- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sunglasses Market Size And Share, Industry Report, 2033GVR Report cover

![Sunglasses Market Size, Share, And Trend Report]()

Sunglasses Market (2026 - 2033) Size, Share, And Trend Analysis Report By Frame Type (Full Frame, Half Frame, Rimless), By Frame Style (Round, Square, Rectangle, Oval), By Frame Material (Metal, Non-Metal), By Price Band, By Region, Segment Forecasts

- Report ID: GVR-2-68038-897-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sunglasses Market Summary

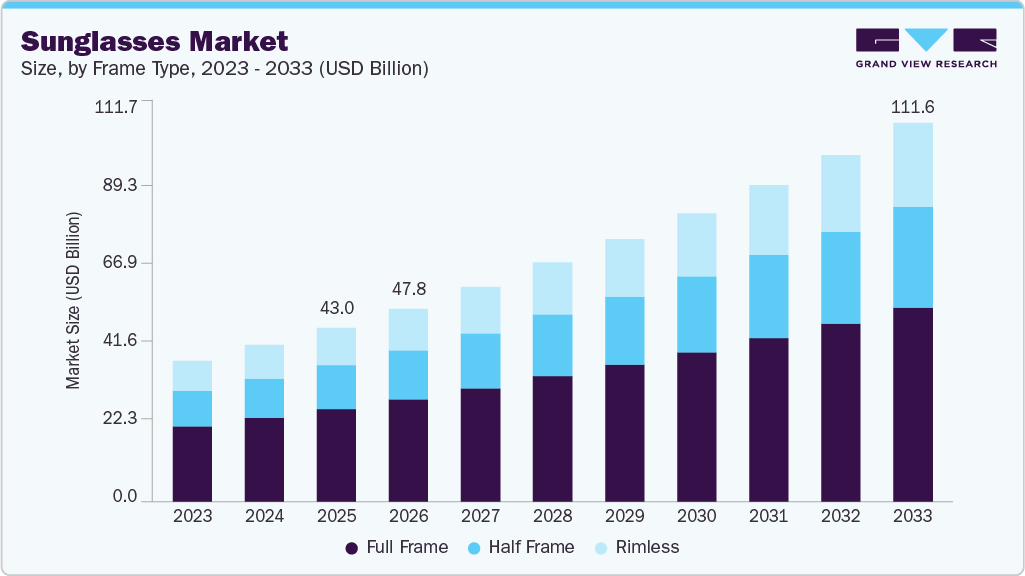

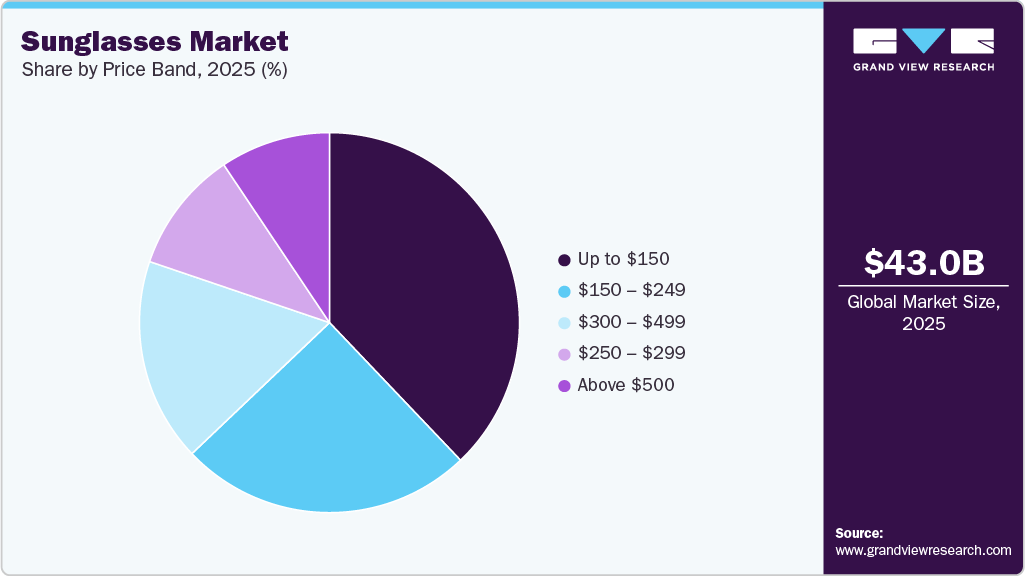

The global sunglasses market size was valued at USD 43.03 billion in 2025 and is expected to reach USD 111.61 billion by 2033, growing at a CAGR of 10.1% from 2026 to 2033. The rising popularity of eyewear, particularly sunglasses, as an essential part of modern lifestyle, is projected to drive the demand for sunglasses over the forecast period.

