- Home

- »

- Beauty & Personal Care

- »

-

Sun Care Cosmetics Market Size, Industry Report, 2033GVR Report cover

![Sun Care Cosmetics Market Size, Share & Trends Report]()

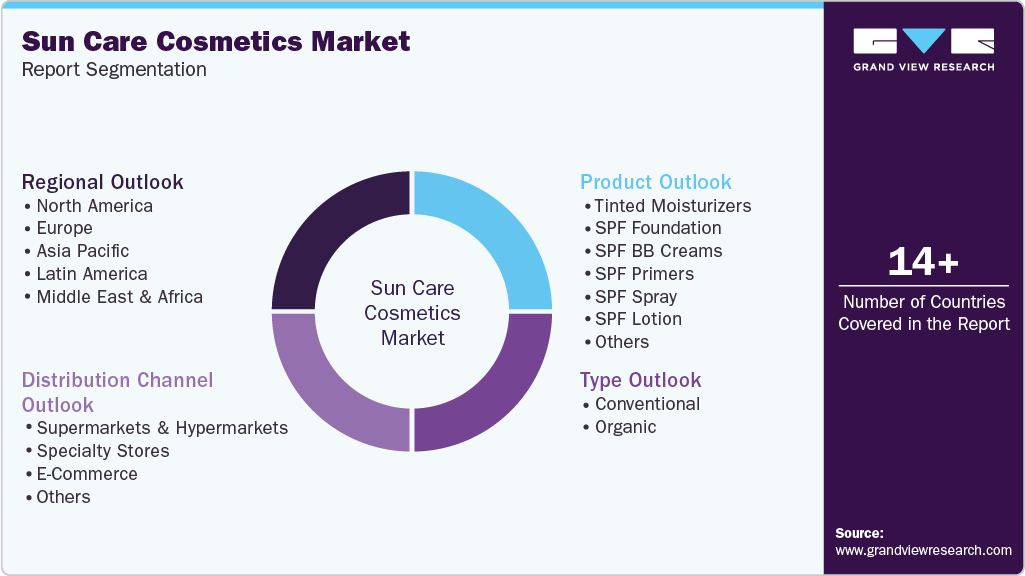

Sun Care Cosmetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tinted Moisturizers, SPF Foundation), By Type (Conventional, Organic), By Distribution Channel (Supermarkets & Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-034-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sun Care Cosmetics Market Summary

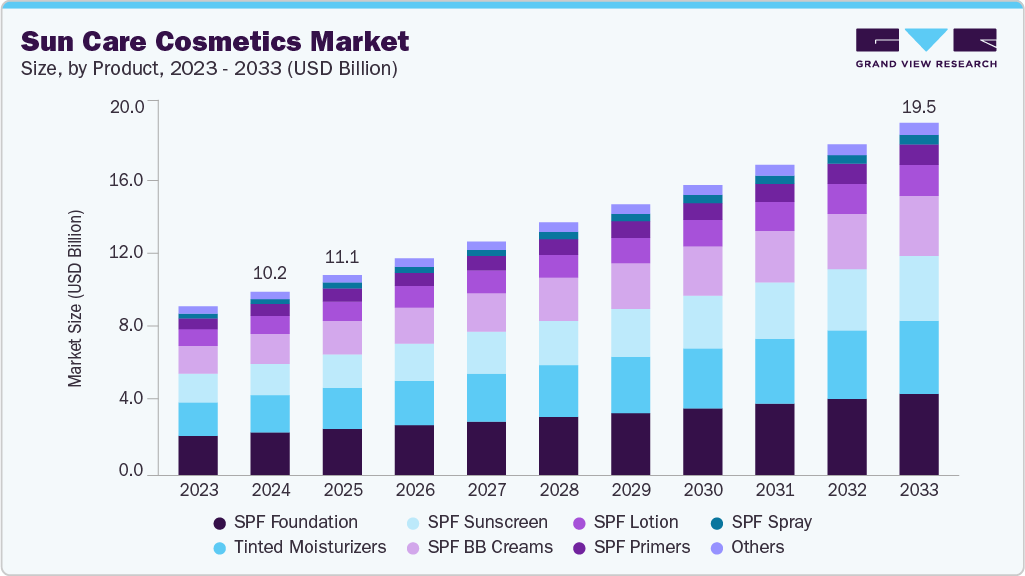

The global sun care cosmetics market size was estimated at USD 10,191.7 million in 2024 and is projected to reach USD 19,514.2 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. Rising concerns about the detrimental effects of sunrays and improved awareness regarding skin cancer are the major factors driving the market growth and innovation.

