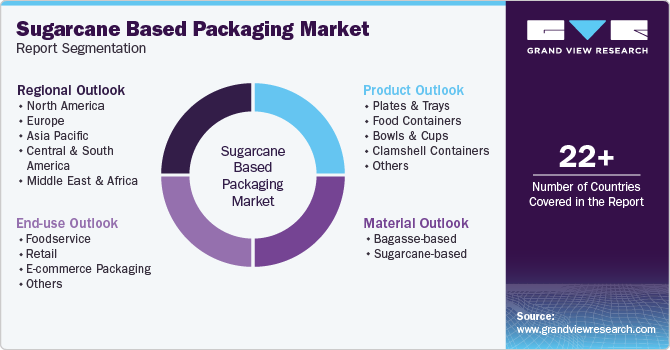

Sugarcane-based Packaging Market Size, Share & Trends Analysis Report By Material (Bagasse-based, Sugarcane-based), By Product (Plates & Trays, Food Containers), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-546-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Sugarcane-based Packaging Market Trends

The global sugarcane-based packaging market size was estimated at USD 351.60 million in 2024 and is expected to grow at a CAGR of 9.7% from 2025 to 2030. Large companies are committing to net-zero targets and sustainable packaging mandates, driving demand for sugarcane-based alternatives. Brands are shifting to biodegradable materials to enhance their ESG performance and meet consumer expectations.

The market is witnessing significant expansion, particularly in high-growth consumer markets such as food service, personal care, and e-commerce packaging. With global regulatory frameworks tightening around single-use plastics, multinational brands are rapidly integrating biodegradable and compostable packaging solutions. Companies like Unilever and Nestlé are investing in sustainable alternatives, and sugarcane-derived materials such as bagasse are emerging as preferred choices due to their structural integrity and environmental benefits.

Innovations in material processing, including advanced molding techniques and hybrid polymer blends, are enhancing the performance of sugarcane-based packaging, making it more competitive against traditional plastics. This trend is further amplified by growing consumer demand for sustainable packaging solutions, leading to increased production capacities across key manufacturing hubs in Asia Pacific and Latin America.

Drivers, Opportunities & Restraints

Government mandates and industry-wide sustainability commitments are major driving forces behind the growth of sugarcane-based packaging. Countries such as the United States, Canada, and members of the European Union have implemented stringent plastic bans and extended producer responsibility (EPR) policies that incentivize the adoption of biodegradable alternatives. For instance, the European Green Deal’s circular economy initiatives encourage businesses to transition towards renewable materials like sugarcane bagasse to meet carbon neutrality targets. Furthermore, rising ESG (Environmental, Social, and Governance) criteria in corporate strategies are pressuring companies to integrate eco-friendly packaging into their supply chains. As a result, packaging manufacturers and FMCG brands are increasingly investing in sugarcane-based packaging technologies, fostering rapid market expansion.

One of the most promising opportunities in the market lies in the development of advanced barrier coatings that improve the material’s moisture resistance, durability, and suitability for a broader range of applications. Traditional bagasse packaging has been limited in certain segments, such as liquid packaging and frozen foods, due to its relatively high permeability. However, innovations in plant-based and biodegradable barrier coatings-such as bio-PET and PHA coatings-enable sugarcane packaging to compete with petroleum-based alternatives. Companies investing in these advancements can unlock new high-value applications, including pharmaceutical packaging and extended shelf-life food products, positioning themselves as leaders in the next generation of sustainable packaging solutions.

Despite its growing adoption, the market faces challenges related to high production costs and supply chain volatility. The processing of sugarcane bagasse into high-quality packaging materials involves complex refining, pulping, and molding processes, which are often costlier than traditional plastic manufacturing. Fluctuations in raw material availability, particularly due to climate variability affecting sugarcane harvests, can impact supply consistency and pricing. Developing economies, where sugarcane is predominantly cultivated, may also face infrastructure limitations that hinder efficient transportation and processing, further adding to cost pressures. These factors create a pricing disadvantage compared to petroleum-based plastics, requiring strategic investments in production efficiencies and economies of scale to drive long-term market competitiveness.