Key Market Trends & Insights

- The sunglasses market in North America accounted for a share of 31.60% of the global revenue in 2025.

- The sunglasses market in the U.S. is projected to grow at a CAGR of 9.5% from 2026 to 2033.

- Based on frame type, the full-frame sunglasses accounted for a share of 53.09% of the global revenue in 2025.

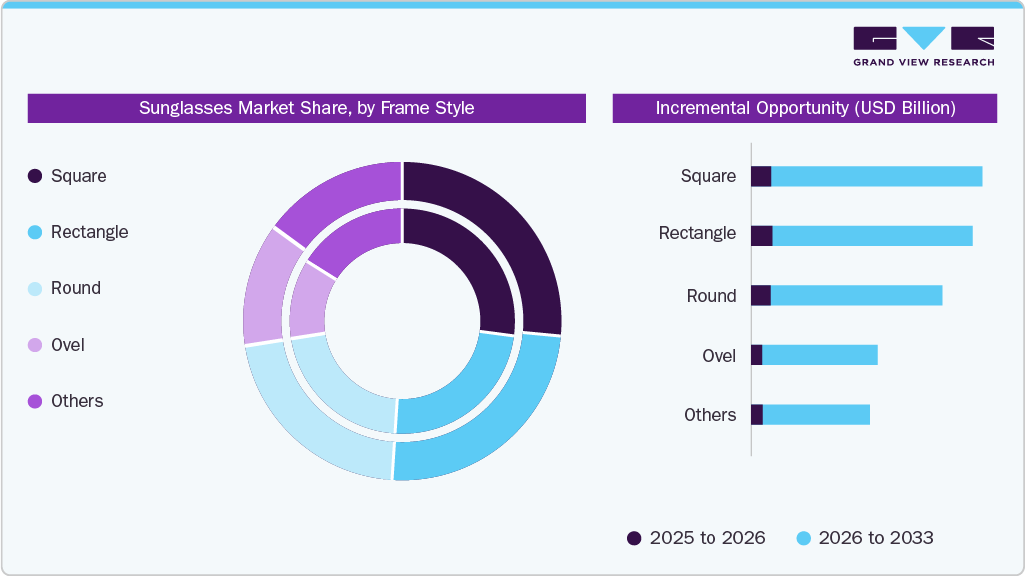

- Based on frame style, Square sunglasses accounted for a share of around 26.57% of the global revenue in 2025.

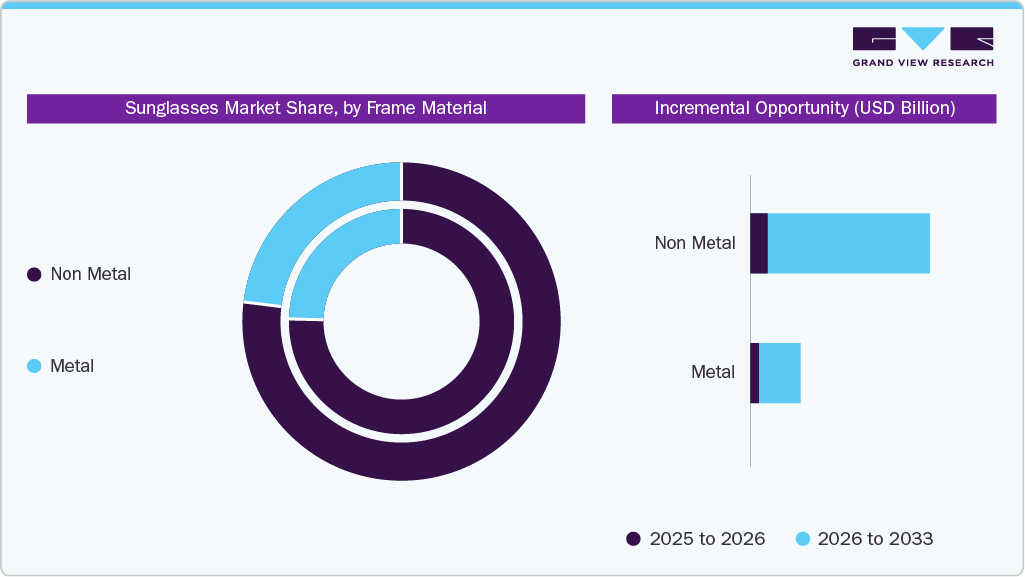

- Based on frame material, the Non-metal sunglasses accounted for a share of around 74.60% of the global revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 43.03 Billion