Key Market Trends & Insights

- The Asia Pacific sun care cosmetics market held the major share of 38.68% of the global sun care cosmetics market in 2024.

- The sun care cosmetics market in China is expected to grow significantly over the forecast period.

- By product, the SPF foundation segment held the highest market share of 23.33% in 2024.

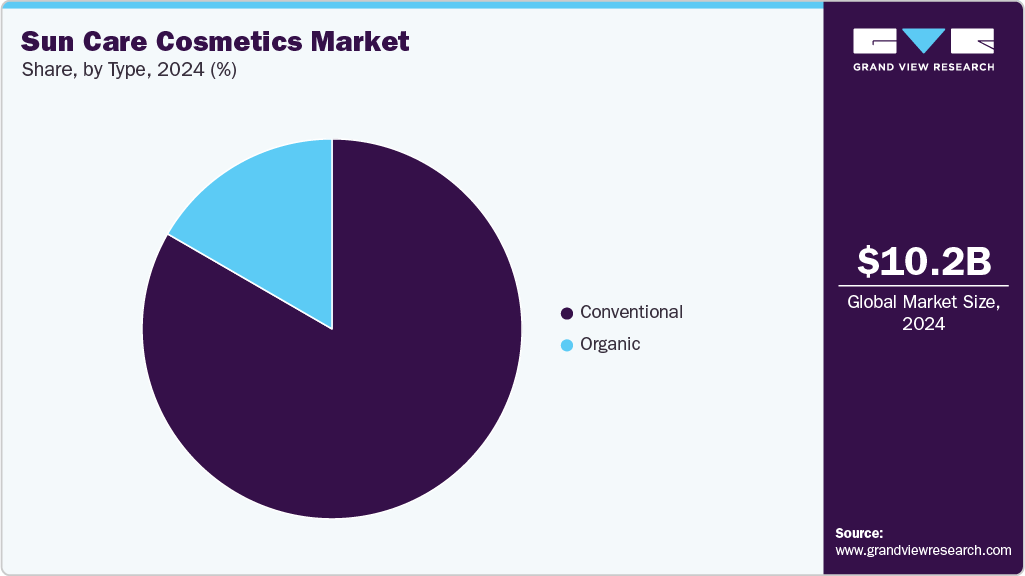

- Based on the type, the conventional segment held the highest market share in 2024.

- Based on the distribution channel, the supermarkets & hypermarkets segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10,191.7 Million

- 2033 Projected Market Size: USD 19,514.2 Million

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

Consumers nowadays want multifunctional cosmetic products that protect against skin concerns, such as skin cancer, sunburns, dark spots, wrinkles, dryness, or antiaging, while also providing makeup/beauty benefits. Therefore, innovation in cosmetic products, including sun care cosmetics, is the best way for players to gain traction.In October 2022, the U.S.-based cosmetic brand TOWER 28 BEAUTY, INC. launched an SPF foundation for sensitive skin, SunnyDays SPF 30 Tinted Sunscreen Foundation. The foundation is available in 14 different shades, providing light to medium coverage. Gen Z and millennials are among those who often follow specialty stores customer reviews as well as top influencers on social media. Therefore, brands and companies are launching specialty stores marketing campaigns on platforms, such as TikTok, Instagram, and Facebook, to gain maximum customer exposure. This has also paved the way for multiple growth opportunities in the industry.

With increased access to the internet and social media apps such as Instagram and YouTube, consumers are looking for assistance to explore sun care cosmetic products on these platforms and gain the necessary information related to skin and hair care routines. With detailed videos from how to know your skin/hair type to what kind of night/day routines to follow, these apps have a wide variety of content that suits the needs of beginners as well as experts. Brands are further making it easier to gain access to product information by increasing their specialty stores presence on social media apps as well as collaborating with influencers on these platforms.

