Surface Water Sports Equipment Market Size, Share & Trends Report]()

Surface Water Sports Equipment Market Size, Share & Trends Analysis Report By Sports Type (Paddle Sports, Ski Sports, Board Sports), By Price Range, By Distribution Channel (Sporting Goods Retailers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-443-3

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

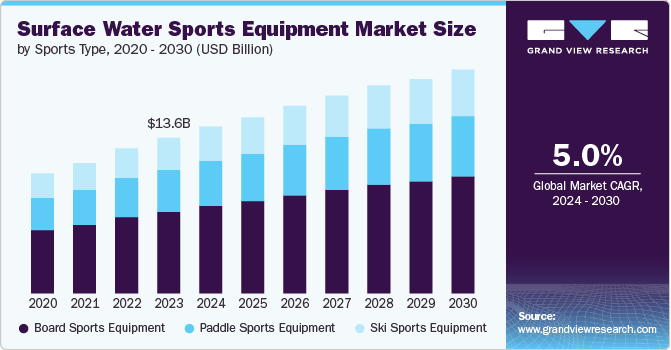

The global surface water sports equipment market size was estimated at USD 13,600.0 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market is witnessing a remarkable evolution, driven by a combination of increasing popularity of water sports, advancements in technology, and a growing awareness of health and wellness among consumers. As more individuals seek outdoor recreational activities to enjoy and stay fit, the demand for high-quality water sports equipment continues to rise. This article delves into the current trends, growth drivers, manufacturers' initiatives, and growth opportunities in this vibrant market.

As adventure tourism gains traction, water sports, including kayaking, paddleboarding, and jet skiing, are becoming key attractions. Destinations are promoting environmentally responsible water sports activities, further driving demand for related equipment. Innovations in technology are transforming surface water sports equipment. Smart features, such as GPS tracking, fitness monitoring, and enhanced safety features (like automatic inflators on life jackets), are being integrated into water sports gear, appealing to tech-savvy consumers. Water sports are recognized not only for their recreational value but also for their health benefits. Activities like paddleboarding and kayaking offer excellent cardiovascular workouts. The wellness trend is driving individuals to invest in equipment that can facilitate enjoyable fitness experiences.

Leading manufacturers are focusing on research and development to create innovative products that cater to market demands. Brands like Hobie and Naish are continually introducing new designs and materials to enhance performance and user experience.

The surface water sports equipment market is set for sustained growth, driven by innovations in product designs, campaigns and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global surface water sports equipment market.

There is a growing trend towards sustainability, with manufacturers focusing on eco-friendly materials and production processes. Brands are increasingly offering products made from biodegradable materials and adopting sustainable practices to reduce their environmental footprint. Moreover, companies are forming alliances with water sports associations, event organizers, and technology firms to enhance their product offerings and expand their market presence.

Sports Type Insights

Board sports equipment segment accounted for a share of 52.5% of the global revenue in 2023. Many of these sports can be enjoyed in coastal areas, lakes, and rivers, making them accessible to a large number of enthusiasts. The increasing number of surf schools, rental shops, and accessible coastal areas has contributed to the growth of these sports. The popularity of international competitions, such as the World Surf League, has brought significant attention to these sports, encouraging more people to participate and invest in equipmentSki sports equipment segment is expected to grow at a CAGR of 5.3% from 2024 to 2030. various age groups. These sports offer an exhilarating experience, combining speed, skill, and fun, which appeals to thrill-seekers and adventure enthusiasts. The development of high-performance, lightweight skis made from advanced materials like carbon fiber and composites has improved the user experience. These innovations make skis more durable, easier to handle, and better suited for a range of skill levels. Water skiing and wakeboarding destinations, particularly in regions with favorable weather conditions, are attracting more tourists. Popular locations in Europe, North America, and Asia are investing in facilities and infrastructure to cater to this growing demand for water sports, leading to increased equipment sales.