- 2033 Projected Market Size: USD 111.61 Billion

- CAGR (2026-2033): 10.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

High-end designers and fashion houses have incorporated sunglasses into their collections, turning them into coveted items. Iconic fashion brands such as Gucci, Prada, and Chanel have produced eyewear lines, making sunglasses a practical accessory as well as a style statement. Celebrities and influencers often sport these designer shades, further reinforcing their status as a fashion essential. Various organizations, including the World Health Organization (WHO), are actively raising awareness about the detrimental impacts of UV radiation. They are crafting guidelines and suggestions to safeguard against excessive sun exposure. The American Academy of Ophthalmology advises appropriate eye protection, such as sunglasses with UV-blocking capabilities, to shield the eyes from the potential harm caused by prolonged exposure to ultraviolet rays.

Furthermore, Prevent Blindness, an eye health and safety organization, has designated May as Ultraviolet Awareness Month with an aim to educate the public about the heightened risk of various conditions, ranging from corneal sunburns to diseases like cataracts and eye cancers. Furthermore, consumers are increasingly willing to spend more on branded, expensive sunglasses to make unique fashion statements. Manufacturers are responding to these trends by offering sunglasses in a range of styles, colors, and shapes to cater to consumer preferences.

For instance, in July 2023, Luxottica partnered with Eastman Kodak to include Kodak products in the Luxottica brand by January 2024. The brand will manufacture optical products for Kodak and will also undertake servicing for the same. Since Kodak is an iconic brand with good brand value, it will help Luxottica leverage its brand position. The fashion industry has been pivotal in popularizing sunglasses as a must-have accessory.

In October 2023, Meta Platforms and Ray-Ban, a brand from Luxottica Group, partnered to introduce the second-generation Ray-Ban Meta smart glasses featuring AI technology. These smart sunglasses come equipped with an integrated speaker, a 12MP camera, and a five-microphone system, offering users the capabilities of live streaming, music playback, messaging, and phone calls.

Moreover, the rise of social media and the constant sharing of personal photos have also contributed to the acceptance of sunglasses as a lifestyle accessory. People now view sunglasses as a way to express individuality and enhance their overall look. Whether oversized, retro, or minimalist frames, sunglasses can add a touch of sophistication, mystery, or glamour to one's appearance. They have become an essential part of the modern selfie culture, and people take great care in selecting the perfect pair to complement their outfits.