Moreover, marketing communications can influence product adoption to a significant extent. Players can focus on factors like brand image, product efficiency, and the ethical & ecological aspects of the product in their marketing campaigns to target consumers. Easy product availability also affects consumers’ buying decisions and product adoption.

Consumer Surveys & Insights

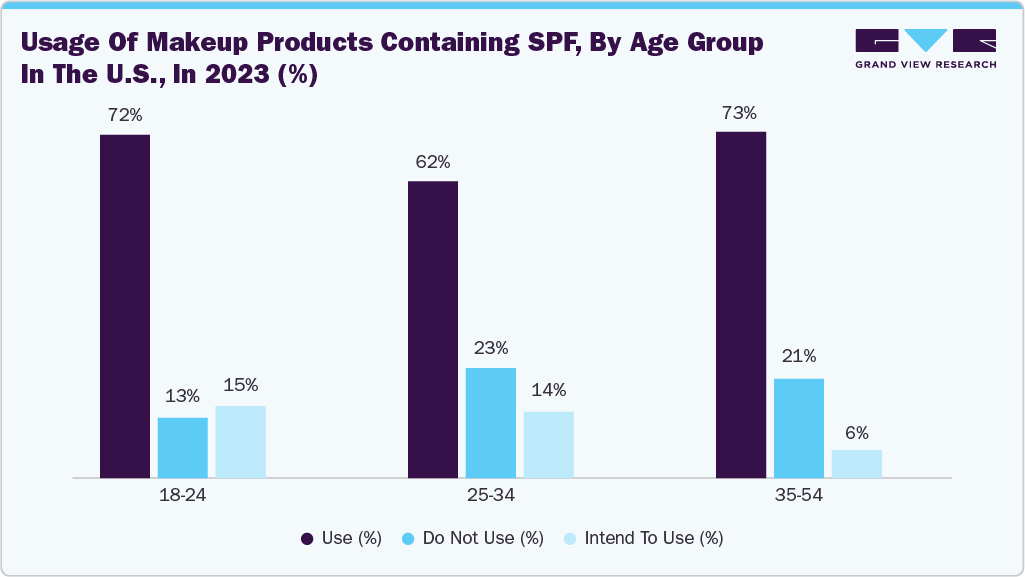

Consumer behavior in the sun care cosmetics industry exhibits distinct gender-based patterns driven by differing skincare priorities, product familiarity, and lifestyle habits. Female consumers generally lead in product adoption, demonstrating consistent awareness of SPF’s preventive benefits in combating premature aging, pigmentation, and skin damage. Women are more likely to incorporate sunscreen into daily routines as part of broader skincare regimens that emphasize hydration, protection, and anti-aging.

Moreover, consumer behavior in the sun care cosmetics industry reveals distinct patterns across age demographics, shaped by lifestyle, awareness, and skincare priorities. Gen Z demonstrates high engagement with SPF-based products, with a focus on sun protection integrated into daily skincare routines, influenced by social media awareness and preventive self-care. Millennials prioritize multi-functional skincare, seeking hydration and sun protection simultaneously, reflecting convenience-driven consumption.

Gen X consumers exhibit moderate SPF use but show a higher affinity toward products that offer anti-aging and moisturization benefits, often favoring established brands with trusted formulations. Baby Boomers prioritize hydration and anti-aging properties but show relatively lower proactive SPF use, typically purchasing sun care products seasonally or during travel. Across all age groups, hydration remains a universally sought-after benefit. At the same time, sun protection is increasingly valued by younger consumers, indicating a generational shift toward early prevention and long-term skin health.

Trump Tariff Impact

The Trump-era tariffs significantly impacted the global sun care cosmetics industry by increasing the cost of importing key raw materials and packaging components, particularly from China. Major manufacturers such as Edgewell, which owns brands like Banana Boat and Hawaiian Tropic, faced tariff rates on certain chemical ingredients that surged up to 60%, pushing them to renegotiate supply contracts or consider sourcing alternatives. As a result, production costs rose sharply, leading many companies to raise retail prices. Multinational corporations like L’Oréal, Estée Lauder, and Shiseido also felt the pinch, responding by reformulating products or shifting parts of their supply chain to countries outside tariff jurisdictions such as South Korea, Mexico, and the EU. This restructuring disrupted traditional pricing strategies and posed challenges in maintaining product consistency and efficacy.

