Superconducting Wire Market Size, Share & Trend Analysis Report By Product (Low Temperature, High Temperature Superconductor), By End-use (Energy, Medical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-344-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

“2030 superconducting wire market value to reach USD 2.07 billion.”

Superconducting Wire Market Size & Trends

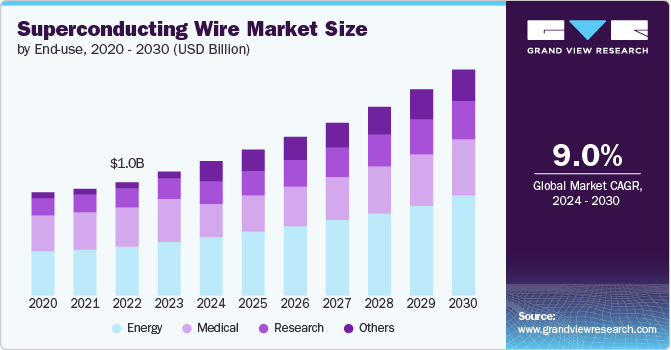

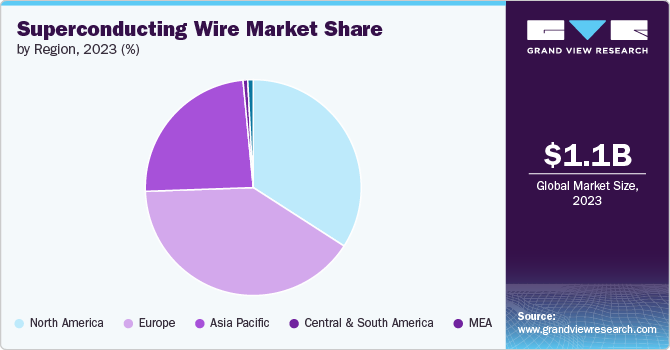

The global superconducting wire market size was estimated at USD 1.14 billion in 2023 and is estimated to grow at a CAGR of 9.0% from 2024 to 2030. Superconducting wire offers superior conduction of electricity with minimal losses making it a popular wire material for energy generation and critical applications. The growing demand for efficient power transmission is anticipated to boost the market over the forecast period.

Superconducting wires have several benefits when compared to copper wires, owing to the higher maximum current densities and zero power dissipation that it exhibits. They are widely used in superconducting magnets, which are used in scientific and medical equipment where high magnetic fields are necessary.

Drivers, Opportunities & Restraints

The continuous investment in R&D activities on superconducting wires to enhance performance and achieve optimal cost reduction is a key driver of market growth. Innovation in material science and manufacturing technology helps to continuously develop advanced wires, and also reduce production cost, reduce transmission loss and increase efficiency.

A key opportunity for the market lies in government support for the development of superconducting technologies for use in energy transmission and nuclear energy programs. Governments’ invest provide grants, funding programs and incentives for research on the development of efficient energy production processes. Most importantly, development in this area is expected to help aid the nuclear energy funding program and support the green energy transition.

The market faces inherent restraints, such as the high manufacturing cost of superconducting wires. The complex production process, and the high price of superconducting materials such as YBCO play a substantial role in the price of the final product. Moreover, the specialized technology warrants the use of special machinery and cleanroom facilities that increase capital cost, hence making it all the more impertinent that overhead costs are controlled effectively.

Product Insights

“HTS accounted for the highest revenue share of over 53.0% in 2023.”

Superconducting wires are produced by various methods depending upon the property exhibiting critical temperature. Low-temperature superconductor (LTS) wires are produced using superconductors with low critical temperature, such as Nb3Sn (niobium-tin) and NbTi (niobium-titanium). Medium-temperature superconductor (MTS) wires are produced by melting magnesium and boron powders at magnesium's melting temperature, following by forming and finishing.

High-temperature superconductor (HTS) wires accounted for the highest revenue share of about 53.0% in 2023 in the global market. HTS wires are produced using superconductors with high critical temperature, such as yttrium barium copper oxide (YBCO) and bismuth strontium calcium copper oxide (BSCCO). The powder-in-tube (PIT) process is an extrusion process often used for making electrical conductors from brittle superconducting materials such as niobium-tin or magnesium diboride and ceramic cuprate superconductors such as BSCCO.

End-use Insights

“Energy accounted for the highest revenue share of over 43.0% in 2023.”

Superconducting wires offer near-zero electrical resistance, thereby enabling high-speed power transmission over long distances. There is a significant reduction in transmission energy loss, hence resulting in lower costs and improved grid reliability. Since the energy industry is making the shift towards net-zero carbonization goals, it is looking for ways to improve energy efficiency and sustainability of transmission networks. With global utility companies investing in grid modernization projects, the demand for superconducting wires is anticipated to increase.