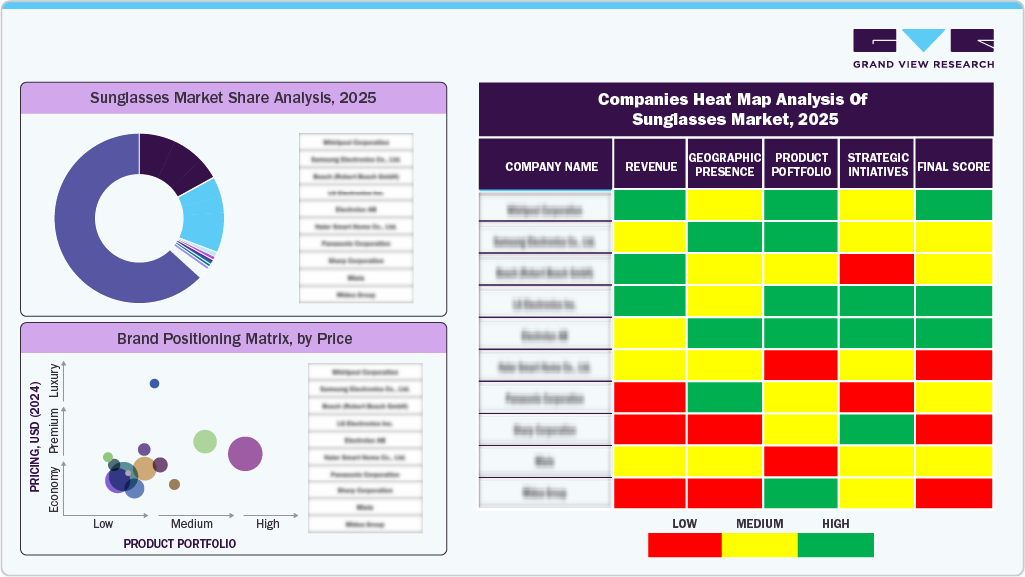

Brand Market Share Analysis

Established brands and emerging players in the sunglasses market create a highly competitive landscape by emphasizing product innovation, design differentiation, lens technology, and pricing strategies. Manufacturers are increasingly strengthening their presence across online retail platforms to capture digitally driven consumers and expand global reach. In addition, sunglasses brands collaborate with celebrities, fashion influencers, athletes, and designers to launch co-branded or limited-edition collections, leveraging their visibility and style influence to enhance brand appeal, drive trend adoption, and connect with younger, fashion-conscious consumers.

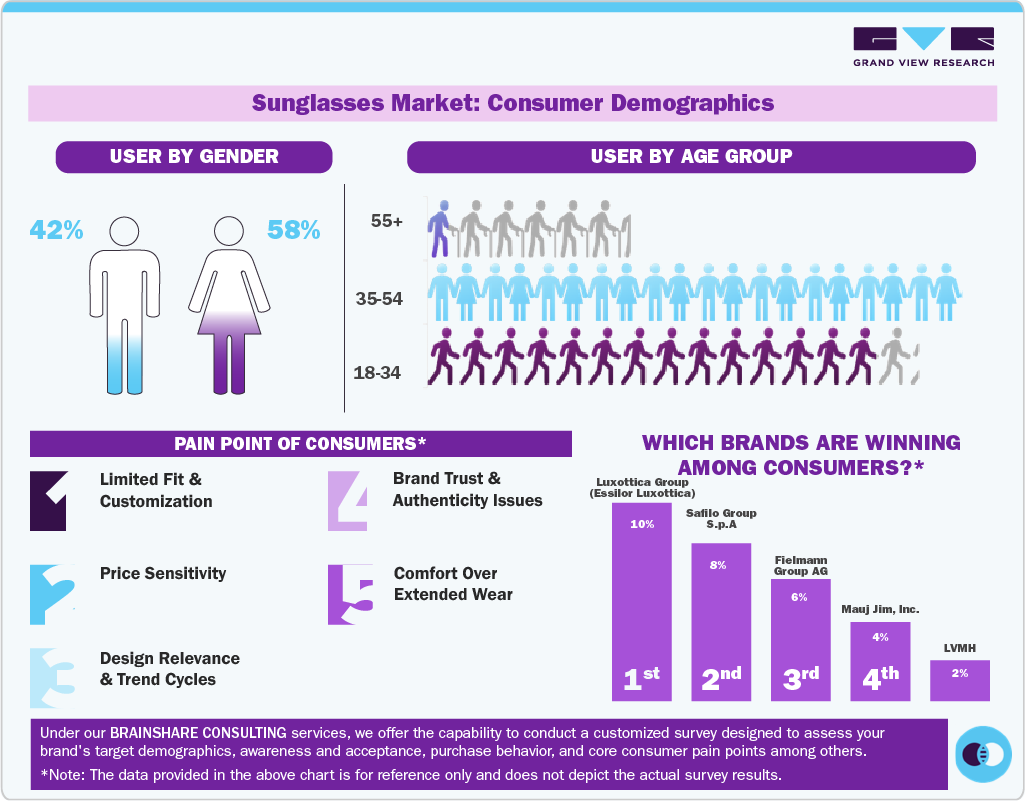

Consumer Insights for Sunglasses

In the global sunglasses market, functional protection and style are both central to consumer behavior. According to research from The Vision Council, a majority of adults’ report wearing sunglasses primarily to improve visibility in bright conditions, with 72% saying they wear shades to see better in strong sunlight and 62% emphasizing UV protection as a key reason for use, highlighting the role of sunglasses as essential eye-health accessories rather than just fashion items.