Mid-sized and independent sun care brands were particularly vulnerable, often unable to absorb the increased costs without passing them on to consumers. Many of these companies faced margin pressures, exacerbated by rising freight charges and customs inspections tied to imported packaging materials. Some responded by reducing product sizes, simplifying packaging, or localizing production to minimize exposure. However, these adjustments sometimes compromised product quality or delayed launches, which affected brand reliability and customer satisfaction. In addition, types began noticing inconsistencies in packaging and a spike in prices, particularly for sunscreens reliant on specific chemical filters affected by trade restrictions.

Product Insights

The SPF foundation segment led the market with the largest revenue share of 23.33% in 2024. Consumers want all-in-one products that combine effective sun protection with makeup. SPF foundations eliminate the need for separate sunscreen and foundation, saving time and appealing to those accustomed to efficient routines. With rising concerns about UV damage and skin aging, Millennials and Gen Z are increasingly focused on anti-aging. A survey conducted in 2025 revealed that 57% of Millennials and 56% of Gen Z women are stressed about aging, leading many to adopt proactive skincare measures early on. This proactive approach includes integrating SPF into daily routines as a foundational step in preserving skin health and appearance.

The SPF sunscreen is expected to grow at the fastest CAGR of 8.2% from 2025 to 2033. SPF face sunscreen is a daily skincare essential that offers comprehensive protection and multiple skin benefits. It shields the skin from harmful UVA and UVB rays, helping to prevent sunburn and DNA damage and significantly lowering the risk of skin cancers such as melanoma and squamous cell carcinoma. In addition, it plays a vital role in preventing premature aging by preserving collagen and elastin, thereby reducing wrinkles, fine lines, and sunspots. SPF sunscreen also helps maintain an even complexion by minimizing hyperpigmentation, discoloration, and blotchy patches caused by sun exposure.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the market with the largest revenue share of 33.82% in 2024. These retail outlets serve as one-stop destinations, allowing consumers to easily pick up sunscreens while shopping for groceries or household items. They offer a wide range of sun care products, from conventional to branded options, often at competitive prices thanks to bulk buying and high sales volumes. Frequent promotions, discounts, and loyalty offers further enhance their appeal. High foot traffic in these stores and strategic product placement, such as end-aisle displays or checkout counters, encourage impulse purchases.

The e-commerce segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033. Online sales channels are rapidly gaining popularity for cosmetics shopping due to convenience, variety, personalization, and social commerce. Over 65% of consumers prefer to browse and purchase cosmetics online after engaging with brand content on social media, while 82% expect personalized digital shopping experiences. Online platforms allow shoppers to explore a wider range of products, compare prices, read reviews effortlessly, and take advantage of exclusive discounts and subscription services.

Type Insights

The conventional segment led the market with the largest revenue share of 83.34% in 2024. Conventional sun care cosmetics are mass-produced, synthetic-based formulations for broad accessibility and consistent sun protection. These products often rely on chemical UV filters like oxybenzone, avobenzone, and octinoxate to absorb harmful UVA and UVB rays. In addition, they frequently contain artificial preservatives (such as parabens), synthetic fragrances, and texturizing agents like silicones for improved feel and shelf life.

The organic segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033. Consumers today are increasingly drawn to organic sun care cosmetics due to a growing emphasis on health, environmental responsibility, and ingredient transparency. This has driven many to prefer mineral-based sunscreens that use safer UV filters like zinc oxide and titanium dioxide. On the environmental front, awareness around the impact of chemical sunscreens on marine ecosystems, such as coral reef bleaching, has prompted bans in places like Hawaii and Palau, increasing demand for reef-safe, biodegradable formulations. Moreover, the rise of the clean beauty movement has led consumers to favor products with natural, organic, and non-GMO ingredients, along with transparent labeling and certifications (e.g., USDA Organic, NSF/ANSI 305), reinforcing both trust and brand loyalty.