Price Range Insights

Mass segment accounted for a share of 80.5% of the global revenue in 2023. The segment caters to a broad range of consumers, including beginners, families, and casual enthusiasts who seek affordable options. The lower price points make these products accessible to a larger audience, driving higher sales volume. The mass-priced segment benefits from high-volume sales due to its affordability and widespread appeal. This volume-driven approach allows manufacturers and retailers to generate significant revenue, contributing to the segment’s dominance. The mass-priced segment is also prominent in the rental markets at tourist destinations, where visitors often opt for affordable equipment for temporary use. This contributes to the segment's large market share.

Premium segment is expected to grow at a CAGR of 5.2% from 2024 to 2030. Premium equipment often incorporates the latest technological advancements, such as improved materials (e.g., carbon fiber, advanced composites), enhanced hydrodynamics, and smart features like GPS tracking and performance analytics. These innovations appeal to serious enthusiasts and professionals who seek the best possible performance. Many luxury resorts and water sports destinations cater to affluent tourists by offering premium equipment rentals and experiences. This trend is particularly strong in regions known for high-end tourism, such as the Caribbean, Mediterranean, and Southeast Asia.

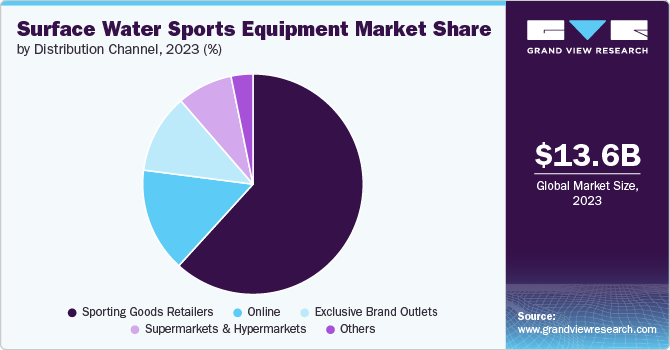

Distribution Channel Insights

The sales of surface water sports equipment through sporting goods retailers accounted for a revenue share of 61.7% in 2023. Sporting goods retailers often employ knowledgeable staff who are well-versed in the features and benefits of various surface water sports equipment. This expertise is valuable to customers seeking advice on which products best suit their needs, making these retailers a preferred shopping destination. These retailers typically offer a broad range of brands and products, from entry-level to premium options. This variety appeals to a wide customer base, from casual users to serious enthusiasts, ensuring that customers can find the right equipment for their needs.

The sales of surface water sports equipment through online distribution channel is expected to grow at a CAGR of 5.7% from 2024 to 2030. Online shopping offers unparalleled convenience, allowing consumers to browse and purchase surface water sports equipment from the comfort of their homes at any time. This flexibility is particularly appealing to busy individuals who may not have time to visit physical stores. Many manufacturers are increasingly adopting direct-to-consumer sales models via their websites, bypassing traditional retail channels. This approach allows them to offer lower prices and exclusive products, further driving online sales.

Regional Insights

The surface water sports equipment market in North America captured a revenue share of over 38.3% in the market. Activities such as wakeboarding, water skiing, paddle boarding, and kayaking are gaining popularity among both recreational and competitive participants. The growing interest in these sports drives demand for related equipment. Higher disposable incomes in North America enable consumers to spend more on recreational activities and high-quality equipment. This trend supports the growth of the premium segment within the market.Consumers are increasingly seeking high-quality, premium equipment that offers superior performance and durability. This trend is particularly strong among serious enthusiasts and competitive athletes.

U.S. Surface Water Sports Equipment Market Trends

The surface water sports equipment market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.The market is experiencing robust growth driven by increased participation in water sports, technological advancements, and a rising focus on recreational and outdoor activities. The growth rate is influenced by seasonal demand patterns, consumer preferences, and innovations in equipment. Advances in equipment design, materials, and performance features enhance the appeal of water sports. Innovations such as lightweight materials, enhanced safety features, and improved hydrodynamics attract consumers looking for high-performance gear.