At the same time, evolving trends in eyewear design are shaping how consumers express personal style through sunglasses. Recent fashion insights show that oversized frames, geometric shapes, aviator styles, and bold silhouettes are gaining traction as statement pieces, with trend cycles constantly refreshed by seasonal fashion movements and lifestyle influence. These stylistic shifts are reflected across both mass-market and premium segments, where brands are increasingly launching collections that balance protective performance with contemporary aesthetics.

The dual importance of eye protection and fashion appeal means that consumers evaluate sunglasses not only for their ability to block harmful UV radiation but also for how well they complement individual taste and wardrobe choices. This is reinforced each year by awareness efforts such as National Sunglasses Day, which underscores the value of year-round sunglass use and encourages broader public engagement with eyewear trends and UV safety.

Frame Type Insights

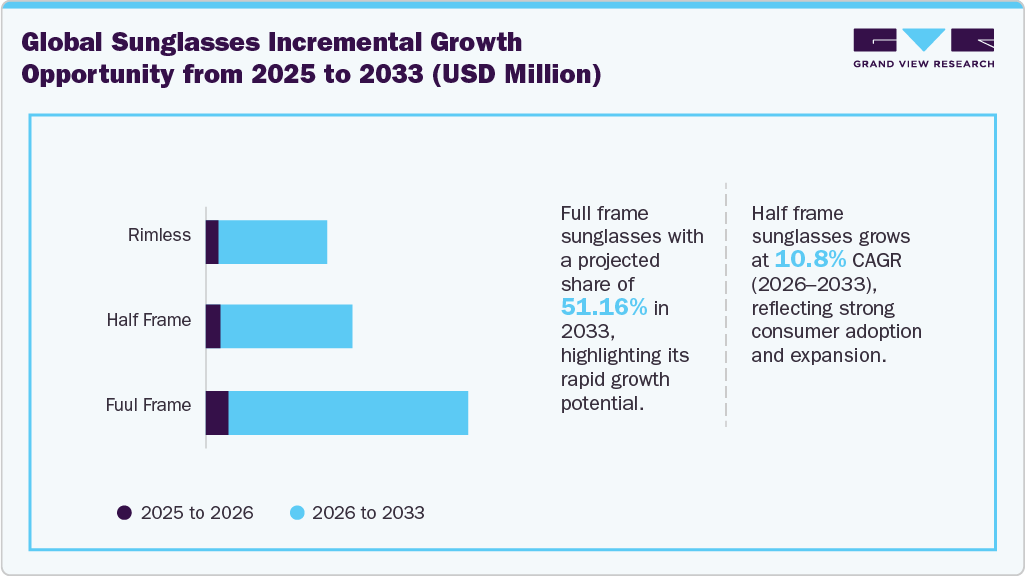

Full frame sunglasses accounted for a share of 53.09% of the global revenue in 2025. Full-frame sunglasses are gaining popularity as consumers increasingly prioritize maximum eye coverage, visual comfort, and functional reliability alongside appearance. Buying behavior has shifted as sunglasses are no longer treated as occasional accessories but as daily-wear protective products. Consumer guidance from Kraywoods highlights eight core purchase considerations, including UV protection, frame coverage, lens quality, comfort, durability, and lifestyle suitability, indicating that frame construction plays a decisive role in perceived product value. Full-frame designs address several of these criteria simultaneously by enclosing the lens entirely, reducing side-angle light intrusion, and improving overall UV shielding compared with rimless or half-frame alternatives.

Half frame sunglasses are projected to grow at a CAGR of 10.8% from 2026 to 2033. Their growing adoption is closely tied to lifestyle patterns that involve prolonged use, such as driving, office work, and mixed indoor-outdoor routines, where visual clarity and reduced frame weight are prioritized over full facial coverage. Half-frame constructions expose part of the lens edge, resulting in a slimmer profile and lower overall weight compared with full-frame designs. This makes them particularly appealing to wearers who value an unobtrusive look and minimal contact on the face, especially in professional or everyday settings. In the RX segment, half-frame styles are often selected for their clean, refined appearance, as they draw less visual attention to the frame while still supporting essential lens functionality.

Furthermore, the appeal of half-frame sunglasses is further reinforced by comfort and usability advantages during long hours of wear. By reducing frame material around the lens, half-frame designs place less pressure on the nose bridge and temples, which helps minimize discomfort and fatigue over time. This characteristic is especially relevant for prescription users who wear eyewear continuously throughout the day. The open lower or upper rim also supports a wider field of view, which can feel less visually restrictive during activities such as driving or desk work. Combined with modern lightweight materials and precise fit engineering, half-frame sunglasses are positioned as a practical solution for consumers seeking functional eyewear that balances visual performance, comfort, and understated style.

