Supply Chain As A Service Market Size, Share & Trends Analysis Report By Product (Solutions, Service), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-263-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

SCaaS Market Size & Trends

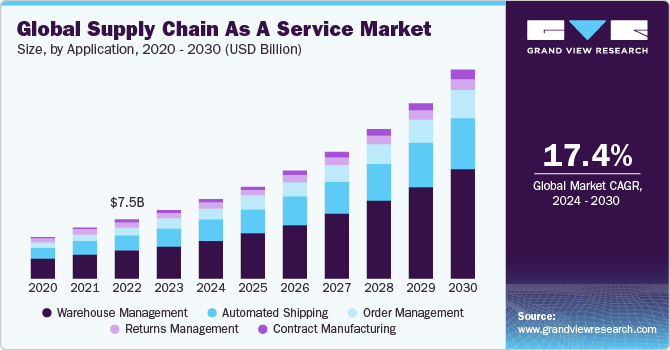

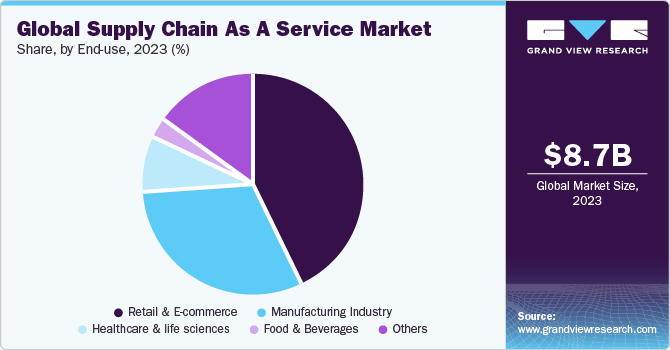

The global supply chain as a service market size was estimated at USD 8,710.1 million in 2023 and is projected to grow at a CAGR of 17.4% from 2024 to 2030. The increasing outsourcing of the various supply chain processes drives market growth. Supply chain as a service (SCaaS) includes advanced technologies and methodologies, which help to optimize the supply chain processes. It includes automation, real-time visibility, predictive analytics, and machine learning algorithms that help streamline operations, reduce lead times, minimize inventory holding costs, and improve overall efficiency.

Many businesses are outsourcing non-core functions of the supply chain, which allows them to focus their resources and efforts on core competencies, such as product innovation, marketing, and customer service. By adopting the supply chain as a service, businesses can leverage the expertise of specialized professionals to optimize supply chain performance while freeing up internal resources for strategic initiatives.

Supply chain as a service (SCaaS) offers cost-effective solutions that help businesses to reduce supply chain costs, improve inventory management, and streamline logistics operations. By leveraging shared resources, economies of scale, and pay-as-you-go pricing models, businesses can achieve cost savings and operational efficiencies without making large upfront investments in technology and infrastructure, which allows business to optimize sourcing, manufacturing, and distribution processes across multiple regions and suppliers. The above factors will positively impact the market growth.

The increasing globalization of markets has led to more complex and extended supply chains. Supply chain as a service providers offer solutions tailored to manage the complexities of global sourcing, transportation, customs compliance, and cross-border logistics. This is particularly relevant for multinational companies looking to expand their operations into new regions, which will further drive the demand for supply chain as a service over the forecast period.

COVID-19 pandemic has accelerated the adoption of digital technologies in supply chain management as companies seek ways to overcome disruptions and adapt to remote work environments. Supply chain as a service providers offering cloud-based platforms, digital collaboration tools, and robotics solutions experienced increased demand from businesses looking to digitize their supply chain operations and enhance resilience.

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating. The market is characterized by a highly competitive market with various market participants offering specialized services and solutions. The market encompasses a wide range of services, including procurement, logistics, inventory management, supply chain analytics, and risk management. Different companies specialize in different aspects of the supply chain, leading to a diverse ecosystem with multiple players catering to various needs.

SCaaS providers offer expertise in regulatory compliance, risk management, and sustainability practices, helping companies navigate complex regulatory environments and mitigate supply chain risks. This includes ensuring compliance with industry standards, regulatory requirements, and ethical sourcing practices, as well as implementing measures to address environmental, social, and governance (ESG) considerations.