Europe Surface Water Sports Equipment Market Trends

The surface water sports equipment market in Europe is expected to grow at a CAGR of 5.2% from 2024 to 2030. The introduction of advanced materials and technologies, such as lightweight composites and enhanced hydrodynamics, is making equipment more performance-oriented and appealing to enthusiasts. European consumers are increasingly concerned about environmental impact. There is a growing demand for eco-friendly products made from sustainable materials and those that minimize ecological impact. There is a rising demand for premium and high-end equipment that offers superior performance, durability, and design. This trend is driven by a segment of consumers who are willing to invest in top-quality products for enhanced experiences.

Asia Pacific Surface Water Sports Equipment Market Trends

The surface water sports equipment market in Asia Pacific is expected to witness a CAGR of 5.1% from 2024 to 2030. Coastal regions in countries like Thailand, Indonesia, and Australia are popular tourist destinations, driving demand for water sports equipment among both tourists and locals. Significant investment is being made in water sports facilities, including marinas, water parks, and adventure tourism centers. These developments are particularly prominent in countries with extensive coastlines and island destinations, such as Australia, Thailand, and the Philippines.

Key Surface Water Sports Equipment Company Insights

The surface water sports equipment market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the surface water sports equipment market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace water sports gear and equipment, especially surface water equipment.

Key Surface Water Sports Equipment Companies:

The following are the leading companies in the surface water sports equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Belassi GmbH

- Blue Sea Watersports

- BomBoard LLC

- Decathlon SA

- Escalade Inc.

- Imagine Nation Sports LLC

- Johnson Outdoors Inc.

- Kent Water Sports LLC

- KJK Sports

- Marine Products Corp.

Recent Developments

-

In June 2024, DECATHLON introduced the groundbreaking Yulex100, the first and only neoprene alternative crafted from 100% certified natural rubber. In a creative campaign developed by AMV BBDO, they "hacked surf cams" globally to connect directly with the water sports community.

-

In March 2024, FunWaterBoard, a leader in the water sports equipment industry, officially introduced an exhilarating range of products that promises to elevate outdoor adventure experiences. Among the highlights is the cutting-edge Funwater inflatable stand-up paddleboard (SUP), tailored for paddle boarding enthusiasts of all skill levels. In addition to the SUP, the new lineup features a robust ice fishing tent and a streamlined inflatable kayak for two, showcasing FunWaterBoard.com's commitment to excellence in outdoor gear. With these offerings, the brand is setting a new standard for adventure equipment.

Surface Water Sports Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14,600.0 million

Revenue forecast in 2030

USD 19,577.5 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sports type, price range, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; and South Africa

Key companies profiled

Belassi GmbH; Blue Sea Watersports; BomBoard LLC; Decathlon SA; Escalade Inc.; Imagine Nation Sports LLC; Johnson Outdoors Inc.; Kent Water Sports LLC; KJK Sports; Marine Products Corp.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Surface Water Sports Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surface water sports equipment market report based on sports type, price range, distribution channel, and region:

-

Sports Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Paddle Sports Equipment

-

Ski Sports Equipment

-

Board Sports Equipment

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface water sports equipment market size was estimated at USD 13,600.0 million in 2023 and is expected to reach USD 14,600.0 million in 2024.

b. The global surface water sports equipment market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 19,577.5 million by 2030.

b. The board sports equipment segment dominated the surface water sports equipment market with a share of 52.50% in 2023. The increasing number of surf schools, rental shops, and accessible coastal areas has contributed to the growth of these sports. The popularity of international competitions, such as the World Surf League, has brought significant attention to these sports, encouraging more people to participate and invest in equipment.

b. Some key players operating in the surface water sports equipment market include Belassi GmbH; Blue Sea Watersports; BomBoard LLC; Decathlon SA; Escalade Inc.; Imagine Nation Sports LLC; and Johnson Outdoors Inc.

b. Key factors that are driving the market growth include the increasing popularity of water sports, advancements in technology, and a growing awareness of health and wellness among consumers. Also, leading manufacturers focus on research and development to create innovative products catering to market demands.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."