Frame Style Insights

Square sunglasses accounted for a share of around 26.57% of the global revenue in 2025, as consumers increasingly gravitate toward eyewear that delivers sharp definition, strong coverage, and a modern, assertive look for all-day wear. Their rising adoption is closely linked to the demand for frames that provide visual structure and a sense of balance, particularly among wearers who prefer styles that counter softer or rounder facial features. Square silhouettes are commonly associated with a clean, architectural aesthetic, making them a preferred choice for everyday use across commuting, outdoor leisure, and social settings.

The appeal of square sunglasses is further strengthened by their functional advantages in coverage and lens performance. The straight edges and wider lens surface help reduce glare and improve eye shielding in bright environments, especially during driving or prolonged outdoor exposure. Square frames also accommodate thicker or polarized lenses without compromising alignment, contributing to stable visual performance during long wear.

Oval sunglasses are projected to grow at a CAGR of 11.4% from 2026 to 2033, as consumers increasingly seek eyewear that delivers visual softness, everyday comfort, and broad aesthetic compatibility for all-day wear. Their growing adoption is closely tied to lifestyle use cases where sunglasses transition seamlessly between work, leisure, and travel, creating demand for frames that feel balanced rather than visually dominant. Oval style offers gently curved lines that soften facial features, making it a widely accepted option across age groups and face shapes. In the sunglasses market, oval frames are often positioned as easy-to-wear styles that combine understated elegance with consistent usability across varied settings.

Their comfort and coverage characteristics further reinforce the appeal of oval sunglasses during prolonged use. The curved lens profile supports even visual distribution, which many wearers perceive as less fatiguing during extended outdoor exposure. Oval frames also accommodate moderate-to-large lens sizes without appearing oversized, allowing effective glare reduction and UV protection while maintaining a refined look. Typically made in lightweight acetate or metal, these frames distribute pressure evenly across the nose bridge and temples, allowing long wear without discomfort.

Frame Material Insights

Non-metal sunglasses accounted for a share of around 74.60% of the global revenue in 2025. These frames are widely used for extended outdoor wear, travel, leisure activities, and everyday social settings, where lightweight construction and smooth skin contact enhance long-term wearability. Materials such as acetate, injected plastics, and bio-based polymers allow frames to adapt naturally to facial contours, helping reduce pressure points and movement during prolonged use. As a result, non-metal sunglasses are often perceived as more forgiving and comfortable for all-day wear.

Metal sunglasses are projected to grow at a CAGR of 9.0% from 2026 to 2033, driven by rising consumer preference for lightweight frames that offer a refined appearance and long-wear comfort. Metal frames are increasingly favored for their slim profiles, balanced weight distribution, and ability to deliver a clean, understated aesthetic suitable for extended daily use. Their corrosion resistance, durability, and premium feel make them particularly appealing to consumers seeking eyewear that transitions effortlessly across work, casual outings, and travel.

Price Band Insights

Sunglasses priced up to USD 150accounted for a share of around 37.89% of the global revenue in 2025. The appeal of sunglasses under USD 150 is strengthened by the inclusion of performance features that were once limited to higher-priced categories. Many models now offer polarized lenses, scratch-resistant coatings, and improved hinge durability, making them suitable for driving and extended outdoor wear. Consumers often choose this price tier for its versatility, using these sunglasses as primary everyday pairs or as reliable options for travel and outdoor activities where easy replacement is valued. As multi-pair ownership continues to rise, sunglasses in this price range remain a core volume segment, aligning with demand for functional, stylish, and low-maintenance eyewear.

Sunglasses priced above USD 500 are projected to grow at a CAGR of 10.5% from 2026 to 2033, driven by rising demand for luxury eyewear that combines premium craftsmanship, advanced lens technology, and strong brand prestige. Consumers purchasing in this segment typically associate higher prices with superior quality, exclusivity, and refined design, making these products popular for fashion-forward use, luxury travel, and high-end social settings. Premium sunglasses often serve as status symbols, reinforcing their appeal among affluent and style-conscious buyers. This category is dominated by high-fashion houses and specialist luxury eyewear brands such as Cartier, Chrome Hearts, Jacques Marie Mage, DITA, Matsuda, Lindberg, and Thom Browne, where sunglasses are positioned as collectible or statement pieces rather than everyday accessories. Limited-edition releases, designer collaborations, and heritage branding further strengthen demand, as consumers value uniqueness and brand legacy.