Rapid advancements in technology, including cloud computing, Internet of Things (IoT), big data analytics, artificial intelligence (AI), and block chain, are driving the adoption of digital solutions in supply chain management. SCaaS leverages these technologies to provide real-time visibility, predictive analytics, and automation, enabling companies to optimize their supply chain processes and improve efficiency.

Product Insights

The solutions segment held the market with the largest revenue share of 83.15% in 2023. The supply chain as a service solution includes cloud-based platforms, logistics, and transportation management. The cloud-based platforms offer scalability, accessibility, and real-time collaboration capabilities, allowing companies to centralize supply chain data, streamline communication, and improve decision-making across distributed networks. The demand for these solutions is driven by the growing complexity of global supply chains, increasing customer expectations for faster and more reliable deliveries, and the need to mitigate transportation-related risks and disruptions.

The service (SCaaS) segment encompasses various service types that cater to different aspects of the supply chain process, which includes procurement services, inventory management servicessupply chain integration, and collaboration services among others. The supply chain as a services focused on identifying, assessing, and mitigating supply chain risks, ensuring regulatory compliance, and upholding ethical standards throughout the supply chain. These factors are expected to promote the demand for supply chain as a service over the forecast period.

Application Insights

Based on application, the warehouse management segment led the market with the largest revenue share of 48.17% in 2023. SCaaS warehouse management focuses on maximizing the utilization of warehouse space to accommodate varying inventory levels and product sizes. It includes implementing efficient storage systems, such as pallet racking, shelving, and automated storage and retrieval systems (AS/RS), to optimize storage capacity and accessibility. These aforementioned factors are anticipated to drive the market growth over the forecast period.

The automated shipping segment is anticipated to grow at a rapid CAGR over the forecast period. Automated shipping solutions integrate with multiple carrier systems to compare shipping rates, transit times, and service levels in real-time. SCaaS platforms provides optimal carrier based on predefined criteria such as cost, delivery speed, and destination, ensuring the most efficient and cost-effective shipping options are chosen for each shipment. The automated shipping helps reduce manual errors, improve order accuracy, and expedite the shipping process, which will positively impact the market growth.

End-use Insights

Based on end-use, the retail & e-commerce segment led the market with the largest revenue share of 43.12% in 2023. The supply chain as a service provides inventory management solutions to help retailers and e-commerce businesses optimize their inventory levels. This includes real-time inventory tracking, demand forecasting, and inventory optimization to ensure the right products are available at the right time and in the right quantities. Further, the supply chain as a service helps to integrate online and offline sales channels, as well as third-party marketplaces. Which provide company to have seamless shopping experience for customers across all channels. All these factors are expected to promote the demand for supply chain as a service over the forecast period.

The manufacturing industry segment has been growing rapidly in recent years. SCaaS offers supply chain planning and optimization services, which help manufacturers to improve efficiency and reduce costs. Supply chain as a services includes demand forecasting, production planning, inventory optimization, and distribution planning. By outsourcing various supply chain functions to third-party providers, manufacturers can focus on their core competencies and drive innovation and growth in a competitive market environment.

Regional Insights

North America dominated the supply chain as a service (SCaaS) market with a revenue share of 36.7% in 2023. North America is a hub for technological innovation, and supply chain as a service provider in the region leverages advanced technologies such as cloud computing, artificial intelligence (AI), Internet of Things (IoT), blockchain, and data analytics to deliver innovative and scalable solutions to their customers. Manufacturers are increasingly seeking to outsource non-core supply chain functions to third-party providers to focus on their core competencies and improve competitiveness, which will further drive the market growth in North America.

U.S. Supply Chain As A Service (SCaaS) Market Trends

The supply chain as a service (SCaaS) market in U.S.is estimated to grow at the fastest CAGR of 16.1% from 2024 to 2030. Companies in the U.S. are continually seeking ways to improve operational efficiency and reduce costs within their supply chains. SCaaS solutions offer opportunities to streamline processes, automate repetitive tasks, and optimize resource utilization, which will drive market growth.