Superconducting wire is used in the medical industry in the production of superconducting magnets. They can produce stronger magnetic fields than electromagnets. They find specialized applications in Magnetic Resonance Imaging (MRI) instruments in hospitals, and in scientific equipment such as mass spectrometers, Nuclear Magnetic Resonance (NMR) spectrometers, fusion reactors, and particle accelerators. They are also used for levitation, guidance and propulsion in a maglev (magnetic levitation) railway system, such as the SCMaglev railway system being developed in Japan that is scheduled to commence in 2027.

Regional Insights

“Germany held over 40.0% revenue share of the overall Europe superconducting wire market.”

Europe dominated the global market and accounted for over 40.0% revenue share of the global market in 2023. This growth is anticipated to continue over the forecast period owing to the robust R&D infrastructure in place within the region. European universities and research institutes are world renown for conducting cutting edge research in material science and are provided grants and funding for R&D by the European Commission.

North America is anticipated to witness a CAGR of 9.1% over the forecast period. It is expected to be driven by the energy transmission and nuclear energy funding projects that are in place within the U.S.

U.S. Superconducting Wire Market Trends

In April 2024, the U.S. Department of Energy (DOE) announced more than USD 1 billion has been funded since 2009 to U.S. colleges and universities, two national laboratories, and one industry organization to support nuclear energy research and development and provide access to world-class research facilities.

Asia Pacific Superconducting Wire Market Trends

Japan is expected to contribute significantly to the region’s demand for superconducting wire. Companies such as Japan Superconducting Technology Ltd. is continuously investing in R&D to develop high speed energy and rail transmission lines, as well as the development of quantum computers.

Key Superconducting Wire Company Insights

Some of the key players operating in the market include Kennametal Inc., and Sandvik AB.

-

Japan Superconductor Technology Inc. was founded in 2002 and is specialized in the manufacture of superconducting material and technology. Its product line includes NbTi and Nb3Sn superconducting wire, High-resolution NMR magnets, various magnets for use in MRI and R&D, component parts and accessories for superconducting magnets

-

U.S.-based American Superconductor was founded in 1987 and specializes in the production of superconducting wires and products for the development of energy & power systems.

Key Superconducting Wire Companies:

The following are the leading companies in the superconducting wire market. These companies collectively hold the largest market share and dictate industry trends.

- American Superconductor

- ASG Superconductors SpA

- Bruker Corporation

- Eaton Corporation PLC

- Epoch Wires Ltd.

- Fuji Electric Co., Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Japan Superconductor Technology Inc.

- LS Cable & System Ltd.

- MetOx Technologies, Inc.

- Nexans SA

- Phoenix Contact

- Superconductor Technologies Inc.

- Sumitomo Electric Industries, Ltd.

- Superox

- Theva Dunnschichttechnik GmbH

Recent Developments

-

In December 2023, U.S.-based MetOx International, Inc., a producer of advanced power delivery technology, announced the expansion of its Xeus HTS wire manufacturing.

-

In June 2023, Japan-based JEOL Ltd. acquired a minority stake in Japan Superconductor Technology, Inc. from Kobe Steel, Ltd. as part of its business expansion strategy.

-

In January 2023, UK-based Tokamak Energy signed an agreement with Furukawa Electric Co., Ltd. and SuperPower Inc. to supply HTS tape for its new advanced prototype fusion device, ST80-HTS.

Superconducting Wire Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.23 billion |

|

Revenue forecast in 2030 |

USD 2.07 billion |

|

Growth rate |

CAGR of 9.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea |

|

Key companies profiled |

ASG Superconductors SpA; Bruker Corporation; Eaton Corporation PLC; Epoch Wires Ltd.; Fuji Electric Co. Ltd.; Fujikura Ltd.; Furukawa Electric Co. Ltd.; Japan Superconductor Technology Inc.; LS Cable & System Ltd.; MetOx Technologies, Inc.; Nexans SA; Phoenix Contact; Superconductor Technologies Inc.; Sumitomo Electric Industries, Ltd.; Superox; Theva Dunnschichttechnik GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Superconducting Wire Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global superconducting wire market report on the basis of product, end-use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Temperature Semiconductor

-

Medium Temperature Semiconductor

-

High Temperature Semiconductor

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy

-

Medical

-

Research

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global superconducting wire market size was estimated at USD 1.14 billion in 2023 and is expected to reach USD 1.23 billion in 2024.

b. The global superconducting wire market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 2.07 billion by 2030.

b. By end use, the energy segment dominated the market with a revenue share of over 43.0% in 2023.

b. Key players operating in the global superconducting wire market are ASG Superconductors SpA, Bruker Corporation, Eaton Corporation PLC, Epoch Wires Ltd., Fuji Electric Co., Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., Japan Superconductor Technology Inc., LS Cable & System Ltd., MetOx Technologies, Inc., Nexans SA, Phoenix Contact, Superconductor Technologies Inc., Sumitomo Electric Industries, Ltd., Superox, and Theva Dunnschichttechnik GmbH.

b. Growth of the global superconducting wire market is attributed to the demand arising from the energy segment and for the production of superconducting magnets in the medical segment.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."