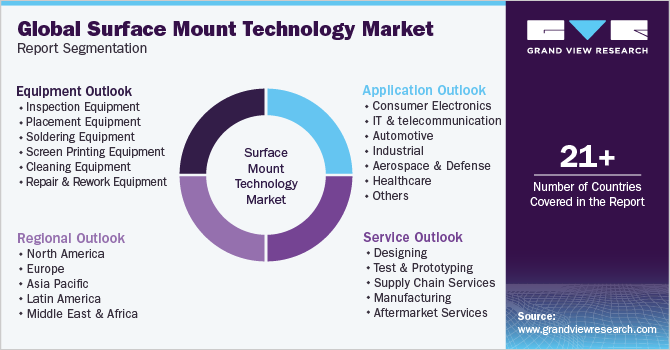

Surface Mount Technology Market Size, Share & Trends Analysis Report By Equipment (Inspection Equipment, Placement Equipment, Others), By Service, By Application, Regional Outlook, Competitive Strategies, and Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-066-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global surface mount technology market size was valued at USD 5,271.9 million and is estimated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The market's growth is expected to be driven by the miniaturization of electronic devices across the globe. The trend towards smaller and more portable electronic devices has led to an increased demand for smaller components, which can only be manufactured using SMT. Miniaturization involves reducing the size of various electronic components, such as resistors, capacitors, and transistors, and integrating them into smaller, more densely packed circuit boards. This is typically achieved through the use of SM, which allows for smaller components to be placed closer together on the circuit board, making the overall device smaller.

SMT is utilized solely to make electrical circuit boards. PCBs are constructed utilizing automated equipment like positioning and inspection, eliminating the need for personal involvement in the assembly process. SMT allows passive and active electronic components to be mounted directly onto the surface of PCBs. As a result, it is critical in the PCB assembly process. SMT has made significant contributions to electronic device mass manufacturing by simplifying PCB assembly procedures. Active components are electronic components capable of controlling the flow of electrical currents, such as transistors, diodes, integrated circuits, and microprocessors. Additionally, active components are widely used in manufacturing various electronic devices, such as smartphones, tablets, laptops, wearables, and IoT devices. Passive components are electronic components that do not require an external power source, including resistors, capacitors, and inductors. Passive components in SMT manufacturing can perform a wide range of functions, such as filtering, decoupling, and voltage regulation. SMT technology manufactures more passive components than active ones owing to the specific dimensions, which measure as little as 0.125 mm by 0.25 mm.

Furthermore, the increasing automation across the industry verticals such as automotive, logistics, e-commerce, and among others is another major factor driving the growth of the market. Additionally, the growth of automation and robotics in the manufacturing sector has made SMT more efficient and cost-effective, as machines can place components with greater precision and speed. Moreover, advancements in automation technology, such as artificial intelligence (AI) and machine learning (ML), have made SMT machines more efficient and accurate, reducing manual labor and improving electronic components' overall quality and consistency. Automation also offers manufacturers to produce electronic components in larger quantities at a lower cost, which helps to meet the growing demand for electronic devices.

Factors such as the high initial investment, the cost of gear for setting up manufacturing units, and the high frequency and necessity for thermal control can result in market limitations. However, introducing novel assembly processes, such as 3D printing and integrated components, as well as concerns about maintenance, rework, and dependability for SMT-manufactured PCBs, offer hurdles to the market's expansion. In addition, the need for more environmentally friendly electronic components is growing, creating an opportunity for the SMT market to produce lead-free and RoHS-compliant components that meet environmental standards.

COVID-19 Impact on the Surface Mount Technology market

The COVID-19 pandemic has significantly impacted several industries globally, including the SMT market. The pandemic caused disruptions in global supply chains, leading to delays in delivering components and equipment for SMT manufacturing. Owing to this, manufacturers of SMT equipment have faced challenges in meeting production targets, which has affected the growth of the SMT market. Additionally, the pandemic has caused a shift in consumer behavior, resulting in a surge in demand for electronic devices, such as laptops, smartphones, and gaming consoles. This has led to increased demand for SMT services, as these devices require a high degree of electronic component integration. However, the pandemic has also caused a decline in the automotive industry, which is a significant consumer of SMT services. The reduction in demand for vehicles has resulted in a decline in the demand for SMT services in the automotive sector.