The Canada supply chain as a service (SCaaS) market accounted for the revenue share of 12% in North America market in 2023. The supply chains of many Canada businesses have become increasingly complex due to factors such as globalization, outsourcing, and the proliferation of product variants, SCaaS solutions help businesses navigate these complex landscapes and ensure compliance throughout the supply chain. These factors will drive the market growth in Canada.

Asia Pacific Supply Chain As A Service (SCaaS) Market Trends

The supply chain as a service (SCaaS) market in Asia Pacific region is characterized by extensive cross border trade and complex supply chain networks. Supply chain as a service solutions help businesses navigate international trade regulations, manage customs clearance processes, and optimize cross-border logistics operations. This includes services such as trade compliance, freight forwarding, and supply chain visibility, is driving market growth.

The China supply chain as a service (SCaaS) market accounted with the revenue share of 40% in Asia Pacific market in 2023, and it is mainly driven by the expanding middle class, and growing e-commerce sector are driving increased demand for supply chain as a service.

The supply chain as a service (SCaaS) market in India is expected to grow at the fastest CAGR of 21.4% during the forecast period, due to the rising manufacturing sector and the increasing adoption of e-commerce. SCaaS solutions help businesses leverage these infrastructure investments to optimize transportation, warehousing, and distribution activities.

Europe Supply Chain As A Service (SCaaS) Market Trends

The supply chain as a service (SCaaS) market in Europe was the second-largest regional market in 2023. As businesses continue to prioritize supply chain optimization, digital transformation, sustainability, and regulatory compliance, the demand for SCaaS in Europe is expected to grow at significant CAGR during the forecast period.

The Germany supply chain as a service (SCaaS) market accounted for the revenue share of 30% in Europe market in 2023. The growth of e-commerce in Germany is driving SCaaS market, to support omni channel fulfillment, last-mile delivery, and customer experience management.

The supply chain as a service (SCaaS) market in France is expected to grow at the fastest CAGR of 18.3% during the forecast period, due to the rising adoption of digital technology in the supply chain industry. SCaaS offers innovative solutions such as cloud computing, big data analytics, and artificial intelligence to improve visibility, agility, and decision-making.

Central and South America Supply Chain As A Service (SCaaS) Market Trends

The supply chain as a service (SCaaS) market in Central and South America is expected to grow at a significant CAGR over the forecast period. Central and South America are witnessing rapid urbanization and increasing adoption of digital technologies; SCaaS solutions are playing a pivotal role in improving operational efficiency, enhancing visibility, and reducing costs throughout the supply chain.

The Brazil supply chain as a service (SCaaS) market accounted for the revenue share of over 70% in Central and South America market in 2023, the market driven by the country's large and diverse economy, expanding manufacturing sector, and increasing adoption of e-commerce.

Middle East & Africa Supply Chain As A Service (SCaaS) Market Trends

The supply chain as a service (SCaaS) market in the Middle East & Africa is witnessing significant growth propelled by the region's expanding economy, increasing industrialization, and adoption of digital technologies.

The Saudi Arabia supply chain as a service (SCaaS) market is expected to grow at a lucrative CAGR of 10.8% during the forecast period, owing to increasing industrial base, and adoption of digital technologies. SCaaS solutions in Saudi Arabia focus on enabling sustainable sourcing practices, carbon footprint tracking, and waste management to meet evolving market demands and regulatory requirements.

Key Supply Chain as a Service Company Insights

Some of the key players operating in the market include IBM Corporation, Oracle Corporation, SAP SE, Accenture, and DHL International GmbH hold.

-

IBM Corporation engaged in the technology and consulting services. The company operates in a diverse range of sectors, including hardware, software, cloud computing, artificial intelligence, blockchain, and consulting services. The company offers a comprehensive suite of solutions tailored to the global market. With a focus on leveraging advanced technologies to optimize supply chain operations, IBM provides innovative solutions to address the challenges faced by businesses across industries. IBM's Watson Supply Chain solutions leverage artificial intelligence (AI) and blockchain technology to enhance visibility, agility, and efficiency across the supply chain

-

Oracle Corporation is a technology company that provides a broad range of software and hardware products, as well as cloud services and consulting. The company serves customers in over 175 countries and operates a vast network of data centers to support its cloud services. Oracle's flagship SCaaS offering, Oracle Fusion Cloud SCM, is a comprehensive suite of cloud-based supply chain management solutions. It includes modules for demand planning, inventory management, procurement, order fulfillment, logistics, and transportation management

American Software, Inc. and Korber AG are some of the emerging market participants in the global market.