Regional Insights

The North America sun care cosmetics market is shaped by evolving consumer preferences and innovation-driven trends. There is a rising demand for multi-functional products combining sun protection with skincare or makeup benefits, such as tinted moisturizers, SPF-infused foundations, serums, and lip balms. Consumers also increasingly seek high SPF (30+) and broad-spectrum protection, especially in facial products, to guard against UVA/UVB damage.

Simultaneously, the push for clean, mineral-based, and reef-safe formulations is growing, with zinc oxide and titanium dioxide becoming key ingredients among eco-conscious buyers. The inclusive beauty movement is also gaining momentum, with brands launching sheer or invisible sunscreens that suit all skin tones, addressing the long-standing issue of white-cast SPF on Black and Brown skin. For instance, Fenty Skin’s Hydra Vizor Invisible Moisturizer SPF 30 is a refillable 2-in-1 sunscreen and moisturizer with a truly invisible formula that suits all skin tones, especially people of color.

U.S. Sun Care Cosmetics Market Trends

The sun care cosmetics market in the U.S. is undergoing a dynamic transformation driven by rising consumer awareness about daily sun protection, photoaging, and long-term skin health. Sunscreen use is no longer limited to beach days but has become a core part of everyday skincare routines, with consumers seeking products that combine protection, skin benefits, and aesthetic appeal. This shift has spurred demand for lightweight, non-greasy, transparent, and multifunctional formulas that suit a wide range of skin tones and types. Mineral-based and “reef-safe” products are gaining traction due to increasing environmental consciousness and regulatory actions banning harmful ingredients like oxybenzone in some states. At the same time, brands are innovating with hybrid SPF products such as tinted moisturizers, setting sprays, and primers, blurring the line between skincare and makeup. Thus, such innovation and increasing consumer's demand are driving the market growth in the U.S.

Asia Pacific Sun Care Cosmetics Market Trends

Asia Pacific dominated the sun care cosmetics market with the largest revenue share of 38.68% in 2024. Asia-Pacific sun care industry is evolving rapidly, driven by rising consumer awareness of UV risks and a growing demand for innovative, skincare-infused sun protection. Daily sunscreen use has shifted from a seasonal habit to an essential part of skincare routines, especially in high-UV markets like Japan and Australia.

Consumers are increasingly drawn to multifunctional products, including makeup- and serum-SPFs that combine sun protection with hydration, antioxidants, anti-aging, and brightening ingredients. Innovative formats such as powders, sticks, mists, cushion compacts, and UV patches are becoming mainstream, offering convenient and cosmetically elegant ways to encourage reapplication. Mineral and natural-ingredient sunscreens are also gaining preference, especially in Japan and South Korea, due to their cleaner profiles and sensitive skin suitability.

The sun care market in China is growing significantly due to rising consumer awareness about UV protection, skin health, and aging prevention. Consumers, especially young urban women, are increasingly incorporating sun care into their daily skincare routines, treating it as essential rather than seasonal. The market is driven by the popularity of multifunctional products that combine sun protection with skincare benefits such as hydration, anti-aging, and skin brightening. Mineral sunscreens and sensitive-skin formulations are gaining traction due to growing concerns about skin irritation and product safety.

Europe Sun Care Cosmetics Market Trends

The sun care cosmetics market in Europe hold significant importance in Europe, largely due to the region’s strong emphasis on advanced, science-backed skin protection. European sunscreens are known for incorporating sophisticated and photostable UV filters that deliver broad-spectrum defense against UVA and UVB rays. These filters are often more modern and effective than those commonly used in other regions, offering consistent, long-lasting protection even with prolonged sun exposure.

European regulations also play a crucial role. Strict guidelines require sunscreens to meet high efficacy standards, including mandatory broad-spectrum protection, which has driven innovation in formulation. Moreover, European products emphasize UVA protection, as these rays penetrate deeper into the skin and are linked to long-term damage, such as photo aging and premature wrinkles. This advanced approach to formulation and regulation reflects the growing consumer awareness in Europe of the risks of sun exposure and the critical role of sunscreens in maintaining long-term skin health.

