Supercomputer Market Size, Share & Trends Analysis Report By Type (Tightly Connected Cluster Computer), By Application (Scientific Research, Defense), By End-use, Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-392-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Supercomputer Market Size & Trends

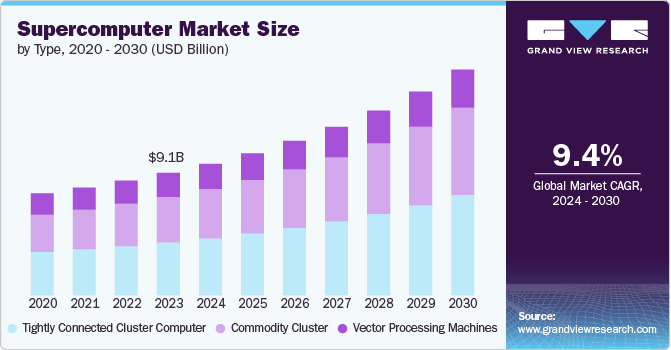

The global supercomputer market size was estimated at USD 9.13 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030. Supercomputers are essential for complex simulations, modeling, and data analysis in various fields such as physics, chemistry, biology, and climate science. Supercomputing capabilities are seen as crucial for maintaining a competitive edge in various sectors.

Numerous industries, such as aerospace, automotive, and manufacturing, rely on supercomputers for design optimization, simulations, and testing. Factors such as technological advancements, increasing data volumes, economic growth and government initiatives, and emerging applications like digital twins and autonomous vehicles are collectively driving the growth of the supercomputer market.

Supercomputing capabilities enable companies to perform extensive simulations in the design stage and diminish the need for physical trials. These simulations cover everything from multi-disciplinary compromises to the aerodynamics of aircraft. Supercomputers play a crucial role for countries in both pushing forward research and strengthening security measures. Various developed nations are stepping up to become leaders in the supercomputing arena, frequently situating these powerful systems within institutions of higher education and governmental bodies. Additionally, governments are utilizing the power of supercomputers to address various security challenges at their borders.

Businesses with large volumes of information are increasingly leveraging data analytics as a critical tool for making informed decisions, a strategy that is essential for staying ahead in the competitive landscape. This movement towards relying on data to guide business strategies is catapulting organizations ahead of their competitors. As a direct result, there is a growing demand in the supercomputer market, fueled by the necessity for more powerful computing capabilities to efficiently process and analyze large datasets. Additionally, an emerging trend in the supercomputer sector is the shift towards cloud-based solutions, particularly for data storage. Companies and research institutions are adopting cloud-based solutions for the cost savings and enhanced capabilities of cloud solutions compared to on-premises systems, which come with additional burdens such as cooling systems, data management, and obtaining certifications.

Type Insights

The tightly connected cluster computer segment led the market and accounted for over 43.0% share of the global revenue in 2023. A tightly connected cluster computer is a type of supercomputer architecture where multiple independent computers (nodes) are linked together with high-speed interconnects to function as a single system. This configuration allows for efficient communication and data sharing between nodes, enabling them to collectively tackle complex computational problems. Tightly connected cluster computers offer a more affordable option compared to traditional supercomputers, making them suitable for a wider range of organizations.

The commodity cluster segment is predicted to foresee the highest growth from 2024 to 2030. A commodity cluster is a type of supercomputer architecture that utilizes off-the-shelf components, such as standard processors, memory, and networking equipment, to achieve high performance. commodity clusters are a significant growth segment within the supercomputer market. Their cost-effectiveness, scalability, and accessibility make them suitable for a wide range of organizations. Combined with the broader trends driving supercomputer adoption, the market for commodity clusters is expected to continue expanding in the forecasted period.

Application Insights

The scientific research segment accounted for the largest revenue share in 2023. Supercomputers enable scientists to model intricate systems like climate change, molecular interactions, and material properties with unprecedented accuracy. Numerous fields, such as genomics, astronomy, and particle physics, generate massive datasets that require powerful computing resources for analysis. Thus, governments and private institutions are allocating substantial funds for scientific research, fueling the demand for advanced computing infrastructure.

The defense segment is anticipated to exhibit the highest CAGR from 2024 to 2030. Increased global conflicts and the need for advanced defense capabilities are driving demand for high-performance computing. Advancements in areas such as artificial intelligence, machine learning, and big data analytics are enhancing the capabilities of supercomputers for defense applications. Furthermore, the reliance on data-driven insights for military operations is increasing the need for powerful computing resources.

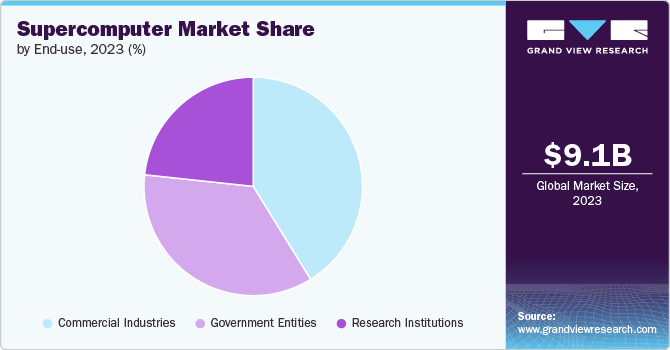

End-use Insights

The commercial industries segment accounted for the largest revenue share in 2023. The commercial industries segment in the supercomputer market encompasses a broad range of end-users. Key segments include financial services, manufacturing, energy, and retail. Banks, investment firms, and insurance companies utilize supercomputers for risk modeling, fraud detection, high-frequency trading, and data analytics. Automotive, aerospace, and other manufacturing sectors employ supercomputers for product design, simulation, and optimization.