-

American Software, Inc. is a leading provider of software and services for supply chain management and enterprise resource planning (ERP). American Software offers a range of solutions designed to help businesses optimize their operations, improve efficiency, and drive growth. American Software's Logility brand provides a suite of supply chain management solutions aimed at helping businesses improve forecasting accuracy, inventory optimization, and overall supply chain efficiency

-

Körber offers a suite of supply chain software solutions designed to optimize logistics and warehouse operations. These solutions include warehouse management systems (WMS), transportation management systems (TMS), order management systems (OMS), and labor management systems (LMS). By leveraging these software solutions, businesses can improve efficiency, reduce costs, and enhance visibility throughout their supply chain networks

Key Supply Chain As A Service Companies:

The following are the leading companies in the SCaaS market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Accenture

- DHL International GmbH

- Blue Yonder (formerly JDA Software)

- Kinaxis Inc.

- Manhattan Associates, Inc.

- Infor Inc.

- BluJay Solutions

- Descartes Systems Group Inc.

- GT Nexus (Infor)

- Elemica

- American Software, Inc.

- Korber AG

Recent Developments

-

In October 2023, Accenture has recently announced its agreement to acquire OnProcess Technology, a leading provider of supply chain managed services. With this acquisition, company aims to streamline processes for its clients, enabling them to efficiently manage service orders, optimize returns, track asset movement, and ensure proper asset reuse, disposal, or recycling

-

In April 2023, Oracle unveiled advanced artificial intelligence (AI) and automation functionalities aimed at aiding customers in optimizing their supply chain management processes. These enhancements harness AI and automation technologies to drive efficiency, streamline operations, and facilitate informed decision-making within supply chain management for Oracle's clientele. The updates encompassed enhancements to quote-to-cash procedures within Oracle Fusion Verticals and the introduction of new features such as planning enhancements, usage-based pricing, and rebate management capabilities in Oracle Fusion Cloud Supply Chain & Manufacturing (SCM)

Supply Chain As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10,082.6 million |

|

Revenue forecast in 2030 |

USD 26,440.1 million |

|

Growth rate |

CAGR of 17.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

IBM Corporation; Oracle Corporation; SAP SE; Accenture; DHL International GmbH; Blue Yonder (formerly JDA Software); Kinaxis Inc.; Manhattan Associates, Inc.; Infor Inc.; BluJay Solutions; Descartes Systems Group Inc.; GT Nexus (Infor); Elemica; American Software, Inc.; Korber AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Supply Chain As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global supply chain as a service market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Order Management

-

Contract Manufacturing

-

Warehouse Management

-

Automated Shipping

-

Returns Management

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Manufacturing Industry

-

Healthcare and life sciences

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global supply chain as a service size was estimated at USD 8,710.1 million in 2023 and is expected to be USD 10,082.6 million in 2024.

b. The global supply chain as a service, in terms of revenue, is expected to grow at a compound annual growth rate of 17.4% from 2024 to 2030 to reach USD 26,440.1 million by 2030.

b. North America dominated the SaaS with a revenue share of 36.7% in 2023, on account of several factors including high adoption rate of advanced technologies, which has driven the growth of supply chain as a service in the region.

b. Some of the key players operating in the supply chain as a service include IBM Corporation, Oracle Corporation, SAP SE, Accenture, DHL International GmbH, Blue Yonder (formerly JDA Software), Kinaxis Inc., Manhattan Associates, Inc., Infor Inc., BluJay Solutions, Descartes Systems Group Inc., GT Nexus (Infor),Elemica,American Software, Inc., Korber AG.

b. Key factors that are driving the supply chain as a service are the increasing adoption of cloud-based supply chain solutions, owing to various features including scalability, flexibility, and cost-effectiveness. Moreover, supply chain as a service helps simplify the process by providing a single point of contact and standardized processes. This thus provides huge growth opportunities to the market

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."