Material Insights

Bagasse-based dominated the market across the material segmentation in terms of revenue, accounting for a market share of 58.78% in 2024. The superior biodegradability and compostability of bagasse make it an ideal material for disposable food containers, aligning with stringent regulations like the European Single-Use Plastics Directive and the U.S. Plastics Pact. In addition, bagasse offers cost-effective scalability, particularly in emerging markets like India, China, and Brazil, where sugarcane processing industries generate abundant bagasse as a byproduct. Innovations in thermoforming and barrier coatings further expand its application range, allowing bagasse packaging to offer moisture-resistant and grease-proof properties, making it a preferred choice over conventional plastic and polystyrene packaging.

Sugarcane-based is expected to grow significantly over the forecast period. Recent advancements in sugarcane fiber extraction techniques drive the adoption of sugarcane-based packaging beyond traditional applications. New refining processes improve fiber purity and structural integrity, enhancing durability and flexibility, which are essential for diverse packaging solutions. As a result, manufacturers can now develop thinner, lightweight, yet robust packaging materials, reducing raw material consumption while maintaining strength and performance. This technological progress attracts major investment from multinational packaging firms aiming to create innovative solutions that align with the circular economy model.

Product Insights

Plates & trays dominated the market across the product segmentation in terms of revenue, accounting for a market share of 40.24% in 2024. The demand for sugarcane-based plates and trays is surging, particularly in the catering, hospitality, and event management industries, where large-scale disposable packaging is essential. With government mandates restricting plastic disposables at public events and large-scale gatherings, businesses are turning to eco-friendly alternatives like bagasse plates and trays. Moreover, consumer preferences are shifting towards sustainable dining experiences, with an increasing number of event organizers and food vendors marketing their services as environmentally responsible. This shift leads to the widespread adoption of sugarcane-based plates and trays across food courts, corporate events, and outdoor dining setups, where durability and compostability are key purchasing factors.

The sugarcane-based bowls and cups market is experiencing strong momentum as foodservice businesses seek compostable solutions for both hot and cold beverages. Unlike traditional paper cups that require polyethylene (PE) lining for liquid resistance, emerging sugarcane-based cups incorporate biodegradable coatings, eliminating plastic barriers. This innovation is particularly relevant in markets like the U.S. and Europe, where regulations are tightening around plastic-lined cups, and consumers are actively choosing eco-friendly alternatives.

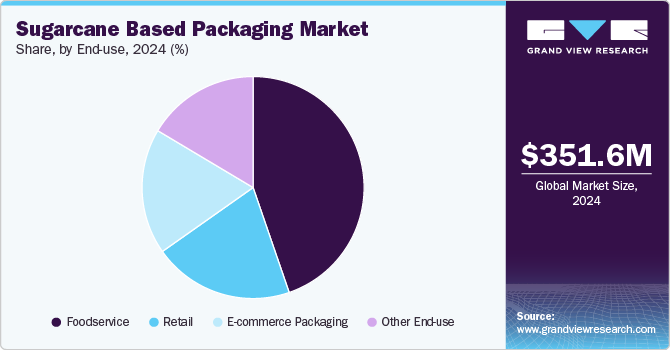

End Use Insights

Foodservice dominated the end use segment of the industry in terms of revenue, accounting for a market share of 44.73% in 2024. Quick-service restaurants (QSRs) and fast-casual dining chains are at the forefront of driving the adoption of sugarcane-based packaging due to mounting regulatory and consumer pressures. Major brands, including KFC, Subway, and Burger King, have pledged to transition to biodegradable and compostable packaging, significantly influencing supply chain dynamics. The increasing shift toward home delivery and takeaway services post-pandemic has further amplified the demand for sustainable food containers, with sugarcane-based packaging offering an ideal combination of strength, grease resistance, and compostability.

In the e-commerce sector, sustainability has become a key differentiator, pushing retailers and logistics providers to explore biodegradable alternatives such as sugarcane-based packaging. With a surge in online shopping, particularly in regions like North America and Europe, companies face increasing scrutiny over excessive plastic packaging waste. Eco-conscious consumers actively favor brands prioritizing green packaging, as evidenced by the growing adoption of sustainable mailers, inserts, and protective wraps made from sugarcane fibers. Market leaders such as Amazon and Shopify are investing in research to develop compostable shipping materials, positioning sugarcane-based packaging as a viable solution for minimizing carbon footprints and improving circular economy practices across global e-commerce supply chains.