Furthermore, travel restrictions and lockdown measures implemented by various governments have affected SMT manufacturers' operations, as many have had to limit or suspend their operations due to a lack of workers or logistical challenges. This has resulted in a decrease in SMT equipment and components production, which has impacted the market negatively. Another significant impact of COVID-19 has been the decrease in demand for PCBs in several industries due to the economic slowdown. The automotive and consumer electronics industries, which are significant users of PCBs, have seen a decline in demand due to supply chain disruptions and reduced consumer spending thus significantly impacting the SMT market. Furthermore, travel restrictions and lockdown measures implemented by various governments have affected SMT manufacturers' operations, as many have had to limit or suspend their operations due to a lack of workers or logistical challenges. Overall, the COVID-19 pandemic has had a mixed impact on the SMT market. While it has increased the demand for SMT services in the consumer electronics sector, it has also caused disruptions in supply chains and manufacturing operations, leading to a decline in the market's growth. As the pandemic continues to evolve, it remains to be seen how the SMT market will be impacted in the future.

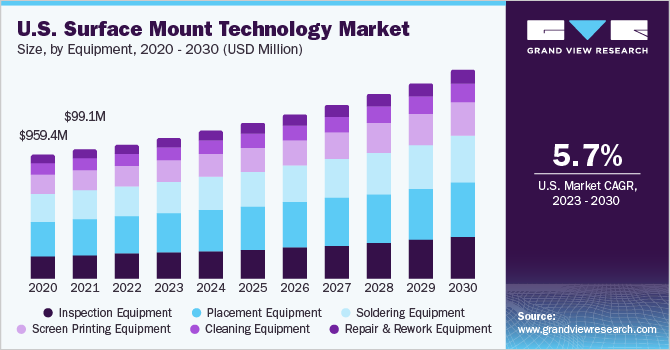

Equipment Insights

In terms of equipment, the market is classified into inspection equipment, soldering equipment, screen printing equipment, placement equipment, cleaning equipment, and repair and work equipment. The placement equipment segment dominated the overall market in 2022 with a revenue share of 27.7%. This dominance can be attributed to the rising need for improving product technology, reliability, responsiveness, and inspection quality. Furthermore, the rising need for this equipment in telecommunications, automotive, consumer electronics, computing, and storage will likely fuel the segment's growth over the forecast period. Placement equipment is a critical surface mount technology SMT market component. These machines accurately and efficiently place electronic components onto printed circuit boards (PCBs). There are various types of placement equipment, such as pick and place machines, screen printers, solder paste inspection machines, and dispensing machines. Placement equipment plays a critical role in the SMT manufacturing process, as it directly affects the quality and efficiency of PCB assembly.

The inspection equipment segment is expected to emerge at a significant CAGR of 6.7% over the forecast period. Inspection equipment is used to inspect and detect defects in the manufacturing process, such as misplaced or missing components, solder defects, and other issues that can affect the device's functionality. Manufacturers are increasingly adopting automated inspection equipment to improve production efficiency, reduce costs, and ensure consistent quality. Integrating artificial intelligence (AI) and machine learning (ML) technologies in inspection equipment has enabled the machines to self-adjust and optimize their performance, further enhancing accuracy and speed. Inspection equipment ensures the quality and reliability of electronic components and printed circuit boards (PCBs) during the manufacturing process. There are various types of inspection equipment available in the market, including Automated Optical Inspection (AOI) machines, X-ray inspection machines, and solder paste inspection machines.

Service Insights

In terms of service, the market is classified into designing, testing & prototype, supply chain services, manufacturing, and aftermarket services. Among these, the designing segment dominated the overall market in 2022 and accounted for a market share of 35.1%. The growth of the segment can be attributed to the increasing demand for PCB design, electronic circuit design, and design for manufacturing (DFM) services for consumer electronics. Additionally, designing services providers can help manufacturers to optimize their designs for cost, reducing the overall cost of manufacturing and improving profitability. Moreover, designing involves the creation of the layout and design of printed circuit boards (PCBs) that are used in an electronic device. PCB design is a critical aspect of the SMT process as it directly affects the quality and functionality of the final product. Designing involves selecting the appropriate components and determining their placement on the PCB. This requires a deep understanding of the electrical properties of each component and how they interact with each other.