Key Sun Care Cosmetics Company Insights

The sun care industry is always changing and updating. To stay head-on in the market, players tend to launch new strategies more frequently. Market players are focusing on increasing investments in advertisements through social sites to increase awareness regarding sun care cosmetics in the market. Moreover, major players such as Beiersdorf AG, Johnson & Johnson Services, Inc, Coty Inc., Shiseido Company Ltd., L'Oréal Groupe, The Estée Lauder Companies Inc., Unilever, Groupe Clarins, The Clorox Company, Naos., etc. are targeting new regions and demography to increase the consumer base and expand their number of offerings by either entering the new market solely or by collaborating with local companies across the globe.

-

Coty Inc., founded in 1904 by François Coty, is a multinational beauty company headquartered in New York City. As of 2024, Coty operates three primary divisions: Consumer Beauty, Luxury, and Professional Beauty, offering a diverse range of products including fragrances, cosmetics, skincare, and hair care. The company owns approximately 40 brands, with notable names such as CoverGirl, Rimmel, Max Factor, Sally Hansen, and Wella.

-

L'Oréal S.A., established in 1909 and headquartered in Clichy, France, stands as the world's largest cosmetics and beauty company. With a diverse portfolio encompassing skincare, haircare, makeup, and fragrances, L'Oréal operates across various segments, including Consumer Products, Professional Products, and Luxe. The company owns 36 brands, such as Maybelline, Garnier, NYX Professional Makeup, Redken, and CeraVe.

Key Sun Care Cosmetics Companies:

The following are the leading companies in the sun care cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- Beiersdorf AG

- Johnson & Johnson Services, Inc.

- Coty Inc.

- Shiseido Company Ltd.

- L'Oréal Groupe

- The Estée Lauder Companies Inc.

- Unilever

- Groupe Clarins

- The Clorox Company

- Naos

Recent Developments

-

In June 2025, Beiersdorf Nigeria launched a specialized NIVEA UV Face Sunscreen developed for the unique needs of African skin. The product was unveiled at an event in Lagos aimed at promoting awareness of the importance of daily sun protection. With Nigeria’s high UV exposure, the sunscreen helps prevent issues such as hyperpigmentation, premature skin aging, and the increasing threat of skin cancer. Targeted at adults aged 25 to 45, it is designed for everyday use and is compatible with makeup. Health experts at the event also highlighted the dangers of unprotected sun exposure and advised against using unsafe skin-lightening products.

-

In March 2025,Neutrogena launched a new campaign featuring actor and wrestler John Cena to promote its Ultra Sheer Mineral Face Liquid Sunscreen SPF 70. The campaign creatively plays on Cena’s famous “You Can’t See Me” phrase to highlight the sunscreen’s invisible, lightweight formula that leaves no white residue.

Sun Care Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,083.0 million

Revenue forecast in 2033

USD 19,514.2 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Beiersdorf AG; Johnson & Johnson Services, Inc; Coty Inc.; Shiseido Company Ltd.; L'Oréal Groupe; The Estée Lauder Companies Inc.; Unilever; Groupe Clarins; The Clorox Company; Naos

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sun Care Cosmetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sun care cosmetics market report based on product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tinted Moisturizers

-

SPF Foundation

-

SPF BB Creams

-

SPF Primers

-

SPF Spray

-

SPF Lotion

-

SPF Sunscreen

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sun care cosmetics market size was estimated at USD 10,191.7 million in 2024 and is expected to reach USD 11,083.0 million in 2025

b. The global sun care cosmetics market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 19,514.2 million by 2033.

b. The SPF Foundation segment dominated the sun care cosmetics market with a share of more than 23.3% in 2024. SPF foundation held the largest market share during the forecast year, owing to its wide adoption and ease of availability across the globe

b. Some key players operating in this market include Beiersdorf AG, Johnson & Johnson Services, Inc., Coty Inc., Shiseido Company, Limited, L'Oréal Groupe, The Estée Lauder Companies Inc., Unilever

b. Key factors driving the market growth include rising concerns about the detrimental effects of sun rays and improved awareness regarding skin cancer

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.