Regional Insights

Asia Pacific dominated the global sugarcane based packaging market and accounted for the largest revenue share of 45.82% in 2024. The region is witnessing robust growth in the market, primarily driven by the booming online food delivery sector and rising government-led sustainability initiatives. Countries like India, Japan, and Australia are enforcing stricter regulations on plastic waste, compelling businesses to adopt eco-friendly alternatives such as bagasse-based packaging.

China Sugarcane-based Packaging Market Trends

The sugarcane based packaging market in China is accelerating due to strong industrial policy support and increasing domestic innovation in sustainable materials. The country’s "14th Five-Year Plan" includes ambitious targets for reducing plastic waste and increasing the adoption of biodegradable materials, making sugarcane-based packaging a strategic focus for both state-owned and private enterprises.

North America Sugarcane-based Packaging Market Trends

The sugarcane based packaging market in North America is gaining momentum due to aggressive corporate sustainability commitments and heightened consumer awareness regarding eco-friendly alternatives. Major foodservice and retail brands, including McDonald's, Starbucks, and Walmart, are actively transitioning to biodegradable and compostable packaging to meet internal sustainability goals and comply with evolving government regulations.

The sugarcane based packaging market in the U.S. is leading the charge in driving sugarcane based packaging adoption through stringent state-level plastic bans and extended producer responsibility (EPR) laws. States like California, New York, and Washington have enacted legislation restricting single-use plastics in food packaging, directly accelerating demand for biodegradable alternatives.

Europe Sugarcane-based Packaging Market Trends

The sugarcane based packaging market in Europe is experiencing rapid expansion, driven by stringent circular economy policies and the European Green Deal’s sustainability targets. The European Commission’s ban on single-use plastics, effective across member states, has mandated businesses to adopt compostable and biodegradable alternatives, positioning sugarcane-derived materials as a key solution.

Key Sugarcane-based Packaging Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Eco-Products, World Centric, Pappco Greenware, Vegware, BioPak, Ecoriti, Green Good, Natural Tableware, and Bio Futura. The market is characterized by a competitive landscape, with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their materials' performance, cost-effectiveness, and sustainability.

Key Sugarcane-based Packaging Companies:

The following are the leading companies in the sugarcane-based packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Eco-Products

- World Centric

- Pappco Greenware

- Vegware

- BioPak

- Ecoriti

- Green Good

- Natural Tableware

- Bio Futura

Recent Developments

-

In October 2024, Accredo Packaging collaborated with Fresh-Lock to launch a 100% bio-based resin pouch with a zipper closure at PACK EXPO International 2024. The pouch, made from sugarcane-derived resin, offers a sustainable alternative to traditional packaging, reducing greenhouse gas emissions and meeting the brand's sustainability goals.

-

In August 2023, Lifestream, a plant-based supplement company, introduced new packaging made from sugarcane-based plastic. The bottles, produced by Forward Plastics, utilize non-GMO sugarcane sourced ethically from Brazil.

Sugarcane-based Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 384.83 million |

|

Revenue forecast in 2030 |

USD 612.76 million |

|

Growth rate |

CAGR of 9.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Eco-Products; World Centric; Pappco Greenware; Vegware; BioPak; Ecoriti; Green Good; Natural Tableware; Bio Futura |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sugarcane-based Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sugarcane-based packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Bagasse-based

-

Sugarcane-based

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plates & Trays

-

Food Containers

-

Bowls & Cups

-

Clamshell Containers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

E-commerce Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sugarcane-based packaging market size was estimated at USD 351.60 million in 2024 and is expected to reach USD 384.83 million in 2025.

b. The global sugarcane-based packaging market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 612.76 million by 2030.

b. Large companies are committing to net-zero targets and sustainable packaging mandates, driving demand for sugarcane-based alternatives. Brands are shifting to biodegradable materials to enhance their ESG performance and meet consumer expectations.

b. Some key players operating in the sugarcane-based packaging market include Eco-Products, World Centric, Pappco Greenware, Vegware, BioPak, Ecoriti, Green Good, Natural Tableware, and Bio Futura.

b. Foodservice dominated the end use segment of the industry in terms of revenue, accounting for a market share of 44.73% in 2024. Quick-service restaurants (QSRs) and fast-casual dining chains are at the forefront of driving the adoption of sugarcane-based packaging due to mounting regulatory and consumer pressures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."