The supply chain services segment is anticipated to register the fastest CAGR of 6.8% over the forecast period. The supply chain services comprise various services, including sourcing & procurement, inventory management, logistics & transportation, and warehousing & distribution. The supply chain process starts with component sourcing, which involves identifying the right components from manufacturers and distributors. This involves selecting the right components based on specifications, quality, and cost-effectiveness. Once the components have been sourced, the procurement process begins. This involves placing orders, negotiating prices, and managing inventory levels to ensure that the required components are available when needed. It also involves ensuring that the components meet the required quality standards. The delivery process is the final stage of the supply chain. This involves ensuring the components are delivered on time and in the correct quantity to the manufacturing facility. Supply chain services may also involve logistics and distribution management, including customs clearance and transportation. For instance, Surface Mount Technology Corp, a firm based in Wisconsin, U.S.A., offers end-to-end supply chain solutions to manufacturers, thereby offering them faster time to market, reducing inventory, delays, and critical downtime.

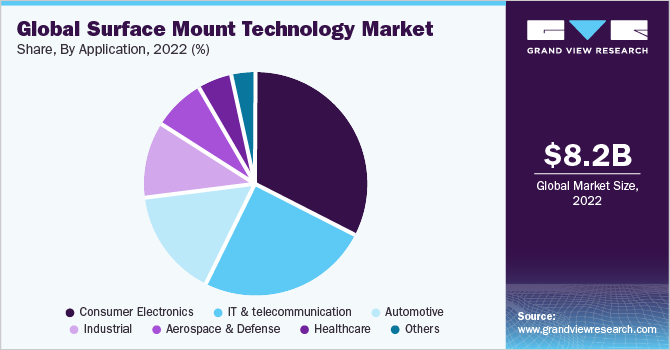

Application Insights

In terms of application, the market is classified into consumer electronics, IT & telecommunication, automotive, industrial, aerospace & defense, healthcare, and others. Among these, the consumer electronics segment dominated the market in 2022 and accounted for a market share of 32.5%. SMT is widely used in consumer electronics manufacturing owing to its advantages over traditional through-hole technology, such as smaller form factors, faster production times, and increased efficiency. Additionally, SMT is used extensively in manufacturing mobile devices, smart wearables, television, gaming consoles, and home appliances. The small form factor of SMT components enables manufacturers to produce smaller, lightweight devices that are easier to carry around. SMT is also efficient, allowing for fast and high-volume production of consumer electronics. Automated assembly lines can handle high volumes of PCBs, enabling manufacturers to produce consumer electronics at scale. Moreover, SMT allows for integrating multiple components on a single PCB, reducing the overall size and weight of devices. This makes consumer electronics more portable and convenient for users.

The industrial segment registered the fastest CAGR of 7.7% over the forecast period. SMT is used to manufacture automation equipment, medical equipment, power electronics, and photovoltaic systems such as robots and control systems. The small size and high performance of SMT components make them ideal for use in these applications. Moreover, the increasing demand for high-performance electronics is rising in many industrial applications, including control systems, sensors, and communication devices. SMT offers superior performance and reliability compared to traditional through-hole components, driving their adoption in the industrial segment. Furthermore, SMT is preferred in industrial automation manufacturing due to its ability to handle a wide range of components, including small and complex components, such as BGAs, CSPs, and QFNs, that are commonly used in industrial automation applications.