The research institutions segment is anticipated to exhibit the highest CAGR from 2024 to 2030. Supercomputers are essential tools for breakthroughs in fields like physics, chemistry, biology, and astronomy. They enable complex simulations, data analysis, and modeling, accelerating the pace of discovery. Moreover, understanding climate change and its impacts requires immense computational resources. Research institutions use supercomputers to develop climate models, predict weather patterns, and study environmental changes. In addition, identifying potential drug candidates and understanding their interactions with biological systems is computationally intensive. Supercomputers accelerate this process by analyzing vast amounts of data and simulating molecular interactions.

Regional Insights

North America supercomputer market is anticipated to grow prominently from 2024 to 2030. The region has been at the forefront of technological advancements, fostering innovation in supercomputing hardware and software. In addition, a robust research infrastructure, coupled with significant government and private investments, fuels the demand for high-performance computing.

U.S. Supercomputer Market Trends

The U.S. supercomputer market is anticipated to exhibit a significant CAGR over the forecast period. The presence of major tech companies, government agencies, research institutions, and industries like aerospace, automotive, and finance contributes to a broad supercomputer market. Moreover, cloud providers are integrating supercomputing capabilities into their platforms, expanding market reach.

Europe Supercomputer Market Trends

The supercomputer market in the European region is expected to witness significant growth over the forecast period. Europe has made substantial investments in high-performance computing (HPC) infrastructure, driven by a combination of government initiatives, academic research, and industrial needs. Moreover, the region has a strong tradition of scientific research, and supercomputers are essential tools for tackling complex challenges in fields like climate modeling, materials science, and drug discovery.

Asia Pacific Supercomputer Market Trends

The supercomputer market in the Asia Pacific region led the market in 2023, accounting for over 35.0% share of the global revenue. China has been at the forefront of supercomputing development, leading in terms of the number of supercomputers on the Top500 list. Massive government investments and a focus on technological self-reliance have propelled the country's supercomputing capabilities. Moreover, the region is witnessing increased adoption of supercomputers across various sectors, including weather forecasting, climate modeling, drug discovery, material science, and engineering simulations.

Key Supercomputer Company Insights

Companies active in the supercomputer market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in June 2023, Eviden, a business of Atos Group, signed a USD 100 million contract with the National Centre For Medium Range Weather Forecasting,

India Ministry of Earth Sciences, to develop two new advanced supercomputers focused on weather simulation and climate studies. These units, utilizing Eviden's BullSequana XH2000, will offer a total computational strength of up to 21.3 Petaflops. They will also incorporate Eviden's exclusive Direct Liquid Cooling technology, which uses warm water to efficiently cool the system.

Key Supercomputer Companies:

The following are the leading companies in the supercomputer market. These companies collectively hold the largest market share and dictate industry trends.

- Atos SE

- Cray

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Honeywell International Inc.

- International Business Machines Corporation

- Lenovo

- NEC Corporation

- Nvidia Corporation

Recent Developments

-

In June 2024, International Business Machines (IBM) Corporation collaborated with Pasqal, a quantum processors developer, to forge a unified strategy for quantum-centric supercomputing and to enhance research applications in the fields of chemistry and materials science. The companies would collaborate with premier high-performance computing institutions to lay the groundwork for quantum-centric supercomputing.

-

In April 2024, Hewlett Packard Enterprise provided a new supercomputer, Helios, to the Academic Computer Centre Cyfronet at AGH University of Krakow, becoming Poland's most rapid system. This fifth-generation supercomputer is designed to propel forward AI-based scientific inquiries and pioneering commercial ventures.

-

In February 2024, Fujitsu delivered a new supercomputer to the Japan Meteorological Agency (JMA) with the goals of enhancing the precision of predictions for typhoons and heavy rainfall and assisting officials in creating plans based on data to offer early warnings and evacuate residents in the face of natural disasters.

Supercomputer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.81 billion |

|

Revenue forecast in 2030 |

USD 16.81 billion |

|

Growth rate |

CAGR of 9.4% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK, France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Atos SE; Cray; Dell Technologies; Fujitsu; Hewlett Packard Enterprise; Honeywell International Inc.; International Business Machines Corporation; Lenovo; NEC Corporation; and Nvidia Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Supercomputer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global supercomputer market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Vector Processing Machines

-

Tightly Connected Cluster Computer

-

Commodity Cluster

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Scientific Research

-

Weather Forecasting

-

Defence

-

Simulations

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Industries

-

Government Entities

-

Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global supercomputers market size was estimated at USD 9.13 billion in 2023 and is expected to reach USD 9.81 billion in 2024.

b. The global supercomputers market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030, reaching USD 16.81 billion by 2030.

b. North America dominated the supercomputers market with a share of 24.2% in 2023. The region has been at the forefront of technological advancements, fostering innovation in supercomputing hardware and software. In addition, a robust research infrastructure, coupled with significant government and private investments, fuels the demand for high-performance computing.

b. Some key players in the supercomputers market include Atos SE, Cray, Dell Technologies, Fujitsu, Hewlett Packard Enterprise, Honeywell International Inc., International Business Machines Corporation, Lenovo, NEC Corporation, and Nvidia Corporation.

b. Supercomputers are essential for complex simulations, modeling, and data analysis in various fields such as physics, chemistry, biology, and climate science. Factors such as technological advancements, increasing data volumes, economic growth and government initiatives, and emerging applications like digital twins and autonomous vehicles are collectively driving the growth of the supercomputer market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."