Regional Insights

The sunglasses market in North America accounted for a share of 31.60% of the global revenue in 2025, supported by strong consumer emphasis on fashion relevance, personal style, and premium eye protection. Consumers in the region actively seek sunglasses that align with current trends, individual expression, and lifestyle use, prompting brands and retailers to frequently introduce new frame designs, colorways, and lens finishes to match evolving fashion preferences. Seasonal launches and designer-led collections play a key role in sustaining demand.

U.S. Sunglasses Market Trends

The sunglasses market in the U.S. is projected to grow at a CAGR of 9.5% from 2026 to 2033. Sunglasses are widely used across driving, outdoor recreation, travel, and everyday wear, making them a functional necessity rather than a seasonal purchase. U.S. consumers place strong emphasis on UV protection, visual comfort, and frame durability, while also favoring designs that fit seamlessly into casual and active lifestyles. The presence of strong domestic and international brands, along with extensive retail and e-commerce penetration, continues to reinforce steady demand across price segments.

Europe Sunglasses Market Trends

The sunglasses market in Europe is projected to grow at a CAGR of 9.5% from 2026 to 2033, supported by the rapid expansion of digital retail and changing consumer shopping behavior. The rise of e-commerce has significantly improved access to a wide range of sunglasses styles, brands, and price points, allowing consumers to compare designs, lens features, and prices with ease. This convenience has accelerated online purchases of sunglasses across the region. European brands and retailers are increasingly using digital platforms to strengthen market reach, engage consumers through targeted marketing, and provide enhanced shopping experiences such as virtual try-ons and personalized recommendations. These strategies, combined with strong fashion awareness and seasonal demand across European markets, continue to drive sales growth and deepen market penetration for sunglasses.

The sunglasses market UK is projected to grow at a CAGR of 10.3% from 2026 to 2033, driven by changing lifestyle habits and increasing awareness of eye protection among consumers. Sunglasses are increasingly used year-round in the UK, particularly for driving, outdoor leisure, and travel, rather than being viewed as purely seasonal accessories. This functional use, combined with growing interest in fashion-forward eyewear, is supporting steady demand across age groups.

Asia Pacific Sunglasses Market Trends

The sunglasses market in Asia Pacific is projected to grow at a CAGR of 11.4% from 2026 to 2033. Various factors, including fashion, culture, economic conditions, and technological advancements, are shaping consumer demand for eyewear across Asia Pacific. Consumers across different Asia Pacific countries have diverse preferences and requirements, leading to numerous local and international brands catering to these various needs. China's booming middle class has created a substantial demand for luxury eyewear. Global brands like Ray-Ban and Prada, alongside domestic brands like Etnies, cater to various consumer segments, from affordable to high-end luxury.

Key Sunglasses Companies:

The following key companies have been profiled for this study on the sunglasses market.

- Luxottica Group (EssilorLuxottica)

- Safilo Group S.p.A.

- Fielmann Group AG

- Maui Jim, Inc.

- LVMH (Louis Vuitton Moët Hennessy Eyewear)

- Marchon Eyewear, Inc.

- Kering Eyewear

- Warby Parker

- Lenskart

- MARCOLIN S.P.A.

- Silhouette International

- De Rigo Spa

- Smith Optics

- CHARMANT Group

- Vogue Eyewear

- IC! Berlin

- Costa Del Mar, Inc.

- Bollé

- Revo Sunglasses

- Cartier

Recent Developments

-

In June 2025, Amiri expanded its luxury eyewear portfolio with a new summer-focused sunglasses collection shaped by the creative direction of founder Mike Amiri and the brand’s Los Angeles heritage. The launch includes 12 models across four named styles, Hollywood, Mulholland, Sunset, and Venice, each referencing iconic LA locations and translating them into distinct frame executions, ranging from sleek rectangular profiles to classic aviator-inspired forms. The collection is positioned firmly in the premium segment, featuring gold-plated detailing and the brand’s MA Quad signature motif, reinforcing craftsmanship and brand identity.