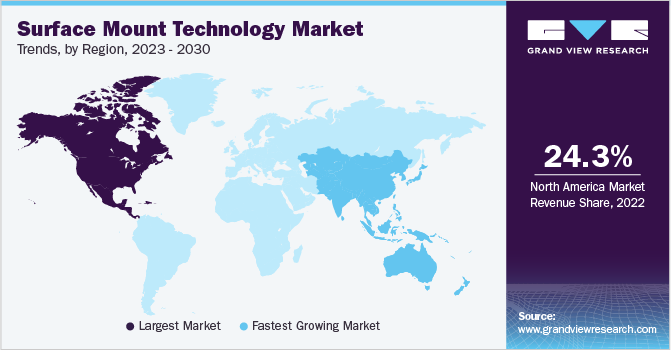

Regional Insights

The North America region gained a significant share of the overall market in 2022, with a market share of 24.3%. This can be attributed to the presence of prominent surface mount technology providers in North America, including CyberOptics, Naprotek, LLC., and Teradyne, Inc., among others. Key players focus on strategic growth through mergers and acquisitions and new product releases. For instance, in July 2022, GJD made an agreement to purchase a new top-of-the-line Hanwha Techwin SM482 plus SMT equipment. The brand-new equipment will provide high-speed automation throughout the electronic assembly process, as well as increase efficiency and reduce GJD's carbon footprint. Moreover, the demand for digital streaming content has also encouraged the manufacture of a variety of high-performance internet-connected gadgets and other comparable technologies, which has propelled the broader semiconductor industry's expansion across the region.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 6.4% throughout the forecast period. The regional growth can be attributed to the increase in demand for 5G networks and the increase in wireless communication standards boost demand for SMT in this region's telecommunication sector. Additionally, favorable government policies is also catering to the market growth. For instance, China's "Made in China 2025" initiative is aimed at upgrading the nation’s manufacturing capabilities and promoting the use of advanced technologies such as SMT. Similarly, Japan's "Society 5.0" initiative is focused on promoting the use of advanced technologies in various sectors, including electronics manufacturing.

Key Companies & Market Share Insights

The surface mount technology market is fragmented and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on new product launches to integrate advanced technologies used in surface mount technology. For instance, in October 2022, Keystone Electronics increased its product offering of ultra-flat surface mounting thread inserts, with the introduction of metric and inch-threaded variants.

Key players in the market are pursuing several strategic initiatives, such as mergers & acquisitions and new product launches, in order to strengthen their foothold in the market, capture a significant market share, and improve overall profitability. For instance, in February 2023, Yamaha Motors announced the launch of a brand new surface mounter YRM20DL, a premium highly efficient modular that achieves improved per-unit area of productivity with a dual lane conveyor, thereby reducing transport losses. Some of the prominent players in the global surface mount technology market include:

-

ASM Pacific Technology

-

Seika Corporation

-

Panasonic

-

Nordson Corporation

-

Cognex Corporation

-

Fuji Machine Manufacturing Co., Ltd.

-

Teradyne Inc.

-

Mycronic

-

Kulicke & Soffa Industries, Inc.

-

Neoden SMT

Surface Mount Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5,530.4 million |

|

Revenue forecast in 2030 |

USD 8,222.0 million |

|

Growth Rate |

CAGR of 5.8% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historic year |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, equipment, application, region |

|

Regional scope |

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Spain; Italy; China; Japan; India; Taiwan; Australia; Brazil; Mexico; UAE; South Africa |

|

Key companies profiled |

ASM Pacific Technology; Seika Corporation; Panasonic; Nordson Corporation; Cognex Corporation; Fuji Machine Manufacturing Co., Ltd.; Teradyne Inc.; Mycronic; Kulicke & Soffa Industries, Inc.; Neoden SMT |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Surface Mount Technology Market Report Segmentation

This report forecasts market revenue growths at global, regional, as well as at country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global surface mount technology market based on equipment, service, application, and region.

-

Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Inspection Equipment

-

Placement Equipment

-

Soldering Equipment

-

Screen Printing Equipment

-

Cleaning Equipment

-

Repair & Rework Equipment

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Designing

-

Test & Prototyping

-

Supply Chain Services

-

Manufacturing

-

Aftermarket Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

Home Appliances

-

Audio and Video Systems

-

Storage Devices

-

Others

-

-

IT & telecommunication

-

Telecom Equipment

-

Networking Devices

-

-

Automotive

-

Driver Assistance Systems

-

Infotainment Systems

-

Others

-

-

Industrial

-

Industrial Automation and Motion Control

-

Mechatronics and Robotics

-

Power Electronics

-

Photovoltaic Systems

-

Others

-

-

Aerospace & Defense

-

Aircraft Systems

-

Military Radars

-

Others

-

-

Healthcare

-

Medical Imaging Equipment

-

Consumer Medical Devices

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

Taiwan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface mount technology market size was estimated at USD 5,271.9 million in 2022 and is expected to reach USD 5,530.4 million in 2023.

b. The global surface mount technology market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 8,222.0 million by 2030.

b. Asia Pacific dominated the surface mount technology market with a share of 48% in 2022. This is attributable to the increase in demand for 5G networks and the increase in wireless communication standards boosting demand for SMT in this region's telecommunication sector.

b. Some key players operating in the surface mount technology market include ASM Pacific Technology, Seika Corporation, Panasonic, Nordson Corporation, Cognex Corporation, Fuji Machine Manufacturing Co., Ltd., Teradyne Inc., Mycronic, Kulicke & Soffa Industries, Inc., and Neoden SMT.

b. Key factors that are driving the market growth include increasing automation across the industry verticals such as automotive, logistics, and e-commerce; the growth of automation and robotics in the manufacturing sector, advancements in automation technology, and the need for more environmentally friendly electronic components.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."