-

In February 2024, Marcolin and Christian Louboutin, one of the world’s most recognizable luxury fashion houses, entered into a global exclusive licensing partnership, running through 2029, for the design, manufacture, and distribution of sunglasses and prescription frames.

-

In March 2024, Marcolin and Skechers confirmed the extension of their global exclusive licensing partnership for the design, manufacture, and distribution of sunglasses and prescription frames, including children’s eyewear collections, with the agreement now running through 31 December 2030.

Sunglasses Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 47.79 billion

Revenue Forecast in 2033

USD 111.61 billion

Growth rate

CAGR of 10.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, Volume Thousand Units, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frame type, frame style, frame material, price band, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Austria; Belgium; Czech Republic, Denmark; Finland; France; Germany; Iceland; Ireland; Italy; Netherlands; Norway; Poland; Spain; Sweden; Switzerland; UK; Hungary; Romania; Portugal; Slovakia; Luxembourg; Croatia; Bulgaria; Greece; Ukraine; Australia; China; Hong Kong; India; Indonesia; Japan; Malaysia; New Zealand; Philippines; Singapore; South Korea; Taiwan; Thailand; Vietnam; Bangladesh; Kazakhstan; Pakistan; Uzbekistan; Brazil; Argentina; Chile; Colombia; Peru; Ecuador; Dominican Republic; Venezuela; Costa Rica; South Africa; Saudi Arabia; UAE; Kuwait; Turkey; Qatar; Nigeria; Morocco; Ethiopia; Egypt; Kenya; Angola; Oman; Israel; Algeria

Key companies profiled

Luxottica Group (EssilorLuxottica); Safilo Group S.p.A.; Fielmann Group AG; Maui Jim, Inc.; LVMH (Louis Vuitton Moët Hennessy Eyewear); Marchon Eyewear, Inc.; Kering Eyewear; Warby Parker; Lenskart; MARCOLIN S.P.A.; Silhouette International; De Rigo Spa; Smith Optics; CHARMANT Group; Vogue Eyewear; IC! Berlin; Costa Del Mar, Inc.; Bollé; Revo Sunglasses; Cartier

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sunglasses Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the sunglasses market on the basis of frame type, frame style, frame material, price band, region:

-

Frame Type Outlook (Revenue, USD Million; Volume Thousand Units; 2021 - 2033)

-

Full Frame

-

Half Frame

-

Rimless

-

-

Frame Style Outlook (Revenue, USD Million; Volume Thousand Units; 2021 - 2033)

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

Frame Material Outlook (Revenue, USD Million; Volume Thousand Units; 2021 - 2033)

-

Metal

-

Non-Metal

-

-

Price Band Outlook (Revenue, USD Million; Volume Thousand Units; 2021 - 2033)

-

Up to $150

-

$150 - $249

-

$250 - $299

-

$300 - $499

-

Above $500

-

-

Regional Outlook (Revenue, USD Million; Volume Thousand Units; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Germany

-

Iceland

-

Ireland

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

UK

-

Hungary

-

Romania

-

Portugal

-

Slovakia

-

Luxembourg

-

Croatia

-

Bulgaria

-

Greece

-

Ukraine

-

-

Asia Pacific

-

Australia

-

China

-

Hong Kong

-

India

-

Indonesia

-

Japan

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

South Korea

-

Taiwan

-

Thailand

-

Vietnam

-

Bangladesh

-

Kazakhstan

-

Pakistan

-

Uzbekistan

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Peru

-

Ecuador

-

Dominican Republic

-

Venezuela

-

Costa Rica

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Turkey

-

Qatar

-

Nigeria

-

Morocco

-

Ethiopia

-

Egypt

-

Kenya

-

Angola

-

Oman

-

Israel

-

Algeria

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising global awareness regarding the harmful effects of UV rays on the eyes, and growing acceptance of sunglasses as a part of modern lifestyle accessories.

b. The global sunglasses market size was estimated at USD 23.52 billion in 2023 and is expected to reach USD 24.82 billion by 2024.

b. The global sunglasses market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 36.44 billion by 2030.

b. Europe dominated the sunglasses market with a share of 31.1% in 2023. The strong performance of prominent players, including Luxottica and Safilo is driving the growth of this region.

b. Some of the prominent market players in the sunglasses market are Luxottica Group, Safilo Group, Maui Jim, De Rigo, Charmant, Specsavers Optical, and Revo.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.